Introduction

I’ve been looking for small-cap companies with growing businesses with which to diversify my stock portfolio (it currently includes just five stocks) and I came across Smith-Midland (NASDAQ:SMID). It’s a U.S. producer of precast building materials which has more than doubled its revenues since 2014. I like the strong balance sheet and small capital requirements, but I’m concerned about the underwhelming margins of the business. While Smith-Midland has had a positive net income during 9 of the past 10 years, its annual earnings have rarely surpassed $3 million during that period. My rating on Smith-Midland stock is neutral. Let’s review.

Overview of the business and financials

Smith-Midland was founded in 1960 under the name of Smith Cattleguard and is a manufacturer of precast concrete products for the construction, highway, utilities, and farming industries among others. The company has three production facilities located in the cities of Midland, Reidsville, and Columbia and employs about 230 people. Some 160 of them work at its 44,000-square-foot Midland facility and none of them are represented by labor organizations. This facility has two concrete mixers and a concrete blender as well as two environmentally controlled casting areas, three batch plants, and a form fabrication shop.

Overall, Smith-Midland operates in a highly competitive and fragmented industry with low barriers to entry. One of the key reasons is that, unlike cement manufacturing, the precast concrete products market is not capital-intensive. In my view, Smith-Midland has a small moat thanks to a portfolio of patented products such as SlenderWall (lightweight energy-efficient concrete and steel exterior wall panels), J-J Hook (positive-connected highway safety barriers), SoftSound (sound absorptive finishes for barriers aimed at absorbing traffic noise), and Easi-Set (transportable concrete buildings) among others.

The company also provides barrier rental services and also gets some royalty income by licensing some of its products to other precast companies. These licensing agreements typically have terms of five years, and the royalty payments range from 4% to 6% of total sales, which are paid every month.

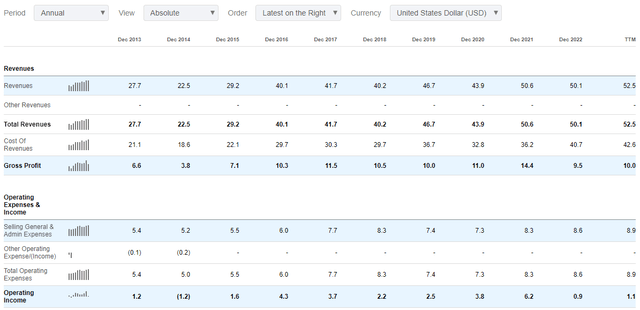

Looking at the revenues of the business over the past several years, we can see that they have been growing steadily since 2014, reaching $52.5 million over the last 12 months. Since 2014, the compound annual growth rate (CAGR) of total revenues has been 10.82% which I consider to be pretty decent. Unfortunately, it seems that the economies of scale are lacking and that the moat of Smith-Midland is too small to make a difference as the gross profit margin has inched up from 16.9% in 2014 to 19% for the last 12 months. And with selling general & administrative expenses usually above 15% of revenues over the past several years, the annual operating income has rarely surpassed the $3 million mark.

Seeking Alpha

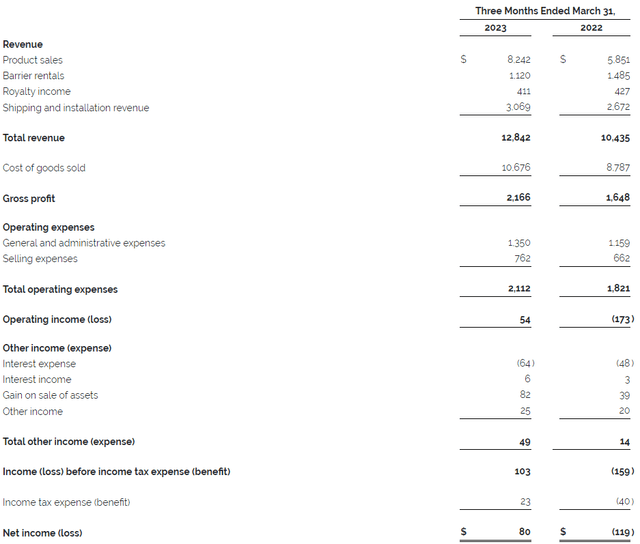

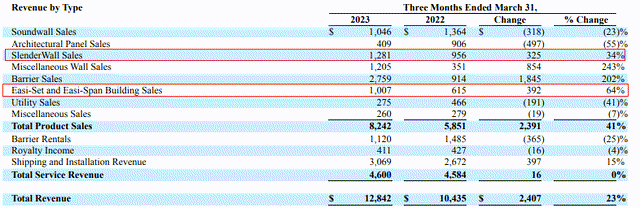

Turning our attention to the Q1 2023 financial results, I think they were underwhelming as the operating income came in at just $54,000 despite a 23.1% year on year increase in total revenues to $12.8 million. The improvement in margins came mainly from the higher production volume and better fixed cost absorption thanks to higher revenues. Revenue from barrier rentals slumped by 24.6% to $1.12 million due to a slowdown in large barrier rental projects. Royalty income, in turn, went down by 3.7% to $0.41 million as a result of weather-related project delays.

Smith-Midland

In my view, the low growth in the gross profit margin to 16.9% from 15.8% a year earlier is particularly concerning considering this was a strong quarter for the company’s patented products, particularly SlenderWall, Easi-Set and Easi-Span. In addition, the shipping and installation revenue of Smith-Midland rose by 14.9% to $3.07 million mainly due to SlenderWall products.

Smith-Midland

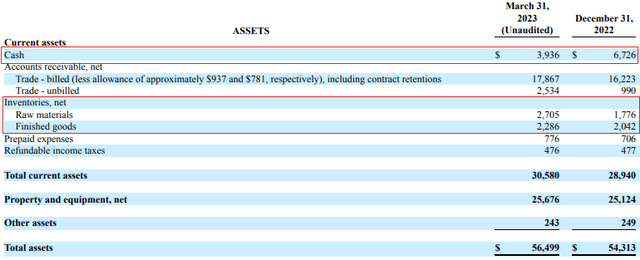

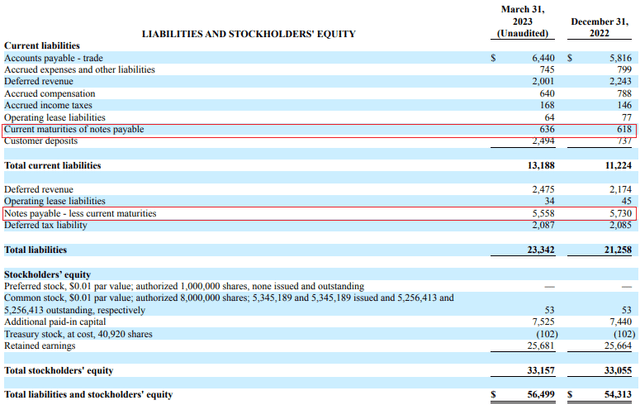

Turning our attention to the balance sheet, I think the situation looks solid as cash stood at $3.94 million as of March and net debt was just $2.26 million. Smith-Midland has an asset-light business model that doesn’t require large inventories as products are typically manufactured after a contractor places an order. In addition, CAPEX is low and purchases of property and equipment came in at $1.16 million in Q1 2023. The CAPEX for the entire 2022 was just $2.75 million.

Smith-Midland Smith-Midland

Looking at what to expect for the future, I think that revenues for 2023 could surpass $60 million thanks to a robust order backlog. As of May 1, Smith-Midland had a sales backlog of around $51.4 million compared to 32.7 million a year earlier (see page 15 here). That being said, I think that operating income is likely to remain below $3 million once again as margins haven’t been showing much improvement over the past few years.

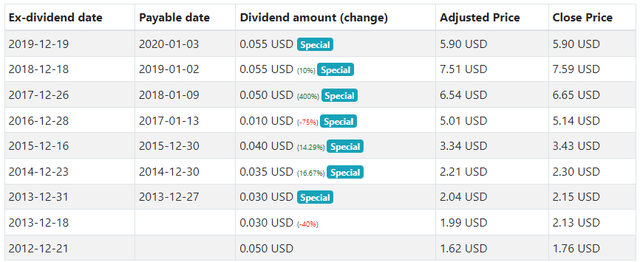

Turning our attention to the valuation, Smith-Midland has an enterprise value of $129.3 million as of the time of writing and the TTM EBITDA stands at $3.85 million. This puts the EV/EBITDA ratio at 33.5x on a TTM basis. In addition, the company does not currently pay a dividend. Even if Smith-Midland resumes dividend payments, I doubt that the dividend yield would be high at today’s share price level. The highest dividend the company has paid out over the past decade was just $0.055 per share.

Digrin

Investor takeaway

Smith-Midland has been growing revenues by double digits over the past several years and its balance sheet is strong. It seems that 2023 could be a good year for the company in terms of sales thanks to a solid backlog but I’m concerned about the lack of economies of scale as well as the small improvement in operating margins in Q1 despite the strong sales of patented products. In my view, the moat of Smith-Midland seems inconsequential and the company is likely to continue to struggle with low profit margins for the foreseeable future. In addition, it doesn’t have a dividend and there is no share buyback program in place.

Overall, I like that Smith-Midland has a long history of revenue growth and profitability and I plan to keep this stock on my watchlist. Yet, I won’t consider opening a position until I see a sustained improvement in operating income margins

Read the full article here