The VanEck Morningstar Wide Moat ETF (MOAT) is one of my favorite holdings as I like the strategy’s focus on high-quality companies with sustainable economic moats. Therefore, I am quite interested to review the VanEck Morningstar SMID Moat ETF (BATS:SMOT), as it applies the Morningstar Wide Moat methodology to small- and mid-cap stocks.

Fund Overview

The VanEck Morningstar SMID Moat ETF gives investors exposure to small- and mid-cap (“SMID”) companies that Morningstar’s equity research team considers to have durable competitive advantages. The SMOT ETF tracks the Morningstar US Small-Mid Cap Moat Focus Index (“Index”), an index designed to measure the performance of SMID companies with sustainable competitive advantages.

The SMOT ETF has not been as successful as its large-cap sibling, as it has only gathered $226 million in assets (Figure 1). The SMOT ETF charges a modestly high 0.49% net expense ratio after fee waivers that are in place until February 2024.

Figure 1 – SMOT overview (vaneck.com)

Wide Moat Strategy In Detail

Similar to the MOAT ETF, the SMOT ETF leverages Morningstar’s team of more than 100 equity analysts to identify companies with sustainable competitive advantages.

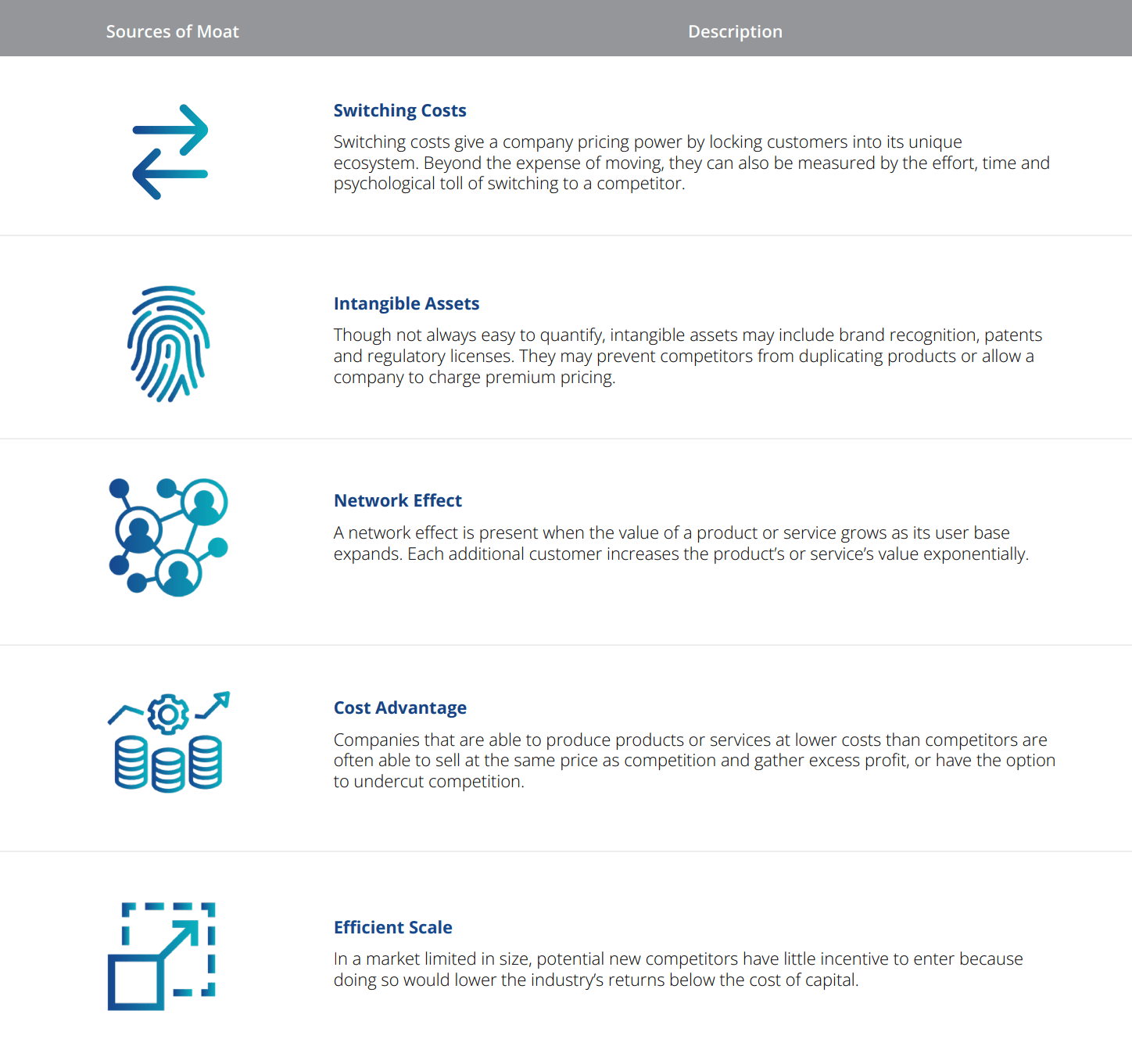

Morningstar’s equity research process considers 5 key attributes to determine if a particular company has an Economic Moat: switching costs, intangible assets, network effect, cost leadership, and efficient scale (Figure 2).

Figure 2 – Morningstar’s 5 sources of MOAT (vaneck.com)

Companies considered to have a wide moat scores well on one or more of the attributes mentioned above and its competitive advantage is expected to last at least 20 years. Companies with narrow moats are expected to maintain an economic advantage for 10 years, while companies without an economic moat have either no advantage or one that is expected to disappear quickly.

Out of Morningstar’s equity coverage, only 10-15% of companies are deemed to have wide moats.

Portfolio Holdings

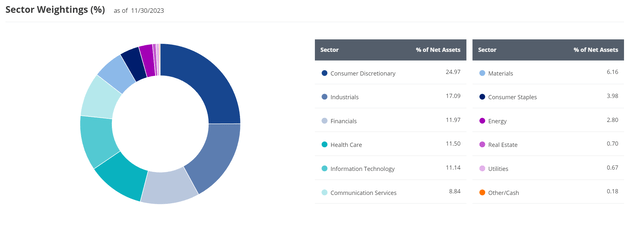

Figure 3 shows the SMOT ETF’s sector allocation as of November 30, 2023. The fund’s biggest weights are in Consumer Discretionary (25.0%), Industrials (17.1%), Financials (12.0%), Health Care (11.5%) and Information Technology (11.1%). The SMOT ETF notably has small weights in other sectors as companies in those sectors tend to be price takers without significant economic moats (i.e. commodity producers).

Figure 3 – SMOT sector allocation (vaneck.com)

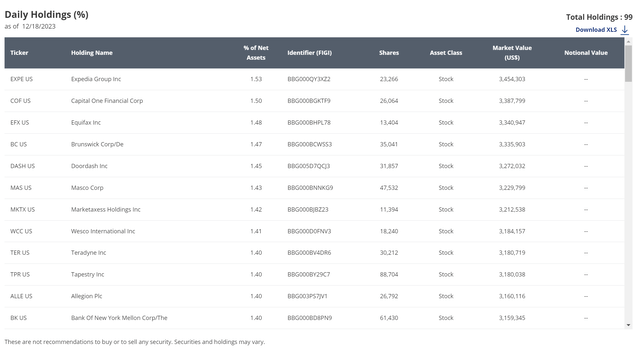

In total, the SMOT ETF contains 99 holdings with the top 10 holdings shown in Figure 4 accounting for only 16% of the fund. While the companies held within the SMOT ETF are considered SMID based on their market caps, they are household names in their own right like Expedia Group Inc. (EXPE), one of the largest travel-dedicated platforms, and Capital One Financial Corp (COF), one of the largest issuer of credit cards.

Figure 4 – SMOT top 10 holdings (vaneck.com)

Distribution & Yield

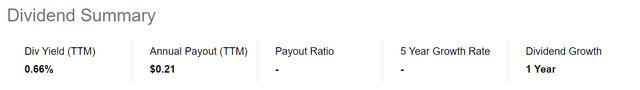

Investors considering the SMOT ETF should not be looking for distribution income from the fund as the SMOT ETF only pays a nominal annual distribution. For 2022, the distribution was $0.21 / share or 0.7%.

Figure 5 – SMOT only pays a nominal distribution (Seeking Alpha)

Returns

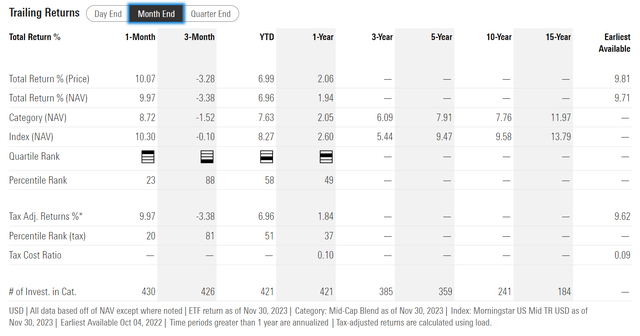

SMOT was only launched in October 2022 so it does not have a long track record (Figure 6). So far, the SMOT ETF has delivered a modest 1.9% total return on a 1-year basis to November 30, 2023. Since inception, returns have been better, at an annual 9.7% pace.

Figure 6 – SMOT historical returns (morningstar.com)

However, SMOT’s poor 1 year performance could simply be a reflection of the market environment, as small-cap stocks have massively underperformed broader markets in the past year.

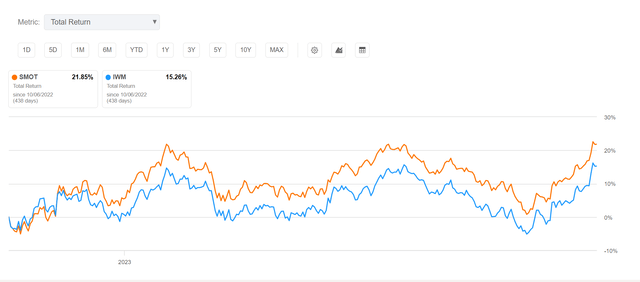

If we instead look at the SMOT ETF relative to the iShares Russell 2000 ETF (IWM), a passive ETF that represents small-cap stocks, the SMOT ETF has outperformed IWM handily since inception (Figure 7). This suggests SMOT’s strategy does have merit.

Figure 7 – SMOT has outperformed IWM since inception (Seeking Alpha)

Small-Caps May Outperform In ‘Soft-Landing’ Scenario

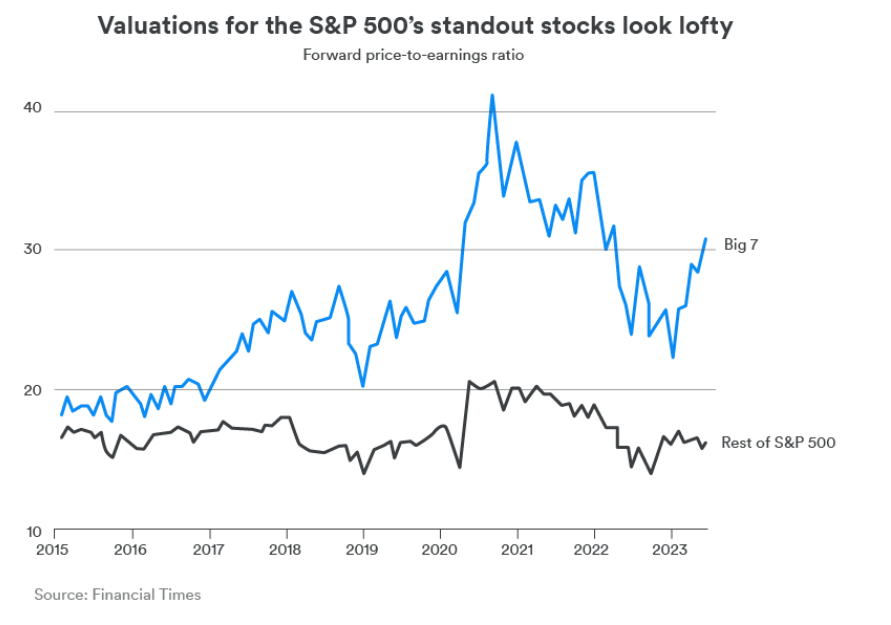

As I have detailed in a recent article on the Royce Value Trust (RVT), I believe if the Federal Reserve has indeed achieved a ‘soft landing’ scenario for the economy, with moderating inflation and consistent GDP growth, then 2024 could be the year of small-caps as investor capital rotates out of expensive ‘Magnificent 7’ mega-cap stocks and into laggards like small-cap stocks. Currently, the ‘Magnificent 7’ are trading at a forward P/E > 30x while the rest of the market is much more modest at only ~16x (Figure 8).

Figure 8 – Magnificent 7 are overvalued compared to the markets (Financial Times)

This rotation can be quite substantial since mega-cap stocks like Apple (AAPL) are individually the size of the entire ‘small-cap’ segment of the markets.

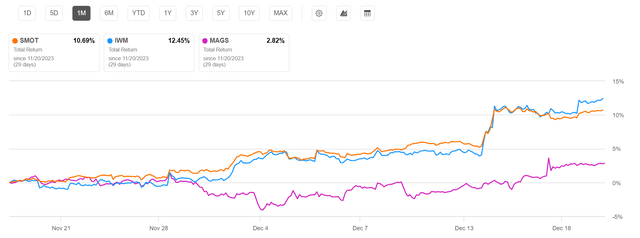

In fact, we are starting to see the rotation happen in real time, as returns for the Roundhill Magnificent Seven ETF (MAGS) (an ETF that invests in the ‘Magnificent 7’ stocks in an equal weighted fashion), has been modest in the past month while the SMOT and IWM ETFs have returned 10.7% and 12.5% respectively (Figure 9).

Figure 9 – Investment flows rotating into small-caps (Seeking Alpha)

Risk To SMOT Is The Economy

The key risk to the SMOT ETF is the economy. If my bullish outlook for small-cap stocks is incorrect, perhaps due to economic weakness in 2024, then the SMOT ETF will unlikely deliver strong absolute returns.

However, I believe the Morningstar Wide Moat methodology should still outperform a passive ETF like the IWM on a relative basis.

Conclusion

The VanEck Morningstar SMID Moat ETF applies the same investment strategy as the popular MOAT ETF to small- and mid-cap stocks. So far in its limited operating history, absolute performance has been modest, with 1-year total returns of only 1.9% to November 30, 2023. However, the SMOT ETF has handily beaten the IWM ETF since inception, suggesting that the Morningstar Wide Moat methodology works.

Given my bullish outlook on small-cap stocks, I believe the SMOT ETF could be a good way to gain small-cap exposure. I rate the SMOT ETF a buy.

Read the full article here