The bearish case against SNDL (NASDAQ:SNDL) is tangible and still developing on the back of consistent quarterly losses and a liquidity position besieged by these losses. The Calgary-based cannabis and liquor retailer just reported its fiscal 2023 second-quarter earnings that saw revenue grow by 9.3% over its year-ago comp to C$244.5 million with a net loss figure that fell by 55%. SNDL is now on track for around C$1 billion in revenue for 2023, up from C$61 million in 2020. The company’s growth by acquisition strategy has worked out and its spring 2022 buyout of Alcanna, Canada’s largest alcohol retailer by retail footprint, has proved transformative to its financial profile. Whilst not a pure-play cannabis retailer, the tables have turned, with cannabis companies making overtures to diversify away from the plant. Tilray (TLRY) is set to acquire eight beer brands from Anheuser-Busch.

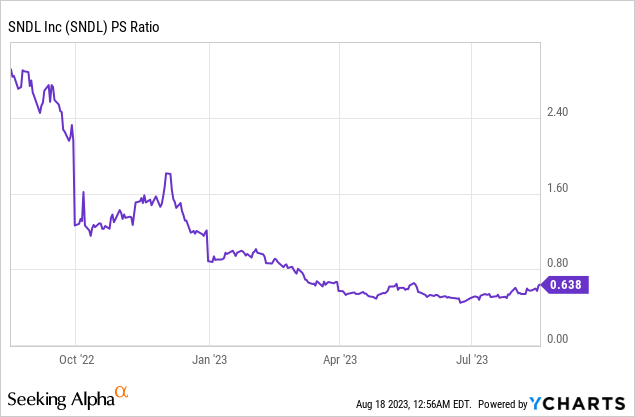

What’s the SNDL play here? A potential expansion of the company’s price-to-sales multiple as market appetite for risk ramps up. This would be on the back of what’s potentially set to be the end of the fastest monetary tightening cycle in decades, even with the Fed funds rate set to remain elevated at 5.25% to 5.50%. Critically, the Nasdaq-listed ticker has been staging a recovery from 52-week lows. This possibly has legs, with the ticker currently swapping hands for a 0.64x price-to-sales multiple, far below its historic average.

Revenue Moves Up As Losses Improve

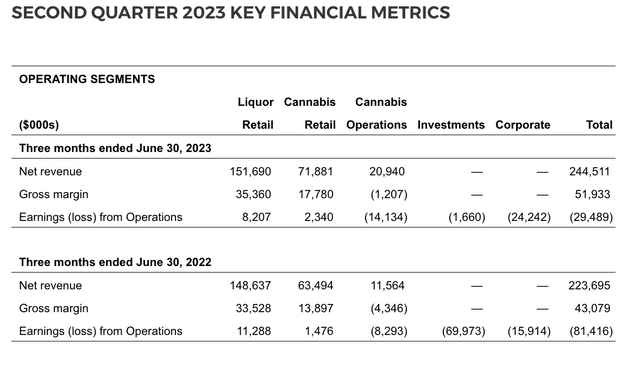

SNDL’s liquor sales came in at C$151.7 million for the second quarter, an increase of 2.1% compared to the prior year. This formed 62% of SNDL’s total revenue and brought in a gross margin of C$35.36 million, around 68% of SNDL’s C$51.93 million gross margin total. Hence, liquor sales are the primary intrinsic factor for SNDL’s long-term bull case. The company acquired Alcanna for C$346 million in 2022 and has maintained healthy year-over-year growth for the unit.

SNDL Fiscal 2023 Second Quarter Earnings Release

Liquor also brought in earnings of C$8.21 million, with cannabis retail bringing in positive earnings of C$2.34 million. However, SNDL is still radically unprofitable with negative earnings from operations of C$29.49 million realized during the second quarter, down from a loss of C$81.42 million in the year-ago period. The improvement came on the back of adjusted EBITDA that was positive at C$2.2 million for the second quarter, a material improvement from a C$26 million loss in the year-ago period.

Cash flow is important here against a backdrop that has seen a dearth of liquidity from collapsed valuations and expensive debt. SNDL used C$8.8 million in cash in its operating activities during the second quarter, a 51% reduction from C$17.9 million in the year-ago period. Critically, the company ended the quarter with C$754 million in cash, marketable securities, and long-term investments. So it’s hard to see where bearish sentiment that the company faces a near-term bankruptcy filing comes from, especially as the second quarter saw its operating footprint realize a reduction in losses.

A Healthy Balance Sheet At A Lower Price

SNDL had a net book value per share of C$4.86 as of the end of its second quarter. Bears would of course be right to flag that net book value will continue to see declines on the back of a cash burn profile set to stay negative. The company’s unrestricted cash stood at C$182.6 million as of the 11th of August. The collapse of Canada’s adult-use cannabis licensed producers has been a direct result of a high tax burden set against a resilient black market, as well as restrictions on advertising. This has reduced opportunities for brand building and product differentiation. SNDL is charged an excise duty on dried cannabis of C$1 per gram or 10% of the value of the gram, whichever is greater. This has inflated the prices of legal recreational cannabis, rendering them less competitive with the black market.

Tilray is currently trading at a US$1.87 billion market cap and forms the most adequate direct comp with SNDL due to its large and growing beverage alcohol division. Tilray recorded revenue of C$250.1 million for its most recent quarter, roughly C$6 million ahead of SNDL. Hence, the disparity starts to look like an undervaluation of SNDL when the strides being made to reduce cash outflow are considered. Critically, concerns from bears that SNDL does not have sufficient cash for more than a year of operations seems misplaced against unrestricted cash of C$182.6 million. The current move of the ticker from its 52-week lows will of course be privy to the broader gyrations of an economy and stock market in a state of flux from inflation and interest rate expectations. Management stated during the second quarter earnings call that they were confident about exceeding their C$30 million in annualized cost savings target by 2024. SNDL should be considered for a buy here.

Read the full article here