Societe Generale (OTCPK:SCGLY) offers a high-dividend yield and low valuation, but this is justified by weak fundamentals and poor earnings momentum, a profile that is not likely to change much over the coming years.

As I’ve covered some months ago, SocGen is one of the cheapest banks in Europe and offers a high-dividend yield, which makes it interesting for long-term income-focused investors. While its share price is up since my last article, SocGen’s valuation remains quite cheap due to some structural issues, plus the bank has updated its strategy some couple of months ago, which was not well received by the market.

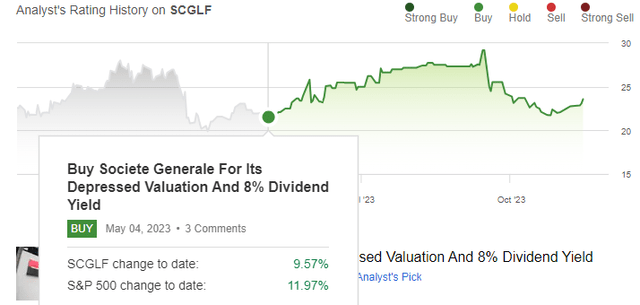

Article performance (Seeking Alpha)

In this article, I do an update regarding the bank’s most recent earnings and strategic update, to see if it remains an interesting play within the European banking sector or not.

Recent Events

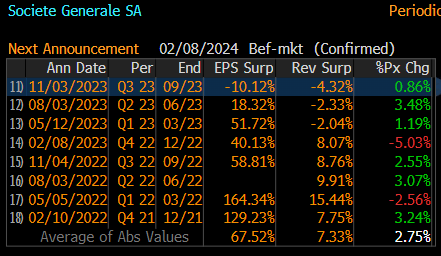

SocGen reported its Q3 2023 earnings a few weeks ago, which were below expectations and showed a relatively poor operating momentum. As shown in the next graph, SocGen missed expectations regarding both the top and bottom-line by a significant margin, but its share price did not react much to this miss.

Earnings surprise (Bloomberg)

While the European Central Bank has been on a hiking pace since mid-2022, SocGen is not a bank that benefits much from this, mainly due to some specific constraints in its domestic retail market. Indeed, its operational performance in the French retail segment has been the main reason why SocGen has missed expectations, as analysts were expecting a better operating momentum than what the bank has delivered.

This happens because, contrary to other banking markets throughout Europe, there are specific issues with banking in France. Indeed, a very popular savings product in France is Livret-A, a banking time deposit product with a fixed rate set by the French finance minister, which is currently paying a 3% fixed rate that is expected to remain unchanged until the end of 2024.

This means that French retail banks have passed to the customers a good part of rising rates, while on the asset side, the vast majority of mortgage loans in France have fixed rates. Adding insult to injury, there is also a regulatory cap on new mortgage loans, which at the beginning of the year was quite low and made for some time new loans unprofitable. While this was recently revised and new loans are now capped at close to 6%, for a good part of 2023, new loans were not attractive and SocGen reduced its production of new mortgage loans for some time.

Additionally, some couple of years ago, when interest rates were at negative levels, SocGen implemented some structural hedges to protect its net interest income, as the bank’s view at the time was that interest rates were expected to remain low for a somewhat long period of time. However, this has not really played out, as interest rates have increased considerably since mid-2022 in Europe, being another headwind for NII growth in recent quarters.

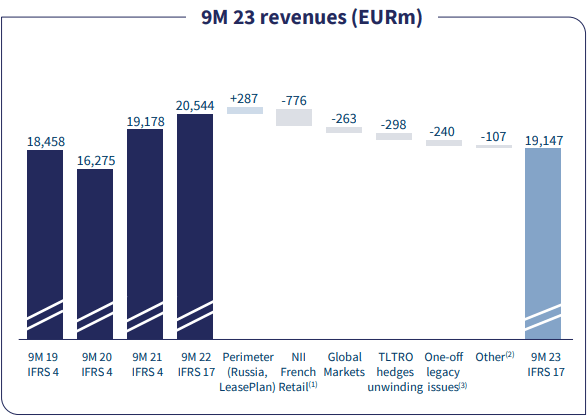

Taking this background into account, ScoGen’s revenues during the first nine months of 2023 amounted to €19.1 billion, a decline of 6.8% YoY. This is a very negative outcome considering that interest rates have increased a lot in Europe in recent quarter, and practically all banks in Europe are reporting much higher revenue on an annual basis. This performance is also worse compared to its closest French peers, Credit Agricole (OTCPK:CRARY) and BNP Paribas (OTCQX:BNPQF), showing that SocGen’s poor top-line performance is not justified only by external factors.

Indeed, as shown in the next graph, SocGen’s revenues were hit by several factors including weak NII in its domestic retail segment, unwinding of TLTRO hedges, weak revenues in the Global Markets unit, and other legacy issues.

Revenues (SocGen)

The only positive factor for its revenues was the acquisition of LeasePlan, a company specialized in auto financing, which will be merged with its ALD unit into a new company to be called Ayvens. There are some cost synergies to be extracted from this business combination over the next few years, but from a revenue perspective the synergies are rather low as the two businesses were quite similar.

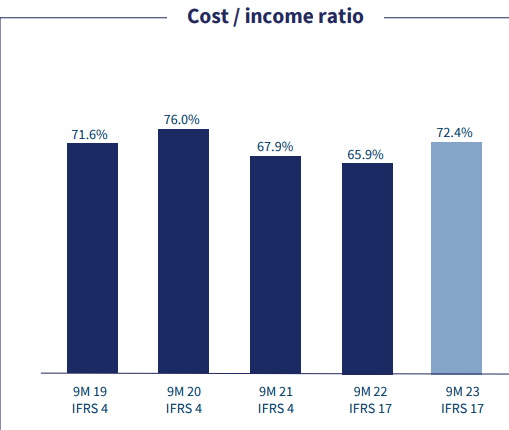

Due to SocGen’s poor revenue performance, the bank’s efficiency remains at the weakest in Europe, as other competitors were able to improve efficiency supported by rising revenues, which generally were higher than cost growth. Over the past couple of years, there has been an inflationary environment in Europe, which led to higher expenses, in both general and staff costs.

While SocGen was able to report contained cost growth, leading to overall expenses of €13.8 billion in 9M 2023, up by 2.4% YoY, which is a positive outcome considering the inflationary pressures in recent years, its cost-to-income ratio was 72.4% over the past nine months. This ratio is quite high in absolute terms and also when compared to the most efficient banks in Europe, which have reported C/I ratios below 40% in recent quarters, supported by strong revenue growth.

Efficiency ratio (SocGen)

On a more positive note, the bank’s credit quality remained at very good levels, with its cost of risk ratio being relatively unchanged compared to previous years, but due to the combination of lower revenues and higher costs, its operating income declined by 21% YoY to €4.6 billion in 9M 2023. Its reported net income was above €2 billion, a strong increase from the previous year because SocGen booked a loss of more than €3 billion in 2022 related to its exit from Russia, thus adjusted for this effect, its net income declined by some 30% YoY. Its profitability, measured by its return on tangible equity ratio (RoTE) was only 5% in 9m 2023, a very weak level of profitability within the European banking sector.

SocGen’s earnings momentum in recent quarters has been weak, but more worrisome is that the outlook for the next few years is not much better. Indeed, the bank presented its strategy update back in September, releasing some targets that were not very impressive and, not surprisingly, its share price was down by 12% in the day.

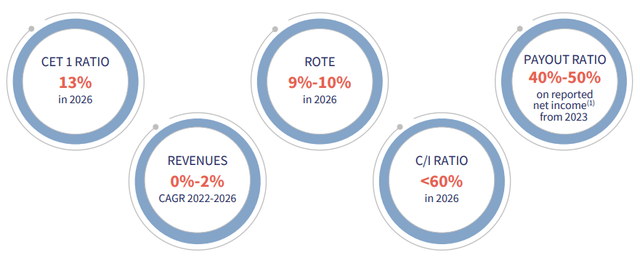

Regarding revenues, the bank’s goal is to grow annual revenues by 0-2% from 2022-26, showing that SocGen’s weak performance in recent quarters is not expected to change much going forward. To improve its profitability, SocGen’s strategy relies mainly on cost cutting, aiming to reach a cost-to-income ratio below 60% by 2026. This is still a level above the sector average and SocGen’s track record regarding cost cutting is not fantastic, thus there is a significant execution risk and it’s quite likely that SocGen will not be able to reach this efficiency level, as inflationary pressures are expected to remain strong over the next few years.

Its RoTE is expected to be between 9-10%, again a level that is not particularly impressive compared to its closest peers, and remains below the bank’s cost of capital, being a major reason why its shares trade consistently below book value. Regarding capital and dividend distribution, its goals are not much different from its current position, aiming to have a CET1 ratio of 13% and a dividend payout ratio between 40-50%.

Main targets (SocGen)

These targets are, generally speaking, somewhat poor, showing that SocGen’s fundamentals are not strong in the European banking sector. Moreover, the bank’s profile is not expected to change much in the coming years, thus its revenue and earnings growth is likely to remain quite muted, not boding well for its valuation and share price.

This means that the main attractive factor of its investment case remains its high-dividend yield, given that it currently offers a yield above 7%, based on its 2023 dividend of €1.70 per share. This represents a dividend payout ratio of about 34%, to adjusted earnings, while based on reported earnings its payout ratio was close to 100%.

Related to 2023 earnings, current consensus expects a dividend of about €1.20 per share, which represents a decline of 30% YoY. However, this seems to be conservative as the bank’s EPS in 9M 2023 was €1.90 per share and has a distribution provision of €1.33 already booked in its accounts, thus a dividend cut is possible but I think it may be lower than what the market is currently expecting. Nonetheless, considering the positive operating momentum in the European banking sector and higher dividends expected ahead, a potential dividend cut from SocGen is not likely to be well received and is likely to be another headwind for its share price ahead.

Conclusion

Societe Generale offers a high-dividend yield, being the main reason for investors to consider its shares in my view. Moreover, it’s currently the cheapest bank in Europe, trading at only 0.3x book value (in-line with its historical average over the past five years), but this seems to be justified by the bank’s weak profitability level that is not much likely to improve markedly in the coming years. Therefore, I think a high-dividend yield is no longer enough to justify a ‘buy’ rating, as I now see SocGen as a value trap, and long-term investors should stay away from its shares.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here