I always love finding a company that has an interesting business model. This is especially true if it’s a company that does something that appeals to me. One firm that has passed my radar that ticks this box is known as Soho House & Co (NYSE:SHCO). In recent years, especially now with the pandemic having ended, the firm has done incredibly well to grow its topline. It still struggles from a profit and cash flow perspective, but this year in particular is shaping up to be rather positive. The stock is getting cheaper in response to this. However, I am not yet convinced that growth is strong enough to justify a bullish stance. As much as I wanted to rate this company a ‘buy’ because of how interested I am in it, I believe that a ‘hold’ rating is most appropriate at this time.

Putting a price on exclusivity

Operationally speaking, Soho House & Co is a unique business that focuses largely on selling experiences to its customers. Originally known as the Membership Collective Group, the business traces its roots back to the first Soho House location that was opened up in 1995. The original location, located in London, was opened as an exclusive, membership-based club for its members to enjoy. From that humble beginning, the company has expanded to 41 different houses spread across 17 different countries. At these locations, members have access to lounge spaces, spas, pools, screening rooms, and more. The primary focus of the company is not catering necessarily to the wealthy or the business minded. Rather, the goal is to cater to the young, city dwelling creative class out there.

Pricing depends on exactly what kind of experience you want. But as an example, to get access to all of the houses worldwide, members must pay $4,500 per year if the home base that they choose is in Chicago. This price can change based on location, as well as membership type. For instance, the annual cost with a home base of New York would be $4,899, while in places like Rome and London, prices are €2,750 and £2,750, respectively. The Cities Without Houses option often results in lower prices, while those under 27 years of age can join for only half the price of those who are older. Over the years, the company has expanded its business to include workspaces, restaurants, branded retail products, and more. It even collects management fees from hotel management contracts for the hotels that it owns.

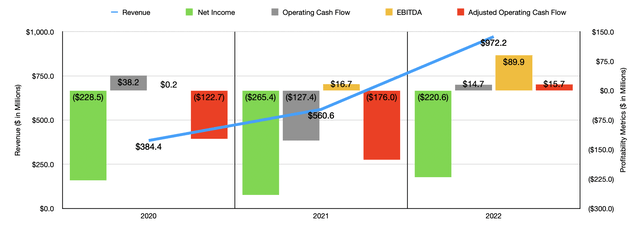

Author – SEC EDGAR Data

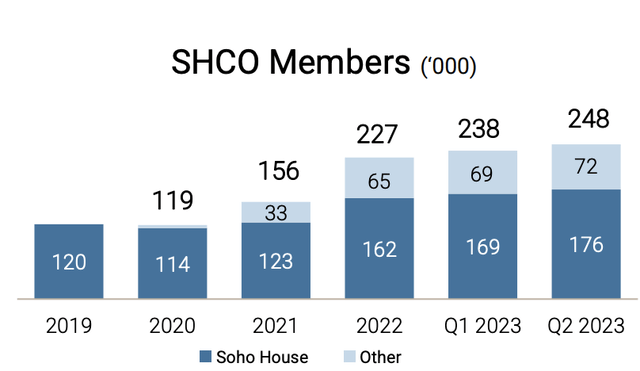

Over the past three years, the company has truly grown remarkably. Revenue went from $384.4 million in 2020 to $972.2 million in 2022. An increase in the number of houses from 26 locations to 40 was instrumental in achieving this. However, the company also saw an explosion in the number of House Members from 119,832 to approximately 162,000 over this window of time. Total memberships are even larger, hitting 226,800 in 2022.

While the topline has been great, the bottom line has been less than ideal. In each of the past three completed fiscal years, the company generated significant net losses ranging between $220.6 million and $265.4 million. The good news is that other profitability metrics have been better. Operating cash flow did decrease from $38.2 million to $14.7 million over this three-year window, but in the middle of those two years was 2021, a year in which the company saw outflows of $127.4 million. If we adjust for changes in working capital, operating cash flow would have gone from negative $122.7 million to positive $15.7 million. The only profitability metric that showed consistent improvement was EBITDA. It increased from only $226,000 to $89.9 million during this three-year window.

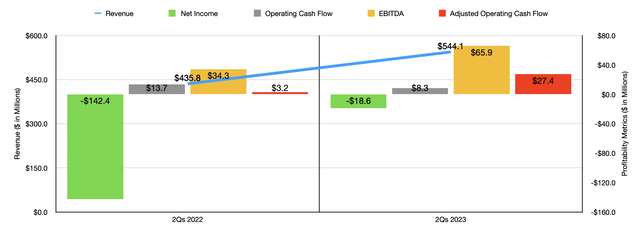

Author – SEC EDGAR Data

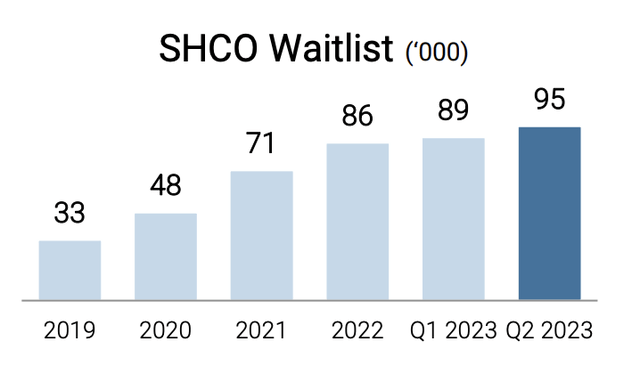

The great thing about the company is that growth continues to impress. Revenue in the first half of 2023 totaled $544.1 million. That’s 24.9% above the $435.8 million reported one year earlier. An increase to 41 houses aided in this regard. House membership expanded from 142,250 at the end of the second quarter of last year to 176,305 the same time this year. Total members jumped from 193,370 to 248,071 over this same window of time. This increase in membership helped to push membership revenues for the company up 38% year over year from $124.7 million to $172.4 million. It’s also worth noting that, as of the end of the second quarter, the company had 95,000 people on its waitlist, waiting to become members. This compares to the 86,000 that were on the list at the end of 2022.

Soho House & Co Soho House & Co

Interestingly, though, this accounts for only 31.7% of the company’s overall sales. In-house revenue, which largely involves the purchase of foods and beverages, as well as accommodations, spa products and treatments, and more, grew 22% from $197.4 million to $241.6 million. This is the largest chunk of the company, accounting for 44.4% of overall sales. And finally, we have ‘other revenues’, which include all the other miscellaneous operations of the company like the hotel management fees, workspaces, and more. This managed to grow 14% from $113.7 million to $130.1 million.

Soho House & Co

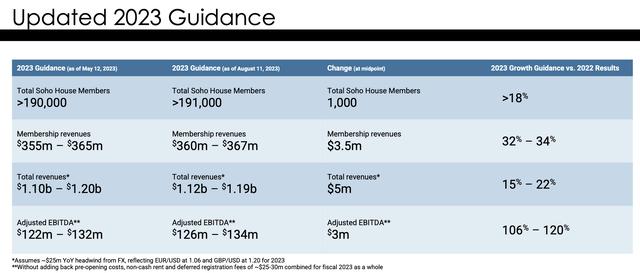

For the most part, profitability also improved. The firm’s net loss went from $142.4 million to $18.6 million. Operating cash flow declined from $13.7 million to $8.3 million. But on an adjusted basis, it expanded from $3.2 million to $27.4 million, while EBITDA nearly doubled from $34.3 million to $65.9 million. This strong performance encouraged management to increase guidance for the 2023 fiscal year. Management is now forecasting over 191,000 House Members for the year. This should bring Membership revenue up to between $360 million and $367 million, while total revenue should be somewhere between $1.12 billion and $1.19 billion. The forecast for EBITDA is between $126 million and $134 million. No guidance was given when it came to operating cash flow. But using my own estimates, which factor in the large amount of interest the company pays on the $710.6 million of debt on its books, this metric should come in at around $46.2 million.

Author – SEC EDGAR Data

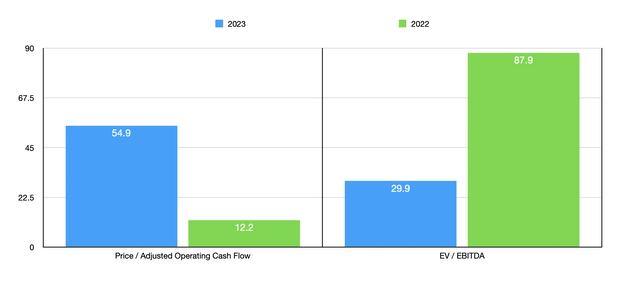

Using these figures, it is not difficult to value the company. In the chart above, you can see how the company is valued on a forward basis using both the price to adjusted operating cash flow multiple and the EV to EBITDA multiple. In both cases, the stock is meaningfully cheaper than if we were to use data from 2022. That is most certainly encouraging. Now, truthfully, it’s difficult to really compare the company to anything else out there. Three companies that I did come up with that are probably the closest can be seen in the table below. But using both valuation approaches, Soho House & Co ended up being the most expensive of the group.

| Company | Price/Operating Cash Flow | EV/EBITDA |

| Soho House & Co | 29.9 | 14.8 |

| Target Hospitality Corp. (TH) | 3.9 | 5.2 |

| Playa Hotels & Resorts N.V. (PLYA) | 9.1 | 8.5 |

| Bluegreen Vacations Holding Corp. (BVH) | 8.5 | 7.8 |

Given how pricey the stock is, I cannot say that I am bullish on the company. But this does not mean that I am bearish on the concept. In fact, I suspect the firm will continue to grow for many years to come. The fact of the matter is that people value exclusivity, and they like the idea of belonging to something special. Those who have the financial capabilities to pay for such a membership will likely flock to the business. This should, I believe, especially apply to the younger generations. After all, the data on this matter is unequivocal.

According to one source, both Millennials and members of Gen Z prioritize experiences over the purchase of consumer goods. 61% of these two groups combined travel in order to focus on personal Wellness. This compares to only 48% of all other generations combined. 61% like to see places that ‘look great’ in photos or videos. That compares to 49% of other age groups. One source from late 2020 concluded that Millennial travelers are seeking ‘more authentic’ experiences on their journeys. And with the age of the digital nomad now upon us, the thought of having an exciting and local community in many other parts of the globe one might travel has got to be appealing.

Takeaway

Based on the data provided, I must say that Soho House & Co is a company that fascinates me. I like the business model, and I can appreciate the rapid growth that management has been able to capture in recent years. Naturally, the results were depressed because of the COVID-19 pandemic. But growth continues to the present day, with the number of members continuing to expand. Having said this, I cannot say that shares are all that appealing. At the present moment, they look to me to be more or less fairly valued when you factor in both the growth prospects and how shares are priced on both an absolute basis and relatively dissimilar firms. Because of these factors, I’ve decided to rate the business a ‘hold’ for now.

Read the full article here