Rapid Recap,

In my previous bearish analysis, I said,

The bull case for SoundHound AI is based on the assumption that its alluring and compelling AI narrative will see SoundHound AI reignite its revenue growth rates.

However, I suspect that the more measured and realistic outcome for Q2 2023 is that SoundHound AI delivers revenue growth rates of 40% CAGR and the company does not significantly upwards revise its 2023 outlook.

My earlier estimations turned out to be prescient. The voice AI technology company is riding a tide that raises all boats, but all this clamor for AI, has left SoundHound AI, Inc. (NASDAQ:SOUN) overpriced relative to what it offers investors.

I recommend that investors avoid this name.

Revenue Growth Rates Require Interpretation

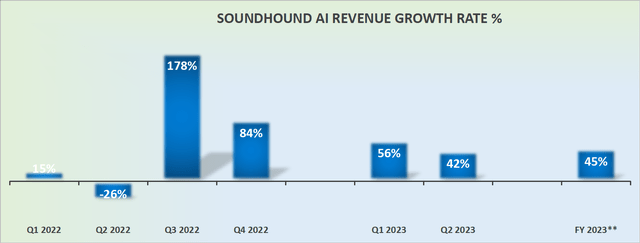

SOUN revenue growth rates

SoundHound’s revenues in Q1 2023 were about $7 million, while its revenues for Q2 2023 were about $9 million. The fact that its revenues are so small makes this story all the more alluring.

And yet, the problem here is that SoundHound AI’s story has got so far ahead of itself, in part due to SoundHound AI’s company name including AI. However, I don’t believe any shareholders would argue this to the contrary.

That being said, its growth rates for Q2 still look remarkably enticing simply because of the easy comparable period with Q2 of last year when the company’s revenues were down 26% y/y.

Indeed, SoundHound’s full-year outlook remains unchanged from its guidance provided earlier in 2023.

This means that despite all investors’ expectations and market narratives surfacing in the past 90 days with regard to AI, SoundHound hasn’t seen any further increased demand than it had at the end of the previous quarter.

The implications were not immediately obvious. Allow me to explain why this is important. I follow many companies and the demand for AI is both broad and deep.

Every company CEO faces one of two questions. Either how they’ll benefit from AI or how they’ll be impacted by AI.

And yet, despite all this cacophony, chanting, and clamor for AI, SoundHound AI has remained relatively unchanged thereby providing solid evidence that this is not the secular growth opportunity that investors had come to believe it is.

But above all, beyond its AI narrative, there isn’t a viable business here.

Hemorrhaging Cash

Let’s pretend, for the sake of our discussion that management works for free and that stock-based compensation is not a real cost.

Consequently, we can see that for H2 2023, SoundAI used $33 million in cash flows. What this means in practice, is that for every $1 of revenues, SoundHound uses $2 in cash flow. This is not a compelling business opportunity. Further, keep in mind that this doesn’t include management’s stock-based compensation.

The one positive aspect facing SoundHound is that its business, for now, holds more than $100 million in cash, meaning that it has at least 18 months’ worth of cash before it needs to revise the capital markets to raise more cash.

The Bottom Line

The excitement around its AI narrative propelling revenue growth didn’t materialize as expected in Q2 2023.

While the revenue growth rates of around 40% CAGR were alluring, the reality is that SoundHound AI’s story had become overly inflated due to the AI buzz. Despite the prevailing AI hype in the market, SoundHound AI’s lack of increased demand and unchanged outlook show that it’s not the growth opportunity investors thought it was.

Its business fundamentals are problematic, and the company’s cash flow situation is concerning, with significant cash burn. Despite holding a substantial cash reserve, SoundHound’s financial health raises doubts about its viability in the long term, leading me to recommend avoiding investment in this company.

Read the full article here