SoundHound AI, Inc. (NASDAQ:SOUN) has soared back to prior highs on artificial intelligence, or AI, hype and the stock being included in key Russell indexes. The problem is that this AI stock still doesn’t have the business to justify the valuation. My investment thesis remains Bearish on the stock, which does not have the results necessary to warrant this rally back above $4.

Source: Finviz

Index Inclusion

On June 26, SoundHound was included in the Russell 2000 (RTY) and broad-market Russell 3000 indexes following the annual reconstitution. While the move provides the stock with greater visibility, the move doesn’t provide SoundHound with any greater business.

Russell captures the 4,000 largest U.S. stocks as of April 28, 2023. SoundHound traded at $2.66 in the last trading day in April, giving the stock a market cap of ~$530 million.

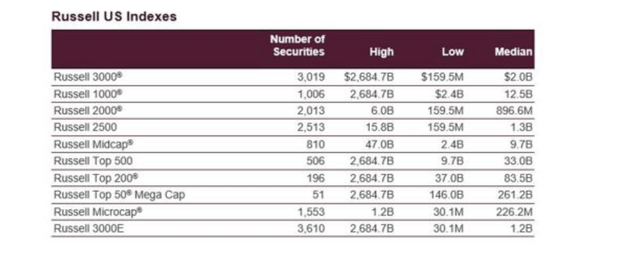

As an example of the additions to the Russell 2000 this year, Wave Life Sciences (WVE) was added with a current market cap below $400 million. The Russell 2000 index includes stocks with a market cap as low as $159.5 million and a median valuation of $896.6 million, placing SoundHound around an average Russell 2000 stock after the recent rally.

Source: FTSE Russell

The index inclusion, however, isn’t any reason to own SoundHound.

Disappointing Numbers

A possible risk to buying SoundHound now is a future exclusion from the list. The AI software company only reported Q1 revenues of $6.7 million in an indication of the limited business produced despite the AI hype.

The company continues guiding towards revenues of $43 to $50 million for the year. Analysts peg revenue of $45 million for 45% growth, further deceleration from the 56% growth reported in Q1’23.

As with other AI software stocks, SoundHound promises a lot of products for enterprise customers like SoundHound Chat AI and Dynamic Interaction with Generative AI. The frustration here is that all of the hype and promise of generative AI unleashed by ChatGPT back in October hasn’t led to much business upside for SoundHound AI.

The company already reported a $300 million backlog back in Q3 ’22, yet the company has spent this period cutting the operating expense run rate by 40%. The backlog is only up to $336 million, following only $10 million in bookings backlog in Q2 ’23.

SoundHound has made a goal of becoming adjusted EBITDA profitable by Q4’23, but the market would much prefer the AI company boost revenue projections with the launch of generative AI chat. The reality is that revenue expectations for the next couple of years have collapsed.

The end result is that SoundHound now trades with an $800+ million market cap, with a $45 million revenue target for 2023. The 2024 revenue target is only $82 million.

The company has raised a massive $150 million in capital YTD. The Q1’23 share count hit 205 million. SoundHound had a listed share count of only 1xx million when ChatGPT was launched.

The AI software company ended March with a cash balance of only $46.3 million, while SoundHound raised another $100 million in non-dilutive debt financing. The prime reason being that is SoundHound burned $14.5 million in cash during the quarter, and during the next couple of quarters should burn a large amount of cash for the relative size of the company.

Also, the AI software company isn’t seeing the explosive bookings one might expect with the explosive hype for AI. The voice-enabled services business for restaurants continues to be mostly talk.

On the Q1’23 earnings call, CFO Nitesh Sharan discussed the expanding pipeline with no real revenue progress since Q4:

The demand is real and one advantage here is the pace at which we can scale because of the much shorter sales cycle and activation timeline. I mentioned last quarter how our advanced pipeline of stores was well into the thousands, and we continue to expand that meaningfully in Q1.

More concerning, competitors are already snapping up high profile deals like the one Google (GOOG) Cloud signed with Wendy’s (WEN). This deal only started in June, with one store location in Ohio as a pilot test for AI ordering. It is a further sign of the revenue delay in restaurant voice-enabled services and likely lack of a major market share position.

Takeaway

The key investor takeaway is that SoundHound AI, Inc. is an interesting AI play, but the stock is clearly overhyped for the actual current business opportunity. The stock being included in the Russell indexes provides another opportunity to exit at the yearly highs, with a market cap far disconnected from the actual business.

Read the full article here