For the 2nd week in a row, there was no data forthcoming from IBES and Refinitiv, which is actually understandable, since the last week of every quarter, and then the first week of the next quarter, is very slow in terms of earnings releases.

Using the last “live” report from IBES data by Refinitiv, the new “forward 4-quarter estimate” (FFQE) which we won’t see until next Friday, January 12th, will be somewhere close to $243.98, up sharply from the last FFQE on 12/22/23 of $232.95.

The S&P 500 earnings yield jumped to 5.19% this week, using that “FFQE”. Remember, there will be a new FFQE next week, and with the rolling into January, ’24, it will essentially be the 2024 calendar EPS estimate.

The quarterly bump is always worth scrutinizing, although it can be tracked well in advance.

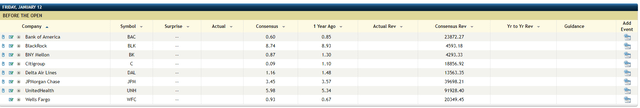

Remember, next Friday, January 12th, we get 6 major financial institutions reporting:

Personally, I’ll be most interested in JPMorgan’s (JPM) numbers since it’s been a top 10 client holding since the Financial Crisis, but clients are also long Citigroup (C) and Bank of America (BAC) as well.

Jefferies (JEF) reports Monday, January 8th after the close, and KB Home (KBH) reports later in the week.

Having never owned the stock, I’ve always thought Jefferies was a quality financial, and I was lucky enough to be able to get their sell-side research for a while.

It’s usually the first broker to report, so a quick read of their results may give some clue as to what’s coming Friday, January 12th in terms of capital market operations, i.e. trading and banking.

Healthcare

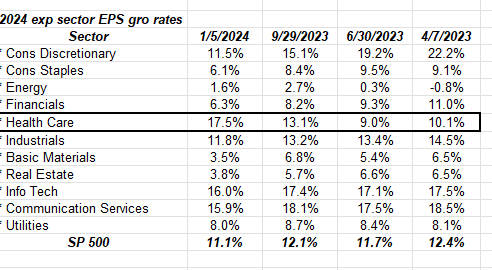

If readers are wondering why the sudden burst in healthcare stocks this week, take a look at the “expected” growth rate for Healthcare EPS that has been developing in the sector earnings data.

Healthcare is the only one of the 11 sectors of the S&P 500 that has seen an improving or positive revisions to its expected 2024 EPS growth rate over the last 39 weeks.

The above spreadsheet clipped starts with April 7 ’23, and takes the reader through the close this week.

The two ways to look at this sector data is 1.) note the sector seeing positive revisions in growth rates, which is actually pretty rare, or 2.) note which sectors are not seeing much degradation or negative revisions in EPS growth rates.

Yes, #1 is preferred, but #2 is also a good tell for what the sell-side analysts are doing with the sector.

Summary/conclusion: Until Friday, January 12th, ’24, it’s another quiet week for earnings, so Thursday’s CPI will get a lot of attention until Friday morning.

After the 9-week sprint from late October through December 29th, the S&P 500 was very overbought, but this week has helped take a lot of enthusiasm out of market sentiment.

One final thought: High-yield credit spreads widened sharply this week, after noting it as our 2nd bullet point in the 2024 forecast.

Last Friday, December 29th, I was having lunch with a former co-worker who still manages a corporate bond fund 30-35 years after he started.

I asked him about what he was hearing about why corporate high-yield spreads had tightened so much in December ’23, and he thought it was due to the buy-side realizing that these yield levels might not last very long, and piled in quickly.

Remember that S&P 500 earnings yield can rise in two ways: the S&P 500 declines in value, or the forward 4-quarter estimate rises with earnings reports as it did during October ’23.

None of this is advice, opinion or a recommendation. Past performance is no guarantee or suggestion of future results. All S&P 500 EPS data is sourced from IBES data by Refinitiv, unless otherwise noted.

Investing can involve the loss of principal. Readers should evaluate their own comfort level with portfolio volatility and adjust accordingly.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here