During the early days of the regional banking crisis, I penned a cautious article on the SPDR S&P Bank ETF (NYSEARCA:KBE), warning about the headwinds from rising interest rates on both the banks’ assets (higher long-term interest rates lead to lower asset values) and deposits (higher short-term interest rates lead to outflow of deposits to money market funds).

Ultimately, the regional banking claimed several victims including SVB Financial, which was seized by the FDIC and sold to First Citizens Bank, and First Republic Bank, which had its asset seized and sold to JPMorgan (JPM).

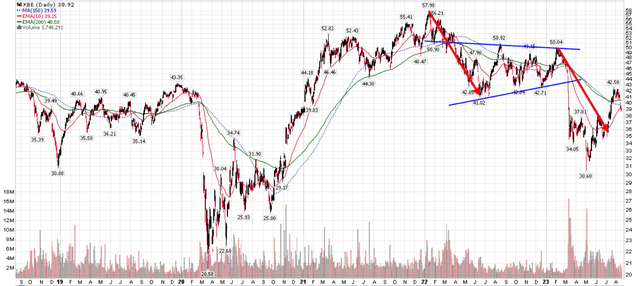

In terms of the KBE ETF, my caution was well warranted, as KBE stock price fell from $38 at the time of my article to a low of ~$30, essentially fulfilling the technical breakdown I foresaw (Figure 1).

Figure 1 – KBE fulfilled technical breakdown (Author created with price chart from stockcharts.com)

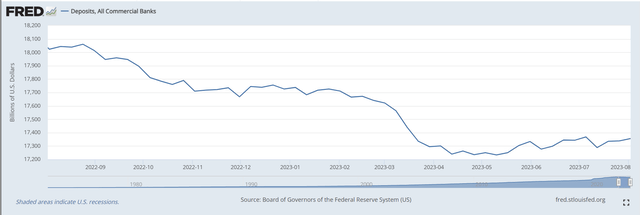

However, the crisis ultimately fizzled out as the deposit run on regional banks eased (Figure 2). According to St. Louis Fed data, commercial bank deposits bottomed at $17.2 trillion in late April and have recently rebounded to $17.4 trillion.

Figure 2 – Commercial bank deposit flight eased in May (St. Louis Fed)

Stabilizing bank deposits helped the KBE ETF recover a large part of the losses experienced since problems first bubbled to the surface in early March.

Higher Long-Term Interest Rates May Pressure Banks Again

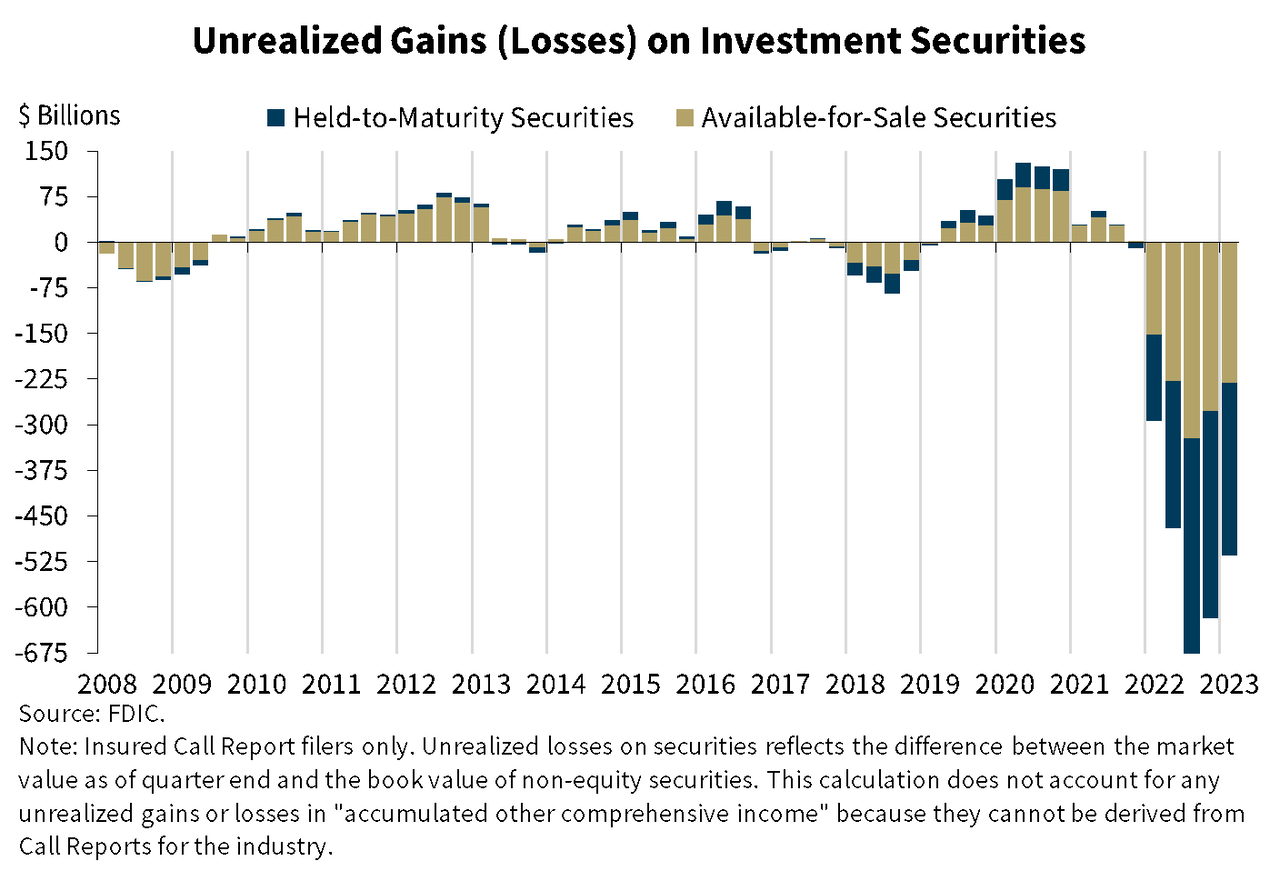

Although pressures have abated on the liability side of the balance sheet for U.S. banks, the situation has not really improved on the asset side. Recall, one of the primary triggers of the regional banking crisis was hundreds of billions in unrealized losses on investment securities sitting on bank balance sheets as interest rates have increased since banks bought these securities (Figure 3).

Figure 3 – Unrealized Gains (Losses) on Investment Securities (FDIC)

Unrealized losses were turned into realized losses for banks like SVB Financial when they experienced deposit flight, which forced them to sell securities to meet liquidity needs.

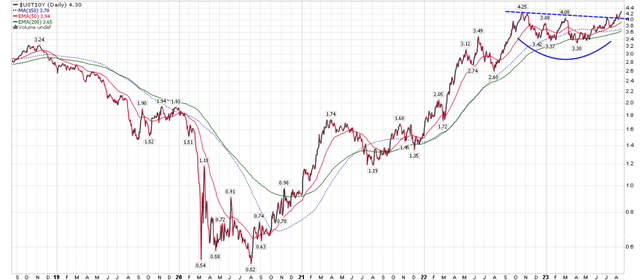

Unfortunately, with long-term interest rates recently pushing to new cycle highs, I fear the unrealized securities losses may actually have gotten worse since March.

Figure 4 – Long-term interest rates pushing to cycle highs (Author created with price chart from stockcharts.com)

Interest rates have been driven higher in recent weeks by a number of factors including expectations for a ‘higher for longer’ Federal Reserve, rising global interest rates (chiefly Japanese bond yields), and a profligate U.S. government leading to out of control spending and a Fitch downgrade.

Investors interested in reading more about these factors can read my recent article on the Simplify Interest Rate Hedge ETF (PFIX), which goes through them in detail.

How To Monitor Health Of Banking Sector

One place where investors can monitor the health of the banking sector is to look the loan balances of the Federal Home Loan Bank (“FHLB”), commonly referred to as the ‘lender of next-to-last resort’.

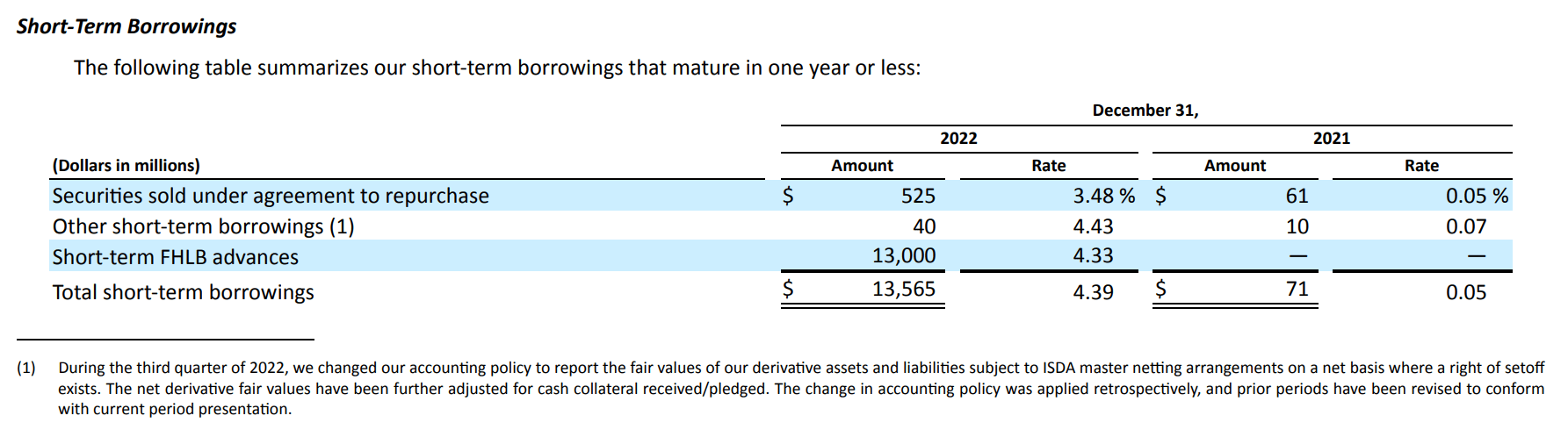

SVB Financial, when it faced deposit flight in late 2022, plugged its capital hole by borrowing $13 billion from FHLB (Figure 5).

Figure 5 – SVB borrowed heavily from FHLB (SVB Financial 2022 10K Report)

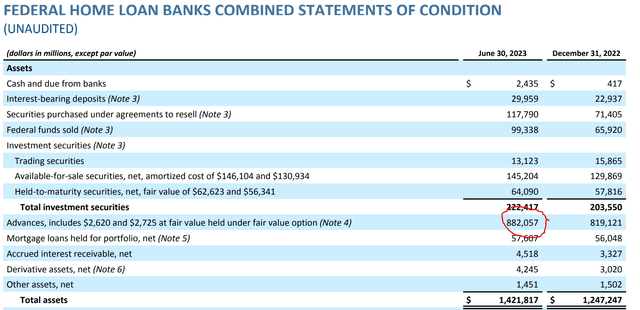

Looking at the latest financials from FHLB, we can see that the FHLB had advanced $882 billion to other banks as of June 30, 2023 (Figure 6).

Figure 6 – FHLB had advanced $882 billion to banks (FHLB Q2 financials)

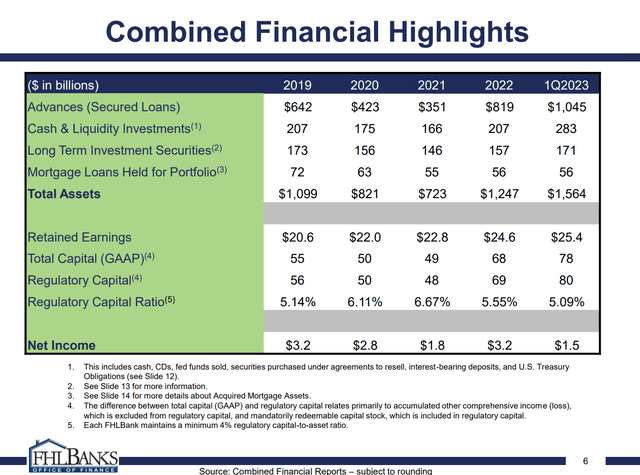

While the figure is a decline from the $1.05 trillion advanced as of March, during the depths of the banking crisis, $882 billion is still a very elevated level (Figure 7).

Figure 3 – Condensed historical financials of FHLB (FHLB)

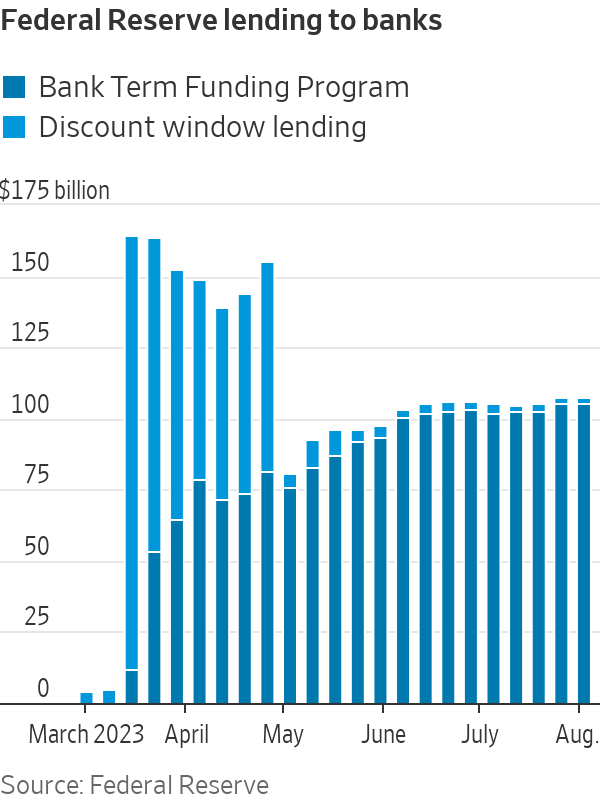

Furthermore, looking at the balance sheet of the lender of last resort, the Federal Reserve, we can see that the Fed is still lending over $100 billion to banks, mostly via the Bank Term Funding Program (“BTFP”) (Figure 8).

Figure 8 – BTFP is still lending over $100 billion to banks (Federal Reserve via Nick Timiraos on Twitter)

So overall, combined lending between FHLB and the Federal Reserve’s BTFP is still near $1 trillion, not much improvement from the March crisis levels.

Fitch Threaten To Downgrade Banks

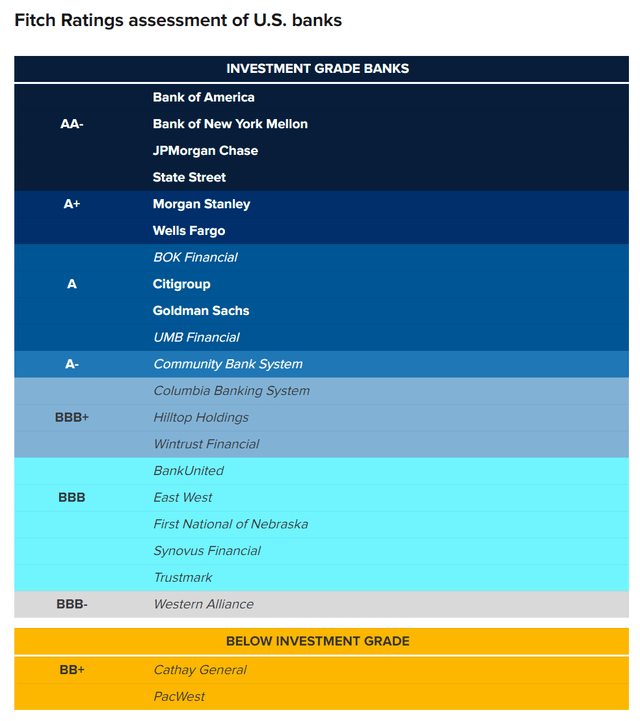

Another risk investors should be monitoring is a potential industry-wide downgrade of banks by the rating agency Fitch.

In June, when Fitch last reviewed the financial health of the U.S. banking industry, it downgraded the whole industry to AA- on structural challenges such as higher interest rates pressuring deposit rates and profitability. Recently, Fitch warned it may have to downgrade U.S. banks again, as the Fed appears to be holding interest rates higher for longer and credit appears to be trending towards higher than normal losses.

For many lower-rated banks, a downgrade by Fitch could boot them out of investment grade (BBB) rating and trigger selling from bond funds, sparking further market volatility (Figure 9).

Figure 9 – A potential Fitch downgrade could negative affect many lower rated banks (CNBC)

Credit Normalizing; Watch Student Loan Repayments

Finally, after 3 years of pandemic-stimulus fueled sugar high, credit metrics for credit cards are finally normalizing, suggesting a tougher time going forward for banks.

Putting further strain on consumers already suffering from high inflation depleting their savings, the federal government is set to resume collecting payments on student loans that have been on hold for over 3 years beginning in October.

According to a Bank of America survey, the resumption of student loan payments will negatively impact more than 43 million Americans, with the average borrower having to budget an extra $200-400 per month to repay student loans.

According to the Consumer Financial Protection Bureau (“CFPB”), one in five borrowers indicate they may struggle financially to repay their student loans once repayment restarts.

Risk To Cautious View

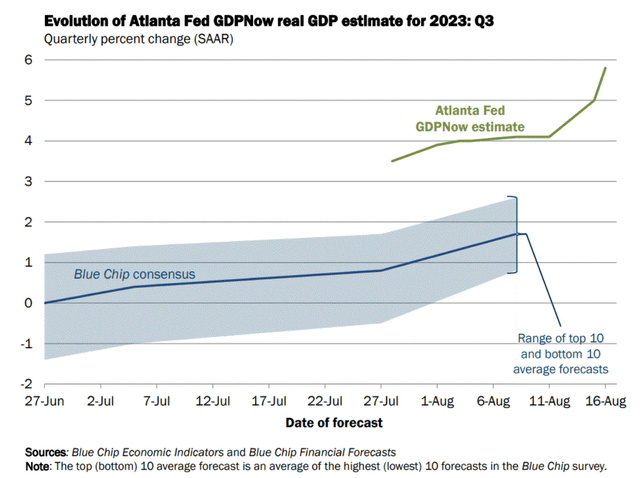

Of course, my view on the KBE ETF may be overly cautious, as the U.S. economy continues to power along, with the Atlanta Fed’s GDPNow tool forecasting a Q3 real GDP growth rate of 5.8% YoY.

Figure 10 – GDPNow forecasting 5.8% YoY GDP growth (Atlanta Fed)

However, a strong economy also emboldens the Fed’s ‘higher for longer’ monetary policy, which may keep the long-term bond yields well bid and pressure banks’ balance sheets. A catch-22.

Conclusion

In summary, although the acute phase of the regional bank crisis appears to have passed, with commercial bank deposits recovering somewhat, the main trigger of large unrealized losses on investment securities remain unresolved.

With a recent surge in long-term bond yields, I fear the unrealized investment losses may have gotten worse and may come back to haunt banks in the coming quarters. With credit normalizing and trending towards above normal losses, I suggest investors avoid cyclical sectors like banking.

Read the full article here