Introduction

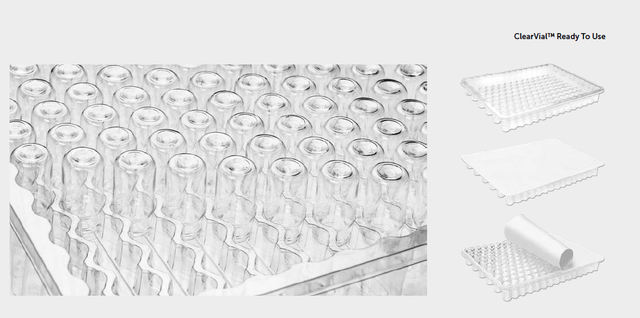

SP Group (OTC:SPGGF) is a Danish company focusing on the production of moulded plastic and composite components for industrial and medical use. The company was created in 1972 and now, just over 50 year later, SP’s products are sold in almost 100 countries all over the world and some of the products are for instance plastic vials in the medical industry and composites used in wind turbines.

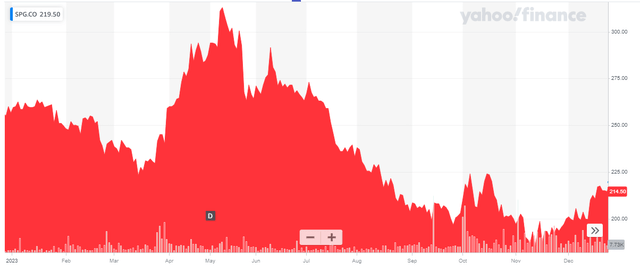

Yahoo Finance

The company’s primary listing is in Denmark where it’s listed with SPG as its ticker symbol on the Copenhagen Stock Exchange. The average daily volume in Copenhagen is 15,000 shares per day representing a monetary value of 3.3M DKK per day. At the current exchange rate of 6.73 DKK per USD, this represents approximately $0.5M on a daily basis. SP Group currently has 12.2M shares outstanding resulting in a market capitalization of just under 2.7B DKK (approximately $400M). I will use the DKK as base currency throughout this article.

What does the company do?

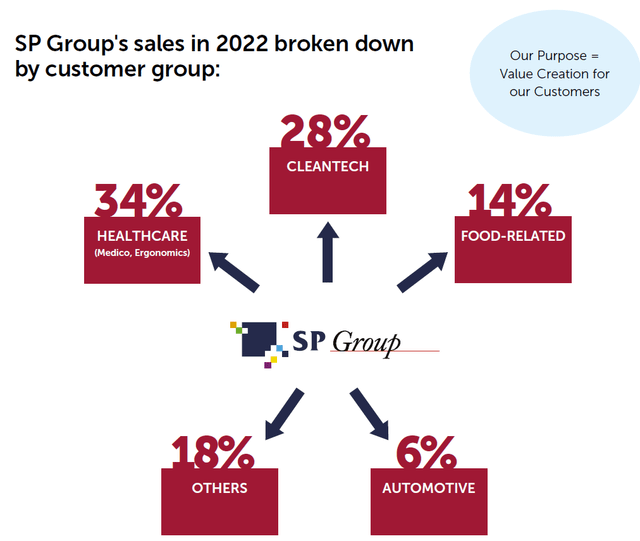

As mentioned in the introduction, cleantech and healthcare are the most important sectors for SP Group to sell its products into. In 2022, in excess of a third of the revenue was generated in the healthcare sector while 28% came from the cleantech industry.

SP Group Investor Relations

The image above also shows approximately 14% of the revenue was generated in the food sector and coating plays an important role there as well. SP Group for instance also produces the coating for waffle irons.

SP Group Investor Relations

At this time, SP Group is the largest injection moulding business in Denmark and the second largest in the entire Nordic region, which is still very fragmented. SP Group does more than just producing the moulds as it’s also able to provide its customers with value-adding initiatives like laser engraving and 3D printing.

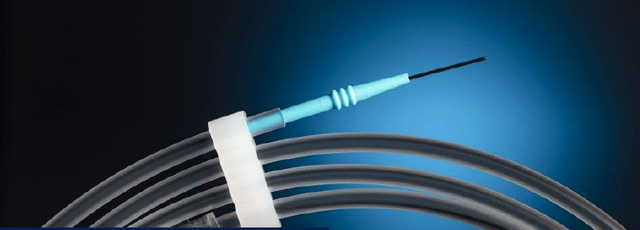

I’m mainly interested in the medical division of SP Group as the company addresses a 15B DKK market with an anticipated annual growth rate of 5%-7%, including the coated guide wires for cardiology and urology purposes.

SP Group Investor Relations

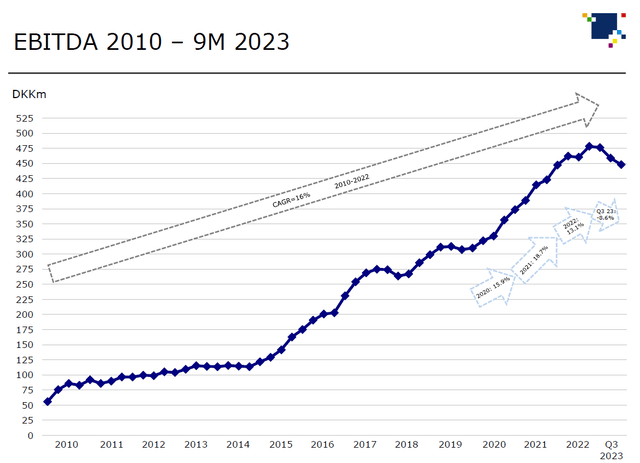

The client-centric approach is paying off as the company can look back on a very impressive growth trajectory. In the past 12 years, the revenue increased by 10% per year while the EBITDA CAGR was a very impressive 16%. Whereas the company reported an EBITDA of less than 100M DKK in 2010, the EBITDA result increased to 478M DKK in 2022 before retreating a little bit in the current financial year as SP Group is adapting to the changing market circumstances.

SP Group Investor Relations

The financial performance has been strong – but 2023 will be a transition year

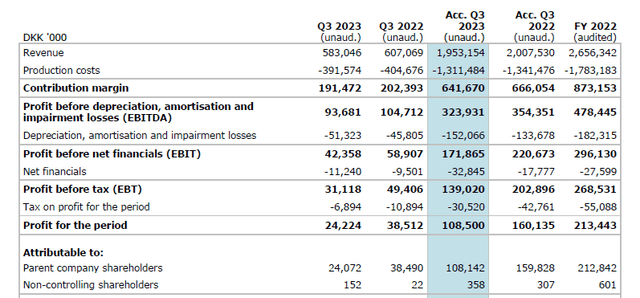

During the third quarter of this year, SP reported a total revenue of 583M DKK resulting in a gross margin of 191.5M DKK which is approximately 5% lower than the gross margin of 202.4M DKK it reported in the third quarter of 2022. Unfortunately this also meant the EBITDA decreased by approximately 10M DKK and this represented a decrease of approximately 10%.

SP Group Investor Relations

On top of that, the net finance expenses also increased, as did the depreciation and amortization expenses and this ultimately resulted in a net income of 24.2M DKK of which 24.1M DKK was attributable to the shareholders of SP Group. This represents an EPS of just under 2 DKK per share, and the 9M 2023 EPS was 8.9 DKK per share. Clearly a substantial and noticeable decrease from the 13.12 DKK per share it posted in 9M 2022.

Margin pressure is one reason but another important reason is the increasing cost of debt as the company saw its total net finance expenses almost double and those additional finance expenses represented an impact of 1 DKK on the EPS.

The full-year guidance calls for the FY 2023 revenue to grow by 0%-10% compared to 2022 while the EBITDA margin will come in around 16$-19%. Unfortunately this still is a pretty wide margin and based on the 9M 2023 results I think it is safer to aim for the lower end of that guidance. In 2022 for instance, the EBITDA margin was approximately 18% while the EBITDA margin in the first nine months of 2023 was 17.6%. The EBT margin in FY 2022 was 10.1% while the EBT margin in the first nine months of the current financial year came in at approximately 7.1%. SP’s full-year EBT margin guidance is just 7%-10% which means we will see continuous pressure on the EBIT margin, in line with the Q3 result of just 5.3%.

That being said, the company continues to grow and those growth investments will now start to generate returns for SP. A new 12,000 square meter facility in Poland is now operational while the company is completing the construction of a new plant in the Atlanta region which should be ready for production by the summer of 2024.

As margins are now coming under pressure I also wanted to make sure the company’s cash flow profile remains intact to ensure it can continue to fund those expansion plans.

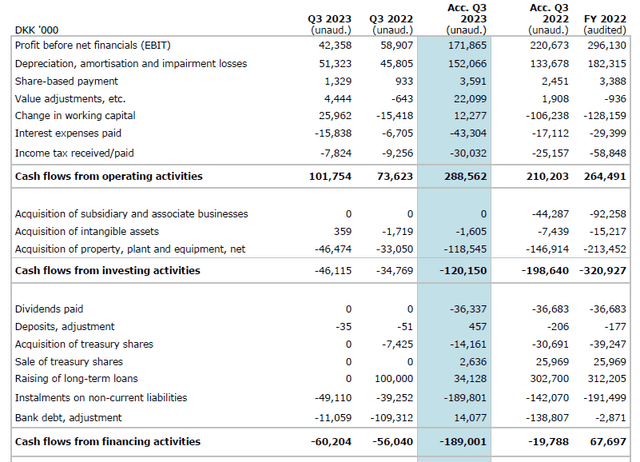

In the third quarter of the year, SP Group generated almost 102M DKK in operating cash flow but this included a 26M DKK working capital release and it excludes the lease payments. The company did not disclose the quarterly lease payments but we know from the FY 2022 annual report the annual lease payments in FY 2022 were approximately 33M DKK so I think it is fair to assume the current quarterly lease payments are approximately 9M DKK.

SP Group Investor Relations

This means the adjusted operating cash flow was 68M DKK after also adding back the 1M DKK difference between taxes owed and taxes paid. The total capex was approximately 46.5M DKK but keep in mind this includes expansion capex as well.

As of the end of September, the net interest-bearing debt came in at 965M DKK but it’s not 100% clear if the company-provided net debt includes the lease liabilities or not. If it does, the debt ratio will likely come in around the 2.3-2.4 times EBITDA – depending on the working capital variation during the final quarter of the year.

The company expects to post strong growth numbers in the next few years

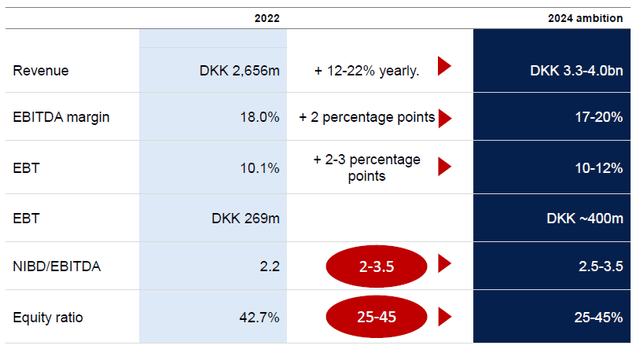

While 2023 appears to be a transition year, SP Group hasn’t pulled its ambition/guidance for 2024 yet. After a strong 2022, SP Group released its ambitions for 2024 with an anticipated revenue of 3.3-4B DKK in 2024 at an EBITDA margin of 17-20% and an EBT margin of 10%-12%.

SP Group Investor Relations

I think those targets are a bit too ambitious for 2024 given the pressure on the margins in 2023. I expect the company to provide an updated guidance for 2024.

Investment thesis

The analyst consensus estimates don’t seem to be taking a revenue increase to 3.3B DKK into account in the next few years as the consensus calls for a 2.83B DKK revenue in 2025 which should result in a 495M DKK EBITDA. This should result in a debt ratio of less than 1.5 times EBITDA while this also implies the company is trading at an anticipated EV/EBITDA multiple of approximately 6.5. Keep in mind this does not take any potential acquisitions into account. As SP Group is referring to the fragmented Nordic market, it may be able to acquire some smaller competitors at a reasonable price which could help the company to reach its revenue and EBITDA targets.

The first priority should be to stabilize the operating margins while continuing to invest in demand-related expansion projects whereby SP Group works with cornerstone customers to build or expand facilities where the additional output will be easily absorbed by those clients. I’m also encouraged by the recent insider purchases in the stock.

I currently have no position in SP Group but I will be keeping an eye on the financial performance. I expect to see an updated guidance for 2024 (and beyond) and an update on the expansion plans.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here