Introduction

Spotify reported its Q2 earnings on July 25. Its stock price dropped 14% by the time we wrapped up the report. It was down 25% from the recent high of $182 per share. The stock went up 22% since our coverage three months ago.

Investors’ Greatest Fears Become Reality

A certain section of the investor community perceives that Spotify (NYSE:SPOT) possesses limited leverage while negotiating with record labels. This perception springs from the understanding that Spotify is in a weaker bargaining position due to the platform’s dependence on labels for the music content it streams to its vast global audience.

Therefore, we believe that recent market reactions, specifically the notable dive in Spotify’s stock price, can be attributed to the company’s acknowledgment that its profitability is being affected by the escalating costs of music royalties.

However, we think the market’s perception of Spotify’s weak bargaining power against labels can be over-exaggerated for two reasons.

1. Premium margin is the right metric to look and it expanded steadily

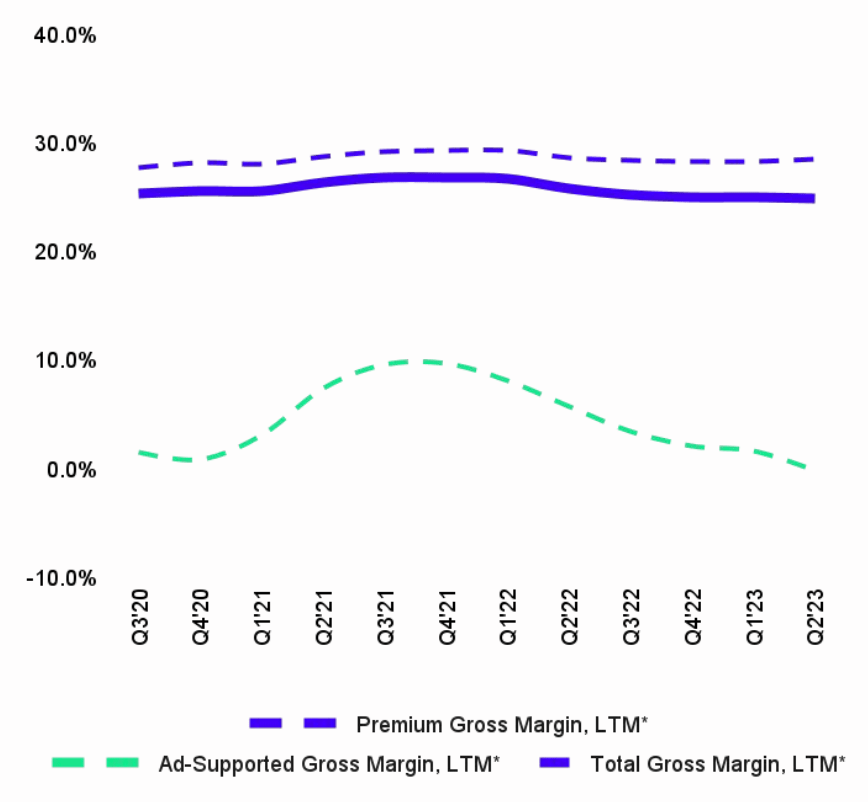

We contend that the premium margin serves as a more accurate indicator to assess Spotify’s bargaining power in dealing with labels. In this particular line of business, Spotify acts as the supplier (label) to individual customers. However, in its ad-supported business model, Spotify becomes the supplier to advertisers while still catering to individual customers. Analyzing the company’s financials, we observe that its total gross margin was affected negatively by the ad-supported business. In contrast, the premium gross margin remained stable and showed gradual expansion.

Gross margin (SPOT)

The difference in premium margin and ad-support margin indicates that Spotify has a stronger bargaining position when dealing with individual customers, as the company can pass the costs to them while still maintaining a healthy margin.

On the other hand, the lower margin in the ad-support business does not necessarily imply weak bargaining power against advertisers or labels. Spotify presently employs the ad-support business as a means to acquire new users. Its ad-supported tier comes with certain restrictions, such as limitations on on-demand song selection, which may impact listening time and engagement. Nevertheless, our assessment is that Spotify’s strategy of using the ad-support model for user acquisition is viable in the long run. By first bringing customers to the platform through the ad-supported tier, there exists a multitude of opportunities to eventually convert them into paid users and earn higher margins.

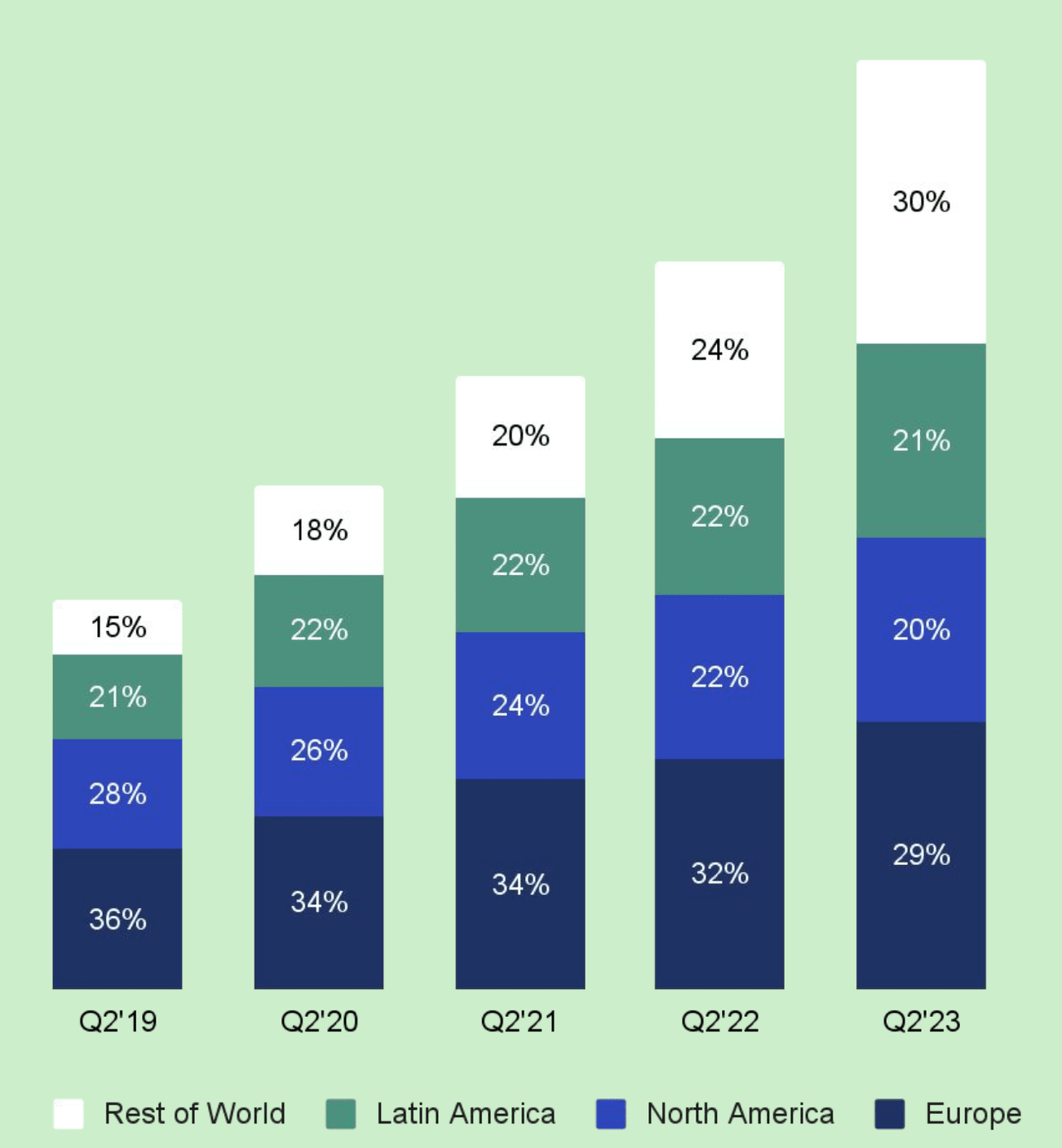

It’s also important to note that management has attributed part of the challenge to the growth in the rest of the world market, where the ARPU tends to be lower, impacting the overall business performance.

Spotify subscriber by geography (SPOT)

2. Ad-support business is still in the growth phase

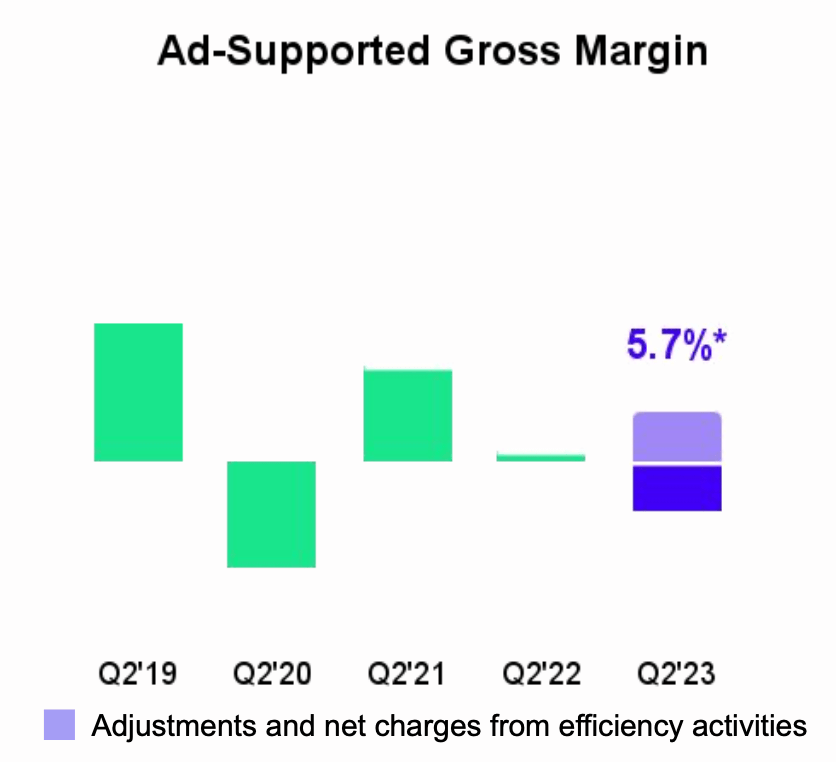

After the adjustment, the company showed expanding ad-support margin to 5.7% rather than a decrease of 5.7%, which led the market to have wide interpretation and was kind of very controversial.

Ad-support gross margin (SPOT)

The management attributed the impact on its ad-support business to two main factors: (1) macroeconomic weaknesses and (2) the termination of contracts and content write-offs resulting from ongoing adjustments to the podcast strategy.

To be fair. The management’s explanation regarding the impact on the ad-support business has raised skepticism among investors. One key aspect that has undermined the persuasiveness of their argument is the historical fluctuation of the ad-support business margin, which has consistently hovered around 0%. Investors often seek stability and predictability in a company’s financial performance. It raised concerns about the company’s ability to maintain steady revenue streams and profitability. Moreover, if the ad-support business margin has been persistently close to zero, it suggests that the company might be struggling to strike the right balance between generating advertising revenue and managing costs effectively.

Nevertheless, it is essential to recognize that despite the fluctuations in the ad-support business margin, this does not imply that the company is running an unsuccessful business.

It is too soon to determine the business’s maximum profitability for a company that prioritizes user growth.

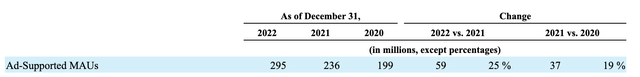

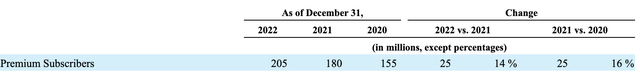

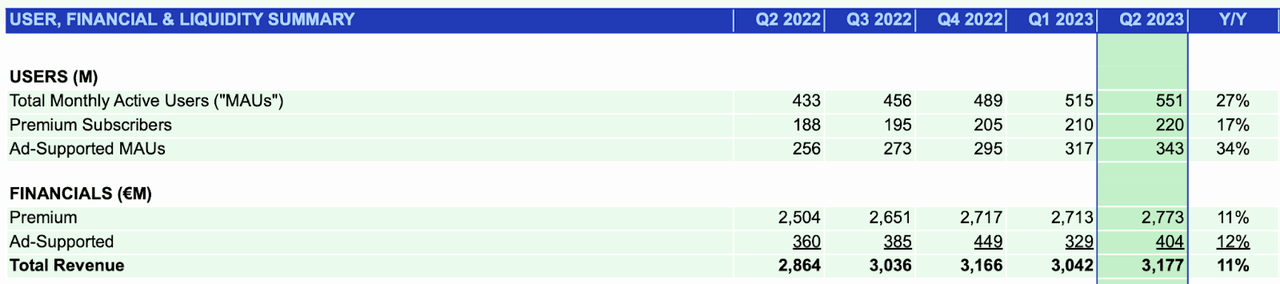

Currently, the company uses its ad-support business to acquire new customers and invests more money to introduce new products such as podcasts. Its subscriber base for ad-supported services increased by 25% in 2022. Its growth accelerated to 34% in Q2 2023.

Ad-support MAU (SPOT) Premium subscribers (SPOT)

Why We Believe in Spotify’s Huge Growth Potential?

Spotify had competitive advantages

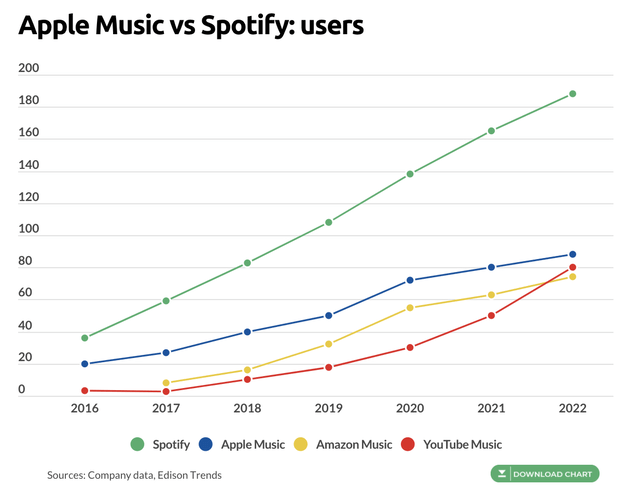

Investors are worried that competition such as Apple Music and YouTube Music can potentially threaten its growth. Especially during the earnings call, an analyst raised concern over TikTok’s entry into the music market.

Even though Apple reported having 1.46 billion active iPhone users and YouTube boasted 2.68 billion active users, Spotify managed to expand its user base at a significantly faster pace than its competitors, thereby securing a dominant market share.

Userbase (Edison trends)

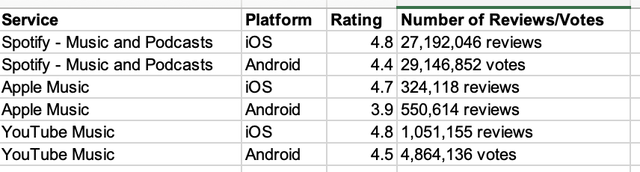

We attribute this to the high level of customer satisfaction that Spotify provides, which we believe serves as its competitive edge and sets it apart from its rivals. Among its top rivals, Spotify’s app received the most ratings and reviews.

Ratings and reviews (iOS, Android OS)

Given that TikTok’s user base is considerably smaller than that of iPhone and YouTube, we think its freemium platform is unlikely to pose a significant threat to Spotify’s premium subscription business at the moment.

- Successful personalization strategy

We also think that Spotify’s success is probably due to the company’s successful usage of AI to tailor experiences and improve user engagement.

Spotify notes that while AI and machine learning can optimize recommendations to maximize engagement, this could potentially reduce quality and variety. For example, AI could get stuck recommending very similar artists/songs/podcasts that keep people listening longer, at the expense of discovering new and diverse content. This could reduce the sense of discovery that Spotify aims to create and cause people’s feeds to become repetitive or static. It could also disproportionately promote content designed to game the AI algorithms, rather than the highest quality content.

Spotify’s management emphasizes they don’t want recommendations to be driven solely by AI models maximizing listens, as that could reduce the ecosystem’s overall diversity and vibrancy. Instead, they want to blend algorithmic recommendations with human oversight and curation. This ensures some editorial control over factors like content quality, diversity, and showcasing rising talent. So Spotify aims to get the benefits of data-driven personalization through AI while still preserving the human touch of experienced music/podcast curators overseeing the process holistically.

Spotify has the moat to defend against new entrants

- Scale and data advantages

With over 200 million paying subscribers and 340 million ad-support active users, Spotify has enormous amounts of proprietary data on listening tastes, habits, etc. This data aids personalization and will be very difficult for competitors to replicate.

Many Spotify users have built up playlists, libraries, and listening histories that would be lost if switching services. This creates inertia to stay with Spotify.

Spotify has patented tech around streaming, recommendations, etc. Competitors can’t easily copy its tech innovations.

Valuation

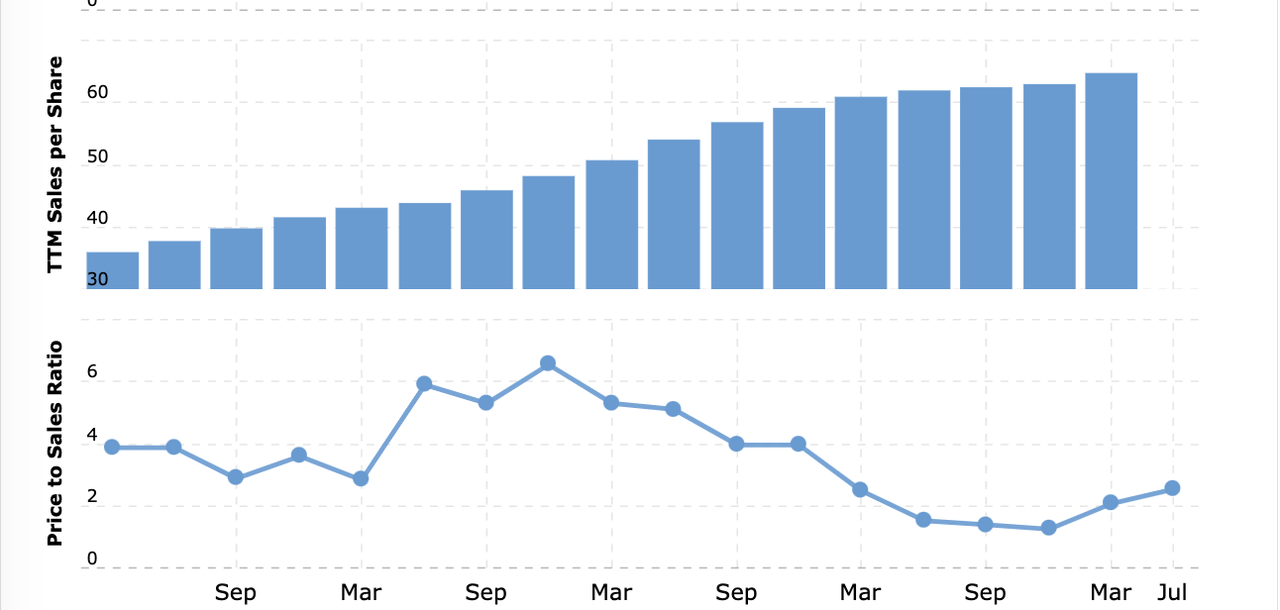

Despite the stock going up from where we first recommended investors buy at the level of a P/S ratio below 2x, the stock now trades at a 2.5x P/S ratio. It is still below its historical level. Also, its revenue growth was in the range of the teens, which we consider still impressive.

P/S ratio (Macrotrend)

Further, its user base grew in the high twenties, which we view as a more important metric to measure growth.

Operating metrics (SPOT)

Conclusion

Despite the market sell-off due to worries about competition and royalty costs, we continue to be very bullish on Spotify as we see the company has a competitive advantage, a higher retention rate, and a strong moat to defend against new entrants. The company still grew its user base in the high twenties. We see financials will eventually follow operating metrics. We rate the stock as a “Buy”.

Read the full article here