The SPX has mounted a strong recovery from the October lows as fears of higher for longer interest rates have eased, and from a short-term perspective, bond market stability suggests the rally could last for a while longer. While the market’s gains this year have been driven entirely by the Magnificent 7, there are signs that the other 493 stocks are poised for recovery, which should help drive the SPX. However, beyond the short term, I maintain my long-held bearish view on the SPX, as weakening nominal GDP growth and extreme valuations make it a poor long-term bet and should underperform cash even under continued stable economic and financial conditions.

The Stock Market Cares About Bond Market Stability Not Yield Levels

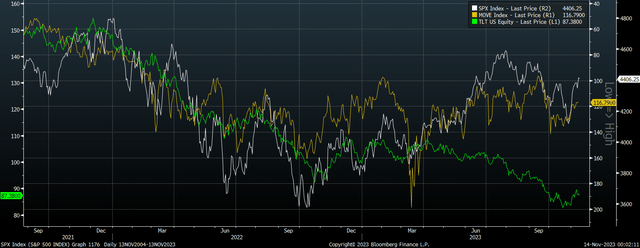

The stock market has never cared much about the level of bond yields but has cared greatly about bond market shocks. The following chart shows the SPX alongside bond prices and implied bond volatility (inverted). While stocks were pressured by falling bond prices in 2021-2022, they have moved more closely in line with bond volatility since.

TLT, SPX, and MOVE (Bloomberg)

In my last article on the SPX, I noted that monetary easing would not arrive until markets have seen a significant decline. This remains my view but over the past two months, we have seen two significant technical developments to suggest stocks want to move higher. Firstly, stocks largely shrugged off the acceleration in upside yield pressure in late September. Secondly, it mounted a strong recovery following signs of bond market stability. This suggests that continued bond market stability could help drive stocks higher still.

Further Gains Will Require Much Greater Participation

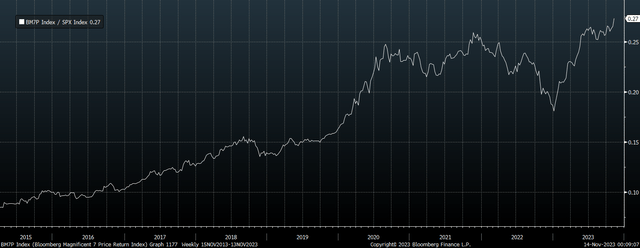

The entirety of the SPX’s gains this year have been driven by a tiny number of mega-cap stocks. The Magnificent Seven (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) now represent a staggering 27% of the SPX’s market cap.

Magnificent 7 Market Cap / SPX Market Cap (Bloomberg)

A meaningful rally will require much greater participation, and there are signs that the strength in mega caps is feeding through into the median SPX stock. The SPW equally weighted version of the SPX has held above its 2022 lows and is mounting an assault on down trendline resistance. A break above here would strongly suggest further near-term gains.

S&P500 Equally Weighted Index (Bloomberg)

Long Term Outlook Remains Extremely Weak

Despite the increasingly constructive short-term outlook, I maintain my long held long-term bearish view on the SPX. Even if we see the recent bond market stability continue for some time, extreme valuations and weak growth prospects will make it difficult for the SPX to outperform cash even under stable economic and financial conditions.

The SPX yields just 1.6%, with dividend payments representing around 40% of free cash flows in line with the 30-year average. Meanwhile, the trend real growth rate of sales, earnings, free cash flows, and dividends tend to track the pace of real GDP growth, which I expect to trend down to around 1% over the long term. With long-term inflation expectations of 2.4%, this implies total annual nominal returns of just 5% assuming no change in valuations. The long-duration nature of the SPX as reflected in its low dividend yield means that even a 1pp increase in the required rate of return would result in a 38% decline in valuations. This would be enough to result in negative SPX returns for years to come.

Read the full article here