2020’s COVID crash and quick recovery was followed by 2021’s (bubble-ish) magical run, which led to the slaughter in 2022. Perhaps the 2022 down year acted as a catalyst for the roaring comeback in 2023. That brings the question, what does 2024 have in store for us? Will we finally get a quiet year with none of the whiplashes we’ve gotten accustomed to since 2020?

That’s hard to predict but what is easier to do is position ourselves defensively, on the back of the 25% run in 2023. When we talk about defensive positioning, two words usually come into the picture: dividends and ETFs. Hence, SPYD SPDR Portfolio S&P 500 High Dividend ETF (NYSEARCA:SPYD) is a logical choice to look at. Is the ETF worth holding as we gear up for the first trading week of the new year? Let’s find out.

What Is SPYD?

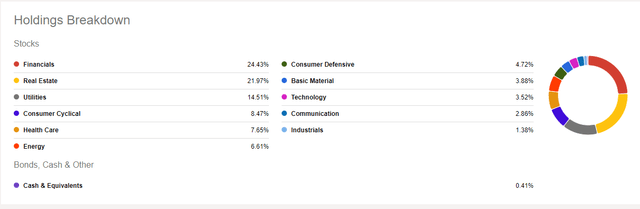

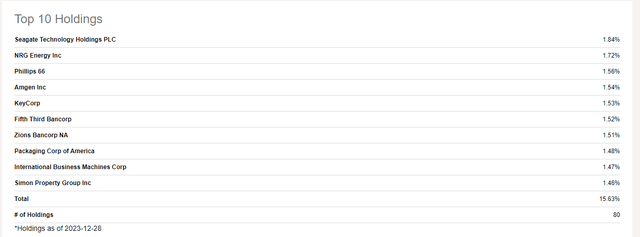

SPYD is an ETF that tracks 80 high-yield stocks that are part of the S&P 500 index. As one would expect in an ETF, SPYD consists of stocks in all major sectors of the market including financials, energy, real estate, and technology. The full breakdown can be seen in the image below, with financials representing 1/4th of the total holdings. Although technology makes up just 3.52% of the holdings, Seagate Technology Holdings plc (STX) and International Business Machines Corp (IBM) are part of the top 10 holdings.

SPYD was launched in 2015 and has almost $7 billion in Assets Under Management. SPYD has been paying quarterly dividend ever since its inception in 2015. But more importantly, what does this ETF offer for investors here on?

SYPD Sector Breakdown (Seekingalpha.com)

SPYD Top 10 (Seekingalpha.com)

Is SPYD A Good Bet For 2024?

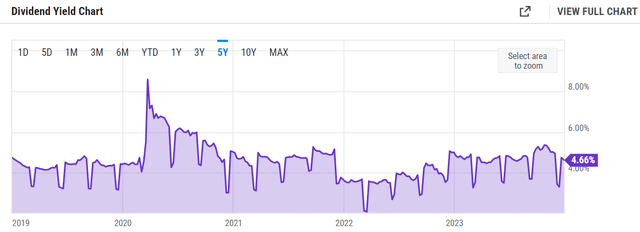

SPYD is yielding 4.66% heading into 2024 and this looks considerably more attractive for risk averse investors seeking income when you compare it to the S&P 500’s average yield of 1.62%. SPYD’s current yield is also a little higher than its 5-year average of 4.52%. SPYD also has an extremely low expense ratio of 0.07%.

SPYD Yield (YCharts.com)

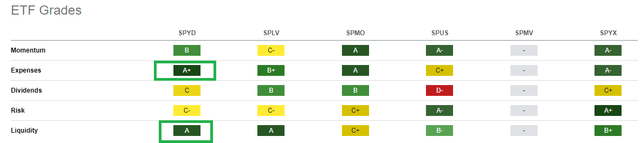

In addition, SPYD compares pretty well against its peers, especially on expenses and liquidity. All these factors considered, it is reasonable on first look to conclude that SPYD is a good dividend ETF to own.

SPYD Grades (Seekingalpha.com)

However, the devil maybe in the details. Despite the recent fall in interest rates, the 10-year treasury still yields close to 4% and is basically risk-free. Why would anyone risk investing in an ETF with 80 stocks for a yield that is less than a percentage point higher?

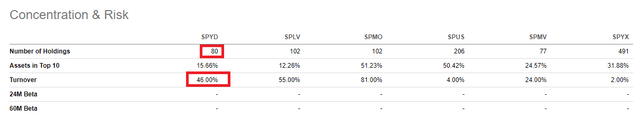

Dissecting the ETF further, I am concerned about the 46% turnover when holding just 80 stocks. In other words, SPYD has the third highest turnover among 6 peers while having the 2nd lowest number of holdings. This may be due to the fact that SPYD is 60% comprised of mid-cap stocks, which are more prone to performance fluctuations than large-caps. This also brings the selection process into question, as put forth by The Sunday Investor.

SPYD Risk (Seekingalpha.com)

High interest rates have also discouraged companies from buybacks and I believe this is likely to continue in 2024 as well, as rates will still likely be high enough for mid caps (60% of SPYD) to not throw money at buybacks.

Finally, another area of contention for me is that nearly 1/4th of the holdings are in financials, which can be a confusing place to be in the current interest rate environment. Gone are the days of Zero Interest Rate Policy [ZIRP] but also gone are the days of ever increasing rates. Financial institutions are having to adjust to their new normal of relatively high interest rates that have flattened but have a downward slope ahead. These companies must strike the right balance between cutting their expenses while milking the spread between the high interest rates they charge and the ones they pay their own customers. Furthermore, when you factor in Real Estate and Utilities, we get nearly 60% of the ETF’s holdings that are exposed to the vagaries of interest rates. No thanks!

Conclusion

While SPYD has some nice features like its low expense ratio and a reasonable yield, I am struggling to find a niche investment thesis for it. If you are looking for high-yield, even with a hint of safety, several names like Realty Income Corporation (O) and Altria Group, Inc. (MO) stand out. If you are looking for riskless yield, the treasury is still not a bad choice either. SPYD is in the middle of nowhere in my opinion and has no salient features that stand out. I rate the ETF a hold for now and would recommend a sell if the yield falls below 4%.

Read the full article here