Investment Thesis

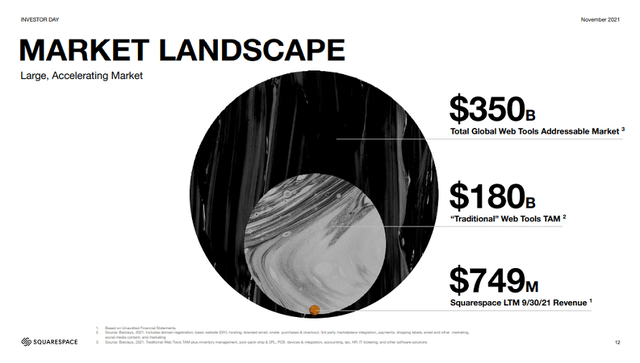

I have a positive view on the web tools subsector and the product offering of Squarespace, Inc. (NYSE:SQSP). The adoption of e-commerce is driven by secular trends, which will contribute to the growth of a multibillion-dollar addressable market. However, maintain a hold rating on the stock in the medium term due to its revenue growth being lower than peers, despite its smaller scale and the possibility of unsustainably high gross/EBITDA margins. Moreover, the potential global macroeconomic slowdown, increased competition from new entrants, and higher external costs for legacy businesses are all factors that pose risks to the industry’s growth and profitability.

Company Overview

Established in 2003, SQSP provides cloud-based software solutions for website building and e-commerce, allowing its clients to build brands and transact with their respective customers. SQSP is focused on simplicity and ease of use, both in website building functionality and overall website aesthetic.

Q1 2023: Guidance Raised on the Back of a Strong Quarter

The company delivered a strong performance in the first quarter of 2023 across various aspects of the business, driven by better customer acquisition, successful changes to the attribution model, and improved performance in international markets. The management highlighted the core strength of the website, which resulted in a 16% year-on-year growth in bookings for the first quarter and a modest increase in the revenue guidance for the full year. Additionally, the CEO mentioned the upcoming release of text generation enhancements powered by OpenAI, which will be made available to all customers in the coming weeks.

International markets are contributing to subscriber growth, with comparable revenue growth rates for the US and international markets. However, the average revenue per user (ARPUS) is not as strong as expected, despite pricing actions and double-digit growth in other top-line metrics. This may improve as non-USD customers receive a price increase later in the year. Overall, the positive revenue growth, healthy margins, and the resilient nature of spending in this category make SQSP and similar web tool companies attractive to investors, especially in the face of uncertain macroeconomic conditions.

Attractive Opportunity But I Remain Cautious in the Medium-Term

I have a positive outlook for the internet infrastructure industry over the next few years. SQSP can tap into a massive opportunity to target the share of websites that currently are not using CMS by offering users, even with little-to-no technical skills, the ability to create professional websites within minutes. Research has shown that businesses with professional-looking websites are perceived as more trustworthy, which will likely drive increasing demand for website-building tools. Additionally, there are over 332 million small and midsize businesses globally that could be potential customers for SQSP.

However, I acknowledge that internet infrastructure companies may face challenges in achieving their growth targets in the medium term due to potential financial constraints for consumers in a challenging macroeconomic environment. The majority of SQSP customers are independent individuals who may delay their entrepreneurial ambitions when facing high costs of capital and external uncertainties. While I expect small businesses to continue using domain and hosting services (similar to how they would not disconnect their phone lines), it is unlikely that these customers will aggressively increase their average spending by consuming more services and add-ons. This could result in a deceleration of previously set revenue growth targets for these companies.

Additionally, there is a risk of heightened competition from new players, including prominent tech brands. If major internet companies decide to invest in becoming more formidable competitors in the web development space, it could have a negative impact on the profitability of existing internet infrastructure companies. Overall, these factors contribute to my cautious stance on the medium-term outlook for the internet infrastructure industry. The potential global macroeconomic slowdown, increased competition from new entrants, and higher external costs for legacy businesses are all factors that pose risks to the industry’s growth and profitability.

Company Presentation

Service up-sell opportunity

Internet infrastructure companies offer their customers a range of additional business applications to enhance and promote their online presence. GoDaddy Inc. (GDDY) is a major reseller of Microsoft 365, while Wix.com Ltd. (WIX) and SQSP resell Google Workspace. Through revenue-sharing agreements with Microsoft and Google, these companies become the primary customer support contacts, providing faster and more customer-oriented support through dedicated call centers compared to the major providers.

Apart from productivity-enhancing features, customers also seek tools to make their websites or online stores appear more professional. This includes features like having email accounts associated with their registered domain. Additionally, there is significant demand for payment tools and solutions that enable seamless online and offline sales of products and services. Customers also look for assistance in curating marketing campaigns and establishing a professional presence on social media platforms. Furthermore, customers seek special-purpose add-ons such as scheduling capabilities or exclusive areas of their website for paid subscribers.

Conclusion

I believe that the website and e-commerce management sector holds promise, and SQSP is positioned well within this space. The long-term prospects are bright, driven by secular trends associated with the increasing adoption of e-commerce, which expands the addressable market into the multibillion-dollar range. However, in the medium term, I maintain a cautious stance due to the potential impact of macroeconomic trends on overall revenue growth.

Read the full article here