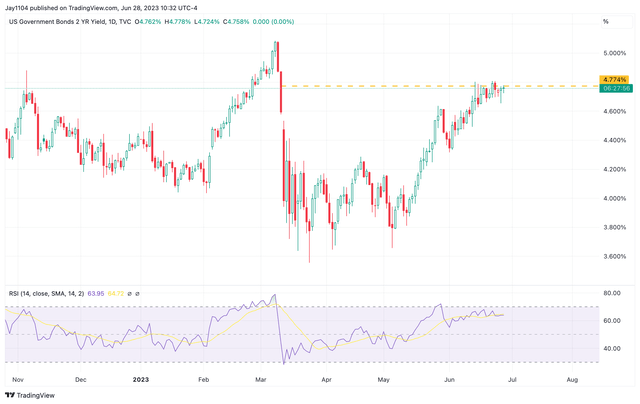

Over the last couple of weeks, yields have risen, and the dollar has strengthened as the market prepares for the Fed to hike rates further in the second half of 2023.

At least when looking at rates and the dollar, the market seems to be positioned for more rate hikes because both the dollar and rates seem like they want to go higher. But equity investors have largely ignored the signals from bonds and the dollar, which has pushed stock valuations to very stretched levels, possibly because the equity market thinks the inflation problems are behind us. Thus, the Fed rate hiking cycle is over.

Divergent Views

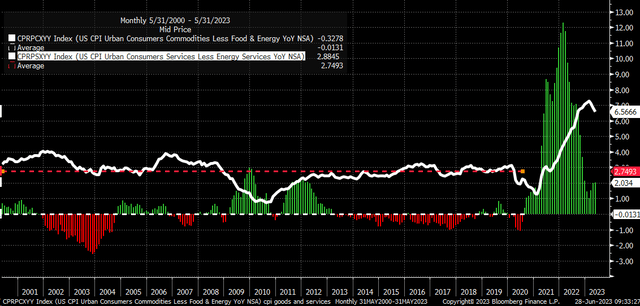

Currently, rates and the dollar are positioning for more Fed rate hikes because inflation has been sticky and slow to come down for services and goods. Yes, while goods are down to around 2% on the CPI, they’re still much higher than the average of the past two decades; the same can be said of services.

From 2000 until the start of 2020, core CPI commodities averaged an inflation rate of 0%, and across much of that time, goods inflation was negative. Today, that same measure of goods inflation is at 2%, well above the historical average. Additionally, core CPI services average about 2.75%; today’s value of 6.5% is almost four percentage points too high.

Bloomberg

One also must remember that energy prices, mainly oil and gasoline, have driven the significant decline in headline inflation. But those base effects should start to wear off by the time we reach September, which also means the deflationary force of falling energy prices will have less impact.

Bloomberg

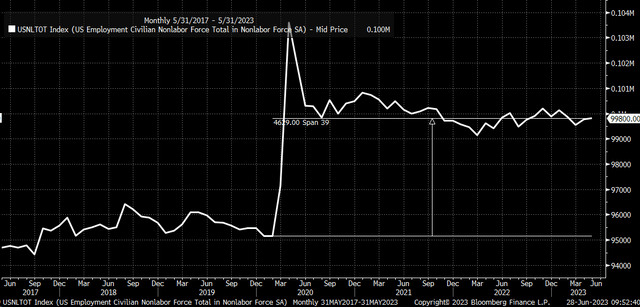

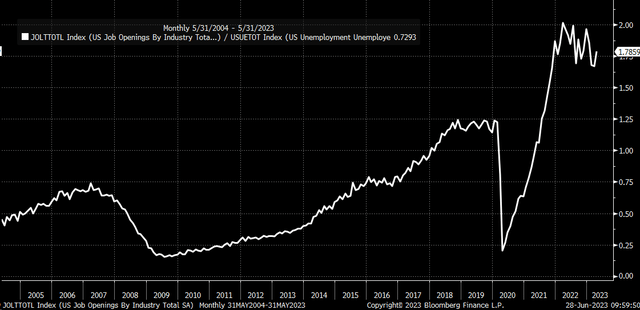

Additionally, there have been signs that the labor market has remained much tighter than many expected. The labor market may be out of balance mainly because nearly 5 million workers have left the labor force since the pandemic’s start. This creates an imbalance in the labor market, as noted by the ratio of unemployed workers to the number of job openings at 1.8%, which is well above the pre-pandemic levels.

Bloomberg

These factors have rates and the dollar positioned to see significant moves higher over the next several weeks. The positioning can be illustrated when looking at the 2-yr Treasury and the 10-year Treasury technical charts, which have been consolidating more recently around their respective critical resistance level. If these rates break through the resistance levels, rates will likely move back to the highs.

Trading View

A Painful Reversion To The Mean May Be Next

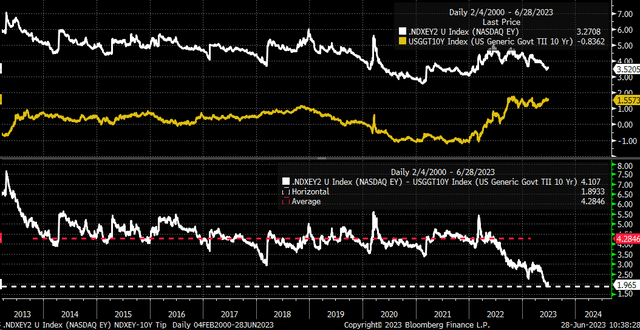

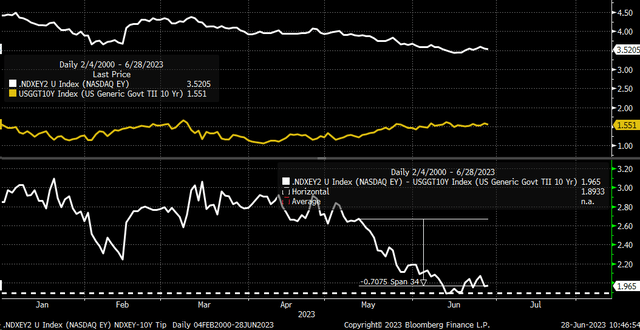

A move higher in rates is a risk to stocks because the valuation for the equity market has wholly detached from those of the past decade. Suddenly, the Nasdaq earnings yield is just 1.96% higher than the current 10-yr real yield. This is significantly lower than the average of 4.28% in the past decade.

Bloomberg

The valuation gap carries the most risk to stock investors because the considerable divergence isn’t likely to last forever and will likely see a revision to the mean at some point. This valuation gap is the most apparent evidence that the equity markets are trying to front-run inflation rates coming down to the Fed’s target and rates on the long end of the yield curve falling.

This is where the divergences in the market are most apparent because if the equity market were adhering to the bond market’s message, which is that inflation is likely to stay elevated, and the labor market is to remain out of balance. The spread between stocks and bonds shouldn’t be as narrow as it is today.

It’s also apparent that this spread between the Nasdaq 100 earnings yield and the 10-yr real yield took its next leg lower following the May 10 CPI report. The spread at that point was around 2.6%, which has since fallen by about 70 bps.

Bloomberg

When looking at this, it would seem that the equity market has decided that inflation is no longer a problem and not only that, but that the worse is behind them and that inflation is probably likely to hit the Fed’s 2% mandate and the rate hiking cycle will be over.

But again, the dollar and the bond market are saying something very different. Furthermore, based on the positioning, which suggests that both may be heading sharply higher, it would go against what the equity market appears to be thinking.

Read the full article here