Rapid Recap

In my previous analysis, I said,

On the surface, StoneCo Ltd. (NASDAQ:STNE) appears to be a compelling investment opportunity, with an alluring narrative, that’s attractively priced.

But when we dig in slightly, a slightly more obfuscated set of results comes to light.

Ultimately, I’m not compelled by StoneCo, as I don’t find it offers me an attractive-risk reward profile. So, I’m leaving a neutral rating on this company.

On the back of this earnings report, I must admit that StoneCo’s prospects positively impressed me. Indeed, there are several positives that shine through in this report.

To be clear, the report is not blemish-free. The underlying growth rates are still subdued, and able to hold back the full bull story.

Nevertheless, given the impressive jump in profitability, according to my estimates, in 2024 StoneCo could see around USD$1.60 of EPS. This leaves the stock priced at less than 9x EPS.

Therefore, I now upwards revise my rating to a buy.

Why StoneCo?

StoneCo is a Brazilian fintech company. It provides financial technology and software solutions that empower merchants to conduct commerce across various channels to empower their business. Their journey began with payment services but has since evolved to encompass a range of solutions for merchants, from financial services to software solutions.

Through their client-centric culture and proprietary Stone Business Model, StoneCo delivers an advanced, cloud-based technology platform that aids clients in connecting, getting paid, and expanding their businesses while adapting to the dynamic demands of omni-channel commerce. This approach, coupled with a hyper-local distribution strategy and on-demand customer service, ensures an enhanced client experience.

StoneCo’s value proposition is its ability to revolutionize how merchants operate and scale. By addressing the limitations posed by traditional banking, StoneCo offers payments solutions, digital banking services, credit solutions, and software solutions, all aimed at enhancing efficiency, growth, and customer experience.

The company’s innovative Stone Business Model, which leverages technology, local engagement, and customer-centric service, differentiate them in an industry marked by legacy practices.

STNE Q2 2023

Their goal is to provide merchants with comprehensive tools that go beyond mere solutions, empowering them to manage their financial lives seamlessly and focus on expansion.

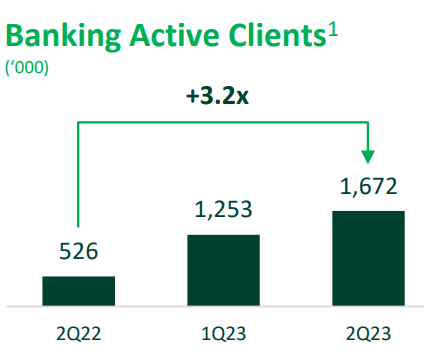

What’s more, as you can see above, this quarter was marked by a 3.2x increase in Banking Active Clients y/y. Followers of my work will know two things.

Firstly, I’m not averse to changing my mind when the facts change. Secondly, I’m a strict believer in the power of customer adoption curves, as I believe they are more insightful than a business’ underlying revenue growth rates. If customers flock to a platform it’s for one reason only, because they value it! And in time, there’s an opportunity to better monetize them.

Moving on, a lot of investors first got involved with StoneCo by coat-tailing Berkshire Hathaway’s (BRK.A)(BRK.B) position in this stock. Berkshire took their position at about $21 per share years back and proceeded to take some profits between ~$60 and ~$94 and since then, the share price has languished to around the mid-teens.

Revenue Growth Rates Continue to Decelerate

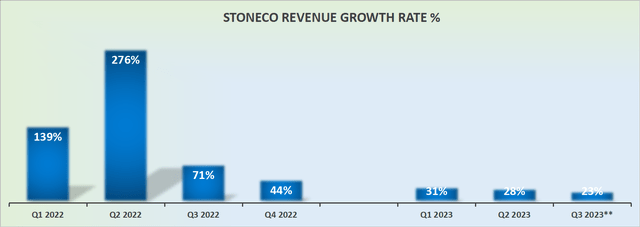

STNE revenue growth rates

In my previous analysis, I said,

[…] how should we think about StoneCo? Is this a business that’s likely to guide for Q3 2023 to grow at 60%? Or 40%? Or perhaps 30%? Needless to say that those growth rates that I allude to are very different, with meaningful ramifications depending on its growth rates.

Turns out that Q3 2023 doesn’t match any of those high expectations. On the contrary, despite StoneCo’s comparables dramatically improving relative to Q2, it appears that StoneCo’s revenue growth rates for the quarter ahead are likely to come at less than 30% CAGR.

In fact, it’s possible that StoneCo’s Q3 could be marked by some deceleration relative to Q2 2023.

One way or another, I believe this cements my view that StoneCo’s fastest growth rates are now in the rearview mirror.

That’s the bad news out. Now let’s discuss the strikingly positive aspect facing investors.

Profitability Profile Shines Strongly

STNE Q2 2023

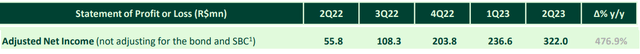

There’s no ambiguity here, StoneCo’s profitability soars. As you can see above, StoneCo’s adjusted net income was up a whopping 477% y/y. And this strong profitability saw StoneCo’s adjusted EPS jumping more than 400% too, from $0.18 in the same period last year to $0.94.

If readers are not too irked by my comment, I would note that it will be difficult for StoneCo to continue delivering this dramatic level of increasing profits without a somewhat proportional increase in revenues.

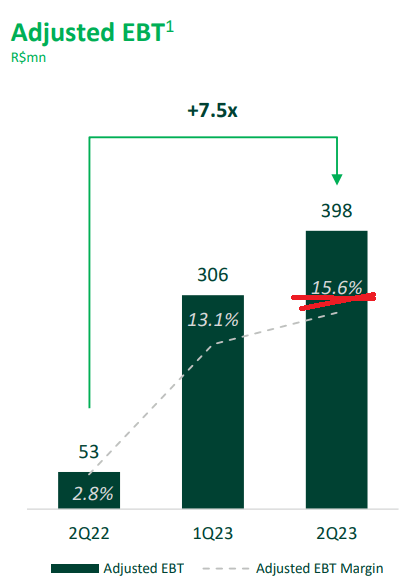

Here’s a graphic that illustrates my assertion:

STNE Q2 2023

StoneCo’s EBIT margin has expanded meaningfully y/y, from less than 3% to more than 15%. But are there really a lot more costs that can be taken out of the business?

Recall, a business has to spend/invest to grow its revenue line. And if the business is cutting back on its costs to the bone, it will struggle to reaccelerate its revenue growth rates.

According to my estimate, it now appears likely that this year, StoneCo could deliver around R$6 of EPS. And as we look further out to 2024, it’s not unreasonable to expect StoneCo to deliver R$8, which converts to approximately $1.60 in EPS.

Consequently, investors are asked to pay under 9x next year’s EPS. That’s an attractive valuation when all is said and done.

The Bottom Line

Upon initial inspection, I stated that StoneCo Ltd. was fairly valued.

However, on the back of this new set of earnings results, a more nuanced set of outcomes. While concerns lingered about the restrained growth rates, my new analysis highlights a remarkable upswing in profitability, as evidenced by the staggering 477% YoY increase in adjusted net income and a substantial 400% surge in adjusted EPS to $0.94.

The question of sustaining this heightened profitability in the absence of corresponding revenue growth looms, underlining the company’s challenge.

Nonetheless, with the prospect of projected earnings growth and an attractive valuation, I’m now upgrading my rating for StoneCo to a buy, recognizing its potential to evolve positively in the future.

Read the full article here