Investment Thesis

StoneCo (NASDAQ:STNE) is a Brazilian fintech company that offers a comprehensive suite of financial technology and software solutions, empowering merchants with payment services, digital banking, credit solutions, and software tools. Through their innovative Stone Business Model, they revolutionize how merchants operate and scale by addressing traditional banking limitations, fostering efficiency, growth, and an enhanced customer experience.

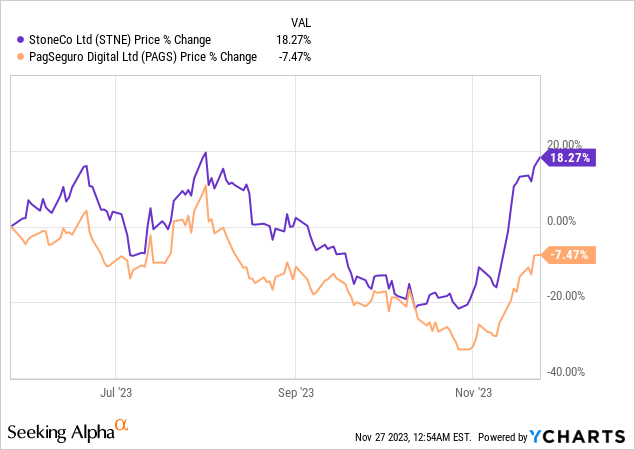

In the past few months, they’ve dramatically outperformed one of its main competitors, PagSeguro Digital (PAGS).

And the reason for this outperformance, in my opinion, is relatively straightforward. StoneCo is now focused on one task, on growing its underlying profitability.

As you’ll soon see, despite the stock being on a tear of late, it’s still only priced at approximately 10x next year’s income. A multiple that I believe is more than just enticing.

Rapid Recap

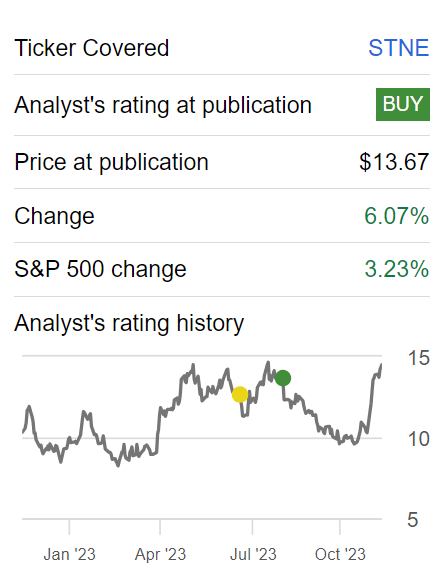

In my previous bullish analysis back in August, I said:

To be clear, the [Q2] report is not blemish-free. The underlying growth rates are still subdued, and able to hold back the full bull story.

Nevertheless, given the impressive jump in profitability, according to my estimates, in 2024 StoneCo could see around USD$1.60 of EPS. This leaves the stock priced at less than 9x EPS.

Author’s Work on STNE

Again, the message coming out of StoneCo is one where the company can improve its cost structure and ultimately end up with a highly profitable enterprise.

StoneCo’s Near-Term Prospects

StoneCo is a leading Brazilian fintech company that specializes in providing innovative financial technology and software solutions to empower merchants in conducting commerce across diverse channels. Initially focused on payment services, the company has evolved to offer a comprehensive suite of solutions, including financial services and software solutions.

StoneCo has a client-centric culture. Through their platform, clients connect, receive payments, and expand their businesses in the ever-changing landscape of omnichannel commerce.

With a hyper-local distribution strategy and on-demand customer service, StoneCo ensures an enhanced client experience. The company’s value proposition lies in its ability to revolutionize merchant operations by addressing traditional banking limitations through payment solutions, digital banking services, credit solutions, and software solutions – all aimed at boosting efficiency.

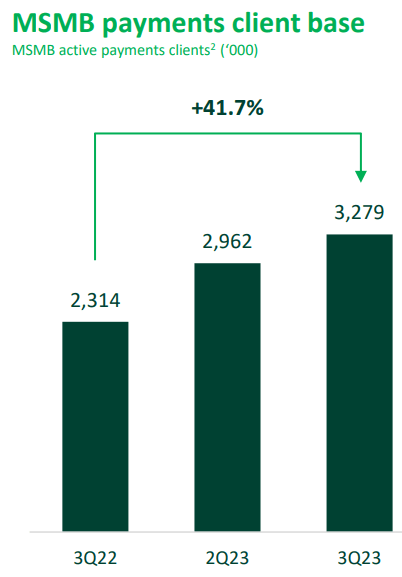

Moving on, StoneCo continues to demonstrate promising prospects in the financial technology sector, positioning itself as a key player in the Brazilian market. With a strong focus on serving micro and small merchants, StoneCo has consistently shown robust financial performance and growth, marked by an increase in total payment volume (TPV) and a broadening client base.

STNE Q3 2023

The acquisition of Linx further strengthens StoneCo’s position, opening up new opportunities for cross-selling and expanding its product offerings. Moreover, the impending banking license adds an extra layer of versatility to its capabilities, enabling the utilization of deposits as an additional funding lever.

However, StoneCo faces certain near-term challenges that warrant attention. The increase in debit share, while reflective of broader market trends, raises questions about the potential impact of credit delinquency on credit card limits.

Furthermore, during the earnings call, StoneCo acknowledged this market trend, noting that the dynamics of credit limitations on credit cards remain a potential headwind.

StoneCo’s cautious approach to scaling credit and other services aligns with a prudent risk management strategy, but getting its banking license will increase the amount of regulation the company faces. This will make the Brazilian fintech less nimble, which could be something to be mindful of.

Seeking To Provide Long-Term Guidance

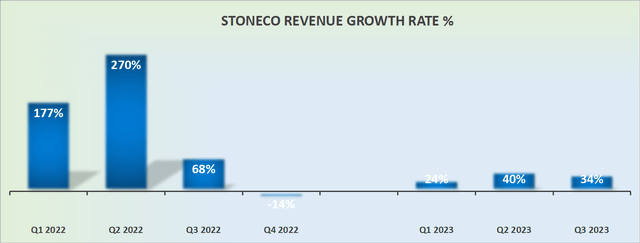

STNE Revenue Growth Rates

During StoneCo’s Q3 results, StoneCo purposely did not provide any guidance as they wanted investors to tune in and pay attention to their Analyst Day to offer medium-term targets financial targets (something we’ll soon discuss).

That being said, one could make the case that StoneCo’s Q3 results were strong enough that management wanted investors to appraise the company on the back of this quarterly result and gain conviction that StoneCo is moving strongly in the right direction, before even addressing its medium-term guidance.

Indeed, what’s important to consider here is just how much easier the comparables should be getting going forward in the near term.

Case in point, for Q2, StoneCo had to overcome a very tough hurdle, but with Q2 now firmly in the rearview mirror, and Q3 delivering very strong results, investors are now more inclined to buy into StoneCo’s medium-term prospects.

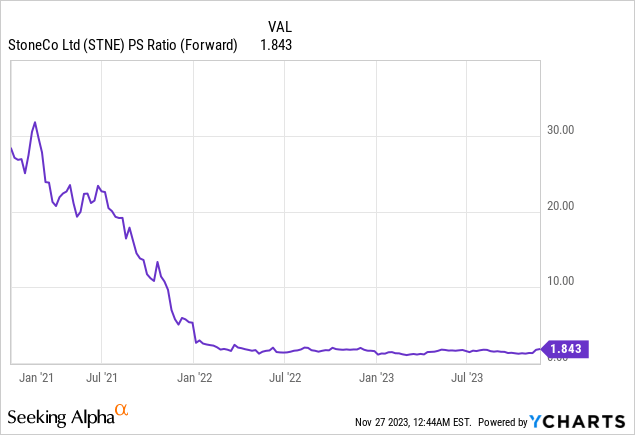

STNE Stock Valuation – 10x Forward Earnings

I highlight the above graph not to indicate anything tangible about its valuation, but instead to describe how much investors’ desire and attraction towards StoneCo has changed over time.

A few years ago, this was a company that could do no wrong. And I’m not saying that just because its valuation has come down significantly that it’s undervalued. After all, cheap stocks can always become cheaper.

STNE Investor Day

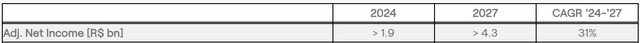

But what I am saying, is that management has put together medium-term guidance to get investors thinking about the overall trajectory that StoneCo is headed.

What’s the likelihood that StoneCo actually delivers R$ 4.3 billion (USD$900 million) in 2027? I suspect that the chances are relatively low, as there are countless aspects that could weigh on this profitability, the most pertinent of which is the impact of the intense competition from PagSeguro and others.

But the point here is to get a sense of the overall trend in profitability. StoneCo is seeing a massive uptick in profits and more profits are going to come with time as StoneCo can layer back and improve its cost structure and reduce its active spend on customer acquisition.

The Bottom Line

In summary, StoneCo is a prominent player in Brazil’s fintech sector, offering a wide range of financial technology and software solutions to empower merchants.

Despite the stock’s recent surge, it remains attractively priced at around 10x next year’s income, indicating significant appeal.

While challenges like increased debit share and credit limitations exist, StoneCo’s conservative approach to scaling services and upcoming banking license illustrate a focus on long-term sustainability.

It practically goes without saying, but if this was a US-based company, with these sorts of financials, investors would gladly pay more than 5x more for the same company.

Read the full article here