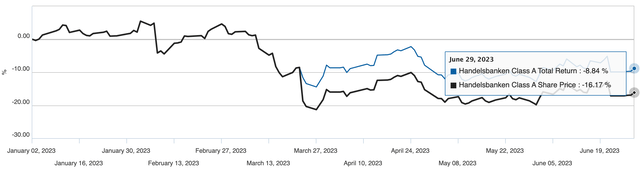

With a high share of variable rate loans, interest rates rising, and economic growth coming under pressure, the health of the real estate market in Sweden has come into sharp focus in recent quarters. That is weighing on shares of lender Handelsbanken (OTCPK:SVNLY) (OTCPK:SVNLF), which is down around 9% YTD including dividends.

Handelsbanken YTD Total Return & Share Price

Handelsbanken Investor Relations

Handelsbanken is certainly facing some uncertainty right now, but given its outstanding historical track record on credit quality, this is arguably the safest of the region’s lenders to be in right now. Furthermore, while asset quality is definitely something to think about looking ahead, the current environment remains favorable for the bank, and that is proving to be a boon for the bottom line alongside the boost to interest income from higher rates. With these shares now below book value, Handelsbanken looks attractively valued. Buy.

Leaning On Efficiency And Credit Quality

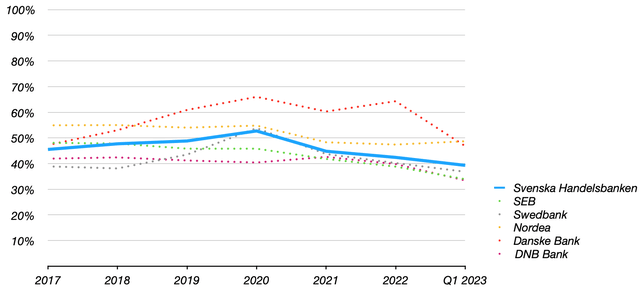

Lacking much by way of funding cost advantages, cost efficiency (i.e., operating expenses as a percentage of total income) has traditionally been one of the standout features of the Nordic banks. Although its efficiency ratio lands at the higher end of the big regional players, especially the Swedish ones, Handelsbanken’s clear sub-50% cost/income ratio nevertheless still compares very favorably to international peers.

Cost/Income Ratios Of Handelsbanken & Select Other Major Nordic Banks

Data Source: Annual Reports Of The Major Nordic Banks

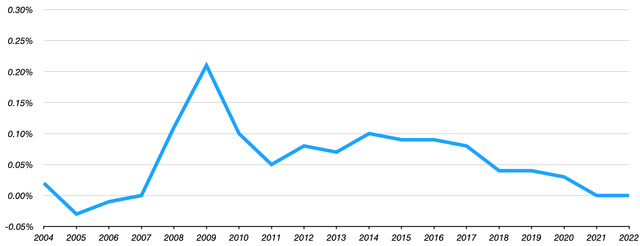

While cost efficiency does form a plank of the long-term bull case, where Handelsbanken really shines is in its underwriting record. Credit quality has typically been very strong here, with the bank recording incredibly low bad debt expenses historically.

To put a number to that, between 2004 and 2022 Handelsbanken’s average annual credit loss ratio was below 6bps. The average of its major Nordic peers is well over twice that.

Handelsbanken Annual Credit Loss Ratio (2004-2022)

Data Source: Handelsbanken Annual Reports

This is a point that tends to get lost when the economy is booming (and when credit quality isn’t holding anyone back), however, it provides crucial protection during economic downturns. For example, in 2020 when banks were reporting large provisioning expenses, Handelsbanken recorded a credit loss expense of just 3bps. Its return on equity (“ROE”) that year was a very healthy 10%. Similarly, during the Global Financial Crisis, Handelsbanken’s credit loss ratio peaked at just 21bps in 2009. In that year, which was the bank’s worst of the GFC period, it generated an ROE of 12.6%.

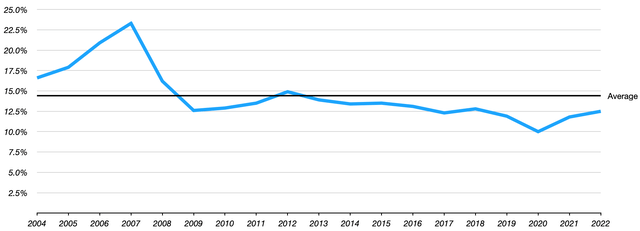

This supports healthy through-the-cycle profitability, with Handelsbanken’s average annual ROE landing at 13% since 2008.

Handelsbanken Annual Return On Equity (2004-2022)

Data Source: Handelsbanken Annual Reports

The key point for prospective investors is that Handelsbanken’s business tends to hold up well during downturns, which may be pertinent in the coming quarters.

Making Hay While The Sun Is Shining

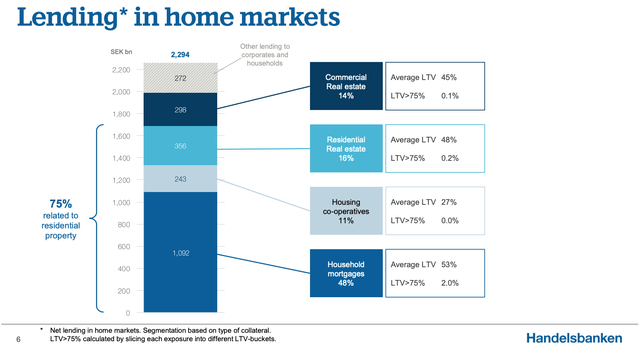

A major concern for Handelsbanken right now is the health of the real estate market in Europe, specifically commercial real estate. Moreover, the bank’s home market of Sweden is particularly vulnerable to higher interest rates due to its relatively high share of variable rate loans and high level of indebtedness. Note that real estate lending accounts for the vast majority of Handelsbanken’s loan book, with various forms of Swedish real estate lending accounting for the bulk of that:

Handelsbanken Q1 2023 Earnings Presentation

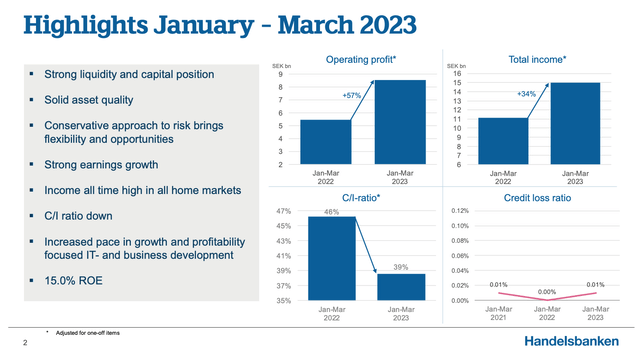

While the above may lead to elevated credit losses in the near future, for now, Handelsbanken is enjoying higher levels of earnings on a combination of higher net interest income and still-low levels of bad debt. In Q1, reported net interest income of SEK11.465B (~$1.05B) was 8% higher sequentially and 36% higher year-on-year. Lending growth has stalled – expected in the face of higher interest rates – with growth driven by an expansion in lending margins.

At the same time, net credit losses of SEK30M amounted to an annualized credit loss ratio of just 0.01%, ultimately driving a 15% ROE for the quarter.

Handelsbanken Q1 2023 Results Presentation

Shares Look Undervalued

Handelsbanken’s Class A shares trade for SEK90.68 at the time of writing, putting them below Q1 2023 book value per share of circa SEK93.40.

With Handelsbanken currently generating a strong mid-teens ROE, the market is clearly pricing in a steep fall in profitability. As mentioned, credit losses arising from a worsening real estate landscape represent the big risk right now, but Handelsbanken has several factors that mitigate this. Loan-to-value ratios remain conservative for one, coming in at around 45% in the property management lending book. Moreover, over 90% of lending is secured by collateral. Even in the extreme event that property values fall below loan values, Handelsbanken can hold these real assets and sell them when values recover, as per the recent earnings call:

Fourth, in an extreme scenario where the estimated value of the collateral being lower than the value of the loan, the bank has the option to retain the assets and divest it at a later stage when the market stress has eased. This happened 30 years ago in Sweden. The losses booked in the midst of the 1990s crisis were eventually turned into net profits during the following years.

Carl Cederschiold – CFO, Handelsbanken, Q1 2023 Earnings Call

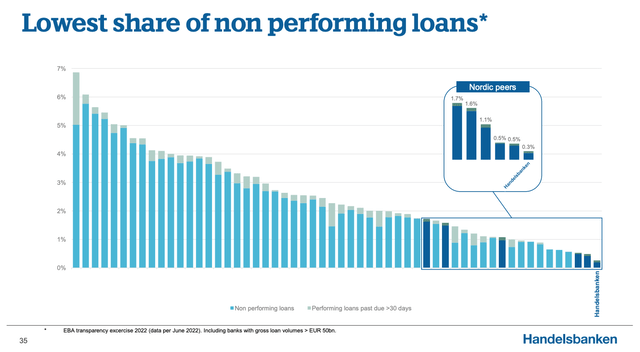

Non-performing loans also remain exceptionally low, both in absolute terms and versus peers. Finally, I would note that the bank is very well capitalized, with its CET1 ratio of 19.4% 100bps over management’s target level.

Handelsbanken Q1 2023 Results Presentation

Even though Handelsbanken may be over-earning right now, the current valuation is too cheap even when based on average profitability levels across the cycle. Approximately 12-13% through-the-cycle ROE should translate to a fair P/B of around 1.2x. That would put fair value at around SEK112 (~$5.20 per ADR), which is roughly where they were before regional banking worries in the US hammered global bank stocks.

While I do expect these shares to trade on a higher P/B multiple in the future, capital returns to shareholders at the current depressed valuation are attractive in their own right. In respect of 2022, the bank declared total dividends of SEK8 per share, SEK2.50 of which was a special dividend. That corresponds to a yield of nearly 9%. Handelsbanken has a history of paying special dividends, with special payouts being declared in five of the past ten years. With profitability currently comfortably above average and the bank sitting on excess capital, the outlook for additional distributions remains good. Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here