Swisscom (OTCPK:SWZCF)(OTCPK:SCMWY) doesn’t strike us as a phenomenal deal, but it is mired with fewer issues. The fibre rollout isn’t a massive burden on the company as it is for some other companies as they are further along towards reasonable targets for Switzerland. The other matter is that they don’t have an issue with rates, partly owing to Swiss monetary policy but also their debt structure. We explain some of the factors that mitigate downside issues for the company with respect to some other European telcos.

Fibre Rollouts

Let’s begin with their majority Swiss business. They spend around 500 million CHF annually on the expansion of their fibre network. Things get a little complicated as to how much coverage they get with that 500 million CHF CAPEX, as COMCO has made their point to multipoint rollout strategy defunct. They had made investments but some of them needed additional processes to become “marketable” as of Q4 2022.

Using Proximus (OTCPK:BGAOF) as a comp it should cost around 100 million CHF or EUR for 100k homes. Given the improvements in coverage we see every quarter and the stated CAPEX with that improvement so far, we see that the same ratio should apply in Switzerland. They want 55% coverage by 2025, and they want 80% coverage by 2030. That will cost them around 1.25-1.5 billion EUR or CHF, which is less than 5% of the market cap. So the outstanding CAPEX burden isn’t high in Switzerland.

Moreover, Fastweb is one of their brands which is a major broadband provider in Italy. However, the CAPEX burden to develop the fibre network is unlikely to fall on Fastweb since this seems to be the job of Open Fibre. Good to know since Italian FTTH and even FTTC coverage is pretty abysmal compared to OECD standards.

Interest

The other thing to note is interest. Rates have only gone up around 250 bps in Switzerland, which isn’t insignificant but it is less than the US and the ECB.

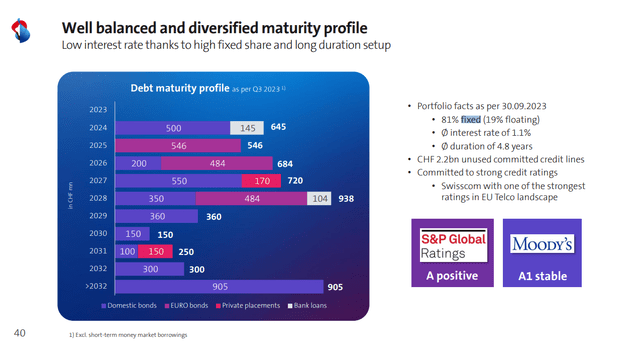

But 250 bps can still do a number on income. Thankfully Swisscom is defended here by a more than 80% fixed rate debt structure and pretty long overall maturities to maintain the status quo in net income for the time being.

Debt Profile (Swisscom Pres Q3)

It has a phenomenal credit rating, owed in part to also quite limited CAPEX burdens.

Bottom Line

The issue is that the company trades at around a 15x PE, despite being in an industry with a rather weak industry structure as the government is very focused on maintaining competition in the industry, and to allow for new operators on the Swiss network without problems. While rationality in the industry is evident with general hiking of subscriptions going on, it isn’t especially attractive. An earnings yield of less than 10% when prevailing rates on fixed income investments, even if hedged, in similarly developed markets, are increasingly competitive with that now, means insufficient equity risk reward. But at least it doesn’t have the issues Proximus does, which has large CAPEX burdens and a questionable dividend situation to deal with that could catalyse further downside.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Read the full article here