Synopsys (NASDAQ:SNPS) has a robust growth track record, with a CAGR of 13% for revenue and 23% for adjusted EPS over the past five years. The stock price has experienced significant gains in the past due to its high-quality and growth record. However, I believe that the current stock price is overvalued, and I am initiating coverage with a ‘Sell’ rating and a fair value of $330 per share.

Electronic Design Automation is Mission-Critical for Semiconductor Design

Electronic Design Automation (EDA) software is utilized for designing and validating the semiconductor manufacturing process to ensure it meets the required performance and density standards. Synopsys and Cadence Design [CDNS] stand out as the two leading players in this specialized market. Both companies have experienced significant growth in recent years, particularly during the boom in the semiconductor industry driven by auto chips, industrial automation, data centers, and AI computing.

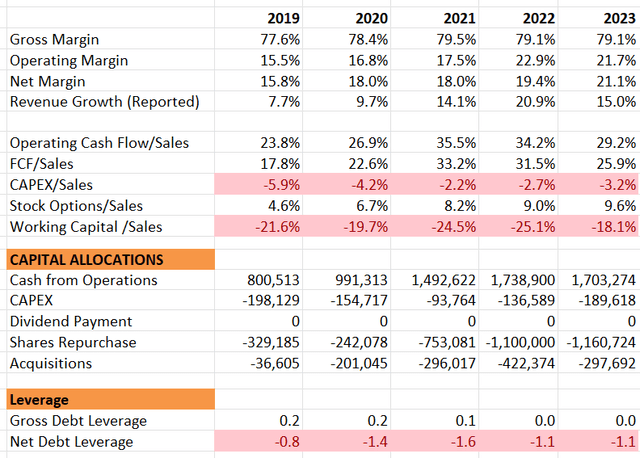

As depicted in the table below, Synopsys’ revenue has accelerated over the past few years. Fueled by strong double-digit revenue growth, they have generated notable cash flow from operations. They have strategically utilized their cash for share repurchases and some small tuck-in acquisitions. Additionally, they maintain a robust balance sheet with a net cash position.

Synopsys 10Ks

I believe that the growth in EDA software is structural, and Synopsys can continue to deliver double-digit topline growth in the near future. Firstly, Synopsys’ revenue is tied to semiconductor designing activities, not the volumes of semiconductor chips. Chip volumes may fluctuate and be highly volatile; however, designing activities represent a structural growth area. For any semiconductor company, continuous innovation and the design of new chips are imperative, regardless of the macroeconomic environment.

Secondly, Synopsys’ software operates on a subscription-based model, and even during economic downturns, semiconductor companies are unlikely to cancel these research and design-related software subscriptions. In other words, Synopsys’ business exhibits a highly recurring nature.

Finally, Synopsys has achieved a CAGR of 13% for revenue and 23% for adjusted EPS over the past five years. Looking ahead, I anticipate the design and manufacturing of various types of chips to increase, primarily propelled by developments in electric vehicles, artificial intelligence, data centers, and industrial automation. Consequently, it seems quite reasonable to assume that Synopsys can at least maintain their historical growth levels in the future.

Margin Expansion Drivers

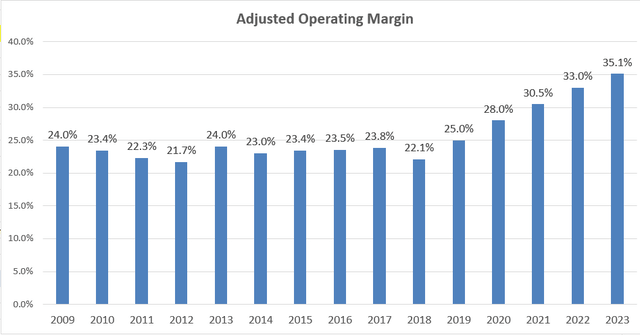

The chart below illustrates their remarkable history of margin expansion. I believe their margin expansion drivers can be summarized as follows:

Synopsys 10Ks

Firstly, with their double-digit topline growth, Synopsys has leveraged their operating expenses effectively, resulting in a lower operating expense growth rate compared to their revenue growth rate. As an example, their sales and marketing expenses decreased from 18.8% in FY19 to just 15.2% in FY23.

Secondly, historically, Synopsys has demonstrated pricing power over its semiconductor customers. Given the mission-critical nature of EDA software, annual price increases encounter minimal resistance from customers, contributing to gross margin improvement.

Lastly, Synopsys is strategically incorporating AI capabilities into their EDA platform as an additional service for customers. Management suggests that the monetization of AI technologies is in its early stages, and these additional services are expected to contribute further to the company’s profitability.

Financial Result and Outlook

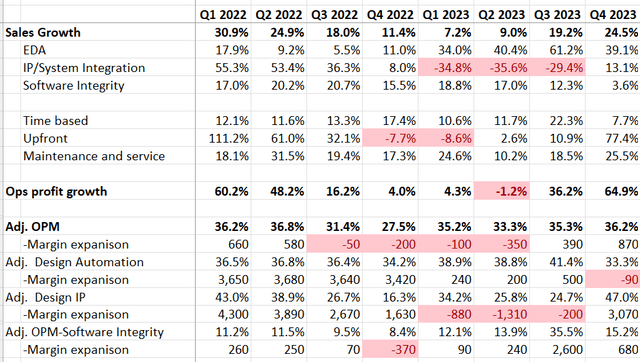

During Q4 FY23, Synopsys achieved impressive year-over-year growth, with a 24.5% increase in revenue and a remarkable 64.9% surge in operating profits, primarily propelled by record margin expansion. Furthermore, the company expanded its backlog to $8.6 billion.

Synopsys Quarterly Results

The operating cash flow for the year stood at $1.7 billion, concluding with $1.59 billion in cash and only $18 million in debts. Notably, they allocated $1.2 billion for share repurchases in FY23, reflecting a generous shareholder payout.

Looking ahead to FY24 guidance, they anticipate revenue ranging between $6.57 billion and $6.63 billion, with a non-GAAP operating margin of 37%. The prospects for strong growth in FY24 seem promising.

With a substantial non-cancellable backlog of $8.6 billion, Synopsys is well-positioned for sustained revenue growth in the coming years. This extensive backlog provides significant visibility for their growth projections.

Moreover, the increasing demand for AI computing and large-scale language machine learning necessitates substantial investments in workload migration and data analytics by enterprises. This trend is expected to drive the demand for AI chips and data centers, positioning Synopsys for structural growth as more AI-related chips are designed and manufactured in the near future.

Valuation

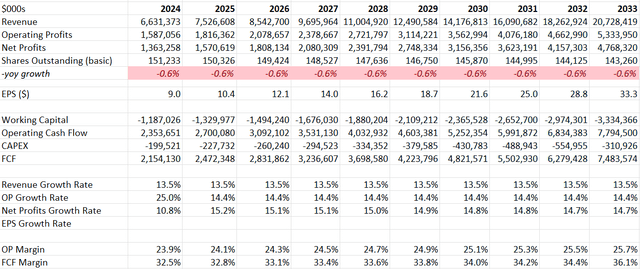

I anticipate a 13.5% growth in revenue for FY24, falling within the range provided in their full-year guidance. Considering the structural growth tailwinds discussed earlier, I project that Synopsys’ normalized revenue growth rate over the next decade will slightly exceed that of the previous decade, landing at 13.5%. This is a half-percent higher than their performance over the past five years.

The expected margin expansion is driven by factors such as pricing power and operating leverage. Based on my calculations, the company is poised to achieve a 20bps annual margin expansion.

Synopsys DCF

The model employs a 10% discount rate, 4% terminal growth rate, and a 16% tax rate. According to the calculations, the fair value is determined to be $330 per share in the model.

Key Risks

Big China Exposure: China constitutes over 15% of the group’s revenue, with sales of EDA software to Chinese semiconductor manufacturers. As previously discussed, EDA software is crucial to the chip designing process, making their products susceptible to potential geopolitical risks between China and the U.S.

Low Margin Software Integrity Business: While their Software Integrity business contributes approximately 9% to the group’s revenue, it operates at a margin of only 10%, notably lower than the more than 30% operating margin of the Semiconductor & System Design segment. Should Synopsys experience faster growth in the Software Integrity business, it could lead to a decline in the overall group margin over time.

Conclusion

While I regard Synopsys as a high-quality growth company, I currently perceive their stock price as overvalued. Consequently, I am initiating coverage with a ‘Sell’ rating, assigning a fair value of $330 per share.

Read the full article here