Introduction

Ever since I started to get serious about dividend (growth) investing, I haven’t had a bad night of sleep – at least not caused by portfolio or economic worries.

When buying high-quality companies with solid balance sheets, strong business models capable of sustainable long-term growth, and steadily growing dividends at reasonable valuations, investors not only do not have to worry about every market drawdown or recession, but they also have a good shot at beating the market.

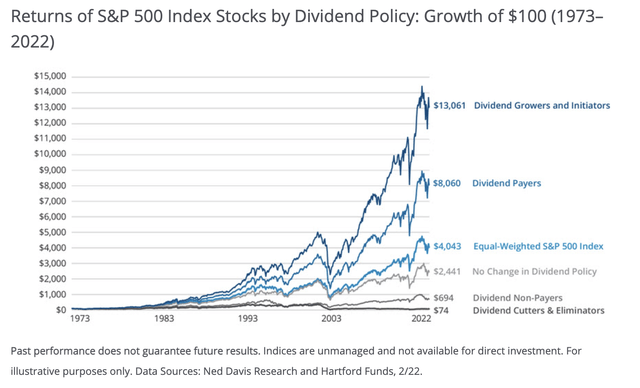

Going back to 1973, a $100 investment in dividend growth stocks has turned into more than $13,000 in 2022. This outperforms dividend payers by $5,500. It outperformed the equal-weight S&P 500 by an even wider margin.

Hartford Funds

When picking the right stocks, investors can build a portfolio that not only has a higher return than the market but also comes with lower risks.

In contrast to companies that cut or eliminated their dividends, companies that grew or initiated a dividend have experienced the highest returns relative to other stocks since 1973-with significantly less volatility. This helps explain why so many financial professionals are now discussing the benefits of incorporating dividend-paying stocks as the core of an equity portfolio with their clients. – Hartford Funds

Hence, while I cover a wide variety of investments, the focus is on dividend growth, which, I believe, is the best way to build long-term wealth.

The problem is finding the right stocks.

Sure, the market has some fantastic ETFs that can help us get the job done.

However, as a stock picker, I want to do the work myself.

One stock that can help us stock pickers build low-risk outperforming portfolios is Sysco Corporation (NYSE:SYY), the world’s largest food distributor.

The company has hiked its dividend for more than 50 consecutive years. It benefits from its ability to gain market share in a highly fragmented market. It has a healthy balance sheet, a 2.8% yield, plenty of room for strong future dividend growth, and a highly attractive valuation.

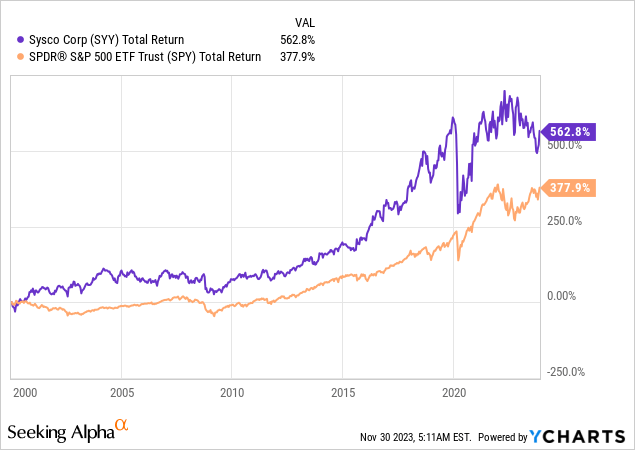

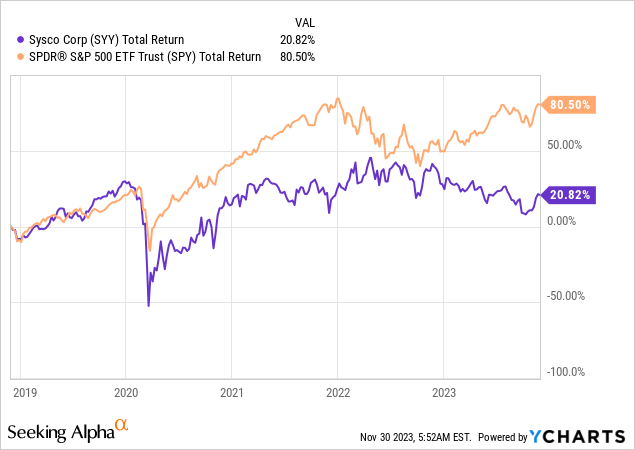

Going back to the year 2000, SYY shares have returned more than 560%, beating the S&P 500 by a substantial margin.

Although the pandemic and current consumer struggles are pressuring certain food segments, I have little doubt that SYY is a great long-term investment at a terrific price.

So, let’s dive into the details!

Dividend Brilliance In Food Services

Established in 1969, Sysco has become the world’s leading distributor of food and related products to the food service industry. It currently serves more than 725 thousand customers through three main segments:

- U.S. Foodservice Operations: This segment includes U.S. Broadline operations, distributing a wide range of food products, and U.S. Specialty operations, including FreshPoint fresh produce distribution, the Specialty Meat and Seafood Group, and other specialty businesses.

- International Foodservice Operations: This segment covers operations outside the U.S., including Canada, Bahamas, Mexico, Costa Rica, Panama, the United Kingdom, France, Ireland, and Sweden.

- SYGMA: Focused on U.S. customized distribution operations, SYGMA serves quick-service chain restaurant customer locations.

| USD in Million | 2022 | Weight | 2023 | Weight |

|---|---|---|---|---|

|

United States Foodservice |

48,521 | 70.7 % | 53,683 | 70.3 % |

|

International Foodservice |

11,787 | 17.2 % | 13,560 | 17.8 % |

|

SYGMA |

7,246 | 10.6 % | 7,843 | 10.3 % |

|

Other |

1,082 | 1.6 % | 1,239 | 1.6 % |

As one can imagine, Sysco caters to a broad customer base in the food service industry, including restaurants, healthcare, educational facilities, and more.

The company’s product offerings span frozen foods, canned and dry products, fresh meats, seafood, dairy products, beverages, and non-food items.

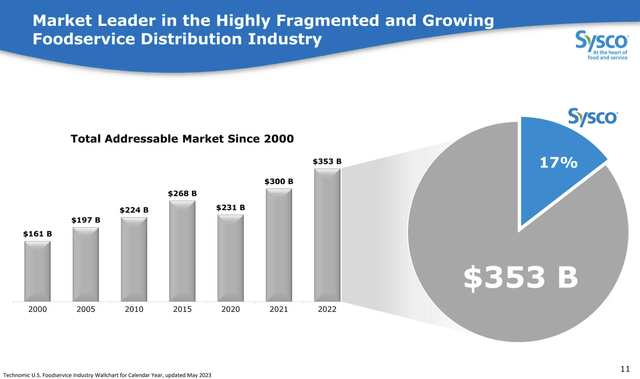

What’s interesting is that Sysco’s addressable market has grown from roughly $160 billion in the year 2000 to more than $350 billion in 2022. That’s a growth rate of 3.6% per year.

Sysco owns 17% of this market.

Sysco Corporation

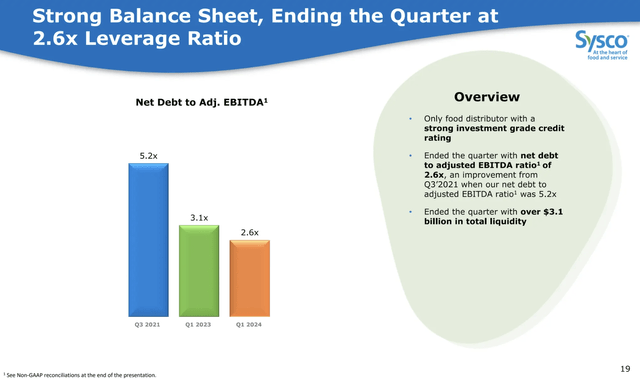

It is also the only food service operator with an investment-grade balance sheet rating. In this case, it has a BBB rating and a healthy 2.6x leverage ratio.

That’s down from 5.2x in 3Q21 when the company was dealing with the impact of the pandemic.

Sysco Corporation

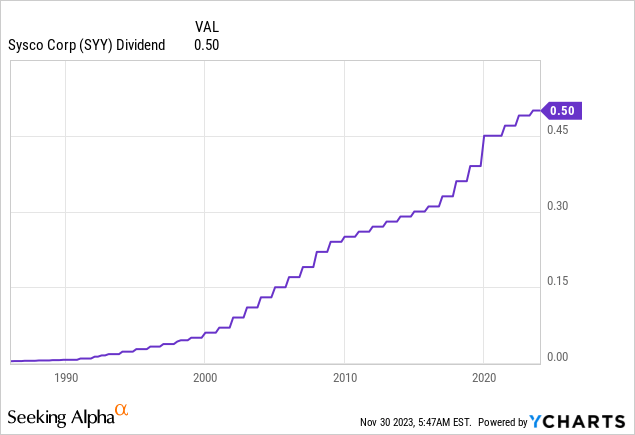

The company also has a focus on its shareholders, as it’s one of the few companies with more than 50 consecutive annual dividend hikes, making it a member of the exclusive dividend kings club.

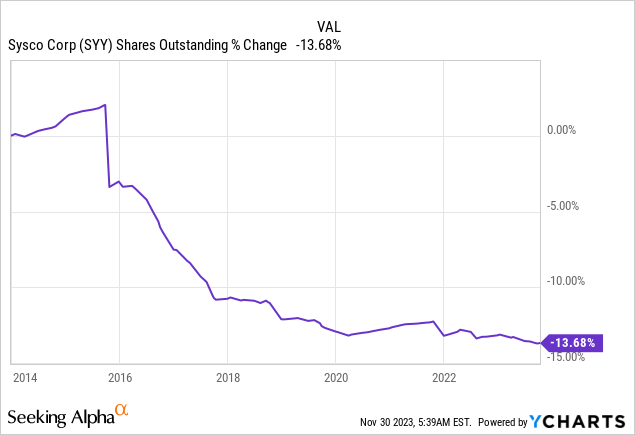

Since its 2015 fiscal year, the company has spent $16.7 billion on shareholder distributions. Roughly half of this was indirectly returned through buybacks.

With regard to its dividend king status, one of the things that bothers me sometimes is that a lot of companies with dividend king or dividend aristocrat status have very slow growth due to often mature business models.

Sysco is different.

It currently yields 2.8%. This yield is protected by a sub-50% payout ratio. The five-year dividend CAGR is 6.6%.

On April 27, it hiked by 2%. Last year, it hiked by 4.3%.

It also helps that the company is on track to generate $2.5 billion in free cash flow next year. This would translate to a free cash flow yield of 7% and implies a free cash flow payout ratio of just 40%.

Hence, I expect dividend growth to pick up in the next few years.

Growth, Market Share Gains & Smart M&A

Despite its high long-term return, SYY has failed to outperform the market over the past five years. One major reason is the pandemic, which did a number on global food demand – especially food away from home.

The recovery in 2021 and 2022 was slow, which made it impossible for SYY to beat a tech-heavy S&P 500.

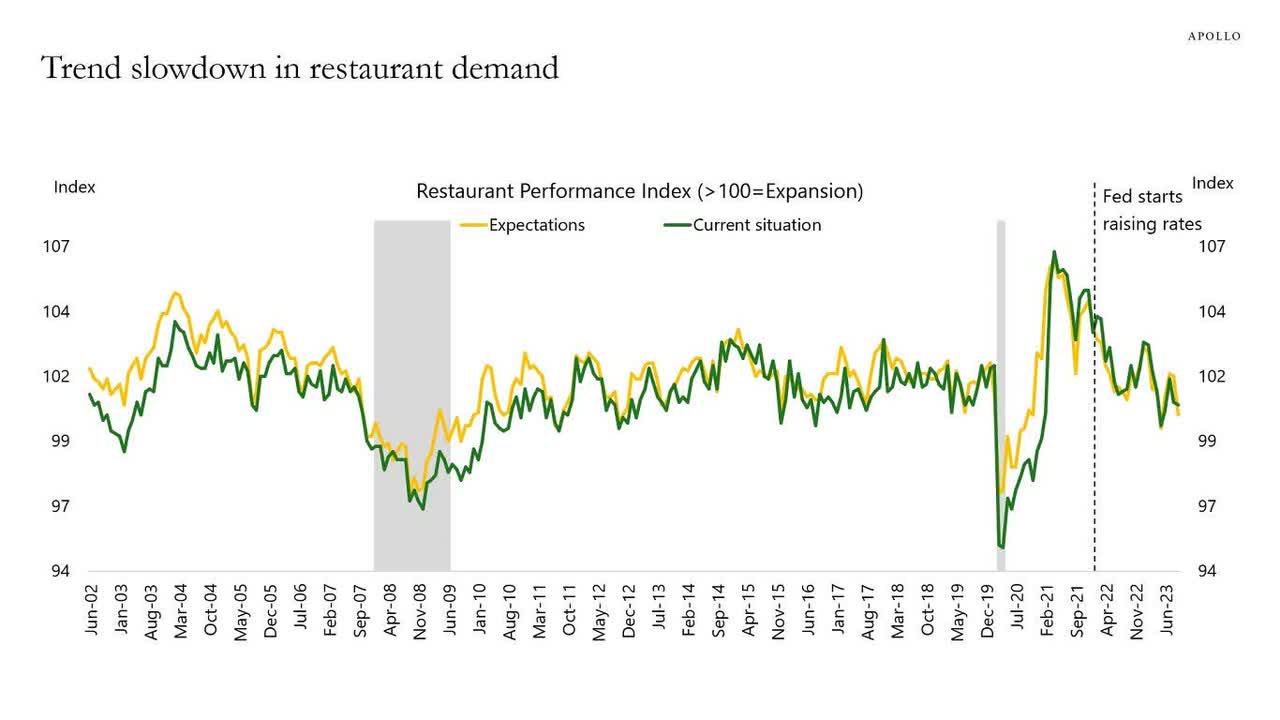

It also didn’t help that elevated inflation is pressuring restaurants.

The restaurant performance index has been in a steady decline since 2021, fueled by higher rates and sticky inflation.

Apollo Global Management

Fortunately, Sysco continues to perform well.

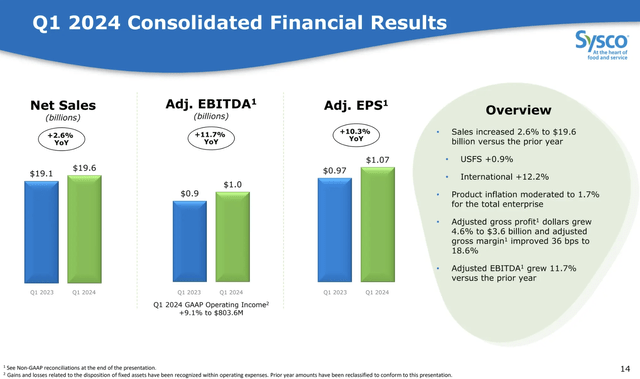

Sysco reported strong Q1 financial results in its 2024 fiscal year, with the highest operating income in its history.

Sales growth came in at 2.6%, attributed to case volume growth and effective cost management in the U.S.

Adjusted operating income and EPS both experienced double-digit growth with EPS reaching $1.07 per share.

Sysco Corporation

Despite challenges like slowing top-line macro and deflationary pressures, Sysco performs well as the leader in its industry.

For example, the U.S. Foodservice segment demonstrated positive momentum, with 1.6% total case volume growth and share gains in key sectors.

According to the company, its national sales team secured significant contracts in healthcare, restaurants, and hospitality, reflecting Sysco’s improved offerings and support structures for large customers.

Meanwhile, there’s a focus on further improving local volumes.

Strategies include investing in additional sales headcount, enhancing sales consultants’ compensation models, emphasizing visit frequency and quality expectations, and expanding total team selling.

Sysco also implemented a global operating model to accelerate progress internationally.

The company is expanding its supply chain capacity, with new fulfillment centers planned for high-growth areas like Mesa, Arizona, and Allentown, Pennsylvania, and it sees progress in operating profit leverage.

The company is also buying equipment supplier Edward Don.

Edward Don sells and distributes a broad range of equipment, from ranges to rotisseries. It is also a major supplier of disposable to-go packaging.

The company generates about $1.3 billion in annual revenues from restaurants and other foodservice facilities, according to Sysco.

The buyer said Wednesday in announcing the deal that Edward Don will function as a standalone operation run by the acquired company’s existing personnel and management. Sysco indicated that no Edward Don employees would lose their jobs as the result of the merger.

In addition to adding Edward Don’s product lines to Sysco’s extensive catalog, the deal will add another 1.4 million square feet of distribution space to the buyer’s holdings.

Edward Don

Thanks to a healthy balance sheet and strong free cash flow, the company is in a terrific position to use acquisitions to penetrate the highly fragmented industry it serves.

Furthermore, despite substantial M&A actions, the company remains committed to returning cash to shareholders.

Sysco plans $750 million in share repurchases and approximately $1 million in dividend payout for FY24.

Depending on M&A activity, there is potential to increase share repurchases without hurting financial health.

Valuation

SYY is currently down 6% year-to-date and I do not disagree that the underperformance is warranted. Investors prefer to avoid industries that are pressured by inflation. I’m one of them.

However, the long-term value of SYY is great, especially because it continues to exploit market weakness by expanding market share, investing in growth, and buying back stock.

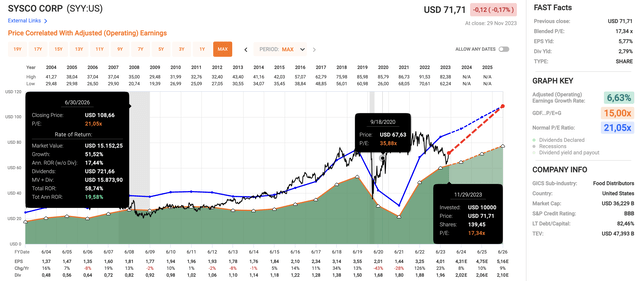

Using the data in the chart below:

- SYY is currently trading at a blended P/E ratio of 17.3x

- Its normalized valuation multiple is 21.1x.

- I believe that valuation is warranted. It has guided SYY well in the past and fits its growth potential.

- Analysts believe that SYY can grow EPS by 8% this year, followed by 10% and 9% in the 2025 and 2026 fiscal years, respectively.

- When combining its dividend, growth expectations, and a potential return to 21.1x EPS, we get an annual return potential close to 20%.

FAST Graphs

We are obviously dealing with a theoretical performance, which may take a few quarters to unfold, but I believe this shows how attractive the longer-term potential of SYY is.

On a long-term basis, I expect Sysco to boost dividend growth again, keep gaining market share, and beat the S&P 500 on a total return basis.

Read the full article here