Getting long-term guidance from a company can be reassuring. Sprinklr (NYSE:CXM) did just that during its investor day (July 12, 2023) where it delivered general guidance all the way out to 2027. Unfortunately, the road from here to there may not be a straight line. Along the way, reminders of this crooked path can ignite fears of failures in well-crafted financial models which in turn trigger large price volatility. Such a tsunami of negativity hit CXM after

Q3 fiscal year (FY) 2024 earnings exposed a divergent business path starting in Q4. In response, CXM collapsed 33.5% and created an intriguing opportunity to buy into the longer-term ambitions at a discount.

Sprinklr Serves Up A Mud Sandwich

Bad news sandwiched between good news is still bad news. So when Sprinklr inserted a warning for FY 2025 between higher guidance for Q4 and reassurances about the longer-term expectations, the most audible news remained the 2025 warning. Management increased guidance for Q4 which in turn increased full-year guidance. Management raised guidance despite identifying “renewal headwinds”:

“Given the macro environment, we are experiencing a higher level of down sales, as large customers right-size their software spend. As such, we are mindful that this cycle of renewals may be one of the more challenging quarters to get through and is factored into the guidance numbers.”

- Subscription revenue: $664M to $666M, up 18% year-over-year from the midpoint and up $6M from prior guidance (which management pointed out exceeds “the full magnitude of the Q3 beat”, a similar feat they achieved and pointed out in Q2).

- Total revenue: $725.5M to $727.5M, up 18% year-over-year from the midpoint and up from $719M to $720M prior guidance.

- Non-GAAP operating income: $80M to $82M up significantly from prior guidance of $65M to $67M. Non-GAAP net income per share of $0.36 to $0.37, up from $0.30 to $0.31 (assuming 273 million basic weighted shares outstanding).

- Non-GAAP operating margin (at the midpoint): 11%, up 1,000 basis points year-over-year and up from prior guidance of 9%.

- GAAP net income: positive for the full year FY ’24, no change

- Total billings: $773M, up “a little over” 17% year-over-year and down slightly from prior guidance of $780M.

The billings slip was the beginning of the rest of the bad news. The encouraging guidance was followed by a huge clump of mud for fiscal year 2025: “based on what [was] just outlined, coupled with an unforgiving macro environment, we expect a sequential quarterly increase of 2.5% for each quarter of FY ’25. This equates to approximately a 10% total revenue growth for the full year.” This estimation of 10% is a significant shortfall from 2024’s annual growth. So while management did not provide specific 2025 guidance in earlier public appearances, this announcement looked like a divergence from the path to 2027. For example, during the analyst day, Sprinklr dangled the prospect of $1B+ of subscription revenue by FY2027. Assuming subscription and total revenue continue to grow around the same rate, 10% annual growth would put Sprinklr at $885M in 2027, at least a 11% shortfall from the target.

Yet, Sprinklr closed the mud sandwich by insisting that the 2025 expectation “does not change our FY ’27 long-term plan.” Moreover, management emphasized this 10% growth for 2025 is “the appropriate starting point for FY ’25.” So when they say “it might change substantially when we talk in March, and we talk about the full year guide”, they are holding out the prospect for upside guidance or at least specifics on how the company will stay on track to the 2027 targets.

Management issued further reassurance about the robustness of its product portfolio: “I want to be clear that the dynamics I’ve just discussed here will be short term in nature and do not change our expectations for Sprinklr’s growth potential across each of our four product suites.” In other words, this 10% growth should be a trough. If so, then the CXM stock price is also likely at a trough.

Of Pressure and Air Pockets

Sprinklr’s CEO gave a hint of the mud sandwich in his introductory remarks. The company misallocated resources during its push to grow the CCaaS (Contact Center as a Service) business. CCaaS did not grow enough to make up for greater than anticipated slippage in other parts of the business that suffered from insufficient attention.

“As we’ve diversified the business and focused on scaling our CCaaS business, we’d like to acknowledge that we have made slower progress on some of our other go-to-market initiatives focused on our core product suites. We expect this will have a near-term impact on growth.”

The CFO went on to further explain: “our focus on succeeding in our CCaaS business slowed progress with some of our other go-to-market initiatives in our core product suites much more than we had anticipated.” Apparently, the initial customer excitement over the CCaaS offering triggered Sprinklr’s over-rotation. (“The number one excitement we’re seeing in the field among customers is our CCaaS product. And so we know we’ve done the right thing”). After experiencing this hiccup, the company is better positioned to reallocate and realign efforts across the product portfolio. Sprinklr will essentially take employees in sales, support, and service who were reassigned to the CCaaS effort and return them to their original jobs and source of expertise. Sprinklr expects this fix to play out over “several quarters.” The timing is critical given three current negative market and business dynamics:

- Incremental pressure on renewals started in Q3 “as certain customers that are impacted by the difficult macro environment adjusted their spending levels.”

- An “air pocket” developed between the transition from marketing-based customer (social customer service and digital customer service) to a contact center-focused customer. Accordingly, bookings growth has slowed.

- Bookings growth was also slowed by a transition for the partner ecosystem. Sprinklr predicts it could take up to a year to work through this air pocket.

Taken together, I can understand why investors could abruptly lose faith in the 2027 targets. However, I want to pull CXM out of the “prove it” penalty box and place it in the “buy now” encampment. The promising product portfolio excites me the most about the potential opportunity ahead.

Portfolio Effects

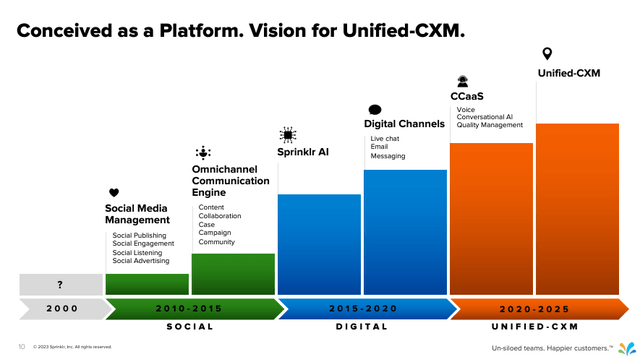

Sprinklr was an early software provider for “social listening”. I remember using the software with awe given the amount of data available on social media channels. The company has innovated since then on a journey to what it calls “Unified Customer Experience Management” or Unified-CXM. The architecture of Unified-CXM combines Sprinklr Service, Sprinklr Marketing, Sprinklr Insights, and Sprinklr Social into a platform that connects and aligns a company’s customer-facing teams across all of the company’s touchpoints with customers. This broad integration is a unique high-tech value proposition that is more comprehensive than adjacent CCaaS competitors like Verint (VRNT).

The Unified-CXM Evolution (Sprinklr Investor Day Presentation (July 12, 2023))

Sprinklr also has extensive experience with AI starting before the current generative AI wave. The company now boasts “thousands” of custom and specialized AI models across over 60 verticals. Sprinklr uses AI to generate structured insights from a multitude of data sources and then delivers those insights to the customer-facing agents in a company. Sprinklr’s AI products are Quality Management, Workforce Management, Conversational Analytics, Conversational AI, Voice Bots, Creative Insights, Product Insights, Visual Insights, Media Insights, Location Insights, and AI Studio. Pavitar Singh, Sprinklr’s Chief Technology Officer, clearly stays very busy!

Conclusion: The Trade

The recent discount in CXM knocked the stock from the top of its lifetime price/sales range toward the bottom, from 6.3 to 4.3. This well-defined range helps meter the investment opportunity. I like CXM at current levels (and lower if the market provides the discount). The shares become dear at the top of the range where the company’s narrative and/or growth profile must kick into a higher gear to justify the lofty valuation.

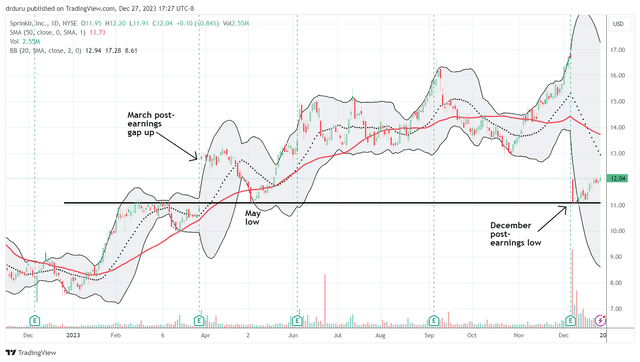

From a technical perspective, CXM held the May lows as support, which in turn created a full of March’s post-earnings gap. Thus, this support looks solid. However, if this support fails, I would look to more solid support at $10. Below that point, I would have to reevaluate/reconfirm the longer-term investment thesis.

CXM perfectly held support at the May low. Can this hold as the trough? (TradingView.com)

Be careful out there!

Read the full article here