Almost as if a switch was pressed, the NASDAQ Composite (COMP.IND) – which encapsulates almost all Nasdaq-listed stocks – collapsed 1.63% on the first day of trading from the highs of 2023. This was the 4th-worst start to a new year since 1972 and only the 5th time that a year started with a one-day drop of more than 1.5%. In the first week of the year, the index fell another 1.64%.

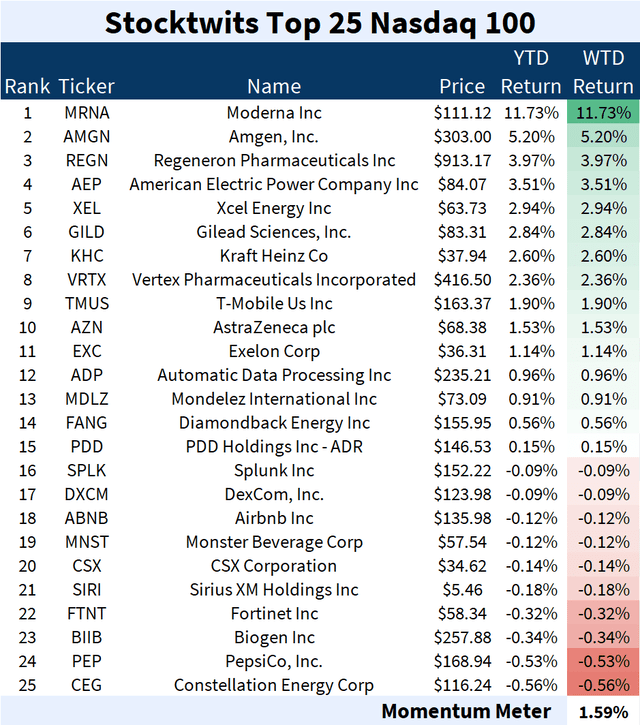

Within the “tech-heavy” NASDAQ 100-Index (NDX), pharmaceuticals ruled the roost in terms of momentum; tech was virtually nowhere to be seen in the Top 25 list – a massive shift in trends seen in Q3 and Q4 of 2023.

Source: StockTwits

In holistic terms, the index isn’t rising: the one-day drop for the Nasdaq-100 in the new year was 1.68%. As of the first week of the year, the index shed another 1.44%.

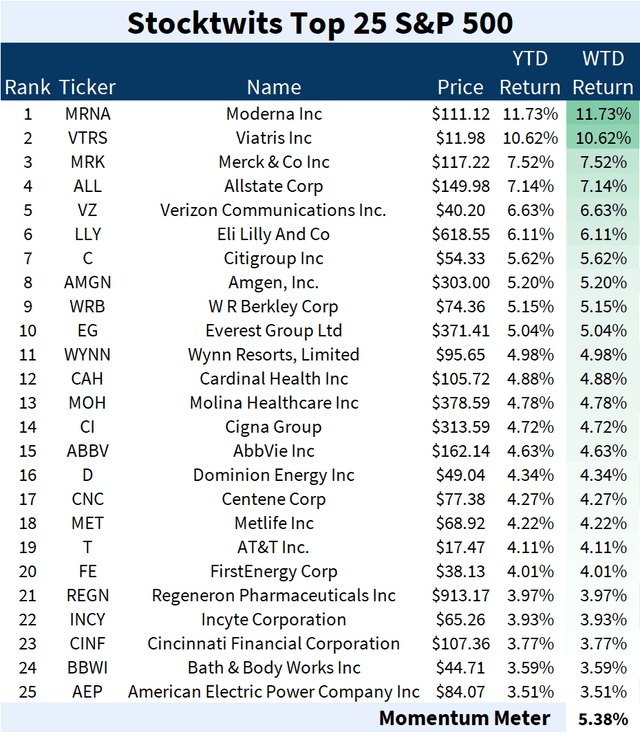

The “broad market” S&P 500 (SPX in index form and SPY in ETF form) was relatively muted: its one-day drop in the new year was 0.57% and it dropped another 0.96% in the first week of the year. Pharmaceuticals and financial services ruled the roost in the Top 25 list.

Source: StockTwits

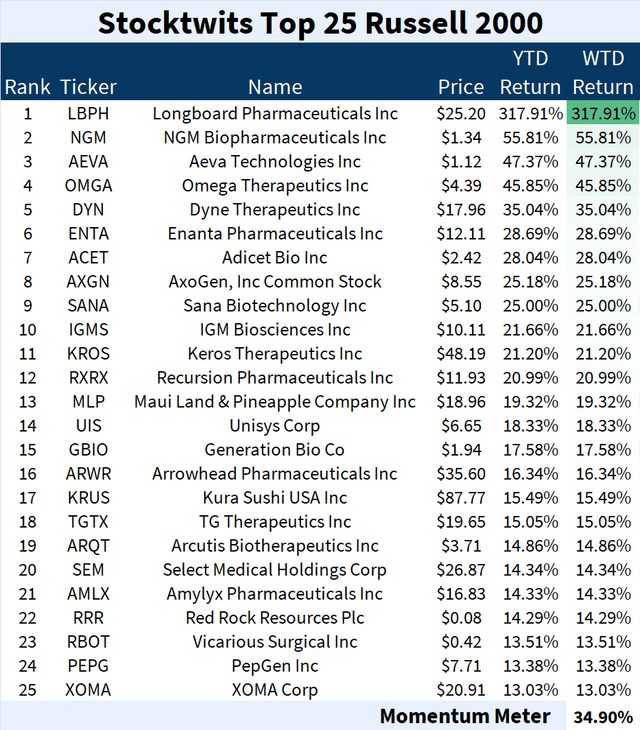

The biggest drop over the week, however, was witnessed in the small-cap Russell 2000 (RUT; represented by the ETF IWM) which pulled back by 3.1%. Its one-day drop in the new year was 0.7%. The top gainers in this index were almost exclusively pharmaceutical companies.

Source: StockTwits

Whether these early trends portend general market directionality in the year to come might be aided (or hindered) by the overall institutional outlook for the year, which runs the gamut from blasé to optimistic.

Institutional Views

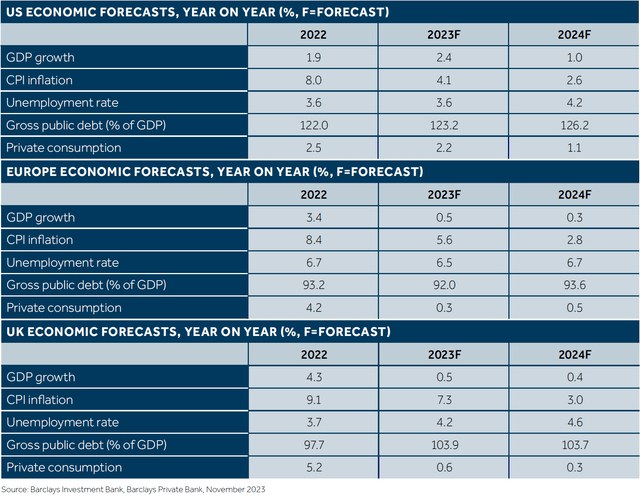

In its outlook for 2024, British investment bank Barclays opined that 2024 will be a particularly muddled year for the Western Hemisphere.

Source: Barclays Capital

While the Hemisphere is expected to see lower year-on-year Consumer Price Index (CPI) inflation, the United States will see a 17% increase in the unemployment rate along with a 50% decrease in private consumption. No region – be it the U.S., the U.K., or the Continent – will experience GDP growth.

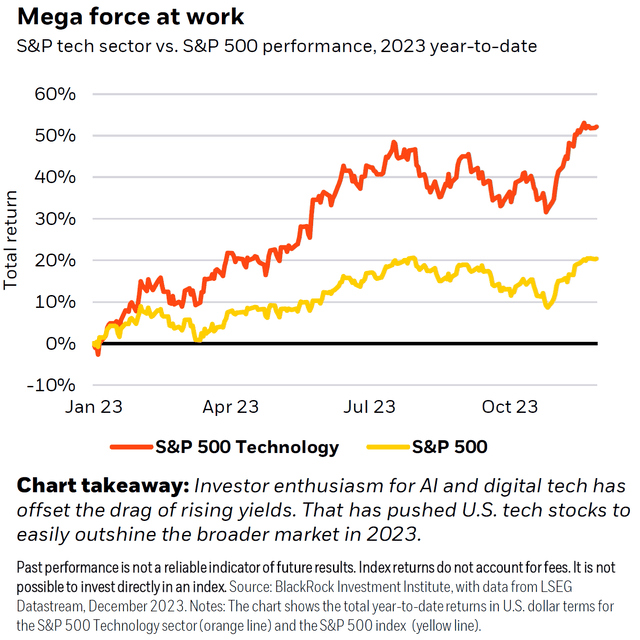

The drop in consumption is a particularly ominous indicator for the technology sector: without significant buy-ins, forward valuations and investor convictions get shaky. As the Blackrock Investment Institute indicated, “tech” enjoyed a conviction premium throughout 2023 and ended the year with a nearly 155% outperformance against the “broad market”.

Source: BlackRock Investment Institute

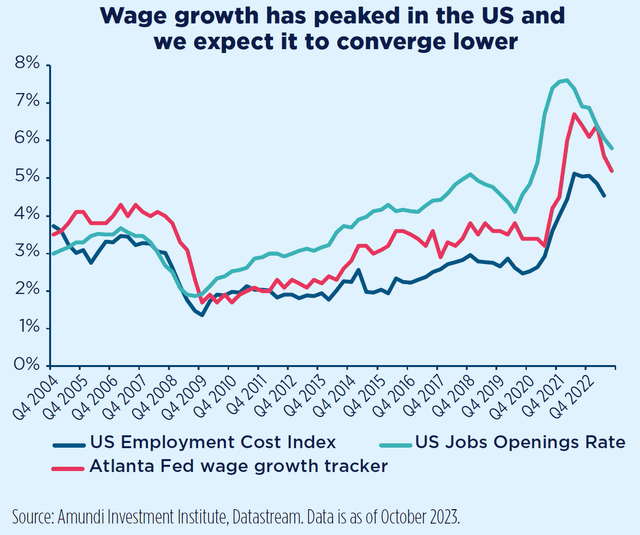

France’s Amundi – Europe’s largest asset manager in Europe and one of the world’s 10 biggest investment managers – estimates that wage growth in the U.S. has peaked and will slide lower in the year ahead.

Source: Amundi Investment Institute

Given that CPI inflation is expected to drop, that drop in wage growth might have a certain rationale. Then why the drop in personal consumption? This is a more complex and multi-factored issue that is not certainly helped by the fact that the average U.S. consumer/resident has been saddled with rising costs far in excess of wage growth for well over a decade now. The “weight of macro consequences” is a slow-moving iceberg seldom addressable with simple measures.

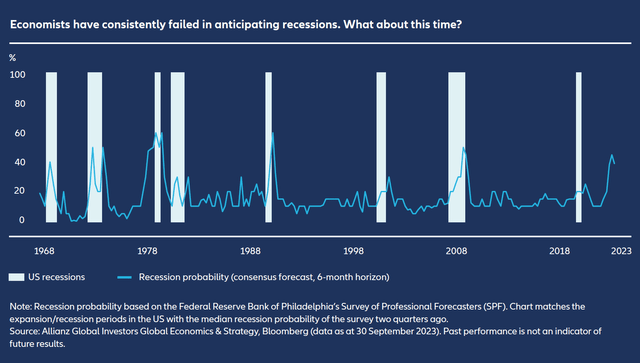

As the U.S. prepares for arguably one of the most contentious elections in modern history, economists and forecasters have been particularly wary of making prognostications, especially aftermarket cool-offs and sector rotations didn’t materialize as expected in 2023. Some have substituted the term “recession” with musings on whether a “landing” will be “hard” or “soft”. Presently, the consensus is inching towards a “soft landing”. However, Germany’s Allianz Global Investors – a subsidiary of the world’s largest insurance company – noted in its outlook that forecasters’ consensus opinions have been wrong on almost every recession since the eighties:

Source: Allianz Global Investors

One feature that stands out is that nearly every recessionary event was almost immediately preceded by a low probability consensus of said recession occurring.

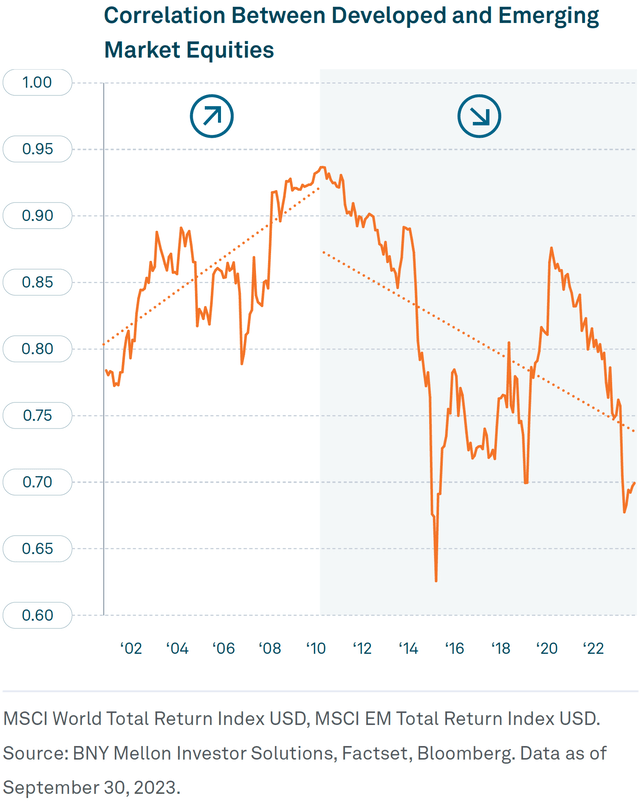

Another assumed truism is that an “American” recession tends to spell doom for the global market and economy as well. In its outlook for 2024 titled “10-Year Capital Assumptions”, BNY Mellon outlines that this may not happen: since the last great recessionary event – the Global Financial Crisis [GFC]- Emerging Markets [EM] have been increasingly uncoupled from Developed Markets [DM].

Source: BNY Mellon

This highlights an often-stated yet frequently-derided trend broadly referred to as “deglobalization”. In effect, the notion of a single “global driver” is increasingly less viable.

Models Breaking

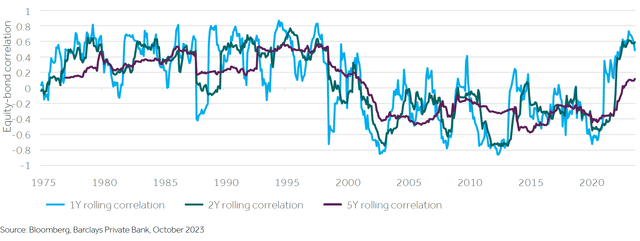

“Deglobalization” is merely one of many indicators that classical models are being challenged. One “classic” is the bond-equities relationship which most investors broadly understand as a “flight to safety” paradigm from equities to bonds when the former looks shaky and vice versa when the outlook has stabilized. Barclays asserted that bond-equity correlations, a key measure for asset allocation strategies, have shot up to levels last seen twenty years ago (i.e. circa the dot-com bubble).

Source: Barclays Capital

At current levels of correlation, the bank states that bonds do not act as the shock absorbers to equities as they have done in the past.

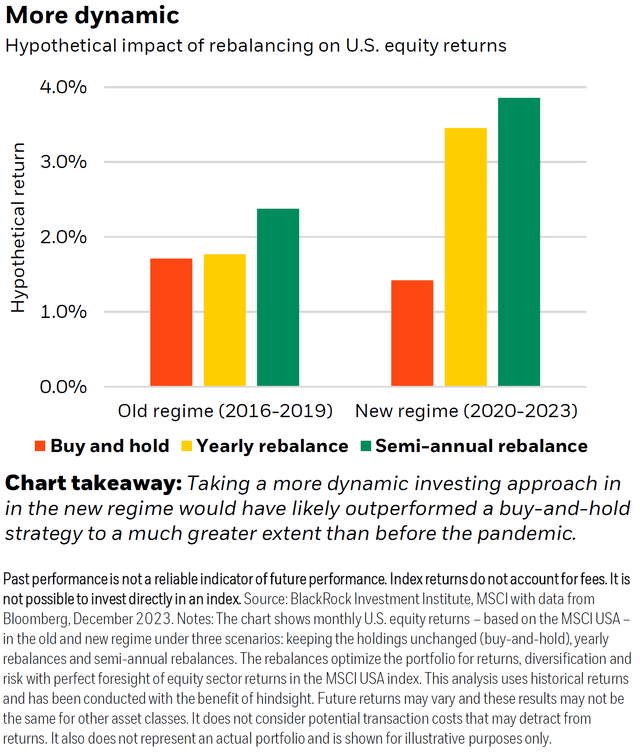

Another “classic” being challenged is an investor favourite: the “buy and hold”. As per studies by the BlackRock Investment Institute, investors who get “granular” with their portfolio allocations have tended to thrive over those with “static” portfolios.

Source: BlackRock Investment Institute

With a wide arsenal of tools and strategies to help outperform static portfolios, BlackRock asserts that investment expertise is likely to give portfolios an edge by enabling more effective core allocations, implementing “alpha” ideas and hedging risk.

The Bottom Line

In the 2024 market outlook article published last month, it was opined that AI, for better or for worse, is here to stay and will continue to have a strong influence in investor conviction at least in the near- to mid-term. While it’s certainly well within reason to hold forth that America’s tech stocks being heavily overvalued relative to the rest of the market is a headwind, AI-related developments will continue to be regarded as tailwinds for the constituents of the sector. A similar tilt in favour is expected to be writ large in the private market as well.

With deeply-held notions being challenged (or even potentially altered forever), it likely would pay – more so now than ever – if investors were to eschew the hype around favourites, examine closely ideas considered to be “fundamental” and explore new strategies available.

Given shifting trends and long-held paradigms, a “caveat emptor” would be in order.

Read the full article here