Tencent (OTCPK:TCEHY) was falling double-digits in Friday trading after the Chinese government announced new rules cracking down on online gaming. In this report, I analyze the potential financial fallout from such regulation, as well as any potential impact on the valuation. TCEHY remains a dominant Chinese tech titan with positive cash flow generation and a solid balance sheet. Prior to this online gaming announcement, TCEHY was positioned for operating leverage, as management has committed to a focus on profitable growth. The stock looks reasonably valued after the decline, even if it is still not as cheap as some Chinese tech peers. I reiterate my buy rating for the stock.

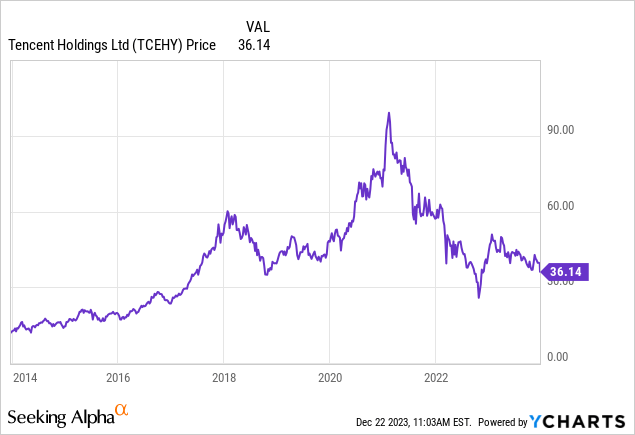

TCEHY Stock Price

After a double-digit decline on Friday, TCEHY found itself trading at 2017 levels.

I last covered TCEHY in August, where I rated the stock a buy on account of the share repurchase program. The government crackdown in online gaming complicates things, but the attractive value proposition remains.

TCEHY Stock Key Metrics

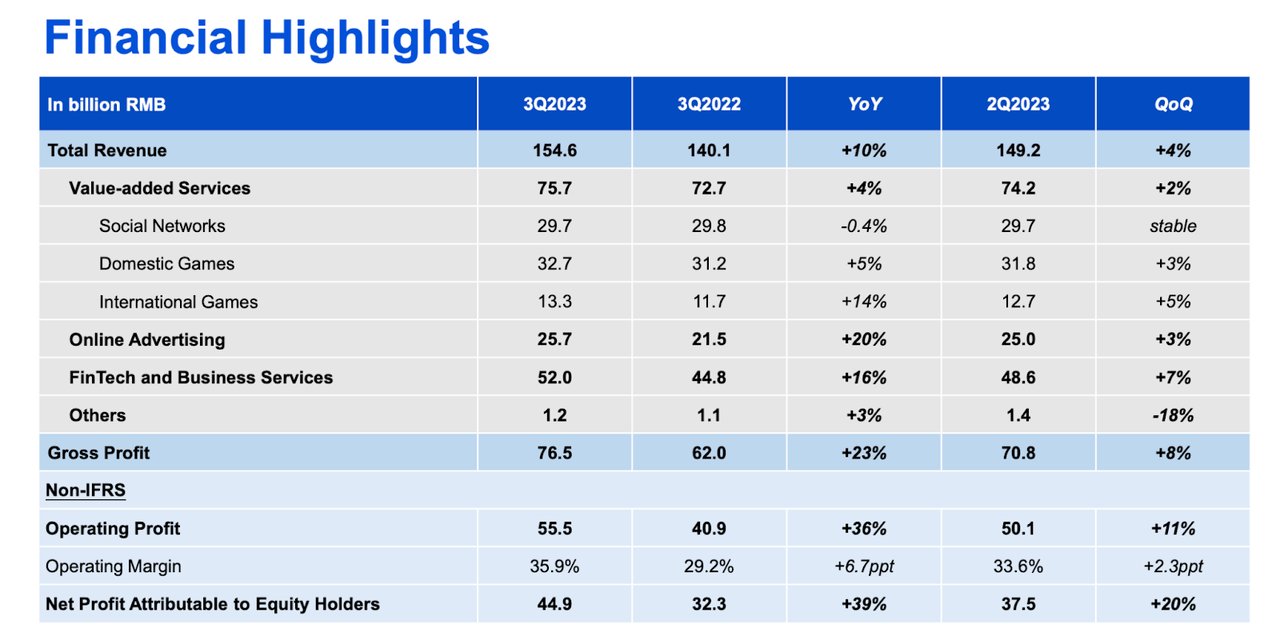

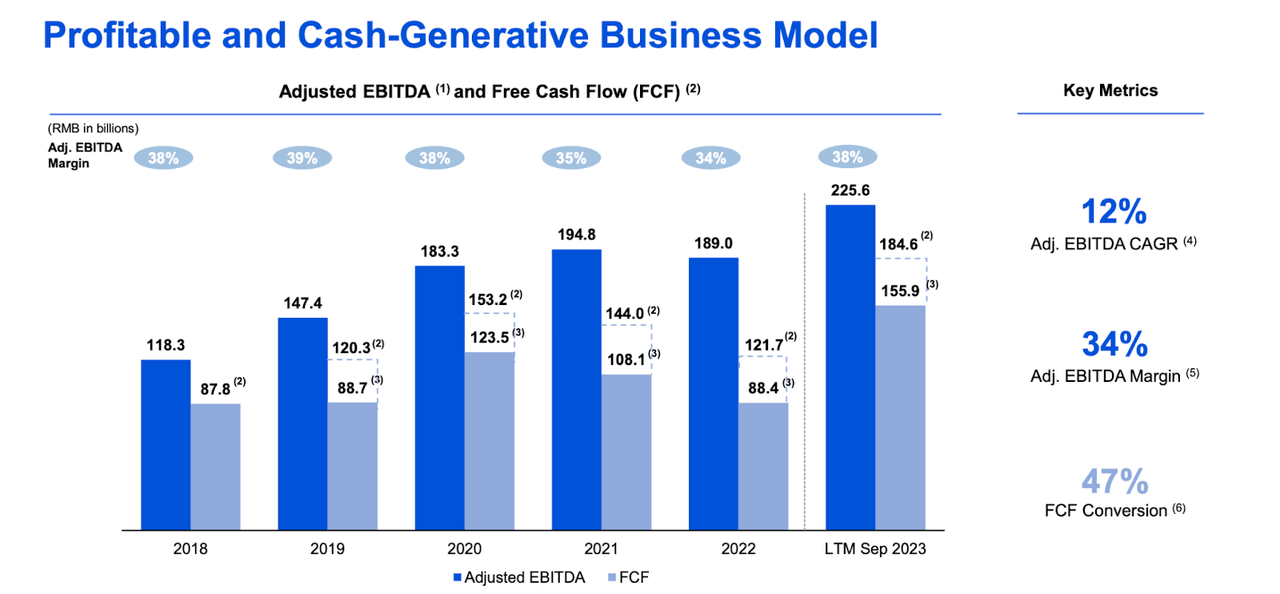

In its most recent quarter, TCEHY delivered solid 10% YoY growth in revenues, led by 20% growth in online advertising. Gross profits grew faster at 23% as the company focused on higher-quality revenue streams. Operating profits grew even faster at 36% YoY due to a focus on operational efficiencies.

2023 Q3 Presentation

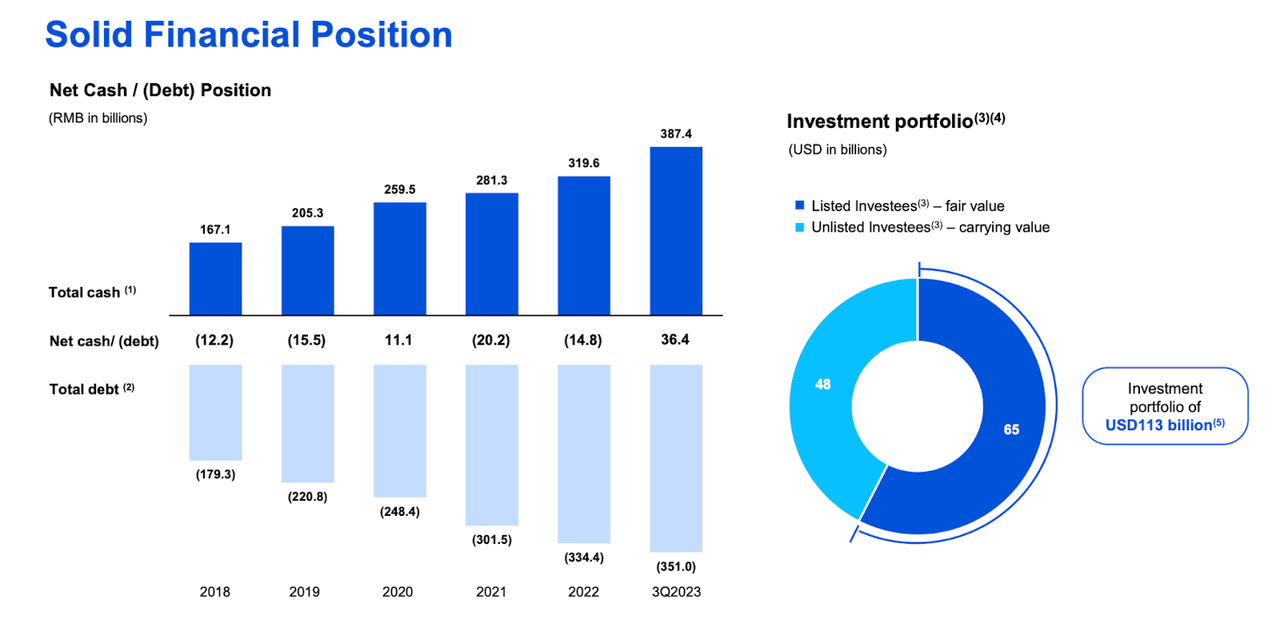

TCEHY exited the quarter with a solid balance sheet, highlighted by $36.4 million RMB in net cash and a $113 billion USD investment portfolio. For reference, the market cap recently stood at $374 billion.

2023 Q3 Presentation

TCEHY repurchased around 48 million shares for $14 billion RMB in the quarter. That marks yet another quarter with aggressive share repurchases. After many years of token repurchase activity, TCEHY appears to be following in the footsteps of another Chinese tech titan in Alibaba (BABA) in increasing the aggression of their repurchase program.

On the conference call, management reiterated their commitment to delivering “greater operating leverage” on account of their “high-quality revenue growth model.” Management noted that they are “exiting certain noncore businesses” and reducing “excessive spending on operations subsidies and marketing activities.” Just as many US-based tech companies have reacted to the tough macro environment by driving expanding operating margins, TCEHY also appears to be showing an increased focus on profitability just at the right time.

Why Did Tencent Stock Fall?

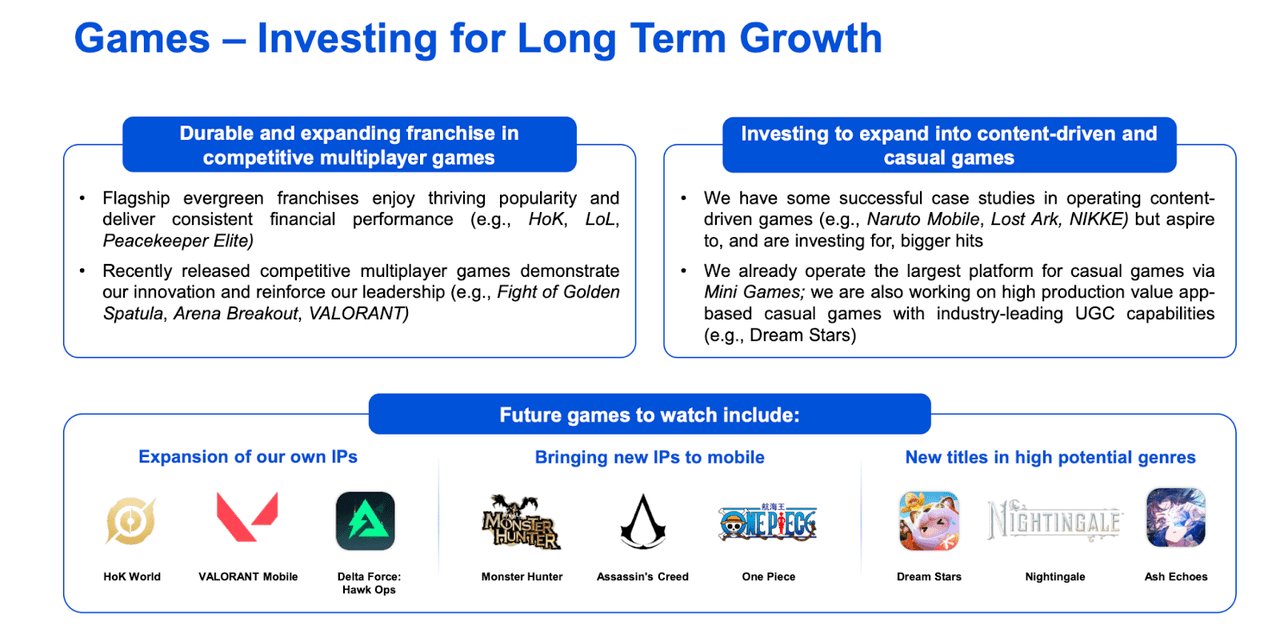

TCEHY stock fell heavily in Friday trading due to new Chinese gaming rules. The new rules limit the ability to promote in-game loyalty, place a cap on in-game revenues, as well as put forth other restrictions. Investors may be concerned that these restrictions may negatively impact TCEHY’s growth engine, given that domestic gaming makes up 21% of total revenues.

2023 Q3 Presentation

It is difficult to predict just how much these restrictions will impact the company’s profits. Assuming that domestic gaming revenues decline by 25%, I estimate that profits would decline by a maximum of 9%. That impact does not look so significant, but the real issues might come in any potential impact to the long term growth story, as gaming revenue growth may be pressured due to the revenue caps.

Is TCEHY Stock A Buy, Sell, or Hold?

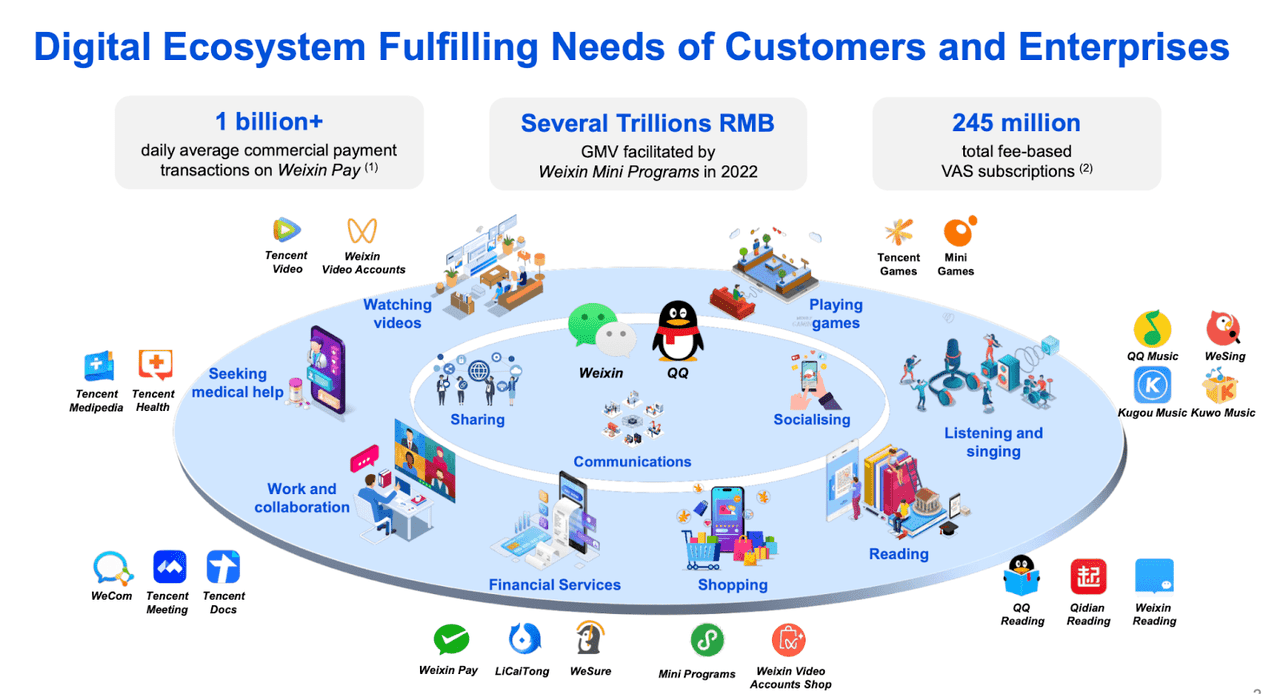

TCEHY is a dominant tech titan with a foothold across many sectors including social media, gaming, cloud, and more.

2023 Q3 Presentation

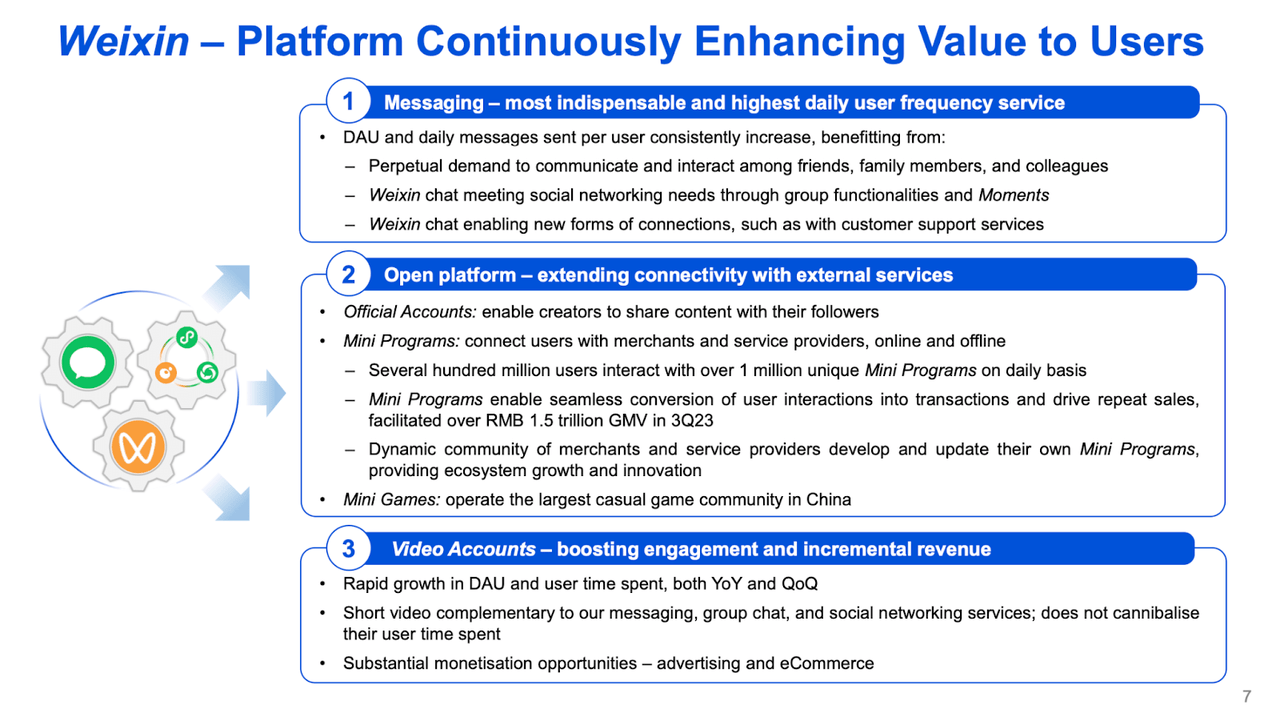

While the gaming segment is in the spotlight today, many investors may view Weixin (WeChat) as the crown jewel. Weixin is often known as “the Facebook of China” though it must be noted that TCEHY may also be facing competitive pressures from TikTok. That said, my anecdotal view is that Weixin remains under-monetized and has a long runway for advertising growth.

2023 Q3 Presentation

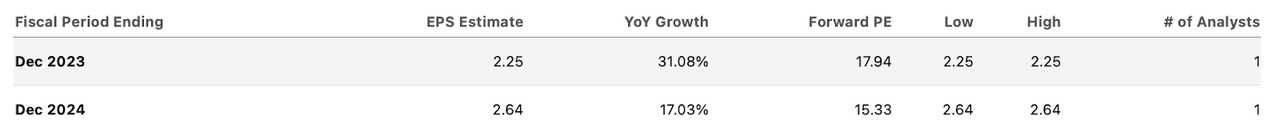

As of recent prices, TCEHY was trading at around 16x this year’s earnings estimates.

Seeking Alpha

Experienced investors in Chinese stocks may point out that TCEHY is not trading nearly as cheaply as Alibaba (BABA), which was recently trading hands at around 8x earnings. One must note that TCEHY is showing stronger revenue growth and may also have higher operating leverage potential due to its tech focus. TCEHY has generated respectable 34% adjusted EBITDA margins, but my hunch is that there is a lot of runway for operating margin expansion.

2023 Q3 Presentation

With a net cash balance sheet (albeit small) and investment portfolio making up 30% of the market cap, TCEHY appears to be offering compelling value, especially relative to the stocks of US-based tech titans, which in general trade at higher valuations. TCEHY of course deserves some sort of “Chinese discount,” but that discount may begin to look exaggerated over the coming years as the company executes against projected operating leverage and moves beyond the near term impact of these gaming restrictions. Assuming a re-rating to 20x earnings, TCEHY might trade at around $53 per share next year, implying considerable upside.

What are the key risks? It is possible that these restrictions permanently impair the growth model. I am of the view that online gaming is a compelling entertainment medium even if TCEHY is unable to promote in-game loyalty, but there might be a cultural shift that I am not appreciating. It is possible that the Chinese government issues further restrictions in the future, perhaps instead aimed at its social media segment. It is possible that TCEHY is re-rated lower to trade more in-line with BABA – it is mainly for this reason that I hesitate to rate the stock a “strong buy.”

Between the solid profitability, strong balance sheet, and attractive valuation, I reiterate my buy rating for the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here