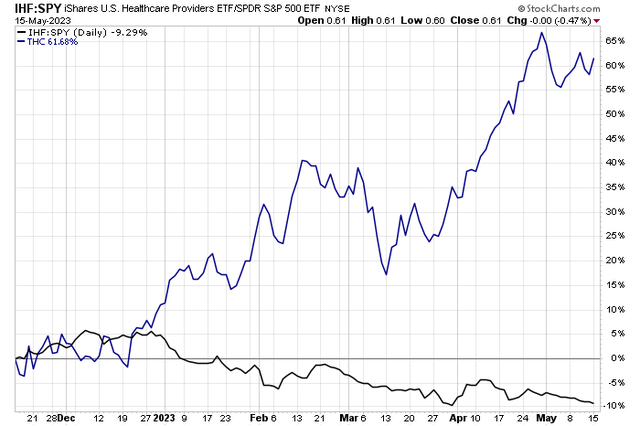

The iShares U.S. Healthcare Providers ETF (IHF) has struggled against the S&P 500 since late last year. As large-cap tech dominates the market, other defensive areas have struggled to keep pace.

Tenet Healthcare (NYSE:THC) has bucked the trend, however. Shares have surged off their Q4 2022 lows, and a robust earnings report last month helps support the bullish case. I still see some fundamental upside to the name and am watching a consolidation pattern on the chart.

Healthcare Providers Relatively Weak, THC Boasts Strong Momentum

Stockcharts.com

According to Bank of America Global Research, THC provides healthcare services primarily through the operation of general hospitals and related health care facilities. Its hospitals offer acute care services, operating and recovery rooms, radiology services, among others. Through its subsidiaries, partnerships, and joint ventures, including USPI, THC operates 61 acute care hospitals, 24 short-stay surgical hospitals, about 440 ambulatory surgery centers, and over 100 other outpatient facilities.

The Dallas-based $7.3 billion market cap Health Care Facilities industry company within the Health Care sector trades at a low 12.5 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal.

Last month, THC issued an upbeat Q1 earnings report. The Health Care sector company beat on the bottom line and raised guidance for the year. The $1.42 EPS figure was $0.27 higher than expected while revenue grew nearly 6% on a year-on-year basis. Importantly, the company raised its adjusted EBITDA outlook for the year and guided revenue in line with estimates. Shares rose around the news, but have since traded sideways, consolidating massive gains earned in the last seven months.

Q1 volumes were broad-based and strong (and those continued through April, according to a BofA conference discussion). Insurance recoveries were robust in the first quarter and hospital volumes accelerated. Downside risks include slower volumes post-COVID and weaker government reimbursements. Leverage issues and labor cost headwinds could also be problematic.

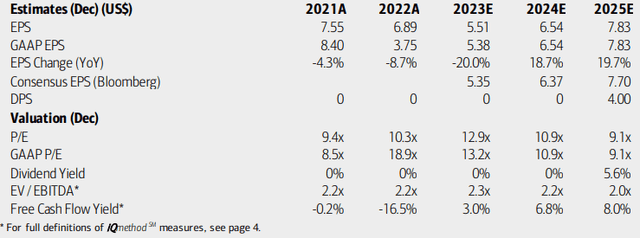

On valuation, analysts at BofA see earnings falling sharply this year after dropping back from 2021’s peak. Per-share profits are seen as recovering in 2024 and ’25, though. The Bloomberg consensus forecast is about on par with what BofA projects. No dividends are expected to be paid in the coming quarters. With P/E multiples that are below those of the market, the stock is priced attractively. What’s more, THC’s EV/EBITDA multiple is exceptionally low while its free cash flow yield inflects positive.

Tenet Healthcare: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

If we assume $5.80 of NTM EPS and apply a 14x P/E (above the stock’s 11.7 5-year average since the next 4-quarters’ earnings are at a trough level), then the stock should be near $81. So, I continue to see value in the shares.

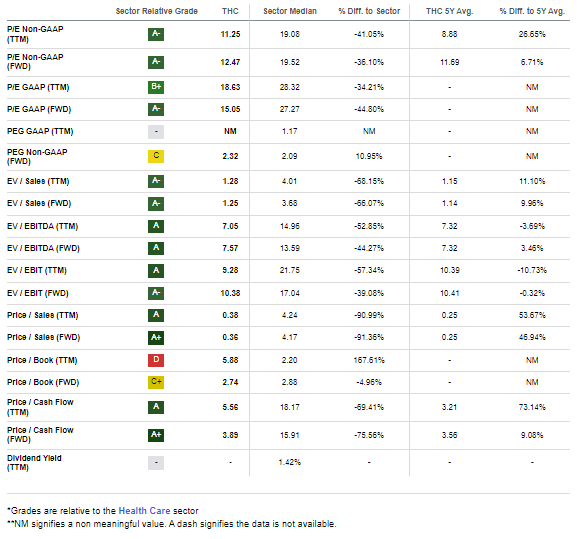

THC: Strong Valuation Metrics Amid Trough Earnings

Seeking Alpha

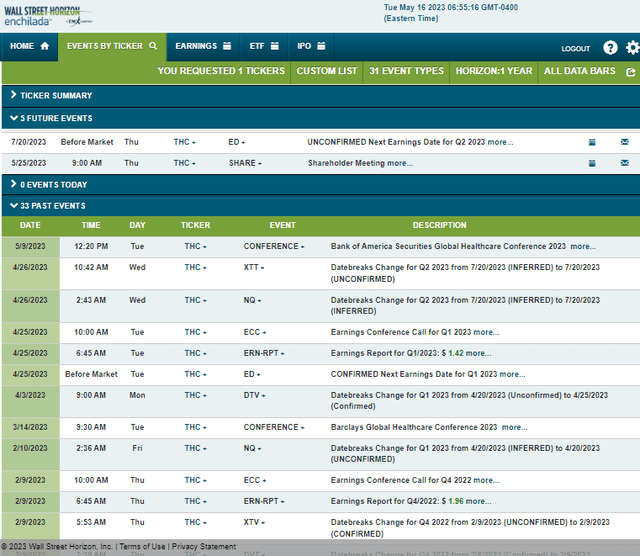

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q2 2023 earnings date of Thursday, July 20 BMO. Before that, the company holds its annual shareholders’ meeting on Thursday, May 25.

Corporate Event Risk Calendar

Wall Street Horizon

The Technical Take

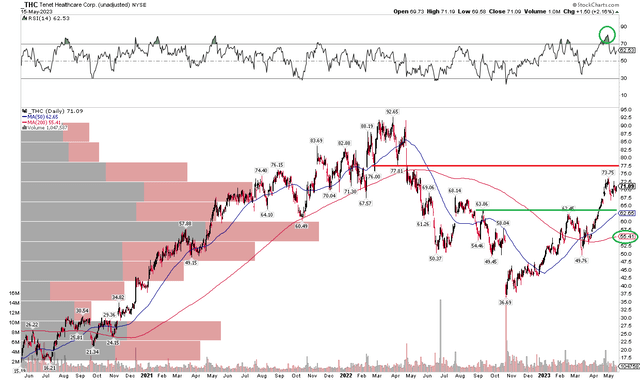

THC has performed well off its October 2022 low. The stock doubled from trough to peak, and the current consolidation is indicative of a bullish coil. I see next resistance at the breakdown point from the early 2022 highs in the upper $70s while support is seen in the $62 to $64 range.

What is encouraging is that the 200-day moving average has modestly turned positive in its slope and the RSI momentum indicator at the top of the chart confirmed the new rebound high in price. Overall, long here with a stop under $60 looks like a solid play. The chart also shows a bullish golden cross that took place in early March – when the shorter-term 50-day moving average crosses above the long-term 200-day. THC has quickly turned into one of the market’s highest momentum stocks.

THC: Bearish to Bullish Reversal, Encroaching On Previous Range-Highs

Stockcharts.com

The Bottom Line

I have a buy rating on THC based on a decent, but no longer ridiculously cheap, valuation and an improved technical situation.

Read the full article here