Teradata (NYSE:TDC) is a company providing a multi-cloud data platform for enterprise analytics.

Founded in 1979, the company went public in 1986. Today, the stock is trading at ~$51 per share, almost double its IPO price. TDC has been in the middle of a major transformation where it has been migrating a lot of its clients to its cloud platform, effectively boosting recurring revenue growth. YTD, the stock price has increased by ~59%.

I rate TDC neutral. My target price model suggests that there may be a potential 9% upside at year’s end. However, I think that the risk-reward remains rather balanced.

Catalyst

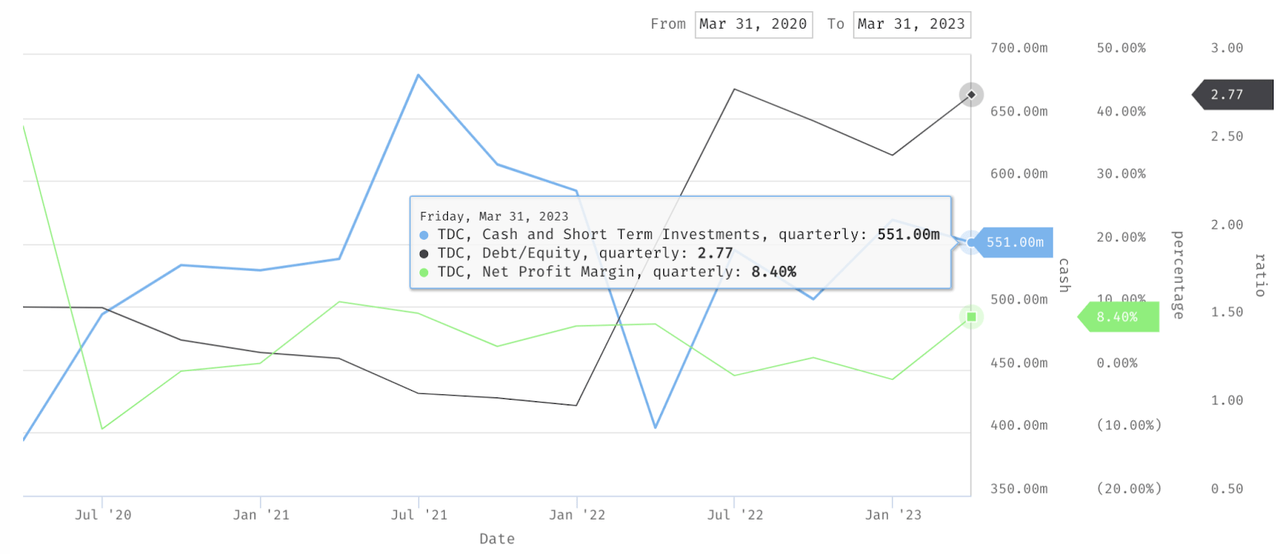

Overall, TDC’s fundamentals are decent, but not great. Overall growth has been declining due to TDC undergoing a cloud translation, though cloud recurring growth has been accelerating. In recent times, cash balance has been steady in the $500 million range, though TDC’s debt-to-equity of ~2.7x is relatively high in my opinion. Cash flow generation is TDC’s other strong point. Over the past two years, operating cash flow / OCF generation has been steady between 10% – 20%.

Stockrow

There are some catalysts to the stock. In FY 2023, I believe that TDC should continue to benefit from the increasing share of higher-margin recurring revenue from the cloud subscription. Gross margin has been quite steady at the 60% range, for instance, and in Q1 also expanded to ~63%. Consequently, TDC’s net profitability has improved in recent times, as reflected in net margin expansion to ~8.4% in recent times. Eventually, this may also drive its valuation premium.

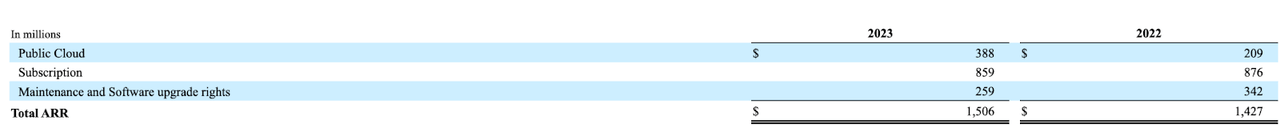

TDC’s 10-K

I think that TDC has also taken the right approach by partnering with the hyperscalers to accelerate its cloud transition. In Q1, cloud recurring ARR grew 85% YoY to $388 million, which I believe is impressive. As we learned in the Q1 earnings call, the partnership with hyperscalers has helped TDC significantly in winning large deals and driving its ARR growth:

Our partnership with Azure and Microsoft in terms of really generating fantastic enterprise capabilities is awesome. If I think about the largest deal that we did, really proud of that 8-figure deal with a health care organization in the United States. We, as a company, believe that data can transform the business as working people led — and what we’re really excited about is helping health care organizations in the U.S., lower that total cost of care. And we’re doing that in partnership with the hyperscalers, and it’s great to see those partnerships pay off.

Source: Q1 earnings call.

Given the hyperscaler partnerships, I expect strong ARR growth to sustain for some time. Partnering with hyperscalers has been a common growth strategy for many cloud software players. However, I think that the synergy with a company like TDC could be more pronounced, given the strong mutual benefits. In general, enterprise analytics like TDC will require not only data storage but high computing capabilities. As TDC brings in larger cloud enterprise clients, the compute and storage requirements would increase, effectively benefitting the hyperscalers.

Another upside opportunity comes from TDC’s share repurchase program, where TDC had $758 million remaining to repurchase as of Q1 2023. Given TDC’s commitment to repurchase more in FY 2023, share price may continue appreciate:

We have committed to deliver at least 75% of free cash flow in fiscal 2023, which was an increase from fiscal ’22 from the target that we had, but we obviously overdelivered on that target in ’22. So at least 75% of free cash flow will be returned to shareholders in terms of share repurchases. In Q1, we are on track to execute and deliver that.

Source: Q1 earnings call.

Risk

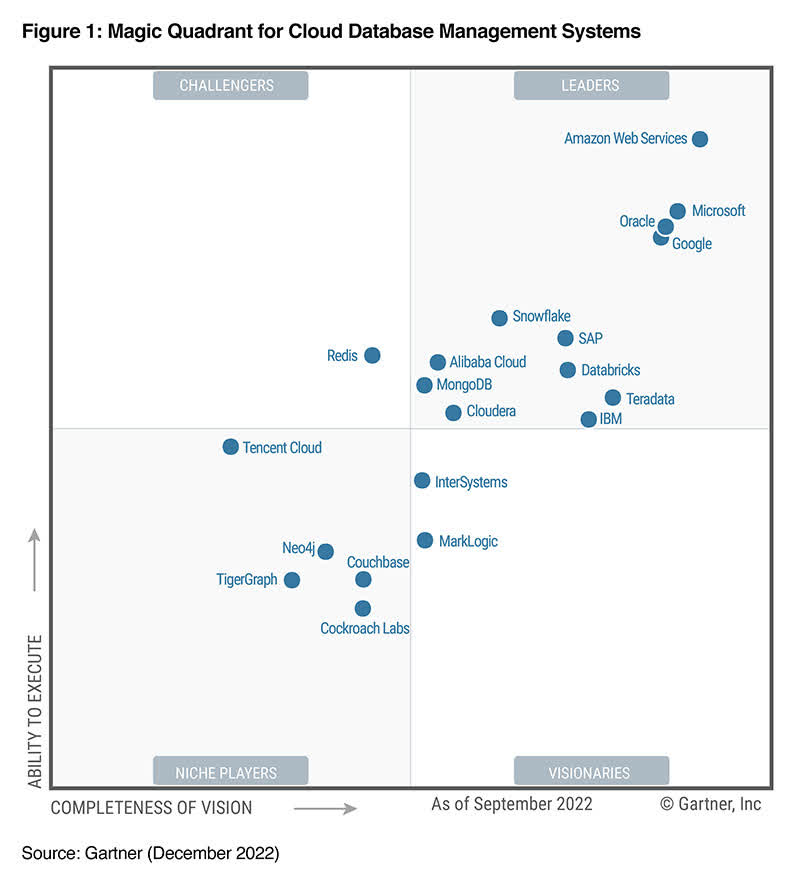

There are two possible moderate risk factors I believe TDC will face in the near term. First, I continue to view the enterprise cloud analytics and database as an evolving and competitive space. Companies like MongoDB (MDB) or Snowflake (SNOW), which have brought in new approaches to cloud databases, may threaten TDC’s market shares.

Gartner

As it stands, these two companies have been gaining popularity in the space and growing their revenues at high double digits.

In addition, the macro weakness may also affect TDC’s enterprise sales cycle, especially given the relatively large deal size. In Q1, TDC also guided conservatively as it accounted for the macro risk. Effectively, this may potentially result in TDC being in transition mode a bit longer than expected.

Valuation / Pricing

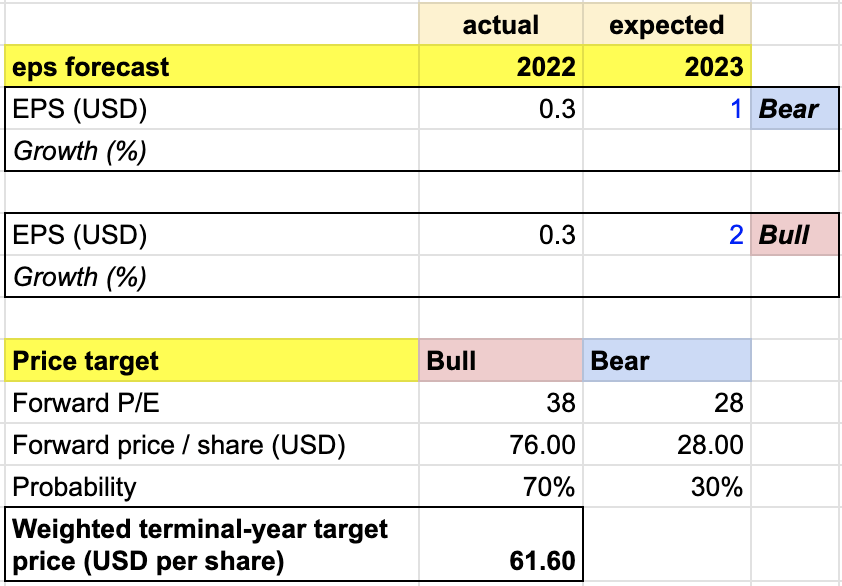

My target price for TDC is driven by the following assumptions for the bull vs bear scenarios of the FY 2023 target price model:

-

Bull scenario (70% probability) assumptions – TDC to finish FY 2023 with diluted EPS of ~$2, in line with the market estimate.

-

Bear scenario (30% probability) assumptions – TDC to finish FY 2023 with diluted EPS of ~$1, 50% lower than the market estimate.

Given TDC’s recent sharp uptrend in P/E, it is relatively challenging to arrive at an appropriate figure. I assign TDC a P/E multiple of 38x for the bull scenario, a higher figure than the market estimate, but much lower than its current P/E. At 38x, it is closer to the end of FY 2021’s P/E of ~31x. I assign TDC a P/E of 28x under the bear scenario, consistent with the market estimate.

Author’s own analysis

Consolidating all the information above into my model, I arrived at an FY 2023 weighted target price of ~$61 per share. With TDC trading closer to ~$56 per share recently, this represents a 9% return.

I give TDC a neutral rating. Given the relatively conservative P/E in my projection and the uptrend in EPS due to the share repurchase program, there appears to be an upside opportunity. However, I would be cautious of TDC’s overall fundamentals and two moderate risk factors. In my view, risk-reward remains balanced.

Conclusion

TDC’s fundamentals are satisfactory, although not outstanding. The company’s overall growth has been decreasing as it undergoes a transition to the cloud. However, the recurring growth in cloud services has been gaining momentum. TDC’s strategic decision to partner with hyperscalers to expedite its cloud transition is commendable. There are potential risks for TDC, including competition and macroeconomic weakness, which could result in longer sales cycles. Due to these factors, I assign TDC a neutral rating despite the upside opportunity.

Read the full article here