The iShares Treasury Floating Rate Bond ETF (NYSEARCA:TFLO) has been a solid near-cash investment for many investors in the past year, as it enjoyed higher coupons that were tied to the rise in short-term interest rates.

However, as we head into 2024, I believe investors need to watch out for potential rate cuts from the Fed. If inflation continues to moderate, then the Fed may need to cut interest rates in order to not ‘overtighten’ the economy into a recession.

Fund Overview

The iShares Treasury Floating Rate Bond ETF provides the investment performance of holding floating rate treasury bonds by tracking the Bloomberg U.S. Treasury Floating Rate Index.

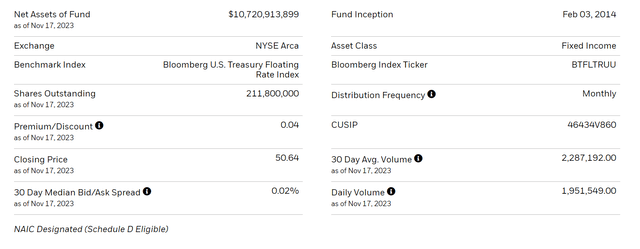

The TFLO ETF has over $10 billion in assets and charges a relatively low 0.15% net expense ratio (Figure 1).

Figure 1 – TFLO overview (ishares.com)

U.S. Floating Rate Treasury Notes

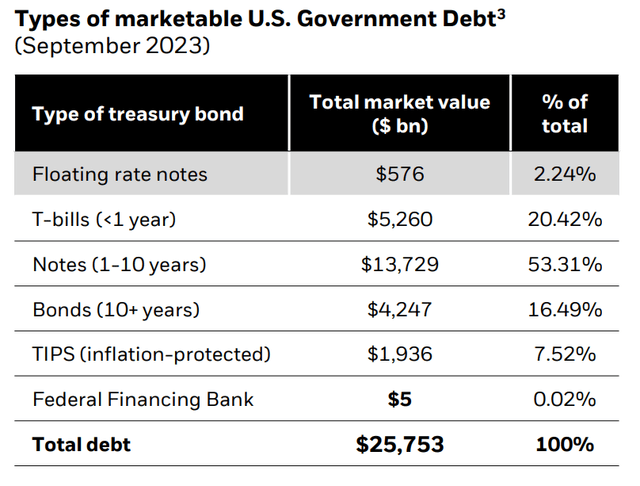

The U.S. Treasury began issuing floating rate notes (“FRNs”) in 2014 and total issuance has grown to $586 billion as of September 30, 2023. Although the absolute figures are enormous, FRNs only account for approximately 2% of the treasury market (Figure 2).

Figure 2 – Treasury market overview (ishares.com)

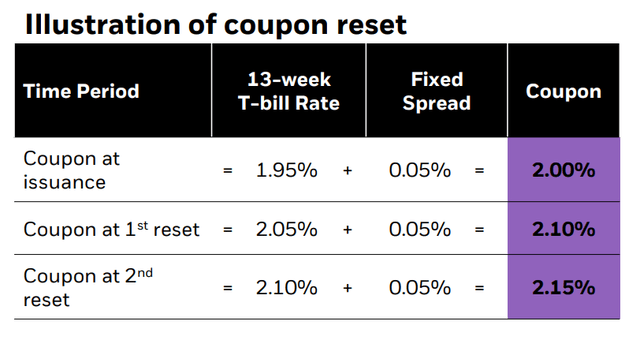

Mechanically, Treasury FRNs pay a coupon that corespond to the discount rate of the most recent 13-week T-bill auction plus a ‘fixed spread’ that is determined at the time of issuance. Therefore, as 3-Month T-bill rates change, the coupons paid by Treasury FRNs also change (Figure 3). In effect, Treasury FRNs act like rolling 3-Month T-bills, without the actual hassle of rolling treasury bills every 3 months.

Figure 3 – Illustrative FRN resets (ishares.com)

Portfolio Holdings

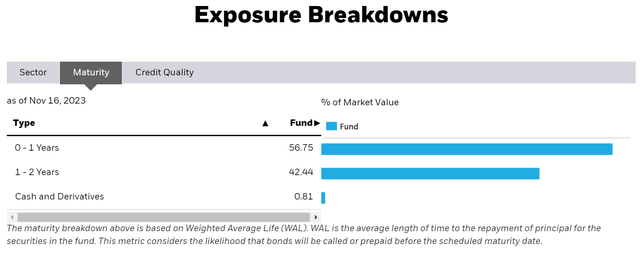

Mechanically, the TFLO ETF is very similar to the WisdomTree Floating Rate ETF (USFR) that I hold in my personal portfolio and have written numerous articles about. TFLO’s portfolio consists of entirely of Treaury FRNs, with maturities between 0 to 2 years (Figure 4).

Figure 4 – TFLO hold FRNs with 0-2 year maturities (ishares.com)

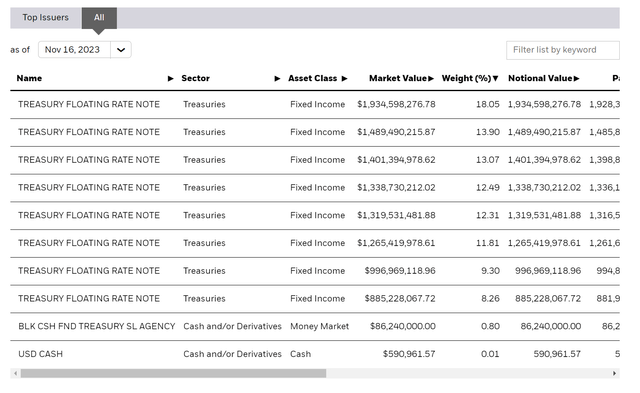

Currently, TFLO’s portfolio is split between 8 different Treasury FRNs plus a small mount of cash (Figure 5).

Figure 5 – TFLO holdings (ishares.com)

Distribution & Yield

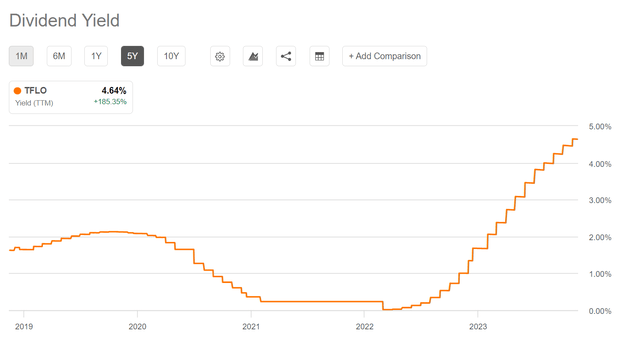

The TFLO ETF has a 30 Day SEC yield of 5.34% and pays a monthly distribution. TFLO’s trailing 12 month distribution is $2.35 / share or 4.64%, but the distribution rate has been rising as the Fed has been raising Fed Funds rates, which lead to higher treasury bill yields (Figure 6).

Figure 6 – TFLO dividend yield has been rising (Seeking Alpha)

Returns

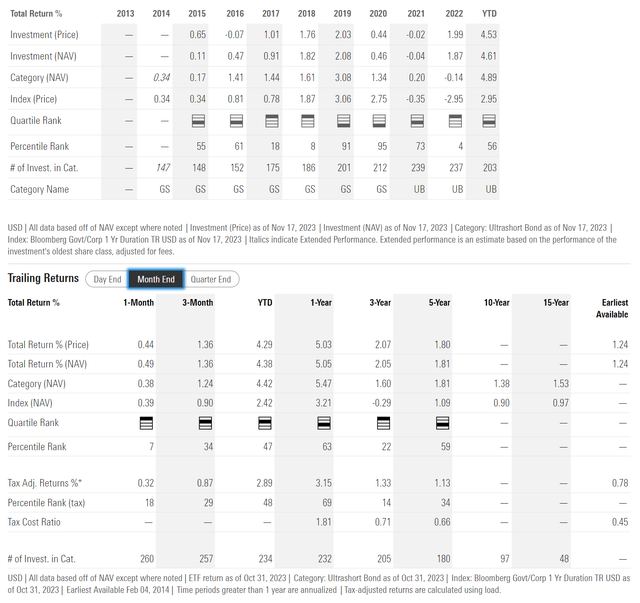

Figure 7 shows the historical returns of the TFLO ETF. Investors should not hope to get rich with funds like TFLO. However, it does provide an excellent way to earn short-term treasury yields while protecting capital, with zero credit (treasury-backed notes) and interest rate risk (floating rate).

Figure 7 – TFLO historical returns (morningstar.com)

Slowing CPI Increases Risk Of Rate Cuts In 2024

In a recent article on the USFR ETF, I noted that the Federal Reserve held the Fed Funds rate steady for a second FOMC meeting in a row, leading some investors to speculate that the Fed may be done with interest rate hikes this cycle. In fact, the question now is when the Fed will cut interest rates in the coming months. Market expectations for a rate cut was moved forward to May 2024 following the November FOMC meeting.

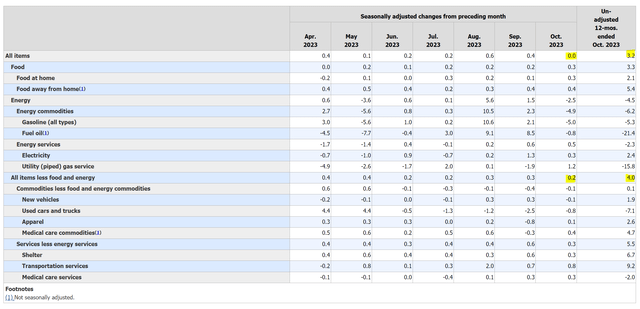

This dovish interpretation was further strengthened this week when the Bureau of Labor Statistics (“BLS”) reported a negative surprise in the Consumer Price Index (“CPI”), with better than expected readings in both headline and core CPI. Headline CPI came in at 3.2% YoY vs. consensus looking for 3.3% while core CPI was 4.0% vs. 4.1% estimates (Figure 8).

Figure 8 – Latest inflation reading was lower than expected (BLS)

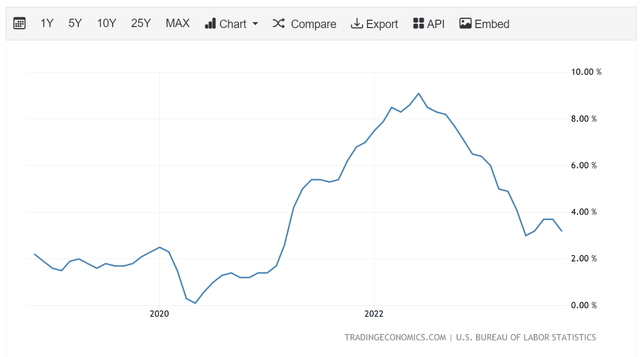

While still higher than what the Fed would like, the trend in inflation is clearly moderating towards the Fed’s goal (Figure 9).

Figure 9 – Headling inflation is moderating (tradingeconomics.com)

Why might a slowing inflation reading prompt the Fed to cut rates?

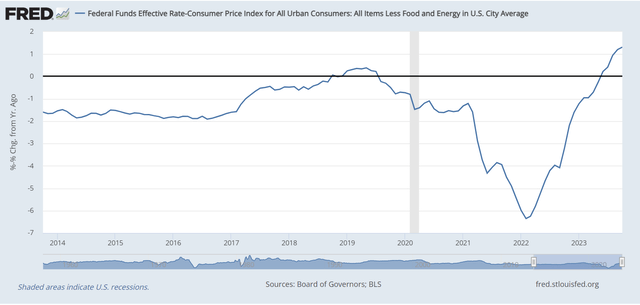

The answer lies in real interest rates. We can crudely think of real interest rates as the Fed Funds rate less the core level of inflation. In other words, when Fed Funds rate is above core inflation, it is considered ‘restrictive’ and will most likely slow down the economy.

However, what happens when inflation starts to consistently decline, like it has in the past few months? As inflation starts to decline, the spread between the Fed Funds rate and inflation begins to widen, i.e. monetary policy becomes incrementally more restrictive for the economy, even if the Fed just holds the Fed Funds rate steady (Figure 10).

Figure 10 – Fed Funds rate less core CPI inflation (St. Louis Fed)

If inflation continues to slow in the coming months, then by holding Fed Funds steady, the Fed will actually be ‘tightening’ monetary policy.

Since the Fed’s mandate is price stability and maximum employment, it is not in their interest to tighten the economy into a deep recession just to reduce inflation. Instead, I believe if inflation continues to moderate in the coming months, the Fed may feel the need to cut the Fed Funds rate a few times, in order to not apply too much pressure on the economy.

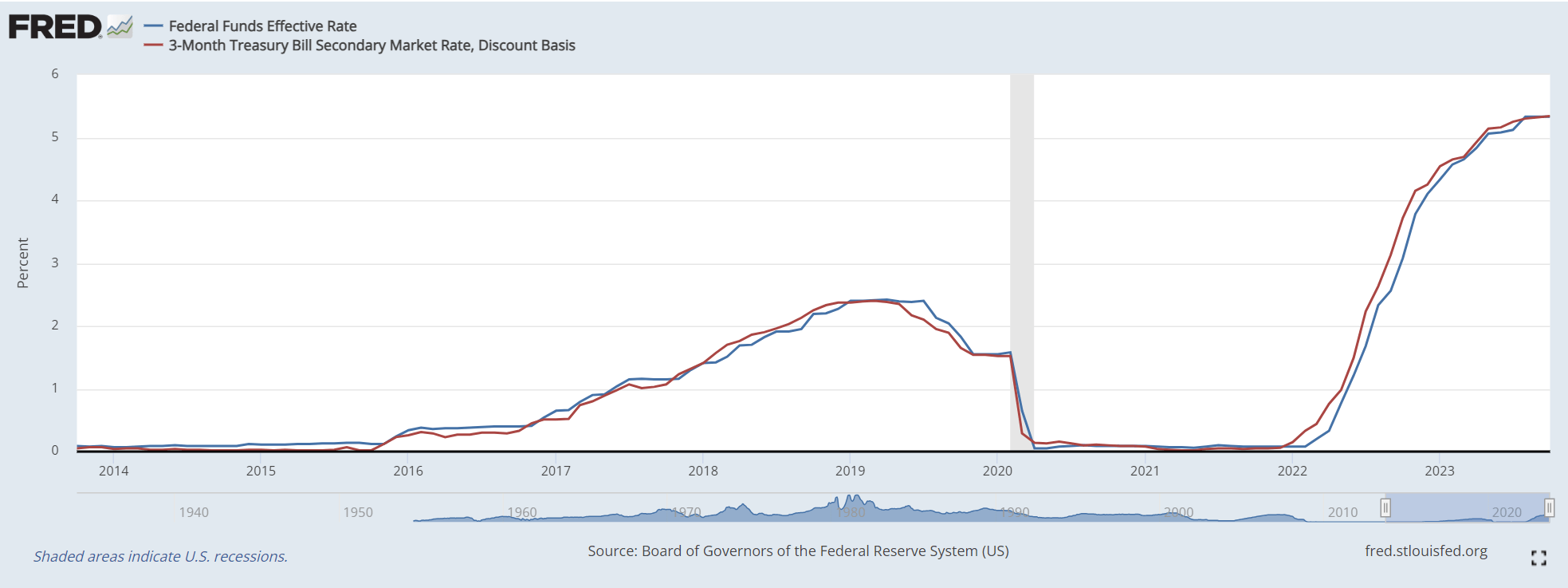

Fed Funds Rate And T-Bill Rates Are Tied At The Hip

For floating rate treasury bill funds like the TFLO ETF, this scenario would be a negative headwind, since Fed Funds rate and treasury bill yields are tied at the hip (Figure 11).

Figure 11 – Treasury bill yields follow Fed Funds rate (St. Louis Fed)

If and when the Fed does cut the Fed Funds rate, we should expect a reduction in coupon payments for the TFLO ETF.

Therefore, my plan is to gradually switch my treasury bill holdings (currently held in the USFR and SGOV ETFs) into 2-year notes and funds in the coming months, ahead of an expected Fed rate cut, in order to ‘lock-in’ high short-term yields and maintain portfolio flexibility.

Conclusion

The TFLO ETF provides exposure to floating rate treasury notes, similar to the USFR ETF. Floating rate funds have been a great place to hide in the past year, as they enjoyed increasing yields from the Fed’s rate hikes without any credit risk.

However, as we move into 2024, I believe investors should start to look for the exits, as it looks increasingly likely the Fed will be cutting interest rates in the next few quarters if inflation continues to moderate. By not cutting interest rates, the Fed risk mechanically applying to too much pressure on the economy.

I rate TFLO a hold.

Read the full article here