Thesis

A championship team is made up of a multitude of parts, all working together toward the ultimate goal. Your portfolio is no different, made up of different companies that have different skills and abilities to fulfill different roles on your retirement or financial freedom team.

Financial freedom and retirement depend heavily on having a constant stream of income. Dividends are one of the most common methods of achieving this goal.

No dividend oriented portfolio is complete without some exposure to the energy industry. While the energy sector can seem like a rollercoaster, it is often the industry with the some of the highest yields, often exceeding the S&P500’s yield of 2% by two to four times.

I will discuss my thoughts on how to structure a long term energy portfolio with a mixture of upstream, midstream, and downstream companies to accomplish the following goals.

1. Provide a steady and reliable income stream

2. Protect invested capital from market downturns

3. Cues to call an audible and restructure the portfolio to lock in gains and protect the income stream.

The Team

Our team will be comprised of a few of the standard positions. Each one has its own unique characteristics and should be deployed situationally. The individual investor (that’s you!) is the quarter back and gets to call the shots. You decide who gets the ball and when. The team will be comprised of the following positions.

- The offensive line (Part 1)

- The running back (Part 2)

- The wide receiver (Part 3)

- The special teams (Part 4)

You have an offensive line for protection. They are steady, reliable, and immovable. You can hand the ball off to your running back to scrape out a handful of yards consistently or you can take a shot by going deep to your receiver.

Reading the defense is key. Balance and paying attention to the macro conditions will dictate your course of action because no one company will be able to deliver on a year in, year out basis. You as the investor has to pull the right levers at the right time to maximize performance.

Why Energy

Before we get started, let’s look at why I believe investing in energy stocks can be highly lucrative. There are two key characteristics that need to be understood to be successful when investing in cyclical energy stocks.

1. Energy companies generate significant amounts of free cash flow.

2. The volatility in the energy market is to be exploited, not feared.

Free Cash Flow

The cyclical nature of the energy markets can certainly cause profitability to vary significantly but the good times more than make up for the bad.

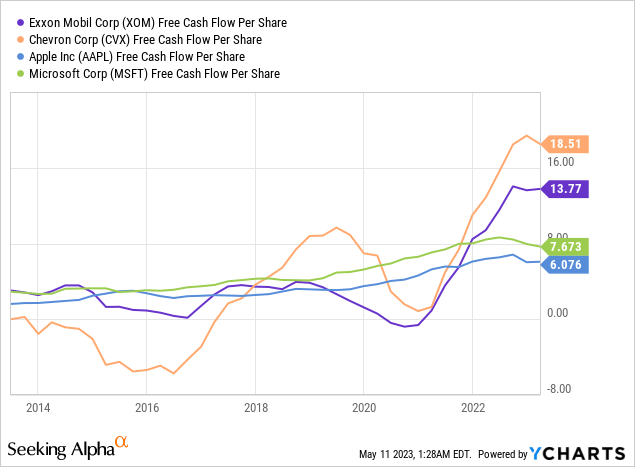

As an example, we will look at how the super major oil producers, Exxon Mobil (XOM) and Chevron (CVX) stack up against technology power houses, Apple (AAPL) and Microsoft (MSFT). Keep in mind, this comparison is not to say that XOM or CVX are better investments than AAPL or MSFT. We are simply looking at the capability to generate cash. Investing in growth technology stocks will fulfill an entirely different investment goal.

The last decade has been rough on the oil industry with an intense price war following the shale boom and the sudden stop of the economy in 2020 due to the pandemic. Despite all of those headwinds, XOM and CVX have held their own against the tech giants in terms of free cash flow generation. Fortunately, for income oriented investors, the energy industry largely has shifted to a shareholder return model from a growth model.

Being Greedy

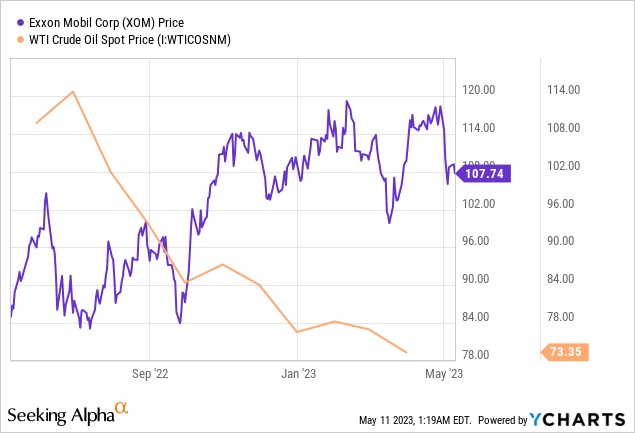

Let’s run with the Warren Buffet theme of being greedy of when others are fearful. As another example, what would happen if we had bought XOM stock in the middle of 2020 and 2021? Here is the result.

1. Purchase on June 30th, 2020 nets a current yield of 8.1% and price gains of over 160%. This is a yield of 4x the S&P 500.

2. Purchase on June 30th, 2021 nets a current yield of 5.8% and price gains of over 100%. This is a yield of 3x the S&P 500.

It’s easy to dismiss this performance because of the massive run energy stocks had during 2022. But if we get even more granular, the market still gives the occasional Christmas gift.

After reviewing the graph below, you can see that with oil prices at decade highs, XOM was up for grabs for $83/share. This still nets a 4.4% yield, or over 2 times that of the S&P 500. Opportunistic buying is a core principle that must be understood to meet our first two investing goals.

Buying in the energy sector has to be done carefully and with discipline. Over the last decade, oil has averaged about $65/barrel per the EIA. The downside risk is real with the average price in the mid $40s occurring in 2015, 2016, and 2022. That is why I stress the need to be patient, waiting for an entry point that protects against capital losses.

To that end, each company has its own intrinsic value that makes it a bargain. The investor needs to know roughly what this value is and be ready to execute when the market gives you that price. Keep in mind the following quote.

“No matter how wonderful [a business] is, it’s not worth an infinite price. We have to have a price that makes sense and gives a margin of safety considering the normal vicissitudes of life.” – Charlie Munger.

The Offensive Line

The job of the offensive line is to protect you, the quarterback. As such this will be the biggest position. The companies we select for this position will be dependable and consistent cash generators who’s profits are minimally affected by swings in commodity prices. The midstream sector is ideal for this part of the portfolio due to their consistent levels of performance. The business model in the midstream sector is usually fee based and structured with take-or-pay contracts that guarantee minimum levels of revenue.

For stable and reliable income, I believe this position should hold roughly 30%-40% of ones’ energy portfolio. Here are my top two picks for this position.

1. Enterprise Products Partners (NYSE:EPD)

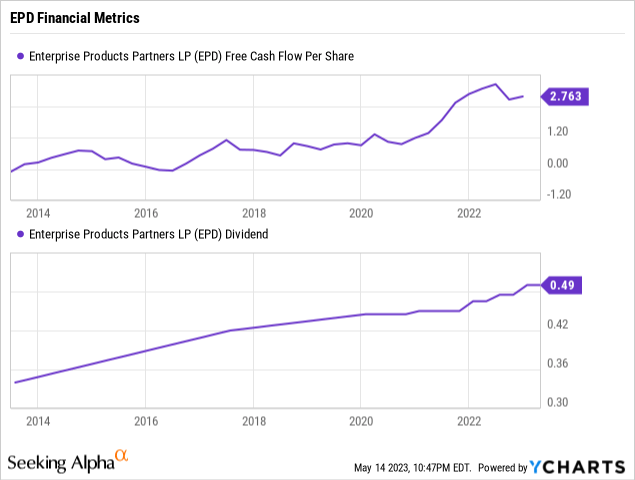

EPD operates in essential infrastructure for the energy industry. The company owns and operates over 45,000 miles of pipelines, processing and fractionation facilities, and export terminals for a variety of energy products. This includes commodities such as crude, natural gas and petrochemicals. Its stellar cash generation has survived the Dot Com bubble, Great Financial Crisis, the U.S. Shale boom, and most recently, the COVID Pandemic.

Enterprise is a midstream company with a very conservative and tactile management. This year marks the 25th year of distribution growth since the company went public. The current yield is 7.6% and is projected to grow in the mid-single digits.

The distribution is adequately protected with a distribution coverage hovering around 2.0x FCF. EPD also has a very favorable debt position with a debt to EBITDA ratio of less than 3.0x. This has earned the company an A- credit rating from Standard & Poor and is the only midstream company to have that distinguished credit rating.

The debt profile was expertly crafted over the last decade. Management carefully acquired debt at an average fixed interest rate of 4.6% and an average term of 20 years. There is a fair chance the opportunity to replicate that will not show itself again for years, if ever.

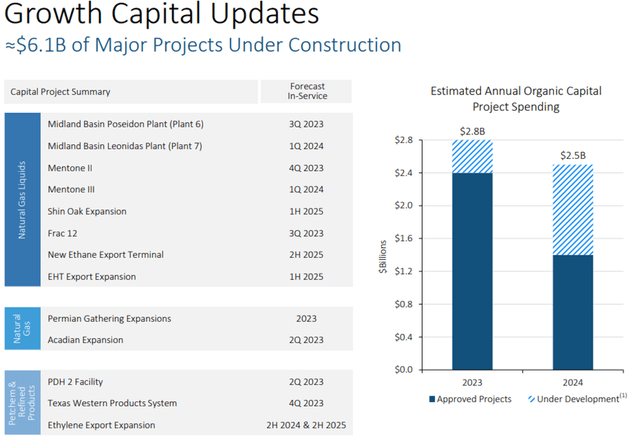

What I like best about EPD is that I believe over the next several years we will see an expansion of the distribution growth rate. The main driver for this will be EPD’s full slate of projects coming online in the next two years. All of these projects are expected to be immediately adding incremental free cash flow from day one with nearly full capacity already sold to customers.

EPD Growth Projects (Q1 2023 Earnings Presentation)

There looks to be no stopping in sight for EPD’s distribution growth thanks to its self-funded operating model and its low debt profile. Additionally, demand for its services are projected to rise as multiple LNG export terminals commence operations in 2024 and 2025. I did a deep dive on Enterprise’s growth prospects in my previous article.

2. Energy Transfer (NYSE:ET)

Energy Transfer has very similar assets and company structure to EPD. Most investors who follow both companies would agree that the major difference is the character of ET’s management. ET’s management has been known to live more precarious that EPD, having a larger taste for growth projects and acquisitions. This was most recently displayed with the acquisition of Lotus Midstream at the beginning of May.

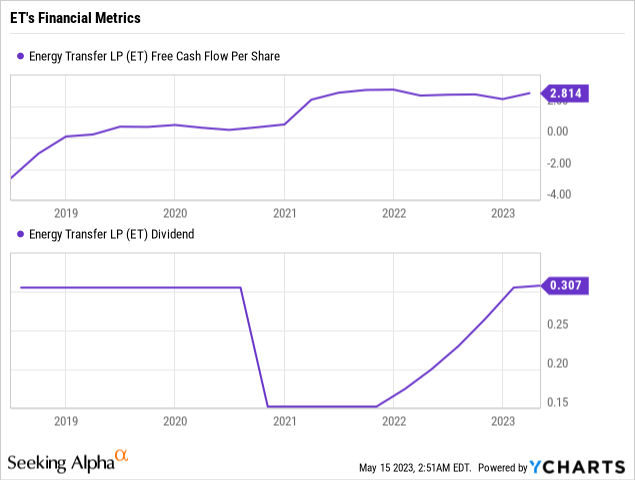

ET has a very generous yield, coming in at 9.8%. However, the debt profile is not as favorable when compared to EPD. At the end of 2020, ET was faced with a difficult decision. It had to pay down its debt or risk getting derated by the credit agencies. In a responsible fashion, the firm cut its dividend in half starting in the 4th quarter of 2020. Now, Energy Transfer has worked its debt-to-EBITDA ratio down to 4.0x to keep its creditors happy.

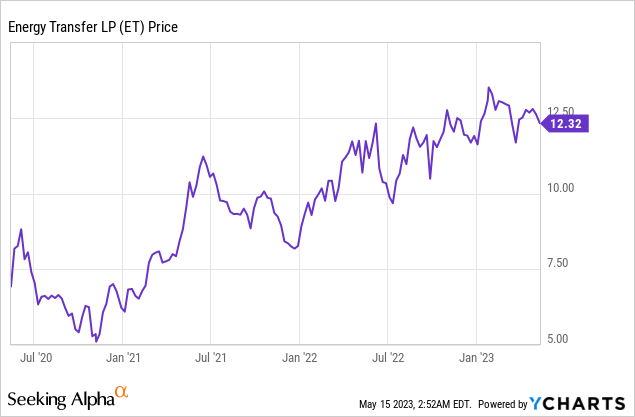

With the debt situation back under control, ET has reinstated the full dividend payout in Q1 of 2023 and has guided for 3%-5% increases for the near term. As a result, the share price has shown tremendous performance and still has a very attractive yield.

ET’s distribution coverage ratio is also sitting roughly around 2.0x. This should provide an adequate margin of safety to the distribution for the investor who has some reservations about the company’s aggressiveness. To compensate for the additional risk, you’ll be rewarded with a nearly 10% yield.

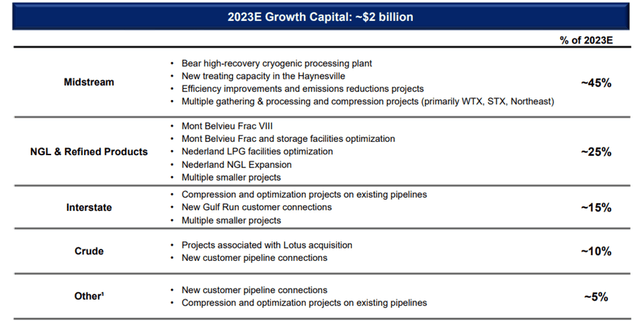

Similar to EPD, ET is aggressively pursuing projects for NGL and LNG exports. The massive Gulf Run pipeline out of the Haynesville, Mont Belvieu Frac VIII, and export terminal expansions on both the East Coast and the Gulf of Mexico are some of the major ongoing projects.

These projects (and those under construction by EPD) are a function of exploiting the tremendous cost advantage the United States has over much of the rest of the world. Together, they are another step in developing the United States energy advantage that has been accelerated since the Ukraine-Russian war.

Energy Transfer Projects (ET Q1 2023 Earnings Presentation)

Overall, I view ET has more of a pedal to the metal style company than EPD. If debt levels are sustained in their current range, ET will be a solid performer over the next several years. The additional risks are offset by the higher yield than EPD.

Risks to Capital

The midstream space is boring. And that is a good thing for income investors. We want growing and reliable income to be the cornerstone of the portfolio. That is the premier reason to have the portfolio weighted so heavily to the midstream space.

The midstream model has shifted in the last 5 years for these companies, with a focus on organically funded growth to minimize the reliance on debt. Being capable of self-fund all growth projects without having to tap a bank is a huge selling point.

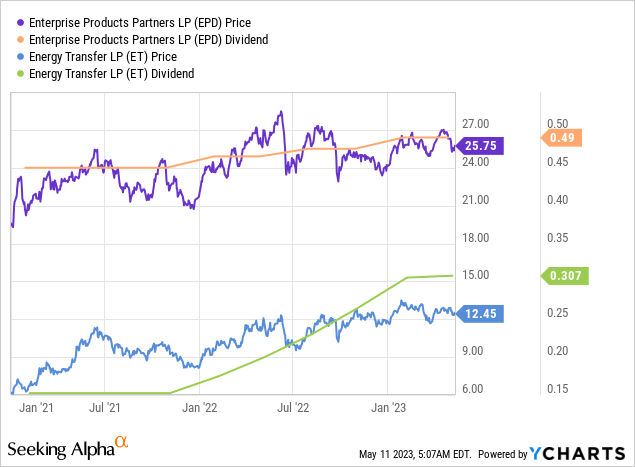

But the market only values these projects for their cash generation capabilities, and as a result, shares largely trade with yield. This effectively creates both a price ceiling and floor for the share price. Over the last two years, both companies share price has tracked its respective dividend. ET is slightly more extreme thanks to increasing its dividend by 100% after its debt reduction goals were met.

Buying when yields are starting to compress only means two things. Less income and higher capital risk. If you look at the graph below it gives a good indicator for the relative value. Buying when there is a large upward deviation between price and the yield curve may expose you to price risk.

When to Stock Up

After establishing that these stocks trade consistent with yield. It’s important to know that crude fluctuations still have the ability to move the stock price within a given range. This is where opportunity knocks.

Dropping crude prices result in the whole sector being weighed down. However, as mentioned earlier, the company’s profitability is unchanged. Late December 2021 and 2022 are examples of excellent opportunities to expand your position in EPD. In both instances, the share price was significantly below the yield curve. Similarly, ET currently looks to be undervalued for its cash generation capability.

Buying into weakness with confidence requires a track record. Let’s look at the COVID pandemic, arguably the most abrupt shocks to the economy ever, for some wisdom. During this time distributable cash flow for EPD fell only 3% in 2020 vs 2019. The change for ET was slightly larger at 5.5% for the same period.

This is due to revenues being tied to volumes and not the commodity price. Ultimately, the crude, NGLs, and natural gas still get sold. They then have to be transported and processed by companies like EPD and ET. If minimum volumes are not met, take-or-pay clauses ensure minimum levels of revenue.

When to Lighten Up

I recommend lightening up or holding the position in this sector when crude prices rise. Inherently, we will be paying more for the same level of cash generation, hurting our overall returns. There will always be the next market panic to capitalize on. Being patient and knowing the intrinsic value of the company is key.

Summary

In Part 1 of the playbook, we have discussed using market volatility to our advantage to capture high cash generating assets at bargain prices. I proposed two solid companies capable of providing a high level of defensive income due to their business models. Both companies’ earnings are based on volumes and are significantly more stable than the underlying commodity price.

These investments are boring but are consistent payers of cash. Buying in an established yield range ensures that an investor does not overpay for the income generated. Both ET and EPD are expected to continue growing free cash flow, and in turn, grow the distribution for several years. In EPD’s case this continues on their 25 year track record of distribution growth.

In Part 2, I will review my top picks for the running back position. These companies will take a beating and continually scrape out earnings. I plan on releasing a new part to the series every month so stay tuned for more.

Read the full article here