The Fed is likely to hint at further interest rate hikes, and commit to keeping the interest rates higher-for-longer at the Jackson Hole Symposium next week. But before getting deeper into the analysis, it’s important to understand the context of the Jackson Hole meeting.

What is the Jackson Hole Economic Policy Symposium

The Jackson Hole Economic Policy Symposium is essentially an annual academic central banking conference sponsored by the Federal Reserve Bank of Kansas City, held in late August in Jackson Hole, Wyoming.

Given the academic nature of the conference, each annual meeting has a special topic, and the organizers invite the submission of research papers on those topics from selected professors, the Fed (and other central banks) staff economics, and private economists. Those research papers are combined in the conference proceedings and published after the conference.

The conference topic is carefully selected to reflect the most pressing issue facing the central banks. In 2022, the topic was “Reassessing Constraints on the Economy and Policy” The Fed Chair Powell signaled at the 2022 conference a more aggressive monetary policy and specifically suggested that the US economy would have to go through some “pain” to tame the inflation, pointing to a need for a higher unemployment and a possible recession.

The 2023 Economic Policy Symposium topic is the “Structural Shifts in the Global Economy“. Thus, this topic reveals what is the most pressing issue today faced by the central banks in their efforts to continue tame the inflationary pressures.

The central bankers are likely to conclude that the major structural shift in the global economy is the accelerating transition from globalization to deglobalization, and that’s inflationary.

Globalization and the goldilocks

The most recent wave of globalization can be tracked to 1945 and the ending of World War II. After the WWII, the US emerged as the dominant global power, and over the next 65-75 years shaped the US-centered globalization via:

- NATO expansion: The US continuously expanded NATO and thus the military control of much of the World. The Cold-War victory and the collapse of USSR in late 1980s accelerated the NATO expansion.

- The US Capitalism global expansion. The military dominance facilitated the expansion of the US capitalist system globally, which allowed the US corporations to produce globally (outsource) at low cost, and also sell their products globally. As a result, inflations stayed low, particularly after the Cold War ended, and economy grew steadily – that’s the goldilocks.

- The reserve currency: The USD as the reserve currency allowed the US government to freely print USD to finance the military and other projects, and run the budget deficit.

Deglobalization and inflation

However, some countries did not accept the US-centered globalization, and the Sep 11th 2001 terrorist attack essentially started the process of deglobalization.

The Fed panicked after the 9/11 and sharply lowered the interest rates, which inflated the housing market, and planted the seeds the 2008 Great Financial Crisis, which in-fact was the key event that accelerated deglobalization. These are the current trends/events that are accelerating deglobalization.

- Internal divide and the rise of populism: a large segment of the population realized globalization did not improve their standard of living, and did not approve of the Wall Street bailouts in 2009. This started the populist movement, which led to the 2016 US election and the Trump Presidency, and also BREXIT in the UK.

- The rise of China: China was the main beneficially of the globalization, however China is still a Communist country. China never accepted the US based capitalist system and democracy, and as such the rise of China challenges the US global dominance. Thus, the rise of China is becoming a threat. The US-China decoupling is currently unfolding via the reshoring of some production from China to other countries like Mexico, and onshoring of some production back to the US. Further, there are trade barriers imposed from both sides in a tick-for-tack trade war.

- Russia is fighting the NATO expansion: The Putin’s Russia is fighting the NATO expansion to Ukraine, and there is no way of knowing what Putin’s future plans are. Globalization has also strengthened Russia as the major beneficiary of higher oil prices.

- The BRICS are fighting the USD global dominance as the reserve currency: China and Russia are leading the efforts to bypass the USD based global financial system and introduce their own financial system with their own currency, which could affect the role of the USD as a reserve currency, and the ability US to run the fiscal deficit.

- The oil geopolitics: the US-Saudi Arabie oil-for-security deal of 1970s, where Saudi Arabia agrees to see oil exclusively in USD is collapsing, which increases the probability of the rolling oil price shocks.

Obviously, these deglobalization trends are longer term inflationary. Also, as an imminent threat:

- The trend of reshoring/onshoring along with the trade barriers is increasing the cost of goods produced, which is likely to boost the goods inflation.

- The process of onshoring is also increasing the US wage growth, particularly given the US labor shortage, which is likely to boost the services inflation. Note, the US labor shortage is partially due to a tight immigration policy, which is also a reflection of deglobalization. Demographics also play a significant role in the US labor shortage.

- The actual war in Ukraine and the oil geopolitics are boosting the prices of energy and food – and thus, the energy and food inflation.

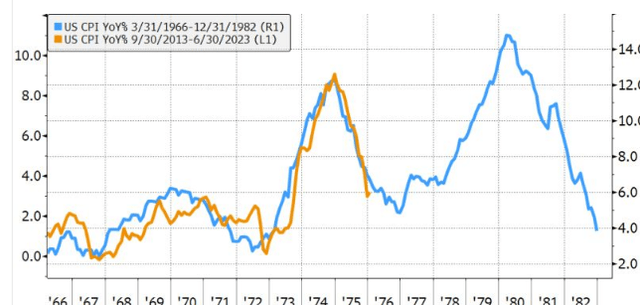

In fact, longer term, deglobalization could create waves of inflation like in 1970s, and we could be already approaching the second wave.

Bloomberg

So, what can the Fed do?

The Fed Chair Powell will have to address these “Structural Shifts in the Global Economy” and recognize the structural inflationary pressures coming from deglobalization.

Obviously, Powell will try not to spook the markets and he will take the credit for the fall in inflation over the last 12 months. However, he will likely mention that the current environment does not support a sustained return on inflation back to the 2% target. Thus, Powell is likely to reinforce the “higher for longer” theme and rule out interest rate cuts.

The Fed can only control the demand side of the equation, particularly through the labor market. The “pain” promised in 2022 via some weakening in labor market has not materialized yet. Thus, Powell could reiterate the need to induce a higher unemployment rate – which by definition implies a recession

Thus, Powell could hint at more interest rate hikes in 2023, as the premature pause could 1) continue to boost energy/food prices, particularly if the USD weakens, and 2) accelerate the wage growth, both of which could spark the second wave of inflation. The Fed might need to overtighten and cause a deeper demand shock to restore price stability.

On the other hand, there is a growing movement favoring the increase in the inflation target to 3%. Obviously, bringing the inflation down to 2% will require a very deep recession, given the deglobalization forces. So why not allow inflation to stay at 3% to avoid the downturn? The Fed could discuss this point, but indicate a firm commitment to the 2% target because any reference to a higher inflation target would de-anchor the inflationary expectations and cause a significant increase in long-term interest rates (TLT).

Implications

Due to the “Structural Shifts in the Global Economy”, the Fed is likely to reinforce the higher-for-longer theme, and possibly hint at more interest rate hikes in 2023 at the Jackson Hole conference next week.

This is likely to disappoint the soft-landing crowd expecting a cut early next year, a continued disinflationary process, with a resilient US economy.

Thus, the recent dip in S&P 500 (NYSEARCA:SPY) is likely to turn into a deeper correction as the market reprices the inflationary reality – given the “structural shifts on the global economy”.

SPY SPDR® S&P 500 ETF Trust that closely tracks S&P 500 (SP500) is currently in a “soft-landing” bubble with a forward PE ratio of nearly 21, which is especially irrational given that the forward earnings estimates are exuberantly optimistic.

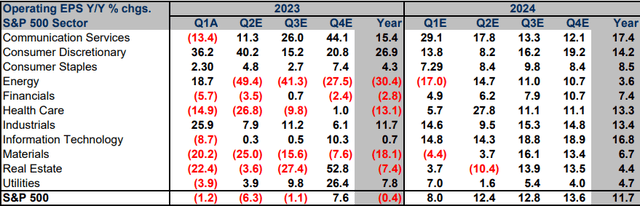

Overall, the analysts expect 11% earnings growth for SPY in 2024, which does not reflect the likely recession in 2024, as the Fed is forced to hold for longer to tame the inflationary pressures. These earnings estimates for 2024 will have to be revised significantly. Thus, SPY faces a significant drawdown.

CRFA

The SPY dividend yield is currently at 1.47%, while the 2-year Treasury note yield has just crossed the 5% level, and this supports the risk-off rotation from SPY to intermediate duration bonds.

Note, SPY has a very high short ratio of 14.16, which means that it is still vulnerable to short-covering rallies. However, these rallies should not be confused with a “bull” market, given the current macro environment.

Read the full article here