The Middleby Corporation (NASDAQ:MIDD) has seen a decline in share price in the last year due to concerns about consumer sentiment in the restaurant industry. I believe that Middleby is currently a hold because even though the firm has a solid balance sheet and future performance, overvaluation due to fundamentals and industry risk makes me move towards caution.

Business Overview

The Middleby Corporation is a global leader in designing, manufacturing, and distributing kitchen equipment for food service, food processing, and residential use. Its Commercial Foodservice Equipment Group offers a wide variety of goods, such as fryers, ovens, ranges, steam cookers, catering supplies, and more. Products like ice makers, refrigerators, heated cabinets, and equipment for craft brewing are also included in this section. While the Residential Kitchen Equipment Group provides a wide range of kitchen appliances for domestic use, the Food Processing Equipment Group specializes in batch and continuous processing equipment. The company’s extensive product line meets the demands of a broad spectrum of clients in different food industry sectors.

Middleby

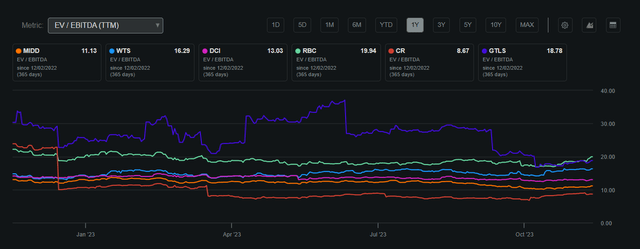

Middleby holds a market capitalization of $6.77 billion and showcases a 9% Return on Invested Capital. Over the past 52 weeks, its stock has experienced fluctuations, ranging from a high of $162.02 to a low of $109.59. At present, the stock is valued at $130.42, accompanied by an EV/EBITDA ratio of 11.13, closely aligning with its 200-day moving average of $137.81. Particularly noteworthy is the company’s EV/EBITDA ratio, which stands notably lower than that of its industry peers, indicating potential value relative to others in the industry.

Middleby EV/EBITDA Compared to Peers (Seeking Alpha)

Middleby also does not pay a dividend which is prudent at a time when operating income is falling. I believe that Middleby still holds a solid ROIC of 9% and can utilize its FCF to improve its core business to raise profitability which will retain the long-term cash flow expectations. As profits stabilize, FCF will improve and allow for a dividend or an increase in share repurchases.

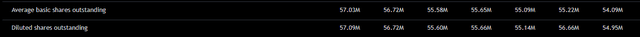

Annual Shares Outstanding (Trading View) Statement of Cash Flows (Trading View) Share Performance (Seeking Alpha)

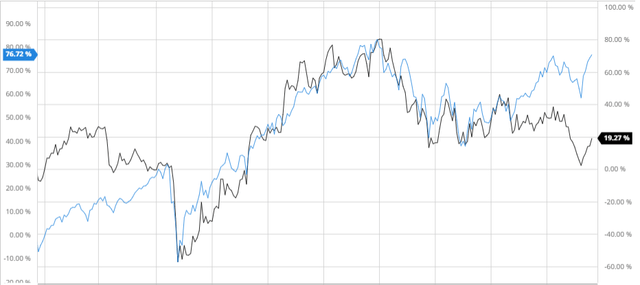

Performance Compared to the Broader Market

When compared to the broader market, Middleby has underperformed in the last 5 years. With the S&P returning 76.72% Middleby has only returned 19.27%. I believe that to be a great buy, fundamentals must be excellent or there must be visible outperformance in the S&P 500 giving a buy case for individual equities. With Middleby not performing well and seeing future headwinds in the restaurant industry, I do not see a clear operational buy case for the firm.

Middleby Performance Compared to Broader Market (Created by author using Bar Charts)

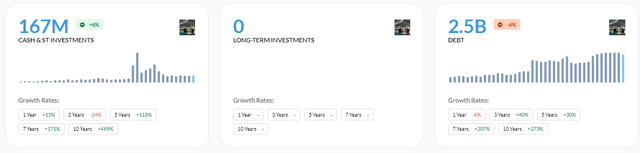

Balance Sheet

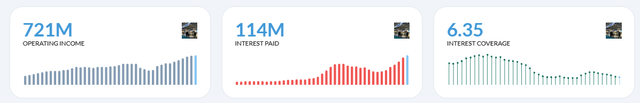

Middleby also holds a solid balance sheet where operating income is outpacing debt. But, with interest rates increasing, Middleby has a reduced interest coverage of 6.35 which should improve as the Fed begins to pivot rates in the future due to inflation declining. With a Current Ratio of 2.27 and an Altman-Z-Score of 2.94, Middleby will be able to remain solvent for many years to come.

Financial Position (Alpha Spread) Interest Coverage (Alpha Spread) Solvency Ratios (Alpha Spread)

Earnings

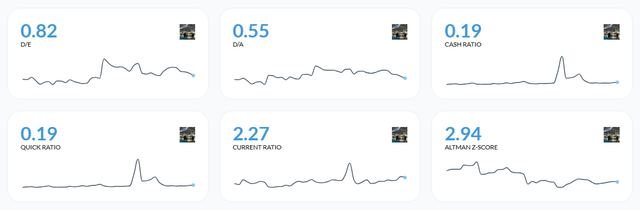

Middleby also reported mixed Q3 2023 earnings with EPS surpassing expectations by $0.03 at $2.35 and revenues missing estimates by $39.35 million at $980.65 million showing a 1.2% YoY decline. I believe this earnings report highlights Middleby’s ability to maintain profitability amid headwinds but also exemplifies the pressure on restaurants where consumer sentiment is in trouble. With earnings and revenues expected to grow in the upcoming years, keeping a close eye on inflation and consumer sentiment will be a leading indicator of if these expectations will be met.

Earnings Estimates (Seeking Alpha)

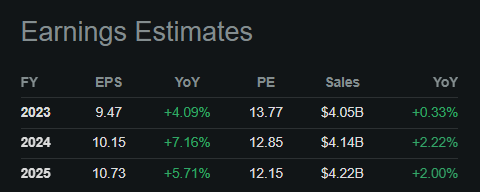

Analyst Consensus

Analysts currently rate Middleby as a “buy” with a 1-year price target of $153.75 demonstrating a potential 17.89% upside. I believe that these estimates are in line with recovery expectations and indicate operational confidence even with headwinds present.

Analyst Consensus (Trading View)

Valuation

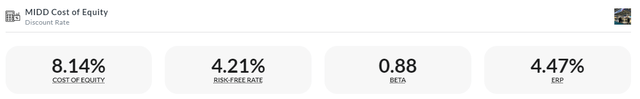

Before calculating a fair value for Middleby, I calculated the discount rate by finding the firm’s Cost of Equity using the Capital Asset Pricing Model. Using a risk-free rate of 4.21% based on the 10-year treasury yield, I found a Cost of Equity of 8.14% which demonstrates the return demanded by investors to compensate for the risk of holding Middleby’s equity.

Cost of Equity Calculation (Created by author using Alpha Spread)

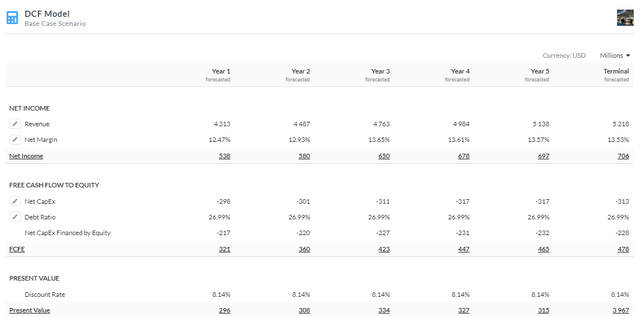

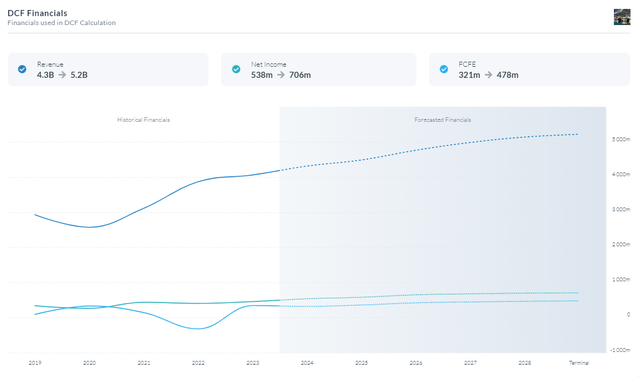

After finding Middleby’s discount rate, I used a 5-year Equity Model DCF based on FCFE to find a fair value. I decided to use a discount rate of 8.14% for my DCF because even though there are headwinds present in the restaurant industry, macro headwinds seem to be subsiding which would warrant a turnaround if inflation continues to decline. I also estimated revenues and margins to continue growing in line with analyst expectations. This resulted in a fair value of $103.48 which means Middleby is overvalued by 21%.

5 Year Equity Model DCF Based on FCFE (Created by author using Alpha Spread) Capital Structure (Created by author using Alpha Spread) DCF Financials (Created by author using Alpha Spread)

Strategic Acquisitions Expanding Margins Through Synergies

The Middleby Corporation’s acquisition strategy is a cornerstone of its growth and industry leadership within the commercial kitchen equipment and food processing sector. The firm is constantly looking for ways to expand its product portfolio by using synergies stemming from its core business. By doing so, Middleby can be a leader in the industry and offer a wide selection of products that cater to its core consumers. This is exemplified by its acquisition of the Taylor Company in 2018 for $1 billion. With this purchase, Middleby was able to strengthen its position as a provider of all-inclusive solutions. The Taylor Company is an expert in food service equipment, with a focus on frozen drink dispensers and soft-serve ice cream makers. Middleby increased the scope of its products and penetrated new market niches by adding Taylor to its lineup. This calculated purchase demonstrates Middleby’s dedication to diversification and its ability to find and incorporate companies that enhance its core competencies and offer a wider range of services to its clientele worldwide.

In addition to broadening its line of products, Middleby’s acquisition of the Taylor Company resulted in substantial cost savings and improved fundamental company efficiencies. Middleby leveraged cost savings and operational efficiency via strategic integration, maximizing resources and simplifying procedures throughout the newly merged companies. As a consequence, the entire financial performance improved, increasing profitability and laying the groundwork for long-term growth.

With regard to fundamental business synergies, the combination made it possible for Middleby to provide its clients with all-inclusive solutions. A more comprehensive and integrated product range was produced by combining Middleby’s experience in cooking and food processing equipment with Taylor’s focus on frozen dessert and beverage distribution systems. This improved the entire value offer for clients while also opening up new avenues for market penetration and cross-selling.

Risks

Cyclical Nature of Industries: Middleby works in sectors that are susceptible to fluctuations in the economy, such as food service and food processing. Shifts in consumer purchasing patterns may have an impact on the items’ demand.

Supply Chain Disruptions: Natural catastrophes, geopolitical crises, or other causes may cause supply chain disruptions that affect the availability of essential parts or supplies.

Conclusion

To summarize, I believe that Middleby is currently a hold because even though the firm has a solid balance sheet and future performance, overvaluation due to fundamentals and industry risk makes me move towards caution.

Read the full article here