Investment Rundown

One of the industries that were hit the hardest during the pandemic was the restaurant industry, one that The Middleby Corporation (NASDAQ:MIDD) serves as they manufacture a wide range of equipment used there. In 2020 the revenues declined quite sharply by 15% YoY to $2.5 billion but has since recovered very well to over $4 billion, a result of continued M&A activity.

As if the pandemic wasn’t enough, the restaurant industry saw further pressure as interest rates rose the spending power of everyday Americans declined and demand declined as a result. Most restaurants run on very slim margins already so with higher rates, increased spending just wasn’t an option. This I think has impacted the demand for MIDD and its products negatively. Even if the growth has been decent since 2020, I think we can see it expand further when interest rates go down and economic activity accelerates.

The valuation right now is a fair bit below where MIDD has historically been trading based on a p/e metric and I think this opens up the opportunity for investors to get diversified exposure to the restaurant and hotel industry. The market here is expected to continue rapid growth and I think MIDD is one of the better ways right now of capturing that as an investor.

Company Segments

MIDD is a global entity specializing in the design, manufacturing, marketing, distribution, and servicing of a diverse range of food service, food processing, and residential kitchen equipment. Within its Commercial Foodservice Equipment Group segment, the company provides an extensive array of equipment, including conveyor, combi, convection, baking, proofing, deck, speed cooking, and hydrogenation ovens.

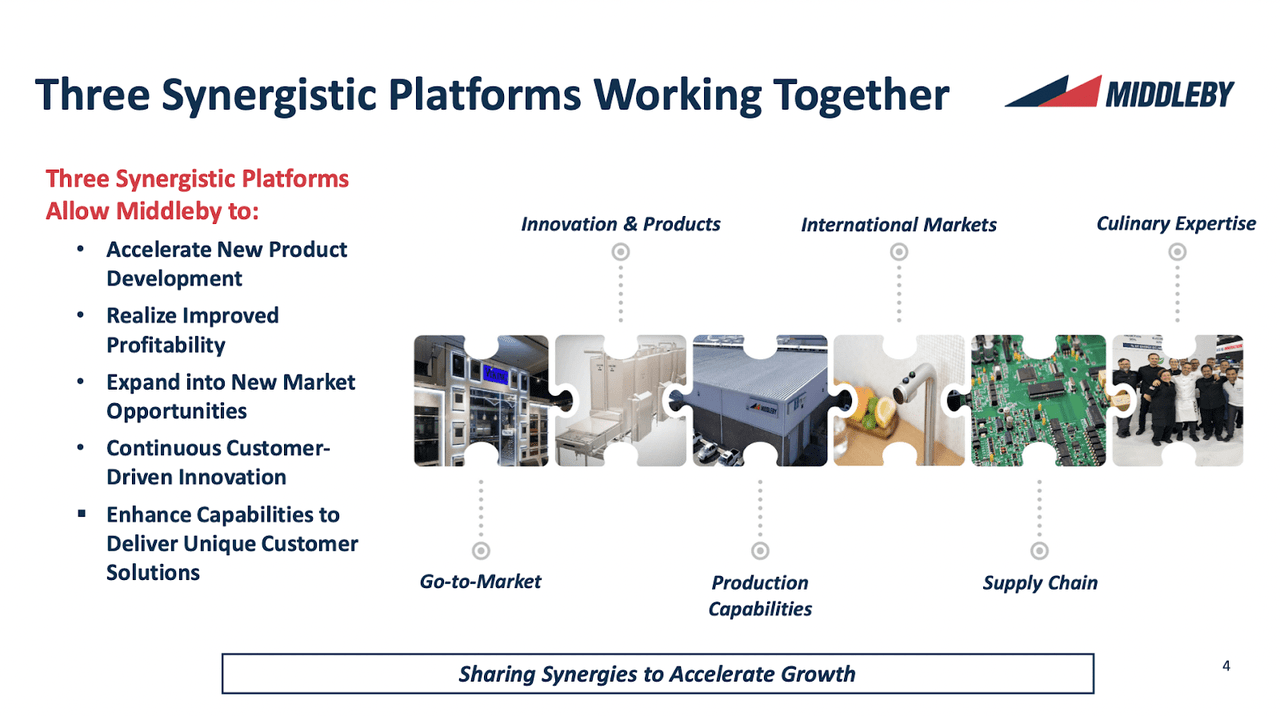

Transformation (Investor Presentation)

Beyond these offerings, MIDD also focuses on enhancing culinary processes across various industries. Its comprehensive suite of products caters to the evolving needs of commercial kitchens, food processors, and residential settings, showcasing the company’s commitment to innovation and efficiency. With a very well-diversified set of products, the company has managed to become quite the name in the restaurant equipment space holding nearly a 20% market share. One of the appealing factors with the company now is the prospects of international growth as well apart from just its recent organic growth in the US.

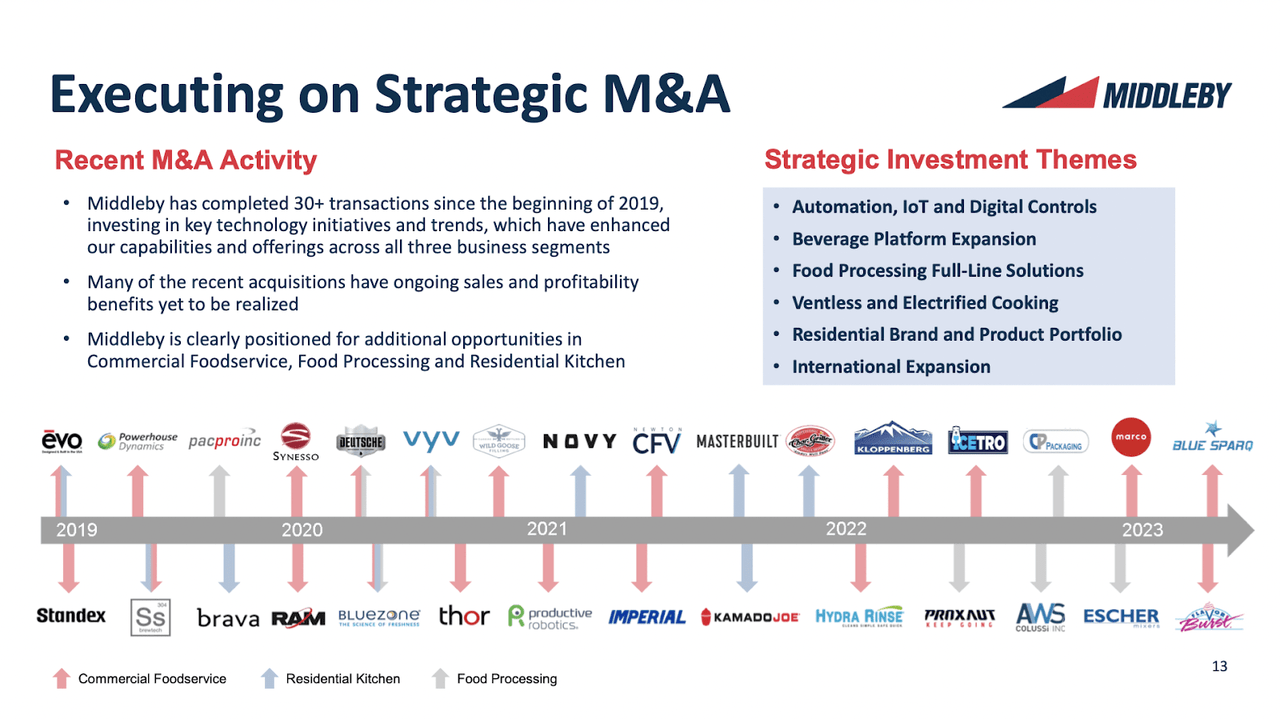

M&A Activity (Investor Presentation)

One of the key drivers for growth has been a lot of M&A activity from the company. In a market that seems to be quite competitive, surviving solely on organic growth might not always be possible. MIDD has since just 2019 acquired over 30 different companies which has helped bolster their revenues greatly as the portfolio expands. To give some context on the impact, the revenues rose from $2.9 billion in 2019 to over $4 billion in the last 12 months, a growth rate of 37%. As far as the impact of leverage there has been a steady climb of debt during that period of around $600 million. However, the net incomes have expanded by 29% during that period. With a valuation far below where it historically trades based on p/e, I think that investors are getting a decent opportunity here that ultimately makes MIDD a buy.

Earnings Highlights

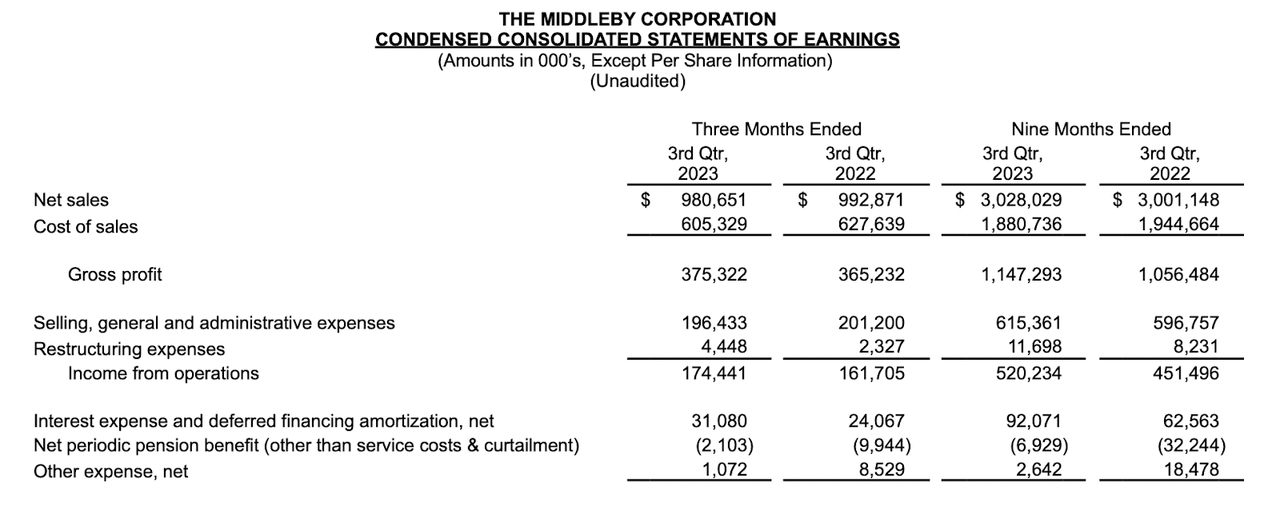

Income Statement (Earnings Report)

Looking at the last income report from MIDD which was released on November 8, 2023, the business continued to in my option post good results. The sales I think held strong at $980 million, a $12 million decrease YoY which I think was to be expected as near-term demand sinks following the quick rise in interest rates and further de-stocking for the Commercial Foodservice and Residential Kitchen segments of the business.

Putting pressure on the bottom line has been the rise in interest expenses for the business. I have gone over how MIDD has made an impressive effort since 2019 to expand the product portfolio by acquiring several businesses, but this has also meant that the debt levels have grown too. Now when rates are higher it seems that MIDD is averaging around $130 million annually in interest expenses. With income from operations at $174 million last quarter or around $500 million annually the impact of rising rates has been noticeable, to say the least. With expanding EBITDA margins though, reaching 23% I think that MIDD is still moving in the right direction, and managing the $2.5 billion debt position seems manageable still.

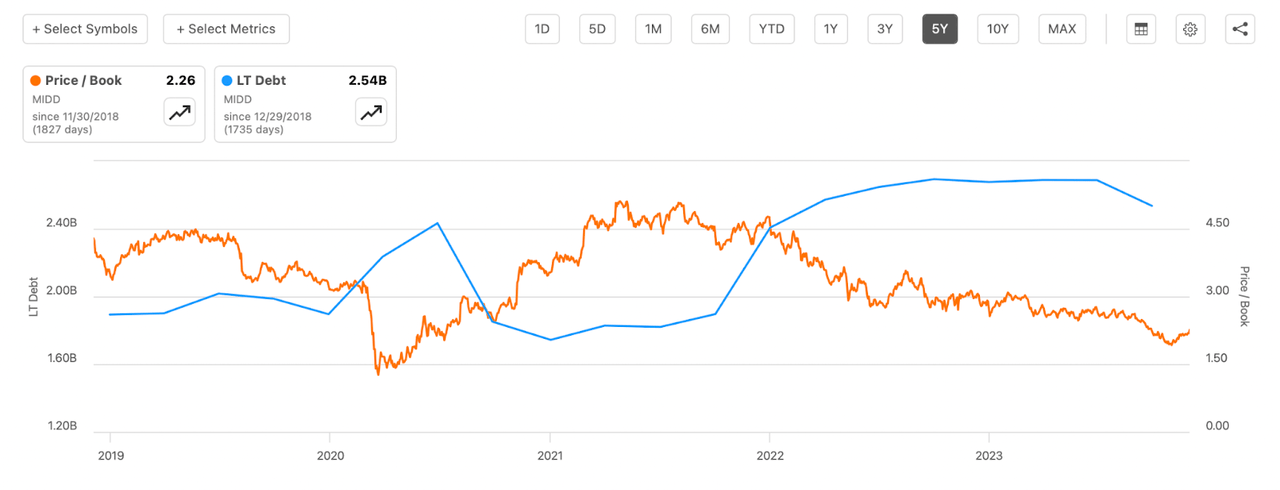

Debt Levels (Seeking Alpha)

The rise of debt on the balance sheet though seems to have resulted in the lowering of the p/b for the business, which now sits at 2.45 on a FWD basis, down from a high of over 4.4 in 2021. This multiple is lower than where the rest of the sector trades and I think exemplifies why MIDD might be an appealing buy right now. With debt of $2.5 billion and EBITDA of $847 million in the last twelve months, we get a leverage ratio of 2.9 which I wouldn’t consider worryingly high right now. So, with that, I think MIDD should be able to trade at a higher p/b multiple but perhaps the market is anticipating further revenue declines for MIDD in the coming couple of quarters. I believe that MIDD could trade at a p/b of 2.5 though which is the same as the sector and that leaves an upside of roughly 5%. On the p/e side of things, I think MIDD looks appealing as well. For the last 5 years, the company has been trading at a p/e of around 18, and right now it’s under 15 on a FWD basis. This leaves an upside of 23% putting a price target of $170. I think this is justified as during those 5 years MIDD has made strong efforts in raising the bottom line, going from under $300 million to over $450 million and with continued M&A activity I think this trend will continue.

Risks

The continuous challenge of input cost inflation and the persistent disruptions in the supply chain pose a more prolonged threat to profit margins than initially foreseen. This is especially notable as MIDD endeavors to address a historically high backlog, facing constraints in adjusting for increased pricing in the current market conditions.

Navigating through these circumstances requires strategic resilience and proactive measures to mitigate the impact on profitability. The company’s ability to adapt to the evolving cost landscape and optimize its supply chain efficiency will play a crucial role in sustaining and enhancing its financial performance amid these challenges.

Segment Overview (Investor Presentation)

Persistent inflation can create uncertainty in the economy, causing consumers to worry about the future value of their money. When confidence wanes, consumers are more likely to scale back on spending, especially for larger purchases like homes or cars. This decline in consumer confidence can have ripple effects across various industries. With higher inflation in the US, the impact has been for restaurants and hotels, or anyone in the hospitality industry that investing heavily into new equipment has been tough. This I think impacts the demand that MIDD is seeing and makes revenue easily impacted by waving market conditions. Higher interest rates have made funding new ventures more expensive as well and that of course also puts pressure on demand for MIDD, however, I do think that should the rates start to decline we will see a bump upward in the revenues and net income for MIDD which may boost the share price too.

Final Words

During the last few years, MIDD has been very active in acquiring new business and boosting its product portfolio further. This is one of the reasons I think that MIDD can be a solid investment right now for those seeking exposure to the hospitality industry. With a price target of $170 for the business, there is ample amounts of upside here and this ultimately leads me to rate the company a buy. Once interest rates go down, I think revenues will tick up even further for MIDD and accumulating a position now seems advantageous.

Read the full article here