The year 2023 was a huge year for stocks, after a terrible year for stocks. A handful of huge stocks provided extraordinary power to push stock indices higher in 2023. And then, over the last two months of the year, there was the mania over the Fed’s gazillion rate cuts in 2024, which not only threw more fuel on the stock market, but also turned around the Treasury market and caused the 10-year Treasury yield to hop-scotch down the mountain in two months that it had spent eight months climbing.

These huge movements in the stock market undid much of the damage that 2022 had done, but not all, and it was unevenly spread.

Indices that are dominated by the largest stocks – including the Magnificent 7 – reached new highs (Nasdaq 100, NDX, and the Dow, DJI).

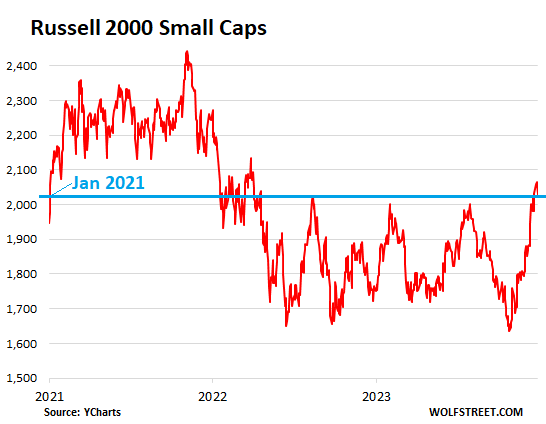

Despite this huge year for stocks, the Russell 2000 (RTY), which tracks 2000 small-cap stocks, ended where it had been in early January 2021 – three years ago. The S&P 500 (SP500, SPX) index ended below where it had been two years ago, and the Nasdaq ended where it had been in August 2021. So here we go:

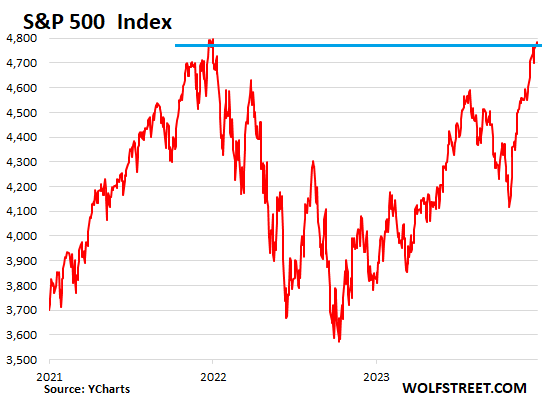

The S&P 500 index surged 24% in the year 2023, thereby reversing the 19.4% decline of 2022, and closed the year at 4,770. Almost but no cigar. At the close, it was 0.5% below the all-time closing high of 4,796 which had occurred two years ago on January 3, 2022. Oh well, maybe next year or whenever.

The years 2022 and 2023 were quite a show, with lots of massive ups and downs, to end up in nearly the same place as where it had started two years earlier (all historic index and stock data via YCharts):

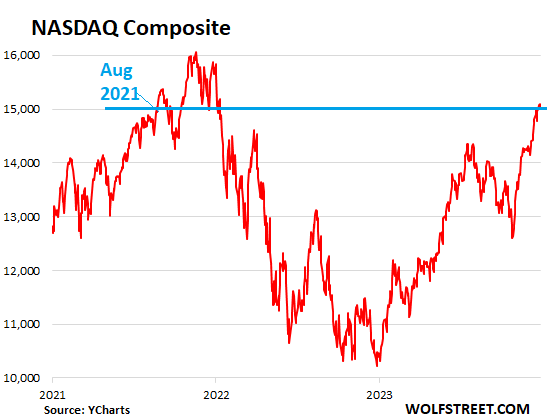

The Nasdaq Composite (COMP.IND) surged 43% in the year 2023, a huge rally, thereby reversing nearly all of the 33% plunge of 2022, and closed at 15,011. But that was still down by 7% from its all-time high in November 2021.

The index had first reached this level in August 2021. So, after 27 months of rabid volatility, it ended up in the same place.

Let’s break this down a little.

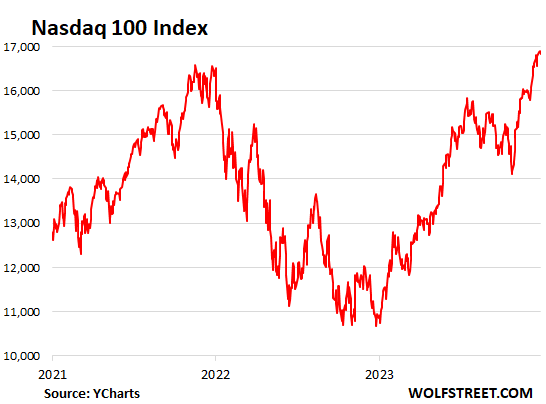

The Nasdaq 100 (NDX), which tracks the largest 100 stocks on the Nasdaq excluding financial firms, exploded by 54% in 2023, erasing its 33% plunge in 2022, plus a little, and started hitting all-time highs in December. It closed at 16,825, up by 2.4% from its previous high in November 2021.

That 54% climb was the best year since the dotcom boom in 1999, which was followed by… OOPS.

A handful of huge stocks with huge rallies powered those indices. Those mega-caps weigh more heavily in the Nasdaq 100 Index and fueled its rise.

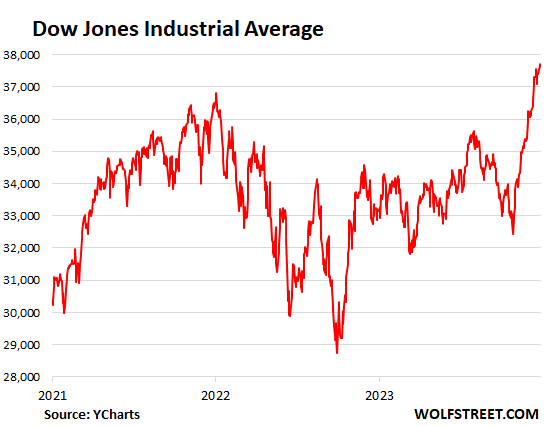

The Dow Jones Industrial Average, which track the largest stock in each industry, 30 of them, rose 13.7% in 2023 and in December started hitting all-time highs, closing the year at 37,690, having more than wiped out its 8.8% decline in 2022. It is now up by 2% from its previous all-time high on January 3, 2022 (the Dow is structured as an average of the prices of 30 stocks, and so it has some quirks).

By contrast, the Russell 2000 Index, which tracks 2000 small cap stocks, ended the year below where it had been three years ago. In 2023 it rose 13.7%, not enough to make up for the 21.6% plunge in 2022. At an index value of 2,027, it was back where it had been in early January 2021 – three years ago.

And it’s down 17% from its all-time high in November 2021. So those three years have been an ongoing wild ride through heck.

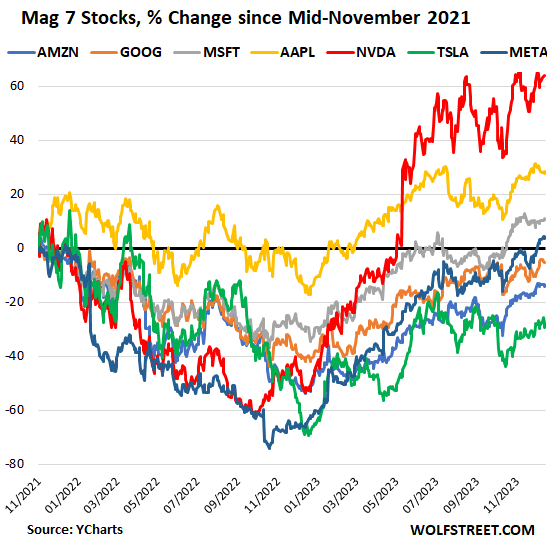

The Mag 7 since Nov 16, 2021.

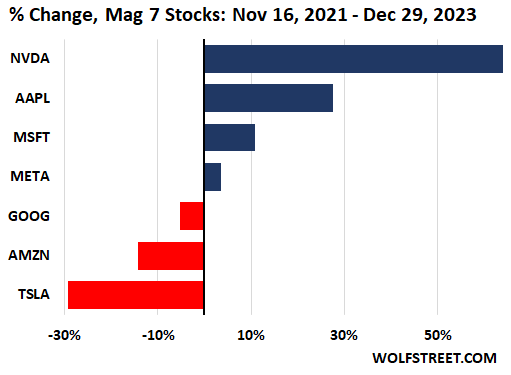

The Nasdaq had peaked in mid-November 2021 and is still below that level. So, we will use November 16 as our starting point.

Since November 16, the stock prices of these seven huge stocks changed in different directions, with Nvidia (NVDA) at the top (+64%) and Tesla (TSLA) at the bottom (-29%). Amazon (AMZN) and Alphabet (GOOG,GOOGL) are also still down from mid-November 2021:

It wasn’t smooth sailing getting there. By November 2022, all of the Mag 7 were in the red since mid-November, with META down 73% at the low end and Apple down only 3% at the high end.

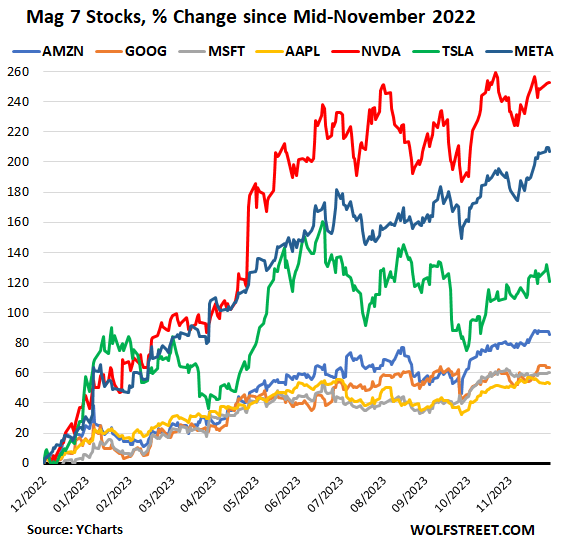

The Mag 7 since November 16, 2022.

Prices of these 7 stocks exploded higher. At the high end, Nvidia spiked by 252%, Meta by 207%, and Tesla by 120% in those 13 months. At the low end, Microsoft (MSFT), with a market cap of nearly $3 trillion, was up 60%; and Apple (AAPL), the largest company in the world with a market cap of nearly $3 trillion, was 53%. These two companies combined gained $3 trillion in market cap in 13 months!

These are stocks with gigantic market capitalizations. Combined, the seven stocks have a market cap of $12 trillion. And so, they move the overall indices in a big way, and over the past 13 months, their massive surge fueled the rise of the overall indices that they dominate.

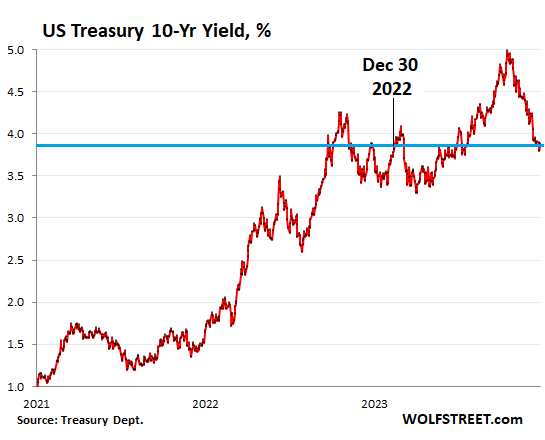

Ok, the 10-year Treasury yield... That was funny too. It ended 2023 at 3.88%, to the basis-point where it had ended 2022 (3.88%), and so it went absolutely nowhere over those 12 months, but it sure climbed a big mountain for 10 months with a lot of blood (including banks that collapsed), sweat, and tears, and then, amid the mania about the Fed’s gazillion rate cuts in 2024, it hop-scotched all the way back down in two months.

In this cycle, the 10-year yield had first reached 3.88% on the way up in September 2022.

Barely visible on this chart: the 10-year yield actually rose for the past two days by a combined 9 basis points, as the mania about the Fed’s gazillion rate cuts began to fade.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here