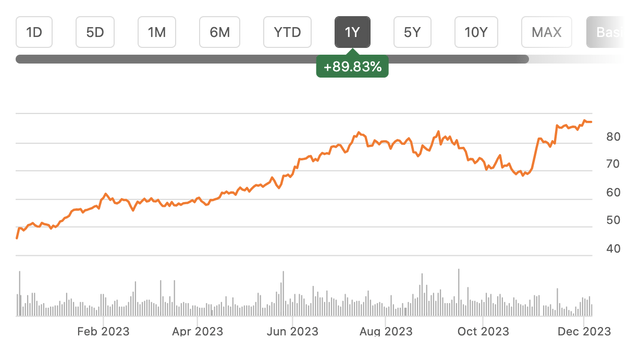

In October, I reiterated my buy recommendation on Toll Brothers (NYSE:TOL), arguing there could be 40% upside. Since then, shares have already returned 24%. Despite this strong rally, I believe investors should stay long Toll. After the company’s most recent quarterly results and strong guidance, I see more upside from here and am substantially raising my price target, from $100 to $114, which could prove conservative with possible multiple expansions.

Seeking Alpha

In the company’s fiscal fourth quarter, Toll earned $4.11, blowing past estimates by $0.37, even as revenue fell by 19%. Net income did decline to $446 million from last year’s adjusted $538 million. For the full year, the company earned $12.36, up 13% from last year with revenue up 2%. It signed $7.9 billion of contracts, for an 80% book-to-bill ratio.

My argument for owning Toll has been that despite fears over US housing, the company could continue to retain the current level of earnings at least through 2024, I have increased confidence in this occurring based on this quarter’s results. Now, as noted above, revenue did decline from last year. This was because 2,755 homes were delivered, down 27%. There was pretty meaningful geographical variance. The West was down 43%, Northeast was down 40%, Mountain was down 30%, the Mid-Atlantic was down 6%, and South was down 7%.

While the West and Northeast have struggled with affordability challenges, we are seeing buyers start to come back. Contracts signed were $2.01 billion, up 53% with homes contracted up 72% to 2,038. Contracts fell 2% in the North, but they rose 40% in the Mid-Atlantic, 87% in the South, 127% in the Mountain region, and a staggering 247% in the West. Apart from the relatively small Northeast market, we are seeing buyers come back in a meaningful way, and even there, declines are largely complete. This has left Toll with a still substantial backlog of $6.95 billion.

Now, the number of homes ordered rose faster than the value of orders. This is because the average price was down 11% as management made a “strategic shift in mix.” Toll actually raised the average net price by $16,000 on a like-for-like home during the quarter. This speaks quite positively to the demand the company is facing. Selling homes for around $1 million, Toll is the highest-end publicly traded builder. It has been extending into the “affordable luxury” segment seeking to capture the more “affluent first-time buyer” and not just trade-up buyers, given there are 75 million millennials. This broadening mix shift is the reason for the lower average selling price. Affordable luxury sales are up 109% from last year, pointing to the strong demand for this product.

Critically, even with this broadening, we saw the company expand its adjusted gross margin to 29.1% from 29%, thanks to strong demand for spec houses, as well as improving construction costs. Key input costs like lumber have come down, building times have shortened, and the jobs market has begun to cool, easing wage pressures. Cost side normalization is helping to offset pressures that could exist on pricing.

This strong level of earnings allowed Toll to repurchase $326 million of stock in the quarter and $566 million this year. As a result, its share count is down by 4.8% over the past year. Management has allocated $400 million to buybacks in 2024.

Toll has done this while maintaining a stellar balance sheet with $1.3 billion of cash. TOL now has just $2.8 billion in debt from $3.2 billion a year ago. Toll has also reduced the capital intensity of its balance sheet because while it controls 70,000 lots, 49% is via option rather than outright ownership. That reduces its exposure to land prices, allowing the company to walk away from lots that may not offer the best economics. Over time, it seeks to migrate towards 60% options exposure. With limited outright landownership and modest net debt, Toll continues to have a balance sheet that will allow it to be resilient during downturns.

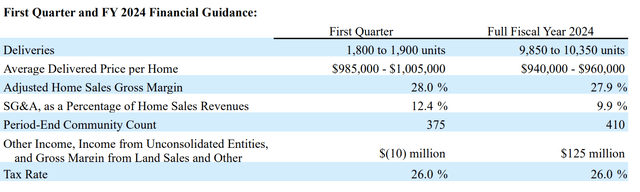

Alongside these results which point to stabilization, management provided initial 2024 guidance, which was stronger than even I anticipated. Toll expects to deliver about 10,100 homes in 2024, up 5% from this year. The average sales price will be about 8% lower as the lower-priced affordable luxury segment continues to gain share. Importantly, margins remain a robust 27.9%, down just slightly from this past year’s 28.7%. This guidance implies about $9.7 billion in revenue, and with these margins, TOL should deliver over $12.75-$13.50 in EPS, at today’s share count. This compares favorably to my “at least $11.50” expectation in October, given the growth in sales volume.

Toll Brothers

I view this delivery target as credible. The company has 6,578 units in its backlog, and at its current contract pace, it will sign about 8,000 homes. As such, it will continue to eat into its backlog, but it should sustain a backlog of over 4,500 homes in a year’s time. Given the strengthening in order seen this quarter, I see an upside to the current pace and would expect the backlog to stay above 5,000 units. We are now in a seasonally quiet period for homebuying between Thanksgiving and Christmas, but management also noted that demand has been quite strong over the past few weeks.

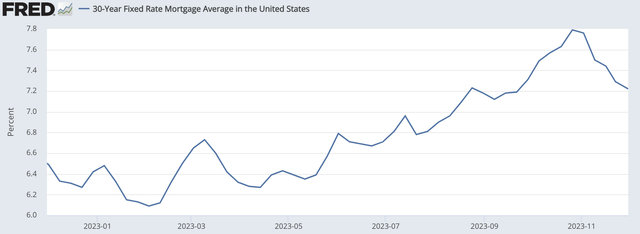

A reason for this is that we have seen mortgage rates begin to decline, having fallen toward 7% from 8% just a few weeks ago. This enables buyers to come back into the market. Rates having also recently been so much higher may even add some urgency to lock in a mortgage now. Management also noted that given the historic spread to 10-year treasuries, 30-year mortgage rates should be under 6% today. So if treasury yields remain around current levels, we may see mortgage rates continue to move lower, providing a nice tailwind into the spring selling season.

St. Louis Federal Reserve

Lower mortgage rates absolutely help Toll, but its higher-end niche does provide a bit of insulation, which is why results have stayed strong. That is because 26% of its buyers are all-cash. The average loan-to-value for those who take a mortgage is 69% vs the 80% standard. The rise in the stock market should be a further benefit as many all-cash buyers fund their purchases by selling out of an investment portfolio. Stocks going up make that home purchase more affordable.

As I argued in my previous write-ups for Toll, I believe home prices can remain elevated even with challenged affordability because the market is supply-constrained after years of little building last decade. The primary risks to my thesis would be either rates surging higher or building supply increasing. Well, it seems mortgage rates may have peaked. Additionally, the builders remain cautious and scarred from past downturns. Housing starts are near 3-year lows. We are not seeing a surge in new construction that could disrupt this favorable supply-demand backdrop.

St. Louis Federal Reserve

Given its budget, we should see the share count decline another 4% over the next year. That combined with my expectation that Toll can deliver the midpoint of guidance, given a housing market with reasonable fundamentals, peaked mortgage rates, and strength in its broader price-point products leaves me optimistic about Toll’s shares. Aided by share count reduction, I am now expecting EPS to be above $13. I have argued for a multiple of 8.5-9x. That would deliver a share price of ~$114. Frankly, if we are passing the peak in interest rates, and migrating to a clearer soft landing, there is an argument for multiple expansions to at least 10-12x as the level of earnings can be sustained for longer. That could push shares past $130 in an optimistic scenario.

For now, though given ongoing economic uncertainty, I am assuming multiple expansion opportunity is likely to stay limited until investors see further evidence that my view of a durable housing market is playing out. Even at $114, shares have a further 28% upside. I know shares have run a tremendous amount, and sometimes it can be difficult to let winners continue to run. However, with resilient earnings and stellar guidance, investors should do that with Toll. These results confirmed the bullish thesis, and investors should continue to buy what is a cheap stock with favorable end-market dynamics.

Read the full article here