I have found, over the years, that some of the best investment opportunities involve companies that require a contrarian mindset in order to appreciate. Heading into the 2023 fiscal year, there was considerable uncertainty regarding anything related to the construction market. With rising interest rates aimed at combating inflationary pressures, the home construction market, not to mention other forms of construction and repair activities, was not exactly viewed in a favorable light. It is true that we are now starting to see some serious weakness in the space. But at the time, the market seemed to overreact to some extent and kept shares of companies related to this space lower than they should have been. This gave investors a great opportunity to buy in on the cheap. And one of the companies that has performed best over this time is TopBuild (NYSE:BLD), an enterprise that’s focused on installing and distributing insulation. After seeing the stock rise significantly, and with the very real likelihood that financial performance will weaken from this point on, I must say that I am becoming more cautious about the enterprise. This has led me to downgrade the firm from a ‘buy’ to a ‘hold’ for now.

The great ride has come to an end

In late January of this year, I decided to revisit my bullish thesis regarding TopBuild. In that article, I recognized that the company did not seem to be an obvious prospect in what was then the current environment. Even so, attractive sales growth, profit growth, and cash flow growth, all helped to push the stock higher. Despite the move higher that shares had seen, units were still trading on the cheap. This led me to keep the company rated a ‘buy’ to reflect my view at the time that the stock should continue to outperform the broader market for the foreseeable future. Since then, the S&P 500 has shot up an impressive 11.9%. Over the same window of time, however, TopBuild has handily surpassed that, with upside of 41.6%.

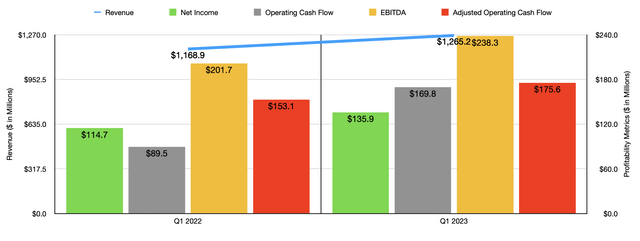

Author – SEC EDGAR Data

To understand why the company performed so well, we need only look at the most recent financial data provided by management. During the first quarter of the company’s 2023 fiscal year, revenue came in at $1.27 billion. That’s 8.2% above the $1.17 billion the company generated the same time last year. According to management, the primary driver of this sales increase was a 5.7% move associated with higher selling prices. But there were other contributors as well. 1.3% of the sales increase was attributable to acquisitions, while the remaining 1.2% was driven by higher sales volume. Growth was particularly impressive under the Installation segment. Based on the data provided, revenue there shot up 13.4%. That compares to the much more tepid 2.7% increase seen by the Specialty Distribution segment.

This growth on the top line brought with it higher profits as well. Net income for the company expanded from $114.7 million to $135.9 million. In addition to benefiting from a growth in sales, the company also saw a surge in the operating profit of its Installation segment, totaling 30.4%. This was caused in large part by an increase in the operating profit margin for the segment from 16.7% to 19.1%. Management chalked this up to the benefit of higher selling prices, higher sales volume, and certain productivity initiatives that the company enacted. Other profitability metrics followed a similar trajectory. Operating cash flow, for instance, nearly doubled from $89.5 million to $169.8 million. If we adjust for changes in working capital, the increase would have been a more modest but still impressive amount, growing from $153.1 million to $175.6 million. And finally, EBITDA grew from $201.7 million to $238.3 million.

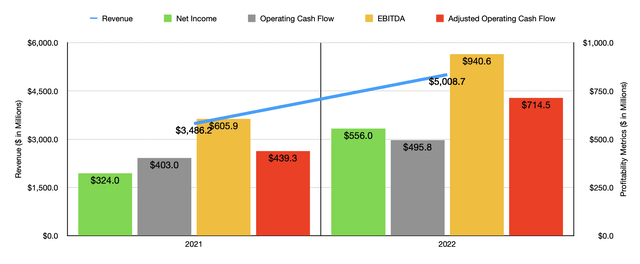

Author – SEC EDGAR Data

As you can see in the chart above, the strength the company experienced during the first quarter of 2023 relative to the same time last year is part of a larger trend that shareholders have enjoyed. 2022 was a spectacular year compared to the 2021 fiscal year. Revenue, profits, and cash flows, all spiked higher during this time. Having said that, all good things must come to an end. Is based on management’s own guidance for the year, 2023’s early strength is not going to last. Because of slowing industry conditions, the expectation is that revenue for the year will come in at between $4.7 billion and $4.9 billion. In its guidance, the management team specifically identified data associated with housing starts and completions as an issue. This is something that I have touched on in other articles, such as here and here.

On the bottom line, the only guidance that management gave involved EBITDA. For this year, the metric should come in at between $820 million and $910 million. That would represent a decline compared to the $940.6 million reported for 2022. If we assume that other profitability metrics will change at the same rate that EBITDA is forecasted to, we would expect net income of $511.3 million and adjusted operating cash flow of $657.1 million.

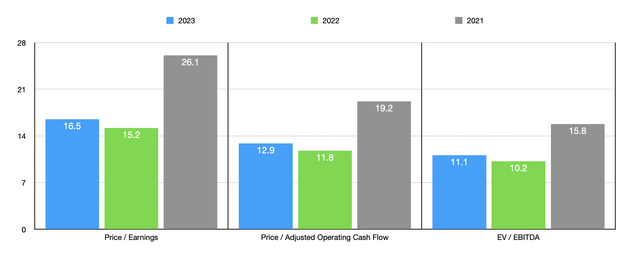

Author – SEC EDGAR Data

Taking these figures, it becomes quite simple to value the company. As you can see in the chart above, I valued the firm using not only the estimates for 2023, but also actual results from 2021 and 2022. The stock does look to be getting a bit more expensive this year than last. But in the grand scheme of things, I wouldn’t argue that shares are all that pricey. Relative to similar firms, the stock might be slightly on the cheap side. In the table below, you can see what I mean. Using the price to earnings approach, only one of the five companies that I compared it to look cheaper than it. This number changes to two companies if we use the price to operating cash flow approach and to three companies if we use the EV to EBITDA approach.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| TopBuild | 16.5 | 12.9 | 11.1 |

| Installed Building Products (IBP) | 16.8 | 13.2 | 9.5 |

| Masonite International (DOOR) | 12.5 | 8.1 | 8.2 |

| CSW Industrials (CSWI) | 26.8 | 21.3 | 16.0 |

| JELD-WEN Holdings (JELD) | 24.8 | 6.9 | 9.6 |

| Gibraltar Industries (ROCK) | 22.7 | 13.4 | 12.8 |

Takeaway

Looking at the big picture, I would argue that TopBuild still looks quite healthy. The business started the 2023 fiscal year off on a strong note. Having said that, management believes that the rest of this year won’t be so great. This is fine in and of itself if the stock were cheap enough. But I have a feeling that further downward revisions my ultimately come into play. After all, the housing market is particularly difficult right now. This, combined with the fact that shares have gotten closer to fair value, has led me to become a bit more cautious. As a result, I have decided to decrease my rating on the company from a ‘buy’ to a ‘hold’ until we get more clarity into what the current fiscal year is turning out to look like.

Read the full article here