Out Of The Penalty Box

The Toro Company (NYSE:TTC) has been in the penalty box with investors since it badly missed estimates and guided the outlook downward in September, as I noted in my last article. The stock lost 12.7% in one day and traded roughly sideways in a range between $79 and $89 for the following three months. Along with my Hold rating last quarter, I recommended a buy target below $81.50, which turned out to be a good entry point.

When a company misses that badly, it is worth waiting for one more set of quarterly results to see if the miss was a one-off due to temporary market issues or if something has permanently changed from the conditions that caused you to invest in the company in the first place. Toro’s 4Q results suggest encouragingly that it is more the former. Specifically, the lawn care market for both the Residential and Professional segments in 3Q saw a pullback in demand from the record levels seen during the “stay-at-home” trend of 2021-22. On top of this, worries about interest rates, the economic outlook, and dry weather also impacted consumer demand. All this left distributors with high inventory levels and reduced demand for product. What we saw in 4Q results was that Toro management was able to respond and mitigate the impact.

Toro’s diversification through acquisitions over the past decade helped the company beat expectations in 4Q. Markets for underground and specialty equipment as well as golf and grounds maintenance remained strong and even still had a backlog of orders built up during the supply chain issues of 2022. Toro shifted some production capacity from lawn care into the other products to better balance customer demand. As a result, sales and EPS, while down from year-ago levels, managed to beat expectations.

Market reaction was strongly positive, with shares up as much as 10% on the day of the earnings release. This is despite modest initial guidance for 2024. Investors seem to be looking past the current issues to an improving residential market and thinking the current guidance may be conservative. Also, with most of the supply chain issues now in the past, Toro can free up working capital and return to its typical free cash flow conversion of around 100% of net income. The added cash can be used for buybacks, which will also help EPS beat the current guidance.

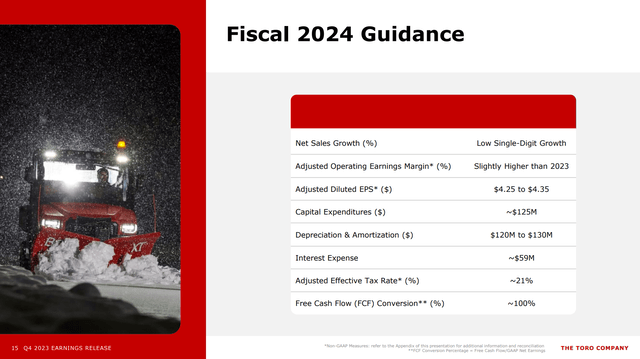

A Closer Look At 2024

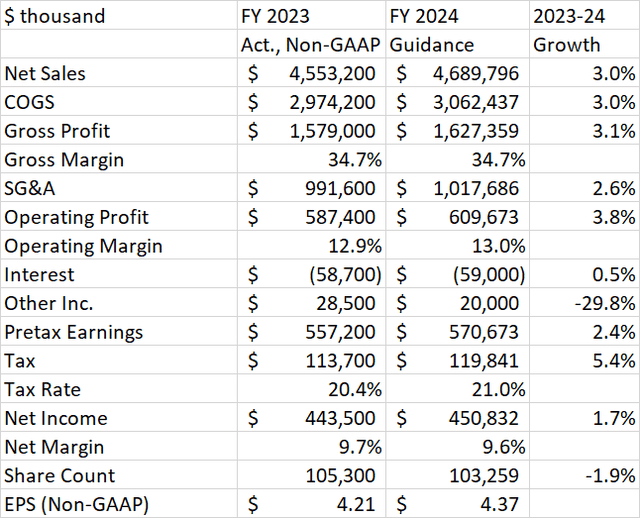

Toro is currently guiding to only modest growth in FY 2024, with sales up a low single digit percentage and operating margin up “slightly”. The resulting EPS guidance for 2024 is in the range of $4.25 – $4.35, up just 2% at the midpoint from FY 2023 actuals.

Toro

Underground & Specialty Construction equipment continues to benefit from higher infrastructure spending, especially in a US presidential election year where the Infrastructure & Jobs Act was a key plank in “Bidenomics”. Golf & Grounds also continues to have robust growth, with international markets outside North America continuing the trends seen in the US in the past few years. The CEO noted on the conference call that golf rounds played in these markets grew 18% this year.

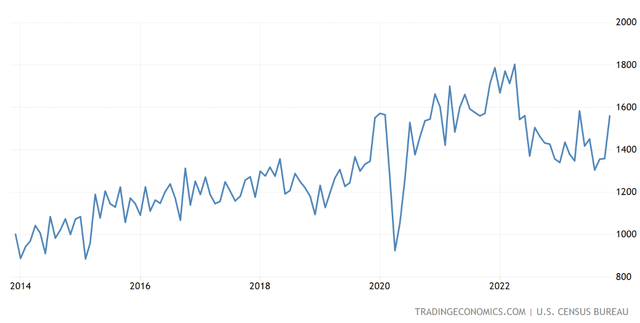

While the company is still not counting on a stronger consumer in 2024, they do expect to gain market share with the introduction of residential product sales at Lowe’s (LOW) starting in the spring season. Although it is not built into the guidance yet, there may be upside to the forecast if the housing market stabilizes. Last quarter, management sounded more pessimistic as mortgage rates were hitting multi-decade highs and housing starts continued to decline from 2022 levels. Since then, interest rates have started falling and housing starts seem to be stabilizing. While not back to 2022 highs, housing starts are still above any number observed between the 2008 financial crisis and the pandemic.

US Housing Starts (Trading Economics)

For now, Toro is predicting only slight improvement in operating margins from the 12.9% achieved in 2023. While most of the manufacturing inefficiencies seen during the supply chain problems of 2022 have passed, there is still some inefficiency from rebalancing production capacity from lawn care products to underground & specialty and golf & grounds. Over the longer term, Toro plans to add capacity in the underground & specialty business. Also, the company has started a new initiative known as AMP (Amplifying Maximum Productivity) which is intended to reduce costs by $100 million per year by FY 2027. I expect this to get operating margins above the 14.2% record seen in 2017 and 2018.

Below the operating income line, Toro has no debt due in 2024 and therefore should see interest expense similar to 2023 at $59 million. Other Income will be lower due to increased corporate incentive compensation and the tax rate will be 21%, in line with the US statutory rate. Putting all this together and assuming no buybacks, the projected EPS is $4.30, in line with the midpoint of company guidance. However, I think buybacks are likely in 2024 as free cash flow improves, as I will show below. The reduced share count takes my EPS estimate to $4.37 in FY 2024.

Author Spreadsheet

Valuation

Trading around $98 after the earnings release, Toro is valued at 22.4 times FY 2024 earnings. This is not expensive relative to history, especially since 2017.

Seeking Alpha

My buy target of $81.50 last quarter was based on a fair P/E of 20 and a more pessimistic 2023 earnings estimate of $4.075. With the drop in interest rates, a stabilization in sales, and plans to improve operating margin, I am comfortable returning to the 24 P/E target I used in the first half of 2023. That would put my new price target at $105. This is about 7% above current levels, slightly ahead of my expectation for the rise in the S&P 500 in 2024, making TTC a Buy.

Capital Management

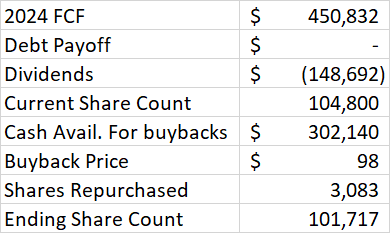

Toro’s free cash flow has been subpar for the last two years, coming in at $154 million in FY 2022 and $157 million in 2023. Each of these years had working capital builds around $250 million as supply chain issues first caused raw material and work in process inventories to build, then the sales slowdown caused finished products inventories to build. As a result, free cash flow was only around half of net income in these years.

Looking forward to FY 2024, Toro can begin reversing some of these working capital builds, which will get free cash flow back to 100% of net income, or $450.8 million. The company recently declared a conservative dividend increase of $0.02 to $0.36 quarterly in 2024. ($1.44 annually, 1.5% yield). This 6% growth in the dividend lags behind the ~10% seen most years. The dividend will use $148.7 million of cash. There is no debt due in FY 2024, and debt/EBITDA is 1.8, within the company target range of 1-2. That frees up the remaining $302.1 million of FCF to be used for buybacks or M&A.

Toro’s M&A activity was minimal in FY 2023, and I am assuming similar for 2024. Applying all excess free cash flow to buybacks would reduce the share count by about 3.1 million. Most of Toro’s acquisitions have worked out well, however they did take a $151 million impairment charge this year for 2022’s purchase of Intimidator Group. I am expecting future acquisitions on average to be at least as accretive to EPS as spending a similar amount of cash on buybacks.

Author Spreadsheet

Conclusion

Toro shares suffered over the past quarter as the negative surprise in 3Q results kept investors cautious. The company is not back to its typical strong performance, but it appears to be managing the temporary slowdown in consumer demand. The company expects only modest growth in 2024 with continued Professional strength and market share gains in Residential with entry into Lowe’s. I believe there is upside to the sales guidance as the housing market stabilizes. Toro is also starting on a 3-year program of manufacturing efficiency improvements that will get operating margins back above the record 14.2% levels seen last decade. Improved free cash flow should allow for increased buybacks, further improving EPS.

These improvements justify returning to a higher P/E of 24, which puts the price target at $105 by the end of 2024, making the shares a Buy.

Read the full article here