By Anu Ganti

The performance of large-cap Technology stocks so far this year has been exceptional, with the S&P 500® Information Technology sector outperforming the S&P 500 by 26% over the six-month period ending June 30, 2023—the 97th percentile of all observations in our database. Tech’s outperformance, driven by mega-cap strength, has been especially notable because of its narrow breadth.

In this environment, concentration concerns naturally come to mind. The Herfindahl-Hirschman Index (HHI) is a widely used concentration measure; it’s defined as the sum of the squared weights of an index’s constituents. Other things equal, a higher HHI indicates an increased level of concentration, but even for completely unconcentrated equal-weight portfolios, the HHI level is inversely related to the number of names. In order to use the HHI to make comparisons within the Tech sector over time, we use an adjusted HHI, defined as the sector’s HHI divided by the HHI of an equal-weighted portfolio with the same number of stocks. A higher adjusted HHI means that a sector is becoming more concentrated, independent of the number of stocks it contains.

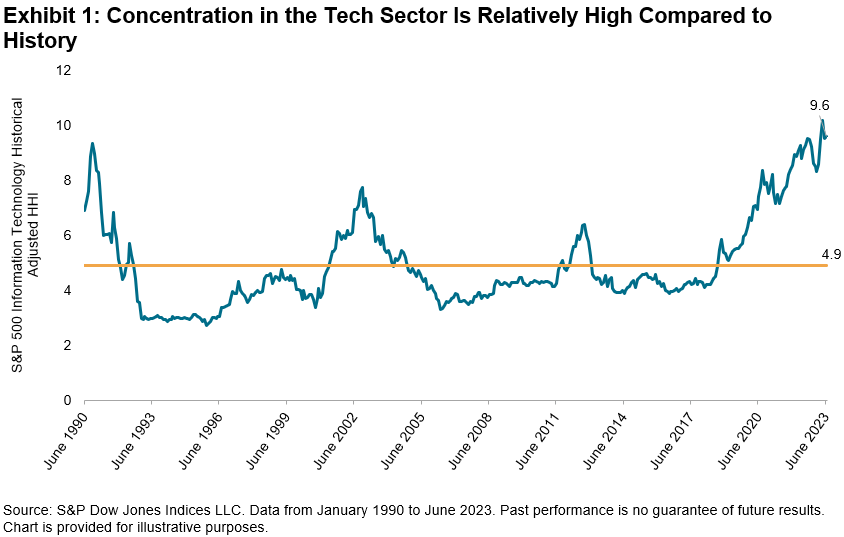

Tech’s current adjusted HHI level of 9.6 is in the 99th percentile of observations, as we observe in Exhibit 1, indicating an extreme level of concentration for the sector compared to the long-term average of 4.9. As Exhibit 1 shows, when concentration has been relatively high in the past, it has subsequently tended to decline.

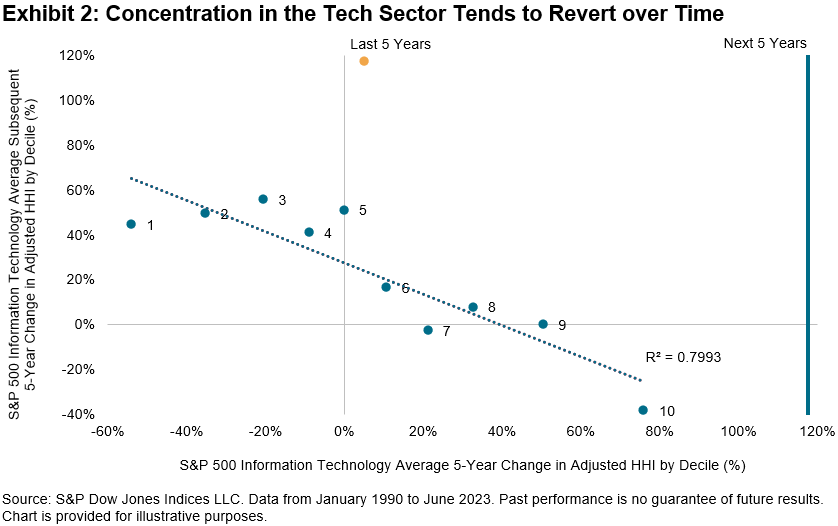

Another way to visualize the movement of concentration over time is to sort our data points into deciles based on Tech’s change in adjusted HHI over the past five years and measure the sector’s average percentage change in adjusted HHI during the subsequent five years. We see a clear negative relationship in Exhibit 2—an indication of mean reversion in action. Currently, Tech’s change in adjusted HHI of 118% over the five-year period ending in June 2023 is unusually high compared to the change of 5% during the prior five-year period ending in June 2018, indicating the rarity of the recent market regime.

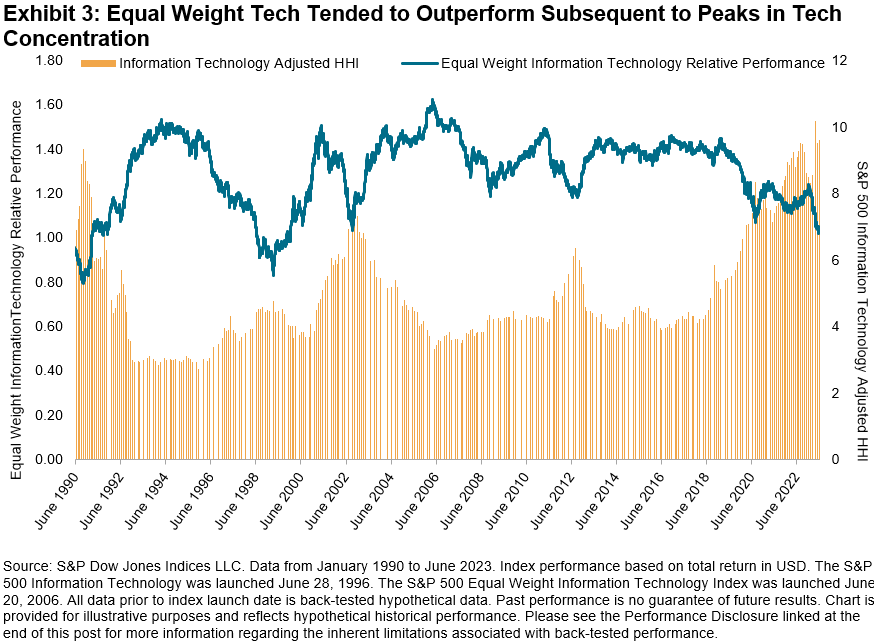

The tendency of Tech concentration to reverse has important implications for the performance of equal-weight sector strategies. Exhibit 3 illustrates the relationship between the Tech sector’s adjusted HHI with the relative performance of the S&P 500 Equal Weight Information Technology Index compared with its cap-weighted counterpart. Typically, after peaks in concentration (such as during 1990, 1999 and 2002), equal-weighted Tech has outperformed.

While apprehensions about concentration naturally bring back memories of the 1990s tech bubble alongside potential headwinds for active managers, we should note that today’s Tech sector is very different from that of the 1990s. More importantly, the role of an index is to reflect the market, and history can help us understand the dynamics of the various index weighting options available to track specific market segments.

The author would like to thank Austin Stoll for his contributions.

Disclosure: Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI, please visit S&P Dow Jones Indices. For full terms of use and disclosures, please visit Terms of Use.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here