Turbine bladesfor a wind turbine being transported to the construction site by truck

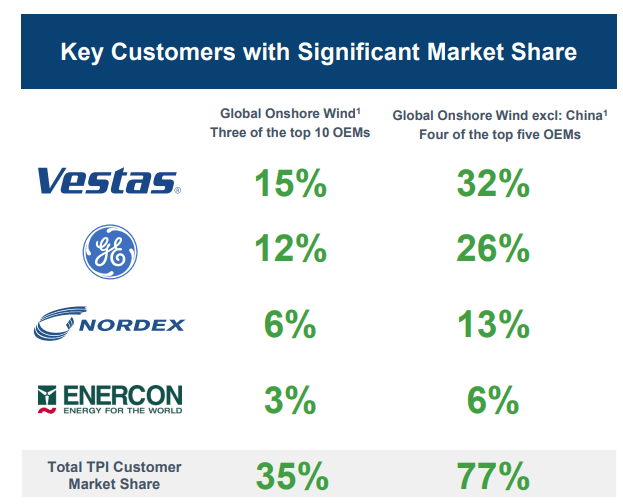

TPI Composites (NASDAQ:TPIC) seems a unique company – an independent producer of complex yet price-competitive wind blades for the largest wind energy components producers and installers in the world: Vestas Wind Systems (OTCPK:VWSYF), General Electric (GE), Nordex SE (OTCPK:NRDXF). It endeavors to produce indispensable components close to or in the markets where the wind energy is being installed en masse, enabling TPIC to offer the best deals. Thus, a spoon is dear when lunchtime is near.

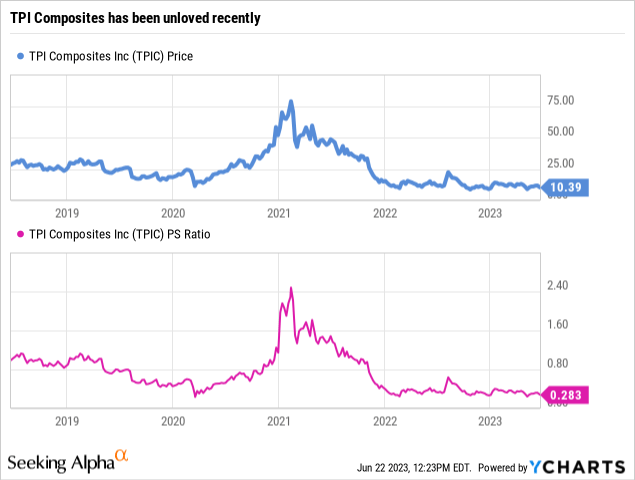

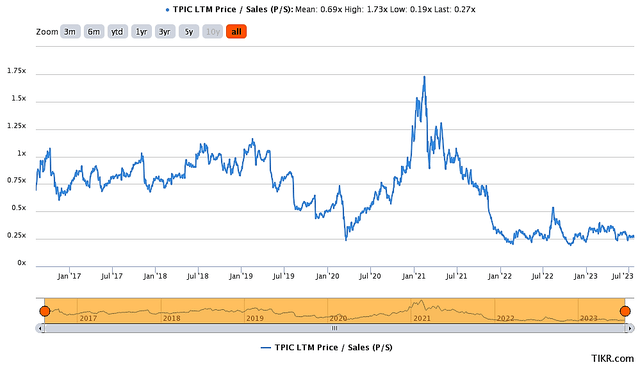

Given that the business is to survive and follow after the wind industry’s drive, overcoming mid-term challenges, the company’s current valuation, between 10 and 12 US dollars or sub 0.3 price-to-sales ratio, I think offers not only a golden ticket to investors but also a rough ride.

Brief overview

Several bullets that represent the company taken from the latest company presentation and Investor Relations web page:

- TPI Components started producing wind blades in 2001;

- Headquarters are in Arizona, USA. But production facilities are sprawling around North America, Denmark; India, Mexico; and Turkiye;

- The company made around 38% of all onshore wind blades on a MW-basis globally, excluding China, in 2022. That was around 8800 wind blades;

- It is a $1.7-1.8 billion-Sales-strong business;

- They manufacture to the customers’ exact specifications in facilities designed, built, and strategically located either near customers’ target markets or in low-cost, world-class locations, to minimize total delivered cost.

- The mission of the company is:

To deliver innovative and sustainable solutions to decarbonize and electrify the world by expanding the adoption of renewable energy. We accomplish this by cultivating an inclusive culture that attracts, develops, excites, and retains exceptional talent.

And though the company is uniquely positioned and tied to best-in-class wind-energy OEMs, the stock has failed to show sustainable price appreciation. There are reasons for concern, but I doubt any of these reasons are serious enough to finish off the business.

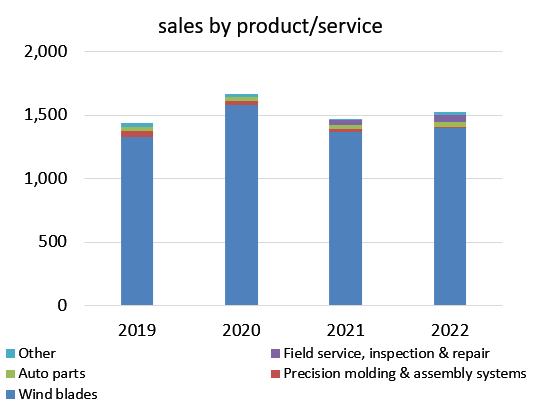

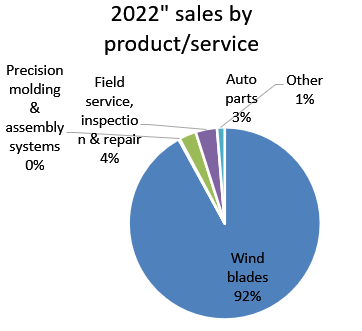

The company mainly operates as a wind blade manufacturer and dreams about better diversification through adjacent areas; you know that a tractor factory can produce tanks, so if your facility outputs wind blades, molding composite materials, it can also produce something like body parts for the automotive industry. In 2022 alone auto parts segment grew by 18%. Nevertheless, Other operations’ size is irrelevant regardless of the current growth dynamics; TPIC is far from being a second Magna International Inc (MGA). Segments are presented in the charts below, and I must note that in 2021 the company separated the Wind blades segment into Wind blades and Field service, inspection & repair. Combined, these two would show a lesser decline to the 2020’s peak figures.

Sales by product/service (Company financial reports) 2022: Sales by product/service (Company’s financial reports)

And the last thing to mention here is that TPI Composites has been pushing its sales constantly, making its stocks attractive. But 2022’s financial data put a stain on this story, so it came as a relief for me when the business started showing progress again, though at the expense of profitability; however, that is a common issue in the industry after the pandemic.

In the right place at the right time

TPI is boasting with its customers – the top dogs in wind energy. The greatest share belongs to Vestas at 35% of sales in 2023; Nordex is not far behind at 33%; GE – 27%; and Enercon – 5%.

TPI’s key customers (Investors’ presentation)

There is an objective reason to exclude the Chinese market from the overall count because it is opened up for the Chinese wind companies only, oh, and by the way, the same holds for the solar energy companies.

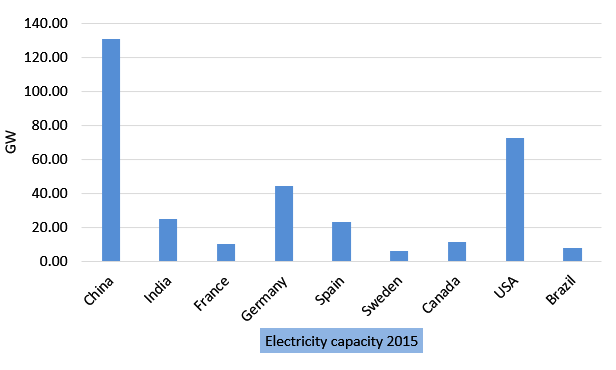

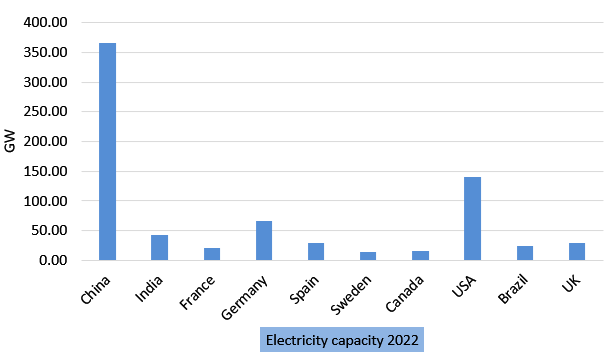

I have been watching wind and solar energy since 2009, from the humble proclamation as a force to be reckoned with to mass adoption. This power is a train that simply goes on and on. Please, examine a couple of charts to support the statement below. Wind energy electricity capacity changed for the US and Canada by 10% ten-year CAGR, 21% for China, 11%, and 8.3% for France and Germany, respectively. I could have proceeded but saw no reason. These rates stand out and, through time, turn over global energy sources. Thus, as I said, the train goes according to schedule, and I can’t see any major delays. To reach zero emissions by 2050, IEA expects wind installs to reach 5X that of 2022. And that lays a solid foundation for the ever-increasing demand for TPI Composites products for years to come. In my view the macroeconomics for the company seems just nothing less than perfect. Still, the company can fail but due to microeconomics principally.

Wind energy electricity capacity in 2015 ( International Renewable Energy Agency) Wind energy electricity capacity in 2022 ( International Renewable Energy Agency)

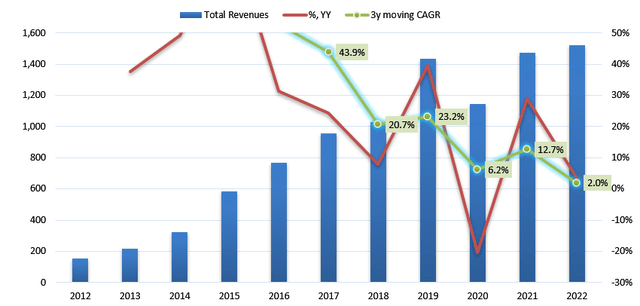

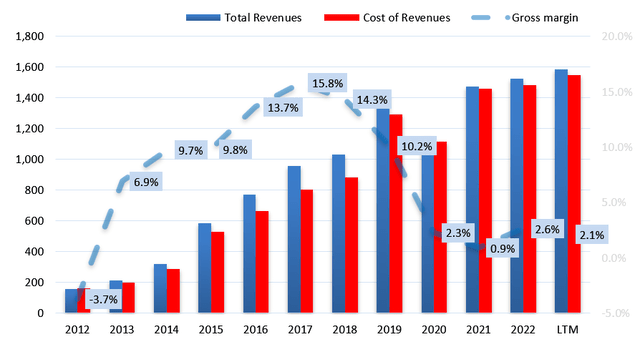

The company’s financial results have put it on the investors’ map. Sales grew from $156 million in 2012 to $1.522 billion in 2022, or 25.6% 10-year CAGR. We are witnessing the maturing of the business; it bumped into a glass wall a couple of years ago and, since then trying to reinvent itself.

Revenue, YoY change, 3-year moving CAGR (Financial reporting and Author’s estimates)

Financial health and trends within the business

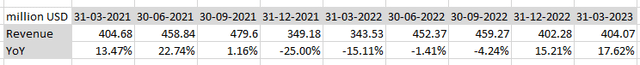

Does the company have what it takes to push sales along with the industry trend? I’ve been asking this myself for the last 18 months, and the last couple of quarters indicated that at least a recovery is taking place, which makes me hopeful. The dynamics must sustain this year to dissipate most fears about the future.

Sales dynamics year over year (Tikr.com)

In my opinion, the main concern with TPI Composites’ future, illuminated by the price action of TPIC stock, is primarily reflected in the following chart. The revenue of the company is growing, and that’s encouraging; however, since 2019, they probably lost pricing power over their customers, which put the business into a tight situation; now they have to juice water out of the sand to stay alive and independent. The 7-year CAGR of Revenue growth was 14.6% in 2022, but COGS changed by 15.9%, a difference of 1.3%, eating up around 9.1% of gross margin over seven years. So, the gross margin is back to where it was in 2012 when things only started to pick up. So discouraging; no wonder valuation of the TPIC fell from its average of 0.7 PS before the start of 2022 to around 0.25 now. That should be stressed twice, that crumbling of gross margin happened on the COGS side, thus raw materials and other essential inputs, even before the inflation spike of 2021-2022+ kicked in.

COGS outpaces Sales’ growth (Financial reporting and Author’s estimates)

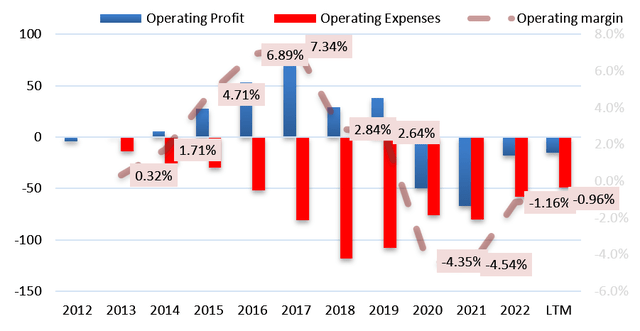

The operating margin turned negative in 2020, and the root cause was still the leading growth of COGS over Revenue. Operating expenses were adjusted to counterbalance the situation when possible. But since the gross margin was already razor-thin, that still turned out dreary. So, when the one bright spot of the business (prolonged revenue growth) started to tarnish in 2022, Mr. Market acted erratically pessimistic.

Operating margin looks dreary (Financial reporting and Author’s estimates)

Once we understand the primary reason for the stress TPI Composites is getting through, we can go back to quarterly results. 4q 2022 showed +15.21% year over year, and 1q developed that trend by +17.62% YoY. That puts most fears back on their shelf, so we can continue checking the company’s financial health.

Management gives the following explanation of the recent misfortunes. Demand for carbon fiber and resins continues to overweight supply, and TPI sees no changes in the equilibrium in the mid-term. Elevated electricity prices in the cost structure keep the situation unchanged. Demand from auto, construction, and other industries also remains hot. But most of the company’s contracts are covered by customer feeds, allowing TPI to stay relatively safe. On the other hand, that doesn’t allow the company to widen its gross margin.

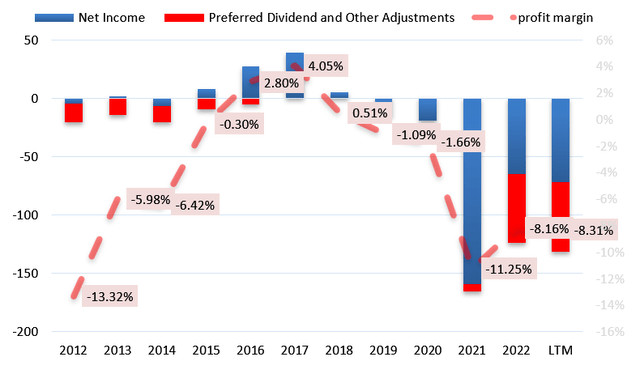

Nevertheless, as if it was not enough pain for investors, the business is in a rush to disappoint with heavy-weight payments for preferred shares that seem to be a part of the deal all the way. See the following chart: the company was rarely profitable. That forces us to ask a tough question: – Does it worth it?

Profit margin is just pain (Tikr.com and Author’s estimates)

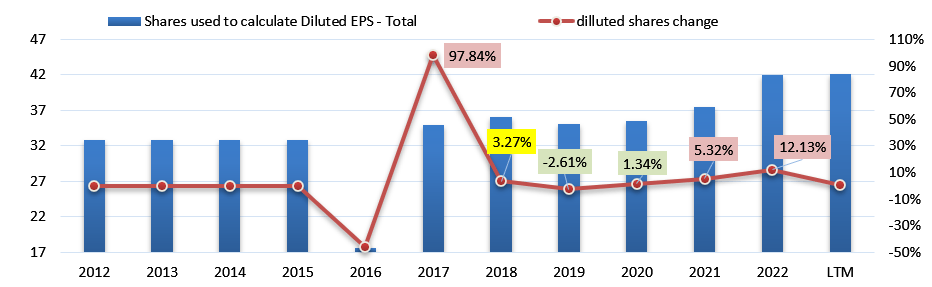

The company’s profitability is so abysmal that a rare analyst would even desire to check how bad things are at the per-share level, I dare say. Making the picture worse, the company doesn’t seem to hesitate in adding more shares when they feel like it.

Diluted shares change (Tikr.com and Author’s estimates)

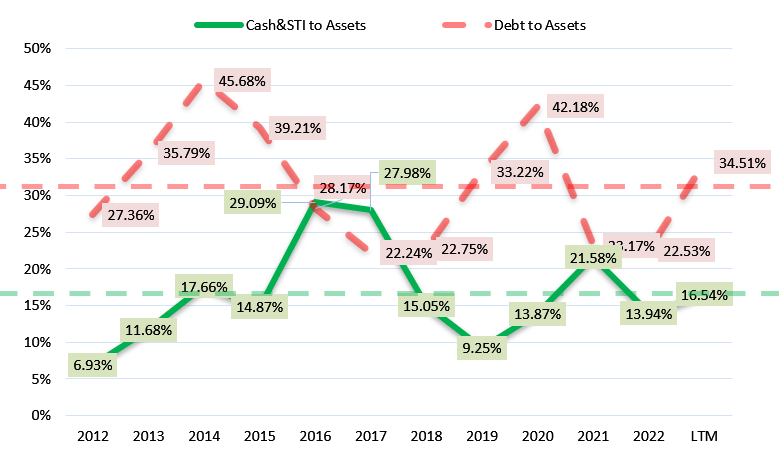

The following chart indicates that the balance sheet’s condition is normal/average. The business has the cash to handle a few upcoming quarters, given that the business is picking up, resulting in consistent sales growth and wider margins. The recent uptick in debt to assets wasn’t exciting, tough.

Financial health (Tikr.com and Author’s estimates)

Yet, I must mark a significant amount of Series A preferred stocks with a par value of 350 million USD at the end of 2022, which is quite a tricky issue as these 350 million consist of $257.7 million of preferred stocks and $97.3 million of warrants to purchase 4.66 million of common shares of TPI at par value of $0.01. Somebody struck an excellent deal with the company, didn’t he?

The company’s presentation dated Nov 8, 2021, pours some light on the matter:

- TPI will issue to Oaktree a warrant to purchase approximately 4.7 million shares of TPI common stock at an exercise price of $0.01 per share;

- Oaktree is an experienced investor with a successful track record of investing across the energy value chain;

- Series A preferred stock will be entitled to a 11% annual dividend, which may be payable in kind during the first two years;

- Proceeds received by TPI will be used to: – Repay all amounts outstanding under the revolving credit facility; and – General corporate purposes;

- Subject to mutual agreement, Oaktree may provide an additional amount up to $200 million for follow-on capital”

So, 4.7 million new shares, if or when that happens, will dilute current shareholders by 11.17%. The rich 11% annual dividend due to Oaktree Capital, compared to ICE BofA US High Yield Index Effective Yield, which currently returns 8.5%. It is nothing short of an inconvenient state of the company, forcing it to accept the terms. On the other hand, despite the cushy terms of the deal, Oaktree didn’t want to sponsor the failure. I hope both sides will eventually get what they want from this deal.

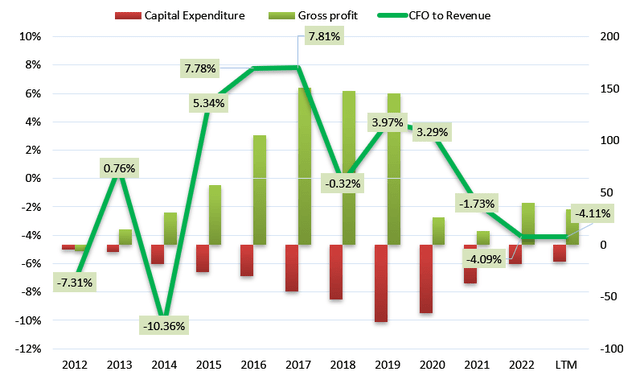

As a closing chart of this section, I offer you the following one. Which shows several concerns: a) Cash flow from operation to Revenue has been on a negative streak since 2021 and continues the search for the bottom, and the curve’s trend neither calms me down; b) I don’t think that the fallen CapEx is a result of exiting a capex-intensive phase of the business, but the company just had to put it in line with the narrowed marginality. It can also be a good thing, telling that business development expenses were carefully vetted for leaner spending.

CaPex and CFO to Revenue (Tikr.com and Author’s estimates)

How to approach the stock?

The price tumbled during the COVID-19 crisis to rise again as it never did before, and once again in late 2021 – yearly 2022 out of concerns that TPI Composites would able to handle not only widening losses but also declining revenue. Luckily, the company pulled that up, giving analysts room to express expectations. The financial part of that article showed that the business is still vulnerable and dependent on many factors. However, the future is still grand for wind energy, especially for the company that resumed its growth. That means that the odds are high enough that the situation could develop the same way it did previously. Maybe not so bright as in 2017-2020; nevertheless, the bad would be balanced by the good. So, statistically speaking, that is entirely reasonable to see TPIC return to a 0.5 level of PS or even 0.7, which proposes a gain between 50 to 150%, in my opinion.

Tikr.com

I started accumulating the stock in 1H 2022 at $12 and as low as $8.9 in 1H 2023. In August 2022, the price went up to $24. The overall position doesn’t exceed 5% of the entire portfolio because I am not that confident about TPI. Given the projected stabilization of sales and favorable sector development, that won’t be impossible to see TPIC re-testing $25 or higher in 12-24 months in my view. The downside can be between 5 to 7.5 USD in a negative case. I advise you to give it a go; the valuation between $9 and 11 is acceptable to participate. The geographic location of the company’s production facilities in Mexico, Turkyie, the United States, and India, close to main wind energy construction sites in the US, EU, and India, is unique for sure. If the independent business fails, I think it could be bought out by one of the wind energy OEMs, which is a cushion for patient investors.

Risk factors

- Have the analysis sent investors down the wrong path, the downside can easily harm the position by 25-40% if the emerging recovery of Sales dynamics proves to be premature.

- The deal with Oaktree Capital is a double-edged blade that has given TPIC the required financial support but has also been sucking the business’s juice out.

- Absolute dependency on a few global wind energy players limits the company’s profitability.

Read the full article here