The value of goods the U.S. traded with the world plunged in June 2023.

This may be the biggest economic story in the world that isn’t getting enough serious news coverage. Most of that coverage is focusing upon the U.S. trade deficit shrinking during the month because of a sharp drop in imports. That coverage then focuses on the United States’ trade with China, which has been in decline since October 2022.

What that coverage is missing, however, is that the United States’ trade with the rest of the world has been falling since February 2023. That trade with the rest of the world is what plunged in June 2023.

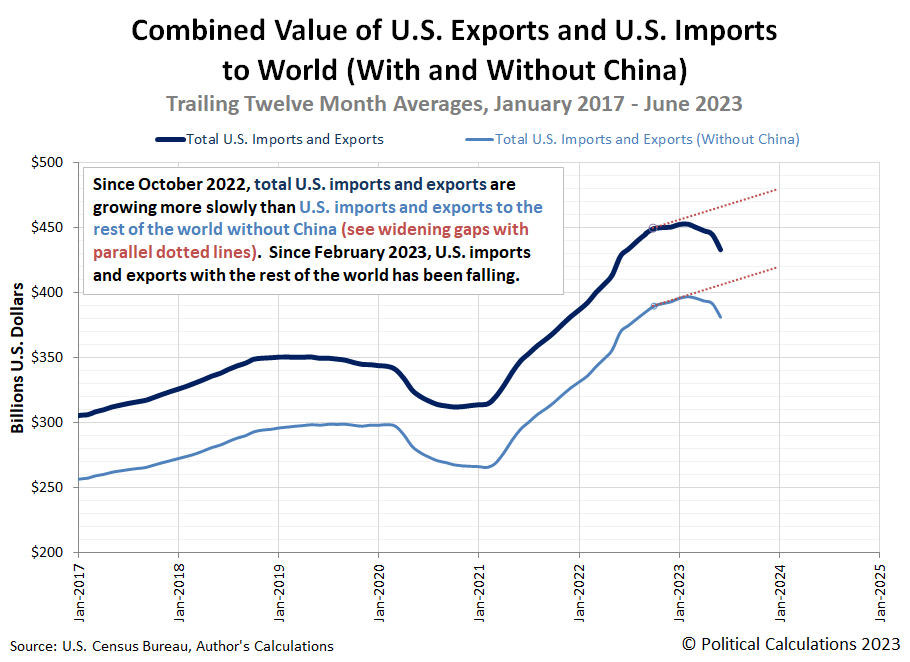

The following chart presents two data series over the period from January 2017 through June 2023. The upper, thicker, dark blue curve represents the trailing twelve-month average of the sum of U.S. exports to and imports from the entire world. The lower, thinner light blue curve represents the trailing twelve-month average of the U.S.’ combined imports and exports without the portion of its trade that’s with China.

We’re using the trailing twelve-month averages as a simple way to smooth out the month-to-month seasonal variation in the data and focus on the underlying trends. This data is capturing the decline that’s been taking place in both the U.S. imports “and” exports. Treating the red dotted lines as counterfactuals (they’re really a linear projection of the U.S. trade with the world without China from October 2022 through February 2023), we find the U.S.’ trade with the world not including China has shrunk by about $25 billion between February and June 2023. When China is included, the gap increases to around $35 billion.

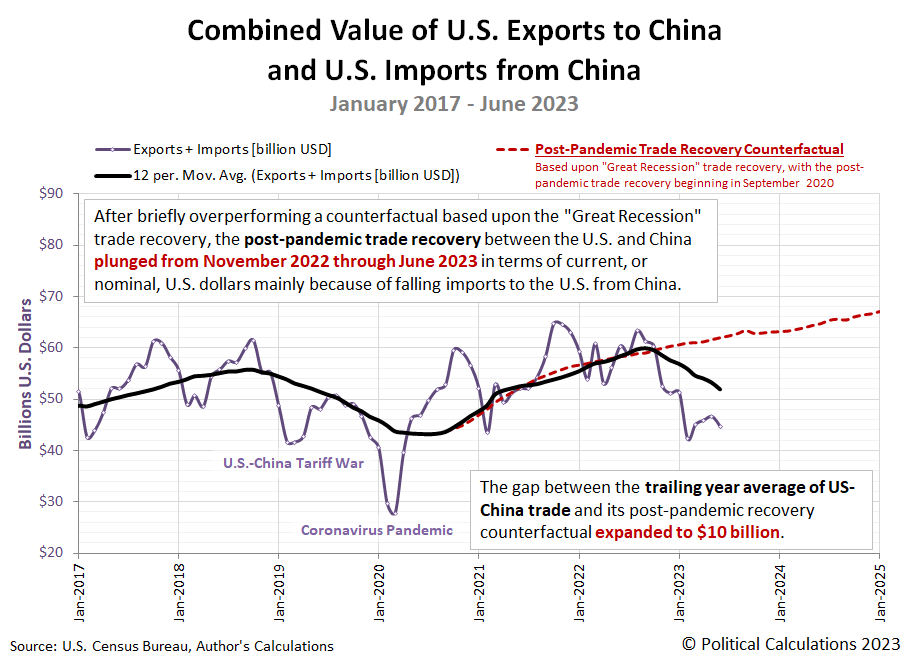

The next chart focuses just on the U.S.’ trade with China. Here, the thinner purple curve represents the monthly raw combined imports and exports between the two countries, while the thicker, black curve represents the trailing twelve-month average of the monthly data. Here, we’ve also presented a counterfactual of what the trade between the U.S. and China would look like if it followed the pattern of the recovery of trade between the two countries after the 2008-09 recession.

Here, we find a sharp dropoff that has taken place since October 2022. As of June 2023, there is a $10 billion gap between the counterfactual and the trailing twelve-month average of the value of goods traded between the U.S. and China.

Now, for the kicker. Looking forward to July 2023’s trade data, China is reporting its trade with the world dropped sharply. Since China is the world’s biggest exporter, that is a pretty good sign that what we’re seeing in the U.S.’ trade data will be continuing when the U.S. reports its July trade figures.

References

U.S. Census Bureau. Trade in Goods with China. Last updated: 8 August 2023.

U.S. Census Bureau. Trade in Goods with World, Not Seasonally Adjusted. Last updated: 8 August 2023.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here