TransUnion (NYSE:TRU) is one of the major 3 credit bureaus, along with Equifax (EFX) and Experian (OTCQX:EXPGY). TransUnion’s sole focus is on consumer credit, unlike the two other bureaus that have both consumer and business credit ratings.

The credit bureaus collect information on consumers, primarily via creditors and public records. They issue credit reports, which contain information about a consumer’s identity, current lines of credit and inquires, and public record. This is the data used by Fair Isaac (FICO) to calculate FICO scores. FICO scores can differ based on credit bureau using different models or having slightly different information, but generally each produce similar reports.

The focus of management’s communication relating to the core business is all around macro. The core business is heavily dependent on the strength of consumer credit, and which direction the macro winds are blowing. Recently, they’ve mentioned the balance between the strong headline numbers with slipping consumer confidence and lenders tightening credit standards. Little of this should actually matter to long term investors.

Two-thirds of TransUnion’s revenue is within the United States. US revenue is roughly a 50/50 split between financial services and emerging verticals. Financial services consist of the typical credit report customers: banks, finance companies, and other lenders. Emerging vertical is a bit more hazy:

We offer onboarding and transaction processing products, scoring and analytic products, marketing solutions, fraud and identity management solutions and customer retention solutions.

This segment is comprised of acquisitions that TransUnion has made over the past several years. Credit reports are essential for lending decisions, but instead of TransUnion leaning into this advantaged business, they’ve elected to make a number of acquisitions that don’t quite seem to fit together that well.

Acquisitions:

TransUnion’s purchase list over the past several years includes the following: Verisk Financial Services (for $515M), Neustar ($3.1B), Sontiq ($638M), Tru Optik Data Corp, Signal Digital, TruSignal, and iovation.

Verisk Financial Services itself was a collection of businesses, TransUnion elected to keep Argus Advisory and divest the rest. Argus Advisory’s website is full of buzzwords, it’s very difficult to understand what they do.

TransUnion’s acquired Neustar near the peak of valuation multiples in 2021, paying $3.1B or 27x adjusted EBITDA. TransUnion reports that the adjusted EBITDA margin of Neustar is 31%, lower than the reported company-wide margin of 37%. TransUnion paid a high multiple for a business with a worse margin profile than its core. The CEO spoke to the vision of combining this business with TransUnion:

Both companies visions are to help make trust possible in the digital economy by resolving the identity of consumers online in order to mitigate e-commerce fraud and help tailor marketing offers and service experiences for consumers during their online transactions.

TransUnion singled out Neustar’s OneID platform as a key reasoning for the acquisition. OneID put out a press release back in 2013 announcing it was working with Salsa Labs on a feature called QuickDonate which hoped to help nonprofits increase donations. While this sounds sophisticated, it appears this product just saves payment information. A feature that most websites have.

Other than that, Neustar has published a lot of press releases, also with lots of buzzwords, while there’s no customer testimonials to be found.

Other businesses part of Neustar included Caller Name Services and Trusted Call Solutions. It’s unclear how call technology is adding value to TransUnion’s core business. They paid a huge multiple for these businesses, and yet there seems to be no clear synergies between them and TransUnion’s core business.

Before these, TransUnion went on a frenzy buying media businesses that it claims allow them to “deliver more real-time targeted data across online streaming services to improve our customers’ digital marketing campaigns”. This also feels quite random and disconnected from TransUnion’s competency.

TransUnion lays out its financial statements fairly clearly, and the vast majority of revenue is derived from the core credit report business. But shareholder’s capital is being funneled into all of these side projects that are very difficult to understand.

Valuation:

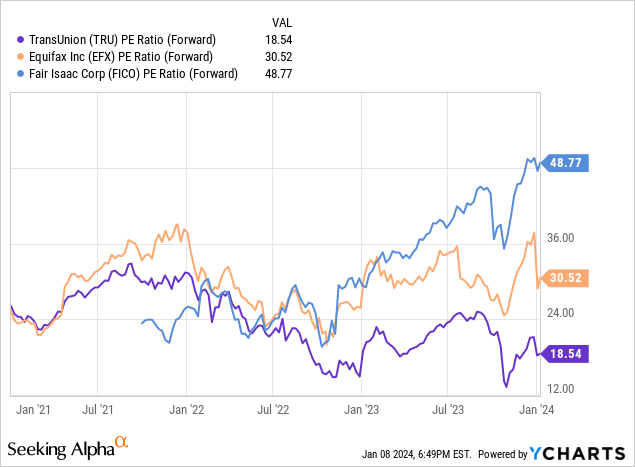

TransUnion deservedly doesn’t trade at an expensive multiple:

TransUnion is not a buy at any price for now. Shareholders deserve better. TransUnion’s management should more clearly articulate what the acquired businesses do and how they are adding value.

TransUnion pays a very small dividend, and doesn’t repurchase shares. In fact, not once on the last 4 earnings calls has management mentioned the word “buyback” or “repurchase”. “Acquisition” however, is mentioned 23 times just on the Q3 call. TransUnion has been extremely liberal with spending shareholder capital on an assortment of random acquisitions. TransUnion’s core business is well established, and its current multiple is cheap, buybacks would be accretive.

For TransUnion to be a compelling investment, they must get back to the basics. Their core business of credit reports is valuable, the sideshow is questionable. TransUnion should be much clearer with investors regarding its acquisitions and how they are creating value.

Read the full article here