Introduction

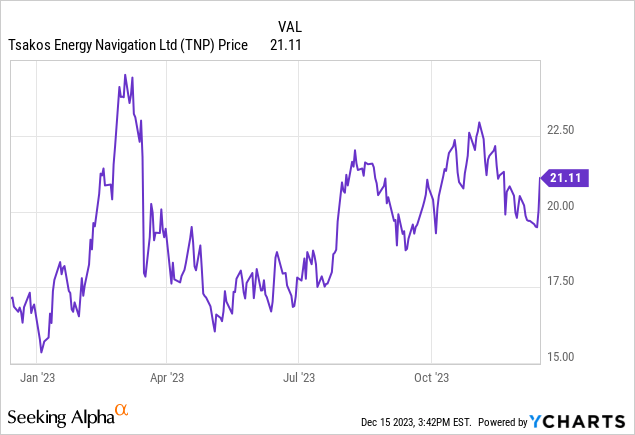

As I have been shifting my focus on buying fixed income in the past few months as I was expecting “peak interest rates” to have been achieved, I’m having a closer look at some of the preferred shares I either already own in my portfolio or the preferred shares I would like to build a position in. As it has been a while since I checked up on the financial health of Tsakos Energy Navigation (NYSE:TNP) and its preferred shares Series F (NYSE:TNP.PR.F), I think an update is way overdue.

The preferred dividends were very well-covered this year

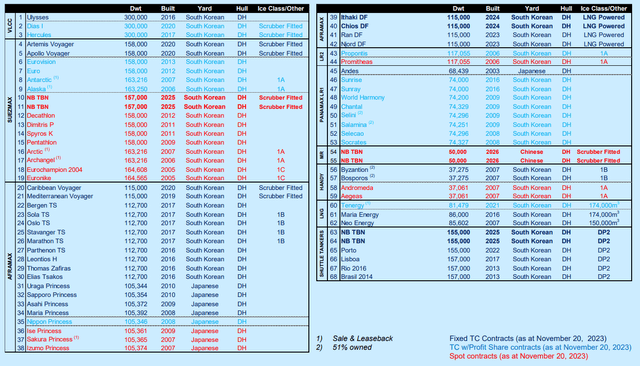

The shipping sector and more specifically the oil shipping sector usually is a very volatile sector, but in the past few years, severe underinvestment in newbuilds in certain segments has really helped the shipping companies for several quarters now. I was mainly interested in Tsakos Energy Navigation as this company offers excellent exposure to several different vessel classes. While the market was focusing on VLCCs and Suezmax class vessels, I wanted to increase my exposure to the Aframax segment as the long-term charter rates started to pick up quite well in 2021 and 2022. As you can see below, Tsakos Energy Navigation has a substantial fleet of Aframax vessels.

TNP Investor Relations

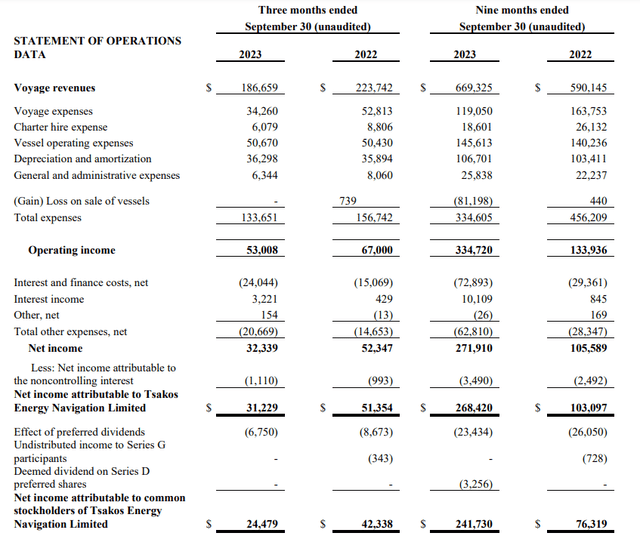

The strong spot and charter prices in this segment of the market has really helped Tsakos, and the company reported a total revenue of $187M in the third quarter of this year. As the total operating expenses were “just” $133.7M, Tsakos Energy Navigation reported an operating income of $53M, as you can see below.

TNP Investor Relations

The company doesn’t escape the high interest rate environment, and the net interest expenses of approximately $21M are definitely weighing on the total result. As you can see above, the interest expenses required about 40% of the operating income. The net profit was $32.2M of which $31.2M was attributable to Tsakos Energy Navigation after adjusting the result for the $1.1M in net income attributable to minority interests.

From the $31.2M, we still have to deduct the preferred dividend payments, resulting in a net income of $24.4M that was attributable to the common shareholders of Tsakos. This immediately already confirms the preferred dividends are very well covered: The company needed just around 20% of its net income to cover these preferred dividends.

The EPS in the third quarter was approximately $0.83 while the 9M 2023 EPS was $8.19. That’s a very impressive result, but it also includes a $81.2M gain on the sale of vessels which represented almost $3/share in additional income. But in any case, Tsakos’ common shares still offer excellent exposure to the different vessel classes.

I still have a pretty substantial position in the Series F preferred shares

As mentioned in the previous article, the Series F preferred shares are trading as (TNP.PR.F) and currently have a 9.5% preferred dividend which will become a floating dividend after July 2028 based on the three-month LIBOR +6.54%. (This will undoubtedly be updated to the SOFR benchmark rate as it is the most likely reference rate but I can’t recall seeing official confirmation on this from Tsakos. In any case, we are still about 4.5 years away from the reset date.)

In the previous segment, I already confirmed the preferred dividends are very well covered by the reported net income despite the annualized depreciation expenses of close to $150M.

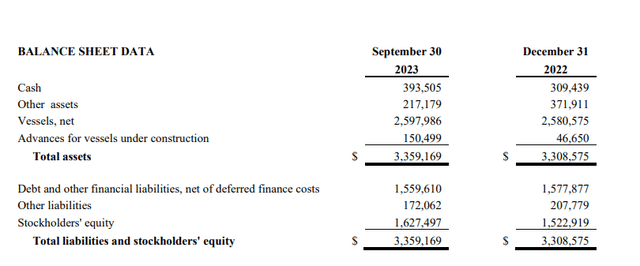

That’s encouraging, but I also want to make sure the balance sheet is strong enough to provide a cushion of common equity to absorb potential losses further down the road.

And I’m very encouraged to see this is effectively the case. The company only shows a shortened balance sheet but as you can see below, there was about $1.63B in stockholders equity on the balance sheet.

TNP Investor Relations

As of the end of H1, there were 4.75 million Series E and 6.75 million Series F preferred shares outstanding for a total of 11.5 million preferred shares representing $287.5M (The Series D preferred shares were called earlier this year). The H1 balance sheet also tells us the $52M in equity attributable to the non-controlling interests also is included in the total amount of equity on the balance sheet. This means there’s approximately $1.3B in common equity attributable to Tsakos Energy Navigation on the balance sheet, which is a very comfortable position to be in.

Investment thesis

I currently have no position in the common shares of Tsakos Energy Navigation but I feel very comfortable owning the preferred shares. These are very profitable times for Tsakos and the company continues to rejuvenate its fleet by selling older vessels and using the incoming cash flow to acquire newbuilds. Two new Aframax vessels were delivered in September and October while two additional Aframax class vessels will be delivered in Q1 2024. An additional six vessels (two DP2 shuttle tankers, two Suezmax, and two MR class vessels) will be delivered in 2025 and 2026.

While the Series F preferred shares are currently trading at a premium to the principal value of $25/share, the yield to call is still a very respectable 8.8% and that is fine with me.

Read the full article here