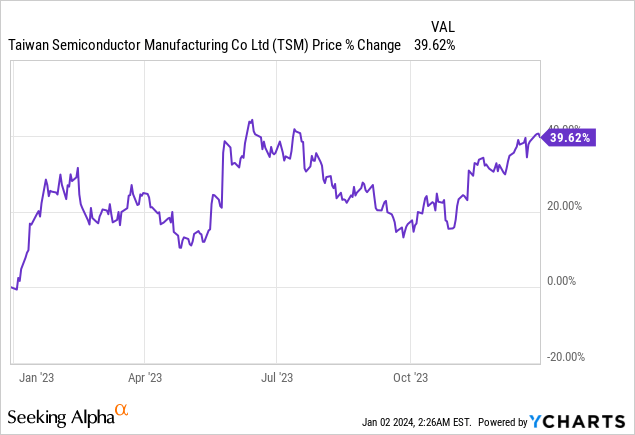

Taiwan Semiconductor Manufacturing Company (NYSE:TSM) is a well-run global foundry with a dominating semiconductor manufacturing market share. The company has achieved double-digit top line growth in the last five years and has a strong financial framework in place. Given the strong market leadership in semiconductor design and manufacturing, potential for a rebound in the semiconductor market in FY 2024 and a cheap valuation based off of P/E, I believe the risk profile for TSM is skewed to the upside even after shares have appreciated 40% in the last year!

Previous rating

I have not covered Taiwan Semiconductor Manufacturing Company before, but I have dealt with Intel (INTC) before which I rated as a buy in October — The Bleeding Has Stopped (Rating Upgrade) — due to a changing trajectory in the important Client Computing Group. Intel is also investing in its foundry business, Intel Foundry Services, which generated 300% revenue growth in Q3’23 and reported $311M in revenues in the third-quarter. Given the limited supply in the market as well as dominant market position of TSMC, I believe the Taiwanese company’s shares are attractive.

Leading market share and top financial performance

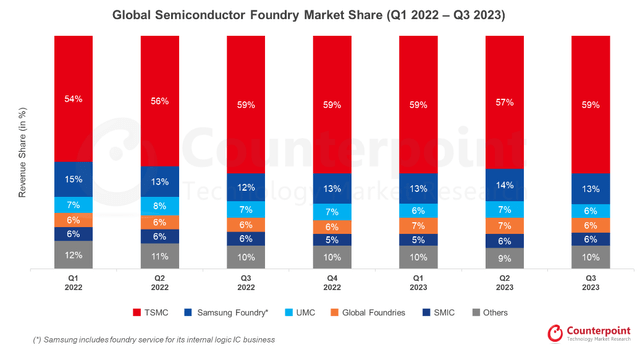

The biggest reason to buy into TSMC is that the Taiwan-based company is the uncontested leader in semiconductor contract manufacturing and design business. According to Counterpoint Research, Taiwan Semiconductor Manufacturing Company had a foundry market share of 59% in the September quarter and this market share has remained remarkably consistent in the last five quarters. Foundries like TSMC produce semiconductors that are needed in computers which are then used to power almost everything else that we use today, including cars, ATMs, and refrigerators.

The second-biggest foundry player in the market is Samsung Electronics which only had a market share of 13% in the third-quarter. In other words, TSMC is by far the most dominant company in the semiconductor industry and has a market share about 4.5 times larger than its nearest rival.

Counterpoint Research

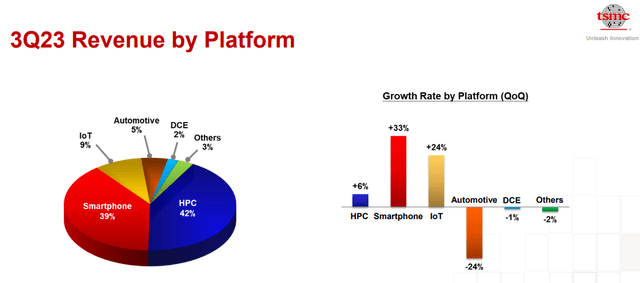

Taiwan Semiconductor Manufacturing Company is especially dependent on the smartphone industry which is also true for Samsung. The South Korean electronics manufacturer runs its own foundry and is a major player in the smartphone business as well (it had a 20% market share in smartphones in Q3’23). Obviously, demand for consumer electronics products is key to TSMC’s top line growth and smartphones alone generated 33% Q/Q revenue growth in the third-quarter for the company.

Counterpoint Research

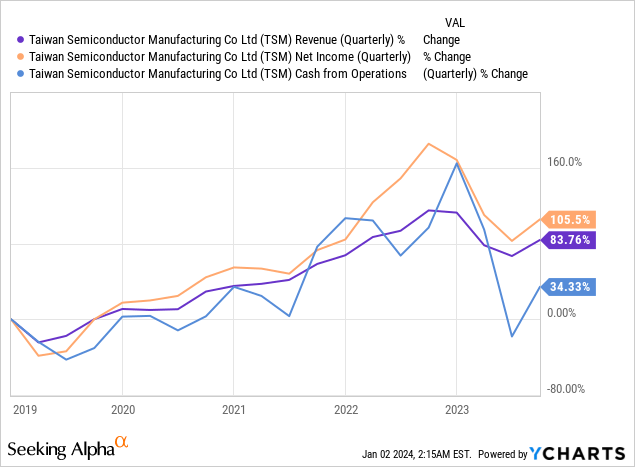

In the last five years, TSMC has been able to grow its revenues and earnings at double-digit rates: TSMC doubled its earnings due to its dominant position in the foundry market and due to accelerating demand for semiconductors during the COVID-19 pandemic. The long term trends look healthy and are reflected in the company’s medium term financial framework: TSMC has stated that it seeks to grow its revenues 15-20% annually between FY 2021 and FY 2026 and achieve gross margins of 53% or higher.

Potential rebound in the semiconductor market in FY 2024

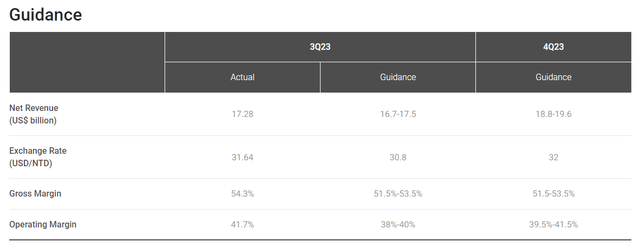

TSMC guided for $18.8-19.6B in revenues for the fourth-quarter, implying 11% quarter over quarter growth due chiefly to strong demand from the consumer electronics industry. The semiconductor maker also expects gross margins as high as 53.5% which would be consistent with TSMC’s longer term financial objectives.

TSM

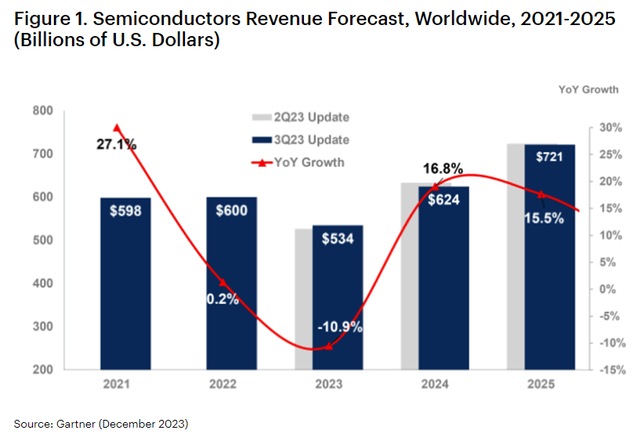

TSMC’s strong short term growth expectations are also confirmed by research company Gartner which sees FY 2024 broadly as a rebound year for the semiconductor industry. Weakening consumer demand in the second half of FY 2022 and in the first half of 2023 have negatively affected demand for semiconductors and resulted in a huge drop-off in device shipments, but there are signs of a recovery on the horizon that indicate that the semiconductor market is set for a rebound. Gartner forecasts the semiconductor industry to return to a year of growth in 2024 with global semiconductor sales set to rise 17% this year to $624B. A recovery in the semiconductor market could obviously result in an acceleration of revenue growth for TSMC as well as EPS upside revisions in FY 2024.

Gartner

In the longer term, I expect TSMC to see a lower market share in the foundry market, however, and potentially lower gross margins as well. This is because the U.S. has become acutely aware in the last several years that it is overly dependent on Taiwanese semiconductor supplies which could be disrupted in case of a potential Chinese invasion. As such, I believe the U.S. and its allies may want to further strengthen domestic production of semiconductors and potentially relocate their chip supply chains back to the U.S.

Valuation of TSM vs. Intel

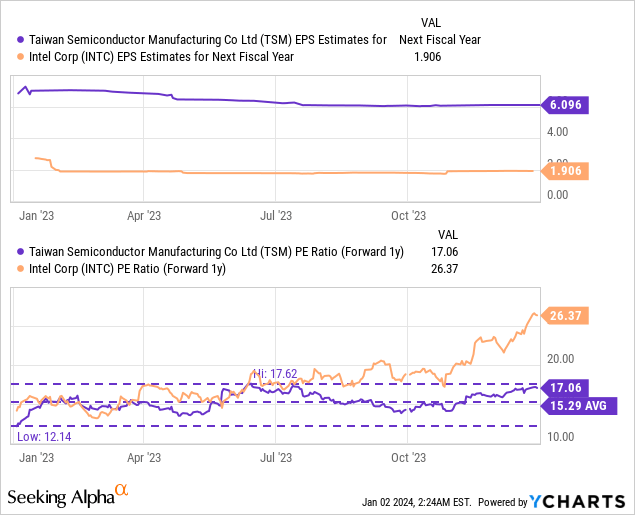

TSMC is trading at a reasonable P/E ratio considering that the company is widely expected to grow its top line and earnings at double-digits in the foreseeable future. According to SA-provided consensus estimates, TSMC is projected to deliver an annual average top line growth rate of 12% between FY 2024 and FY 2027.

Based off of $6.10 per-share in earnings expected for FY 2024, shares of TSMC are trading at a P/E ratio of 17.1X… which implies an earnings yield of approximately 5.9%. Intel, on the other hand, is significantly more expensive, in part because investors have been more bullish pricing in a chip recovery in FY 2024 and may hope for a resumption of dividend growth after the chip maker cut its dividend last year.

Shares of Intel are now trading at 26.4X FY 2024 earnings and an earnings yield of 3.8%, but Intel is expected to grow “only” 10% between FY 2024 and FY 2027. I believe shares of TSMC could trade at 22-23X if the semiconductor market sees a strong recovery in FY 2024 at which point shares would still be significantly cheaper than Intel’s. The valuation multiplier range implies a fair value for TSMC of $134-140.

Risks with TSMC

TSMC is a Taiwan-based semiconductor manufacturing company and as such at risk from a potential invasion by China. China has repeatedly said that it wants to reunify China with Taiwan which could pose a risk to TSMC’s independence. However, this scenario poses an even bigger risk to Western companies that have become dependent on TSMC for its semiconductors.

The biggest commercial risk, as I see it, likely relates to growing investments in the foundry space by some of its peers, like Intel. Intel is still far behind TSMC regarding market share, but Intel has made a long-term commitment to its foundry business. Intel could also be the biggest beneficiary if the U.S. government decided to relocate its chip supply chain for national security considerations back to the U.S.

Final thoughts

From a strategic (market share) point of view, there is no company that is more important in the semiconductor market than TSMC… which of course puts the Taiwan firm into an enviable competitive position. The semiconductor firm has managed to nearly corner the market and owns almost two-thirds of the foundry market today. TSMC has also been able to translate this dominating position in the global foundry industry to generate consistent double-digit top line and earnings growth in the last five years. Going forward, the dominating position in the semiconductor market as well as improving recovery prospects for FY 2024 support strong earnings growth as well. Importantly, with TSMC just trading at 17.1X earnings, and therefore at a solid 6% earnings yield, I believe shares of TSMC are an attractive long term buy for growth investors!

Read the full article here