I continue to believe that the long-term growth story for Twilio remains supportive, given the company’s leading position in the high-growth Communications Platform as a Service (CPaaS) market. However, the company’s recent headcount reductions (5% in December 2023, following 17% in February 2023, and 11% in September 2022) also suggest somewhat struggling topline momentum, especially in the company’s D&A segment. Notably, investors should consider that Twilio is currently running on a 8% YoY sales expansion rate for TTM 2023 vs. FY 2022. And for a below double-digit growth, a 35x 2024 P/E multiple may be a too rich price to justify an investment. That said, I feel that Twilio overshot my (adjusted) price target, which I now set $66.78/ share, vs. $58.15 estimated previously. As a consequence, I downgrade TWLO shares to “Hold”.

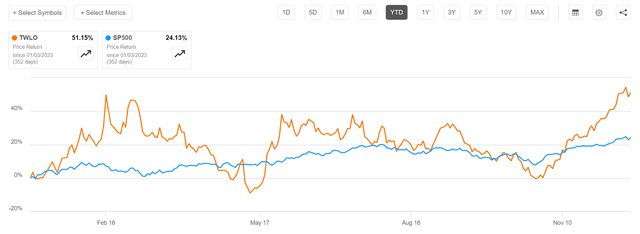

For context, Twilio stock has outperformed the market YTD. Since the start of the year, TWLO stock is up slightly more than 51%, compared to a gain of approximately 24% for the S&P 500 (SP500).

Seeking Alpha

Operational Efficiency Push Through Headcount Reductions …

On December 4th, TWLO shared with investors an 8-K filing announcing that the company is planning to reduce its headcount by approximately 5%, or roughly 300 employees. Notably, this announcement comes after previous reductions of 17% in February and 11% in September 2022. While these changes are expected to result in charges between $25-35 million, with most of the headcount adjustments completed by the first quarter of 2024, I estimate that Twilio’s operating cost savings per year may amount to as much as $50-60 million.

Moreover, as part of the 5% reduction, TWLO disclosed that the company is reallocating resources in various operating segments and eliminating certain go-to-market functions, along with support roles in marketing and finance. Specifically, the company is integrating Flex into its Communications unit, which should help streamline the customer purchasing experience by combining Flex with voice, IVR, and core messaging due to existing product synergies. While some Flex GTM positions are affected, Communications representatives will now be able to sell Flex alongside other products.

That said, in a letter to employees, CEO Jeff Lawson reportedly outlined the reasons behind these organizational changes. He highlighted the success in the Communications division meeting its goals but acknowledged underperformance in the Data & Apps business. Lawson also mentioned overspending on investments within the Data & Apps unit.

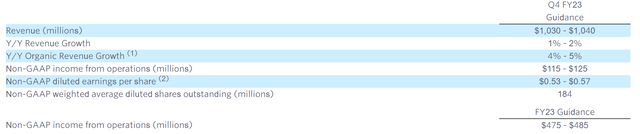

Lastly, as part of the 8-k filing, I highlight that management broadly reiterated its 4Q and FY23 guidance, suggesting revenues and operating income for the December quarter of $1,030-1,040 million and $115-125 million respectively.

TWLO Q3 2023

… Also Expose Fading Growth Momentum

While I view Twilio’s push to squeeze operating efficiency and profitability as a clear positive, I also point out that the headcount reduction comes with a bland aftertaste. Specifically, investors should consider that Twilio’s data and applications business, which is at the center of the restructuring, has been viewed as a key driver of the Twilio growth story. I personally saw 12-15% YoY growth for this segment through the next five years, to 2027. However, CEO Lawson’s letter to employees suggests that growth in the D&A business may trend closer to high single digits, or very low double digits. Further, I note that Twilio’s overall business growth is currently running at 7.9% YoY (TTM vs FY 2023). This is certainly not a topline growth that a tech-/ Saas- focused Investor hopes to see for his/ her portfolio companies.

In my opinion, it is still unclear whether Twilio’s growth weakness is a consequence of lagging structural growth or broader macroeconomic weakness. The negative headwinds of the macro driver could be compounded by the Twilio’s consumption based pricing model. In any case, I argue investors should approach the stock prudently and lower their expectations for Twilio going into FY 2024.

Adjust Target Price to $66.78

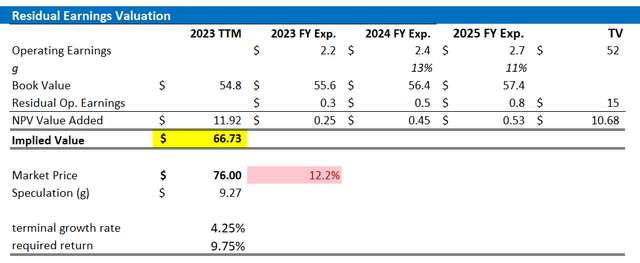

In line with updated analyst consensus EPS estimates for Twilio through 2025, I adjust my residual earnings model for the company’s stock: For FY 2024, I now estimate that Twilio’s EPS will likely fall within the range of between $2.2 and 2.6 (non-GAAP). For FY 2025, I set my EPS expectation at $2.7. Lastly, I lower my terminal growth rate input by 25 basis point, to 4.25%, while I maintain my cost of equity requirement at 9.75% (in line with CAPM).

On the backdrop of the adjustments highlighted above, I now calculate a fair implied stock price for TWLO stock equal to $66.73, suggesting almost 15% downside based on fundamentals.

Analyst Consensus; Company Financials; Author’s Calculations

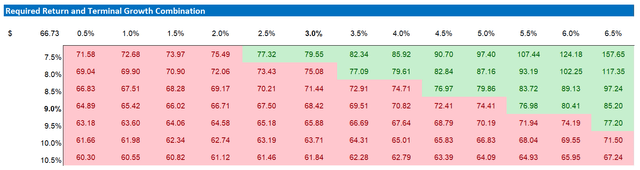

Below also the sensitivity table, which tests different assumptions for cost of equity (row) as well as terminal growth rate (column).

TWLO valuation, sensitivity table

Conclusion

While operating discipline is always appreciated, Twilio’s recent headcount reductions (following significant cuts in February 2023 and September 2022) suggest struggling topline momentum, particularly in the Data & Apps segment. In that context, Twilio’s fading thesis for high-growth SaaS potential exposes the company’s vulnerability on valuation.

In conclusion, I update my residual earnings valuation model for Twilio stock and I now calculate a fair implied share price equal to $66.73/ share.

Read the full article here