Intro

We wrote about Twin Disc, Incorporated (NASDAQ:TWIN) in May of 2023 after the company’s Q3 results where strong double-digit increases were reported in the quarter. Furthermore, the ability to generate free cash flow in that quarter was replicated in Q4 of fiscal 2023 and Q1 of fiscal 2024. Internally generated free cash flow is the most important metric in finance, bar none as it enables companies to map out a path of sustained investment over time back into the company. Twin Disk in this respect was making solid inroads into bringing down its debt whilst building up its war chest of cash for both organic & inorganic investments. Suffice it to say, the market at the time was beginning to read into Twin Disk’s improving financials which subsequently led to a very impressive 40%+ gain in shares of Twin Disc over the past 6+months.

Q1 Trends

The CEO stated on the recent Q1-2024 earnings call that the Board decided to reinstate the payment of a quarterly dividend due to how the company’s financials had been improving in earnest. The reinstatement has come on the back of favorable trading conditions where sustained demand in the marine & propulsions systems continues to drive sales forward. The uncertain geopolitical landscape continues to encourage elevated levels of government defense spending in Patrol Boats while Twin Disc’s mega yacht segment seems to have an upper hand over its competition due to the partnership of its Veth propulsion & Rolla Propeller offerings.

Investors must remember however that despite the almost 14% top-line growth rate in Q1 & a higher gross margin print (26.2%) for the quarter, Twin Disc still reported a net loss (-$1.2 million). Suffice it to say, given the uncertain forward-looking fundamentals we currently see in the land-based & industrial segments, we are maintaining our ‘Hold’ rating for the stock. For example, sales grew by 17% in ‘Land’ in Q1 but this growth rate may not be sustainable as spare part orders have begun to decline. Similarly in the Industrial space, sales fell by almost 20% which again demonstrated the need for a significant increase in OEM deals to stop the bleeding.

Remember, on the whole, trading conditions have improved immeasurably for Twin Disc with supply chain tailwinds enabling the company to turn over product at a much faster clip consequently bringing down inventory ($126+ million at the end of Q1). However, will this trend continue, and won’t acquisitions be needed in the electrification space to keep competition at bay? We state this because at present Twin Disc trades with a trailing book multiple of 1.55 & a trailing sales multiple of 0.73. Both of these multiples (The most important in our opinion as they enable earnings to take place) are trading well above their 5-year averages which come in at 1.04 & 0.57, respectively.

Technicals

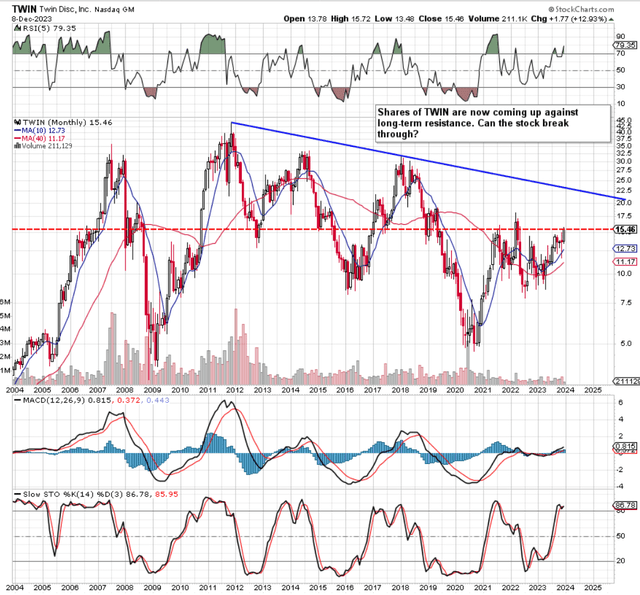

Furthermore, the ramifications of TWIN’s long-term chart (where we have a sustained pattern of lower highs & lower lows) demonstrate significant overhead resistance for shares at present. Shares could potentially break above overhead resistance (which it is presently encountering) but not above the depicted down-trending trendline (depicted below) where resistance would be encountered at approximately the $22 mark. It must be acknowledged that TWIN will remain in a long-term bear market until the depicted bearish trend line gets taken out with conviction to the upside.

Twin Disc Long-Term Technicals (Stockcharts.com)

Daily Technical Chart

Although buying volume trends have been bullish in recent weeks, we have some glaring divergences in both the stock’s MACD technical indicator as well as the RSI momentum indicator. Furthermore, the low level of the stock’s ADX (Trend Following) indicator demonstrates the absence of a sustained trend which means those divergences in the oscillator-derived indicators have merit. Suffice it to say, when one couples the stock’s valuation, overhead resistance & the absence of a strong near-term trend, sustained upside gains remain limited in our opinion.

Twin-Disc Near-Term Technicals (Stockcharts.com)

Conclusion

To sum up, shares of Twin Disc have rallied 40%+ over the past 6+ months with momentum continuing due to a strong Q1 report where sales increased by almost 14% & gross margin topped 26%. Net profit however came in negative and forward-looking share-price gains now look muted due to an overextended valuation, sizable overhead resistance, and uncertainty surrounding growth, especially in the Land & Industrial segments. We maintain our ‘Hold’ rating for Twin Disc. We look forward to continued coverage.

Read the full article here