Thesis

Tyson Foods (NYSE:TSN) is the largest U.S. producer of processed chicken, beef, pork, and protein-based products. In my opinion, the company is currently trading at an attractive valuation of 7.45x EV/EBITDA. I believe that Tyson Foods’ business is driven by two factors: population growth and meat consumption. The firm is currently facing some headwinds, such as commodity price volatility and low consumption due to high prices, but I believe they can come out stronger on the other end. I will explain each of my thesis’s key points below.

Company Overview

Tyson Foods, Inc., together with its subsidiaries, operates as a food company worldwide. It operates through four segments: beef, pork, chicken, and prepared foods. The firm has a broad portfolio of products and brands, including Tyson, Jimmy Dean, Hillshire Farm, Ball Park, Wright, Aidells, IBP, and State Fair.

Segments

Beef (35% of revenue)

The beef segment includes operations related to processing live-fed cattle and fabricating dressed beef carcasses into primal and sub-primal meat cuts and case-ready products. Products are marketed domestically to food retailers, food service distributors, restaurant operators, hotel chains, and noncommercial food service establishments.

Pork (11% of revenue)

The pork segment includes operations related to processing live market hogs and fabricating pork carcasses into primal and sub-primal cuts and case-ready products. Products are marketed domestically to food retailers, food service distributors, restaurant operators, hotel chains, and noncommercial food service establishments.

Chicken (34% of revenue)

The chicken segment includes domestic operations related to raising and processing live chickens and purchasing raw materials for fresh, frozen, and value-added chicken products, as well as sales from specialty products. Value-added chicken products primarily include breaded chicken strips, nuggets, patties, and other ready-to-fix or fully-cooked chicken parts. The firm has the #1 chicken brand in the country.

Prepared Foods (18% of revenue)

Prepared foods include operations related to manufacturing and marketing frozen and refrigerated food products and logistics operations to move products through the supply chain. Products primarily include ready-to-eat sandwiches and sandwich components such as flame-grilled hamburgers and Philly steaks, pepperoni, bacon, breakfast sausage, turkey, etc. This segment also helps the company offset losses in the other segment due to high commodity prices.

International and Eliminations represented 2% of revenue

Outlook

I believe that in the long run, TSN’s growth will be attributed to two things. Meat consumption and an increased demand for the firm’s products as the population grows. The world’s population is expected to grow by nearly 2 billion in the next 30 years, and the U.S.’s by 37 million from 2023 to 2053. As the population grows, so does the consumption of beef, chicken, and pork, and TSN is the largest U.S. meat producer. Tyson Foods supplies the biggest restaurant and fast food chains in the world (YUM brands, KFC, Taco Bell, as well as McDonald’s, Burger King, Wendy’s, etc.). The firm even supplies retailers, prisons, hospitals, and hotels. TSN’s customers are widely known all over the globe. Some might be consuming the firm’s products without even knowing it. The company is also very diversified when it comes to its customer base.

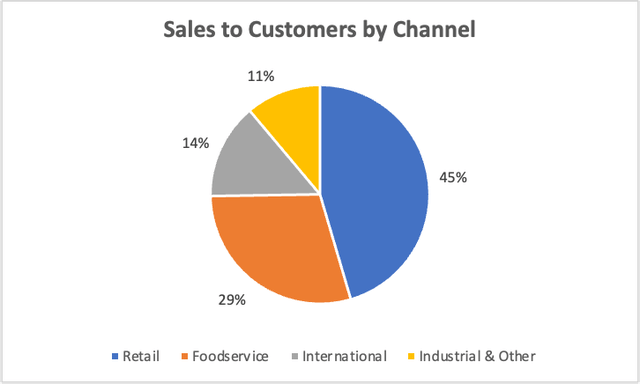

Created by the author using Q2 23 Filings

Meat consumption is increasing as more people focus on a healthier diet (protein based). Meat consumption is projected to grow by 30% in Africa, 18% in the Asia and Pacific region, and 12% in the Latin American region; the projected increase in meat consumption is 0.4% in Europe and 9% in North America. Which sums up to a 14% increase in meat consumption globally by 2030. Tyson Foods is set to capitalize on that growth since it is one of the largest meat producers globally. The company still has opportunities outside the U.S. since 84% of its revenue comes from the U.S. The firm has said that it will expand internationally. This is what the company said in its Q2–23 earnings call.

we will expand internationally where it makes sense. Most of the growth in protein consumption is expected to take place outside the U.S. We can capture this significant opportunity by scaling our existing business, expanding our customer base, and exploring new markets.

Acquisitions have played a big part in Tyson Foods’ growth. The company focuses on acquiring top brands to enter a new market. The firm is expecting to close an acquisition of a sausage company (William Sausage) later this year for $200–250 million. This will expand the company’s capacity and diversify its business even more. TSN has had a lot of insider buying activity recently. The company’s insiders purchased a total of 48,252 shares at an average price of $48.56 per share.

Dataroma

The buying occurred after the stock took a nose dive due to Q2 earnings. Personally, I think what fueled the buying was that management believes their stock is undervalued, and they are pretty confident they will overcome the current challenges and come out stronger on the other end. This is what the CEO had to say in the Q2-23 investor call.

Now let me tell you why I’m so optimistic about our future. Tyson is an iconic company with a broad portfolio of products and powerful brands that has been a recognized leader in protein for nearly 90 years. We’ve been through market cycles before. I’ve been through them before myself and we’ve always come out stronger on the other side.

Why the drop?

The company’s stock dropped by 16% after reporting Q2 earnings and is down by 19% year to date. So why the big drop? Well, the company did miss on both EPS ($-0.84) and revenue (-$484 million). Most of the segments reported negative operating income for the quarter. The unprofitability of the segments led to a net loss of $97 million in Q2 23. This can explain the miss on EPS. As for the missed revenue, it could be explained by the low consumption of red meat due to high prices. The company also slashed its 2023 revenue guidance by $2–$3 billion. The firm revised revenue from $55–$57 billion to $53–$54 billion, which represents almost no growth from 2022’s revenue of $53.2 billion.

Valuation

I used the DCF method to evaluate Tyson Foods. I expect the pain of profitability to carry through 2023. This doesn’t mean TSN won’t be profitable; it just means that it will have a low profit margin. In 2022, the firm had a 6% net margin. I expect the company to have a 1% margin in 2023. My assumptions are that beef and pork revenue will decline by 1% in 2023 before resuming growth of 3.5% and 2.5% from 2024 to 2027. As for the chicken, I only expect an increase of 0.5% in 2023 and 3.5% growth from 2024 to 2027 because chicken demand remained strong in the last year (8% revenue increase YoY) when compared to beef or pork (down 8% and 9% YoY). This tells me that consumers are not yet ready to give up on chicken. The CEO said the following in the Q2 earnings call:

it will recover and of all of our businesses that are challenged right now, Chicken will recover first.

As for prepaid and international, I expect revenue to grow at a compounded annual growth rate of 5.5% and 8% from 2023–2027. This equates to total revenue growth of 3% from 2023 to 2027. For 2023, I followed the company’s revenue guidance due to its solid track record. The main revenue drivers in my model are population and meat consumption growth. Using a discount rate of 7.00%. I discounted the future free cash flow and terminal value into the present. I got an equity value of $33 billion, or $92 per share, which represents an 84% upside from the current price of $50.

Risks

1) Unlike other dominant businesses, Tyson Foods doesn’t have the luxury of increasing prices. What I mean by that is that the company’s products are undifferentiated. Fast food chains can go to any other supplier and buy chicken or beef from them. There is nothing different about TSN’s products. This puts TSN in a very tight spot, as it makes it hard for the firm to improve profit margins. In 2022, 87.5% of TSN’s revenue went towards COGS, leaving the company with a net margin of 6%. If the company doesn’t have pricing power, it will be hard for them to increase profit in the coming years.

2) Tyson Foods’ business is heavily dependent on consumer spending. As things get pricy due to inflation. Consumers tend to shift away from and limit their intake of red meat. This can cause the company to lose revenue, as red meat represents more than 50% of its sales. Beef and pork sales are down by 8% and 9% YoY.

3) Tyson’s business model is also heavily influenced by commodity prices such as corn, soybeans, cattle, and hogs. Volatility and changes in commodity prices are all outside of Tyson’s control. Tyson’s beef and pork segments require a stable supply of cattle and hogs. Distribution in the supply of these commodities can inflate the price more than Tyson’s customers can absorb, which might lead to lower margins.

Conclusion

The bottom line is that Tyson Foods is an industry leader, its products will be in demand in the near future, and the company is currently trading way below its value, according to my calculations. The firm has been through tough times before, and management believes they can come out stronger on the other end just like they did before. Owning a share of TSN is like owning a perpetuity on people eating beef, chicken, pork, and more. I will leave you with a quote, as always.

“I make no attempt to forecast the market—my efforts are devoted to finding undervalued securities.” – Warren Buffet

Read the full article here