May 8 proved to be a very difficult day for shareholders of food giant Tyson Foods (NYSE:TSN). After the company announced financial results for the second quarter of its 2023 fiscal year, shares of the enterprise plummeted. Revenue and earnings per share failed to meet or exceed the expectations that analysts set. In addition, management revised revenue lower and provided additional details about how painful profit margins have become. In the near term, this is very unpleasant for shareholders of the enterprise. However, for those focused on the long haul, this could represent a solid buying opportunity.

Pain opens a door of opportunity

After the market opened on Monday, shares of Tyson Foods plunged, closing down 16.4%. For such a large and well-known company in an industry that is acknowledged as stable for the long haul, this is a rather shocking development. No one factor was responsible for this move lower. Rather, it seems to have been a few combined. For starters, revenue for the company came in weak. During the quarter, sales totaled $13.13 billion. Even though this was slightly higher than the $13.12 billion that the company reported one year earlier, it managed to miss analysts’ expectations by $490 million.

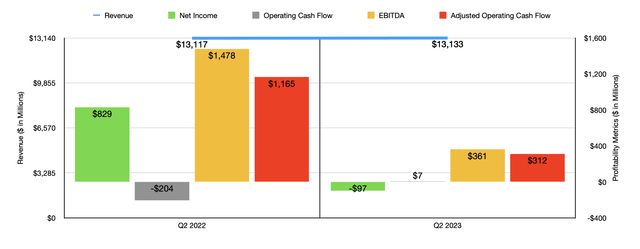

Author – SEC EDGAR Data

Sales volume for the company came in relatively strong, with growth of 3.3% year over year. However, this was largely offset by a 3.2% decline in average pricing. On the volume side, strong chicken and pork demand was largely responsible. However, a reduction in the availability of live cattle negatively affected the beef operations of the company. And an uneven food service industry recovery negatively affected sales volume associated with the company’s prepared food operations. Beef and pork segment sales were also negatively impacted by lower pricing. However, the picture would have been worse had it not been for strength in pricing associated with chicken and prepared foods.

On the bottom line, the picture for the company was also less than ideal. In fact, some may even go so far as to call it disastrous. Earnings per share for the quarter came in at negative $0.28. This was far worse than the $0.79 per share analysts expected it to come in at. Even on an adjusted basis, the company generated a loss of $0.04 per share. That was $0.84 per share lower than what was expected by the market. The loss per share that the company generated during the quarter translated to a net loss for shareholders of $97 million. That’s far removed from the $829 million, or $2.28 per share, that the company generated one year earlier.

There are obviously other profitability metrics that we should be paying attention to. Operating cash flow is one of these. At first glance, this actually looks like an improvement compared to last year. The company went from a net outflow of $204 million in the second quarter of 2022 between that inflow of $7 million the same time this year. But if we adjust for changes in working capital, we would see that the metric declined from $1.17 billion to $312 million. Meanwhile, EBITDA for the business plunged from $1.48 billion to $361 million.

On this front, the company’s problems largely center around a decline in its gross profit margin. During the quarter, the cost of sales for the company accounted for 96% of overall revenue. That compares to the 86.8% reported one year earlier. This was driven by a variety of factors. For instance, due to a beef shortage, live cattle costs increased the company’s expenses by $305 million. The company also incurred $92 million in plant closure costs. The firm experienced a $71 million increase in expenses associated with inventory levels. Raw material and other input costs in the prepared foods operations of the company grew by $55 million. And the company also suffered from a $45 million hit associated with higher feed ingredient costs, grow out expenses, and other relative factors, for the chicken segment. All of this, combined with some other adjustments, raised the cost per pound for the company with a net impact of $851 million of additional expenditures. The company also saw a $373 million impact associated with increased sales volume thanks to strong demand in the chicken and pork segments.

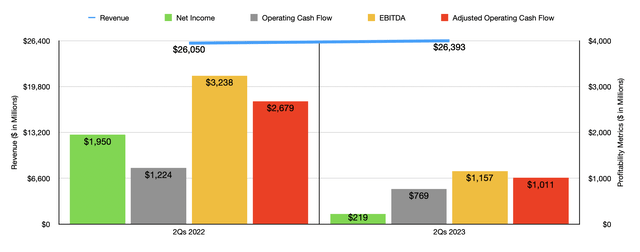

Author – SEC EDGAR Data

Results reported for the second quarter are proof that, the weakness the company saw in the first quarter, was only the start of the firm’s problems. In the chart above, you can see how the company performed for the first half of the 2023 fiscal year as a whole. To make matters worse, management also came out with a revision to guidance. The firm does not really offer any profitability guidance. But they do talk about how much revenue they should generate for the year. The current expectation is for sales of between $53 billion and $54 billion. This would represent a sizable downward revision compared to the $55 billion to $56 billion that management previously anticipated. Long term growth might also be a bit slower than anticipated, as evidenced by the fact that management reduced capital expenditure guidance for the year from $2.5 billion down to $2.3 billion. In its earnings release, the company even stated that the current protein market is challenging. The projection that domestic beef production is expected to be 4% lower this year than last is definitely taking a toll on the company. Although the population of the US continues to grow, pork production should be roughly flat year over year. The only bright spots would be in chicken and prepared foods. Prepared foods growth has been positive, and chicken volumes this year are expected to be about 3% higher than they were a year ago.

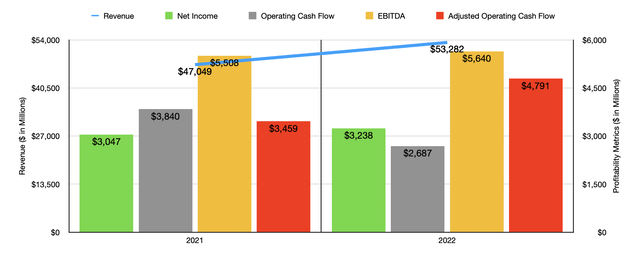

Author – SEC EDGAR Data

Since we don’t know what to expect for the rest of the year from a profitability perspective, we don’t really have any idea how to easily value the company. If we simply annualize the results experienced so far for the year, we would expect net profits of $363.7 million, adjusted operating cash flow of $1.81 billion, and EBITDA of $2.02 billion. As the chart above shows, these numbers would be significantly lower than what the company achieved in 2021 or 2022.

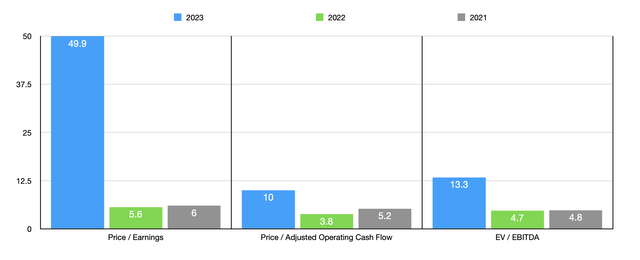

Author – SEC EDGAR Data

Taking these figures, I was able to value the company. In the chart above, you can see how shares are priced compared to how they would be priced if we used data from 2021 or 2022. In truth, the price to earnings multiple here is outrageous. But outside of that, the other profitability metrics don’t look all that bad. In the table below, I also compared the company to five similar firms. On a price to earnings basis, the firm was the most expensive of the group. But when it comes to the price to operating cash flow approach, it was the cheapest. And when you look at it through the lens of the EV to EBITDA multiple, only one of the five firms was cheaper than it.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Tyson Foods | 49.9 | 10.0 | 13.3 |

| Kellogg (K) | 25.3 | 14.7 | 16.3 |

| Hormel (HRL) | 22.8 | 23.5 | 15.9 |

| McCormick & Company (MKC) | 35.8 | 32.4 | 24.8 |

| Conagra Brands (CAG) | 22.7 | 16.1 | 16.6 |

| Pilgrim’s Pride Corporation (PPC) | 11.6 | 19.1 | 6.9 |

Takeaway

Operationally, things are not that good right now for Tyson Foods and its shareholders. Frankly, I believe that additional pain will continue to affect the business throughout this year. Hopefully next year will be different. But at this time, we have no insight into that. It is important to note that Tyson Foods is a long-standing company that has done well for itself and its investors in the long run. And with the exception of the price to earnings multiple, shares do still look fundamentally attractive compared to similar firms. Eventually, market conditions will improve. And when they do, I fully expect that the stock will perform nicely. Given all of these considerations, I think that, for those focused on the long haul, the business does make for an attractive opportunity at this time. But to make use of that opportunity, you might need to be comfortable underperforming the market, perhaps significantly, in the short run.

Read the full article here