Shares of U.S. Bancorp (NYSE:USB) have been a poor performer over the past year, losing about 16% of their value. This has been less severe than losses seen in other, smaller regional banks since the failure of Silicon Valley Bank. That failure has sparked a significant increase in funding costs, to which USB has not been immune. However, due to cautious planning about potential regulatory changes, U.S. Bancorp now has significant balance sheet flexibility, which can drive material earnings growth over time.

Seeking Alpha

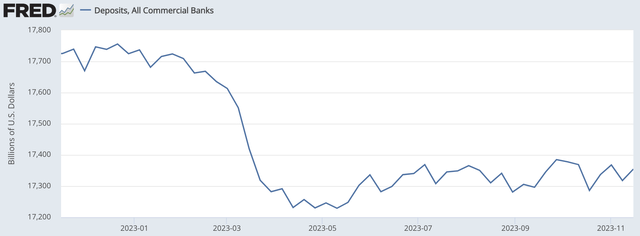

In the company’s third quarter, U.S. Bancorp earned $1.05, beating consensus by $0.05 on revenue of $7 billion. Critically, average deposits rose by 3% to $512 billion. I view stable deposits as a prerequisite for investing in the banking sector. While deposits averaged $512 billion, they actually ended the quarter at $518 billion, pointing to a meaningful ramp of inflows across the quarter, a very encouraging sign Overall, USB has handled the deposit crisis, fairly well. Beyond this quarter’s recovery, deposits are down just $6.6 billion this year, a little over 1%. As you can see below, deposits have fallen about 2% across the industry this year.

St. Louis Federal Reserve

Importantly, it is now fair to say deposits have stabilized, having risen about $100 billion from their lows and bouncing near current levels for several months. Given the Federal Reserve’s ongoing balance sheet reduction, I do not expect meaningful industrywide growth, but the lack of further deposit attrition should help to moderate deposit funding cost increases from, here consistent with USB’s expectations. One challenge for the bank has been a worsening mix shift of deposits.

Non-interest-bearing deposits are down to $98 billion from $115 billion a year ago. In such a high-rate world, having zero-cost funding is quite valuable. These are primarily transactional accounts (ie accounts used to make payroll). When rates were low, I think customers allowed excess balances here as there was so little opportunity cost. With rates at 5+%, customers have drawn down these balances. Ultimately, there is a floor here as balances need to cover transaction needs, and management expects NIB balances to have bottomed with these floors functionally being met.

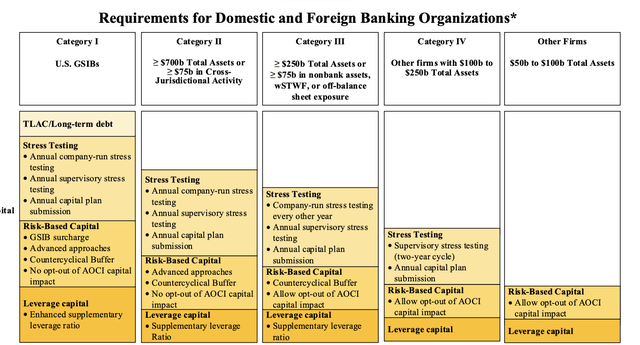

They key thing for investors is that USB has not fully utilized its deposit base. Alongside lower deposits, assets are down $6.8 billion year to date but cash is up by $10.8 billion at $64 billion. In the last quarter, average loans declined from $389 billion to $377 billion. USB has been carrying excess liquidity and been very stringent on issuing new loans, working these balances down. During a period of excess funding stress, carrying extra liquidity is wise. There is another factor at play here. With its completion of the Union Bank merger, USB was preparing for tougher regulatory requirements. However, USB will not be subject to Category II capital rules by the end of next year as originally expected. Category II banks generally have $700 billion in assets whereas USB is at $668 billion at the end of Q3.

As you can see below, there are far fewer rules for Category III banks (which USB remains) than Category II banks. This most important is that as a Category III bank, USB will only have to phase in AOCI losses over three years, starting in Q3 2025, rather than doing so immediately next year.

Federal Reserve

In anticipation of being a Category II bank, USB has been restraining asset growth, reducing risk, and aggressively building capital. Its common equity tier one ratio (CET1) of 9.7% is up 60bp sequentially and back to pre-acquisition levels. Like most banks, USB has a securities portfolio of high-quality fixed income. Purchased when rates were lower, these assets have significant unrealized losses that sit in accumulated other comprehensive income (AOCI).

U.S. Bancorp has $12.3 billion in AOCI losses. The majority of these comes from its $162.1 billion securities portfolio. USB has been allowing this portfolio to gradually run down in keeping with its efforts to reduce assets when it feared it may be subject to tougher regulatory rules. The portfolio was down $1.7 billion from last quarter. Thanks to reinvestment opportunities, the yield rose 12bp to 2.87% This portfolio has a $10.8 billion unrealized loss. As bonds at a loss mature and pull to par, this loss will be $8 billion based on the forward curve by the end of 2025.

If USB has to include AOCI today, its capital would be just 7.2%, or just 20bp above its regulatory minimum. Fearing this would be included next year, this is why USB has been building capital and reducing assets this quarter in order to create more of a buffer. Now that, it has until the end of 2025, management can be more aggressive in optimizing its loan book and deploying excess liquidity in yield-accretive ways. Additionally, it has shortened the duration of its securities portfolio to 3.5 years from 3.8 years in December, further reducing interest-rate sensitivity. Based on this phase-in, USB likely saves about 200bp of capital next year and 150-175bp of capital in 2025.

Because of its loan balance decline in the last quarter, USB has just a 74% loan to deposit ratio, a level it can over-time bring closer to 80%, providing scope for up to $30 billion in loan growth, at today’s wider yield levels.

Now, USB, being a prudently and cautiously managed bank, is not set to do this all at once. It will take multiple quarters, but USB is about to pivot from interest-earning asset contraction to growth. Due to higher deposit funding costs and declining loans, its net interest margin (NIM) was 2.81%, down 9bp sequentially. Because USB is starting Q4 with a more depressed loan level than Q3, management expects a 3% decline in net interest income in Q4, which it expects to be the bottom. I view this as credible, given stabilizing deposits and a shift towards loan growth across 2024. Optimizing its asset to liability position can provide at least a $300 million tailwind in 2024.

It is also important to emphasize that USB’s loan underwriting and reserve positioning are both strong. The company added $95 million of reserves, in keeping with economic uncertainty. USB has set side allowance for losses of 2.08% of loans. By comparison, it has just $1.3 billion or 0.35% of nonperforming assets. This ~6x coverage is extremely strong. USB has sufficient reserves for an economic downturn, and absent one, there could even be modest reserve releases.

USB is also being cautious about its riskiest exposures. It has 3.1% reserves against commercial real estate with 10% coverage against office. Office is clearly a challenged asset, but that is an extremely elevated level of reserves, meaning its P&L has already by impacted. By comparison, USB has 8.3% reserved against credit cards, the riskiest lending asset class it caters too as those loans are unsecured. USB has already taken the pain on its office exposure, and further losses are unlikely to be material, given that reserve coverage.

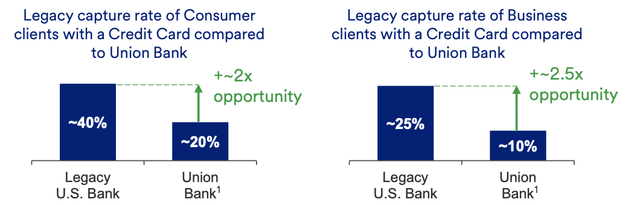

We also are still in the early innings of U.S. Bancorp integrating Union Bank. $1.1 of $1.4 billion in M&A spending is complete while less than half of its $900 million in synergies have been achieved. Thanks to these, operating expenses should be flat next year. I am more excited about potential revenue synergies than cost ones. As one example, USB is much more effective than Union at getting customers to use a credit card.

U.S. Bancorp

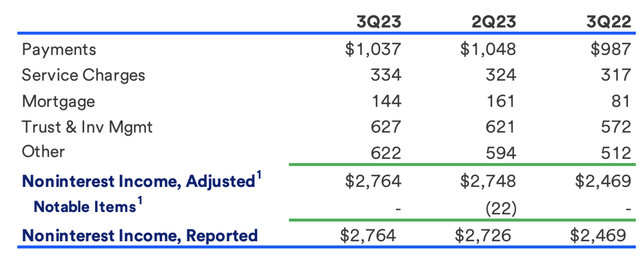

In addition to the net interest opportunities of more cardholders, USB’s solid card franchise provides processing and transaction revenue. Non-interest income rose by 12% and accounts for nearly 40% of revenue, helping to provide stability away from rate volatility. Card fees rose 5% from last year, and there is room for further grow as it adds Union Bank customers. Trust and investment management also continues to be a bright spot.

U.S. Bancorp

U.S. Bancorp has a diversified business that is nearing a turning point. This past year has been all about lending restraint, capital concern, and M&A integration. Next year, we should see loan growth, deposit cost moderation, spending discipline, and M&A revenue synergies. Assuming net interest income bottoms next quarter and that NIM rises back to 2.9% next year, alongside 5% non-interest revenue growth, USB can earn $4.20-$4.40 in 2024, depending on the speed of its asset growth.

Next year I expect USB to continue to build capital as it awaits finalized banking rules for category three banks. USB’s $0.48 dividend costs about $750 million a quarter. By the end of next year, its theoretical CET1 including AOCI would rise to about 8% from 7.2% with a published CET1 above 10.4%, even with asset growth. That will position the company to begin adding some repurchases into its capital allocation plan during 2025. For now, investors can rely on a ~5.1% dividend yield.

With USB flipping into growth mode, we should see solid earnings growth next year with momentum that can continue into 2025 as it deploys excess liquidity and fully realizes the benefits of its acquisition. At 8.6x earnings, shares are attractive. Given its unique positioning for earnings growth, I believe shares should move towards 10x, providing upside to $43, or a 20% total return potential, making USB an attractive buy.

Read the full article here