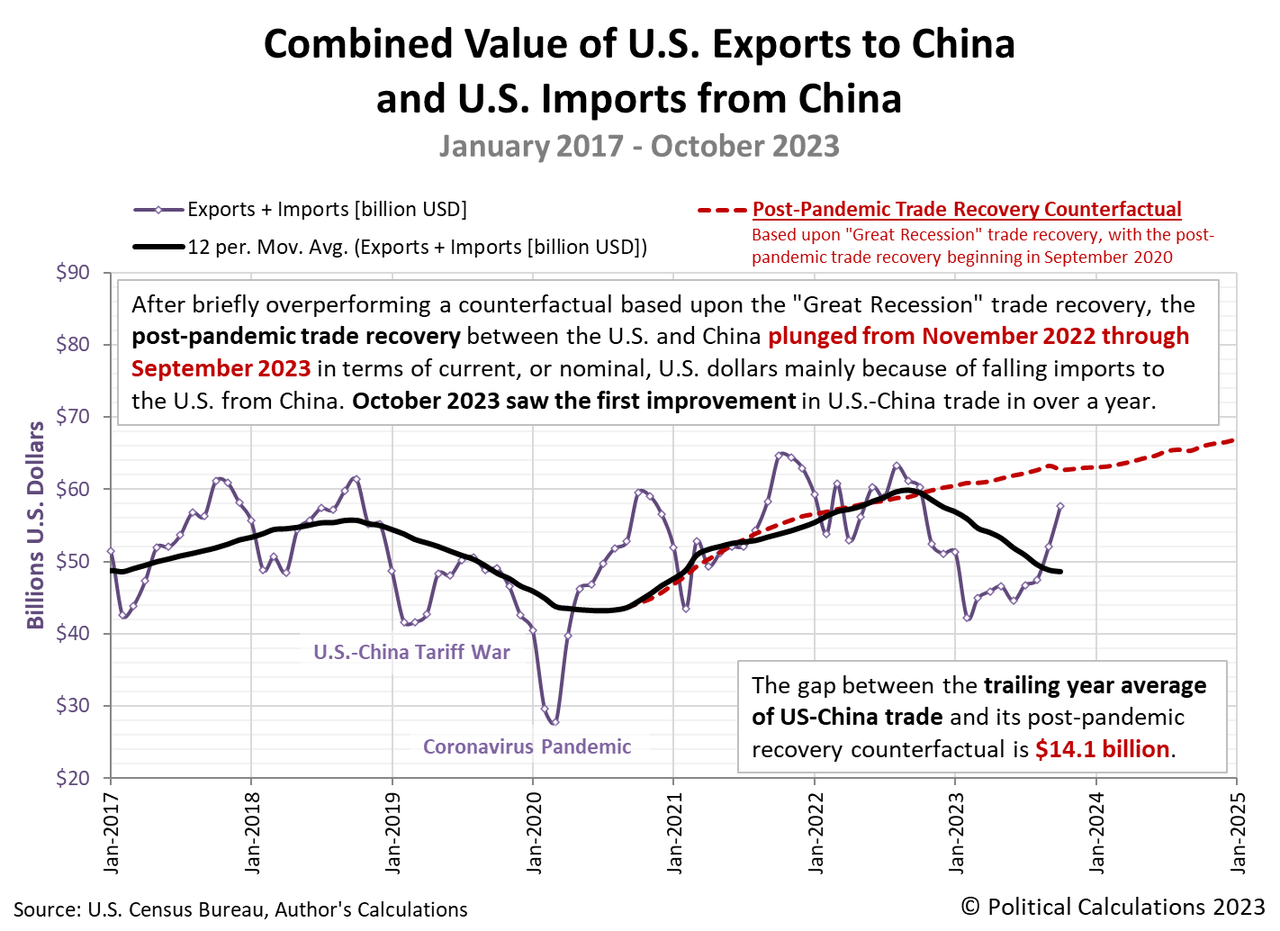

A surge in goods traded between the U.S. and China in September and October 2023 may have helped set a bottom in the ongoing trade recession between the two nations.

As measured by the trailing twelve-month average value of goods exchanged between the U.S. and China, the total value of those goods has been in contraction since September 2022, when they last peaked at $59.9 billion. But the rate at which that contraction is occurring significantly slowed during October 2023.

The trailing twelve-month average value of the combined value of exports and imports traded between the U.S. and China was $48.6 billion in October 2023. That’s just shy of a 19% overall decline in trade recorded since September 2022. It’s also not quite as large as the 22% decline in trade that occurred between the two countries as a result of the one-two punch of the 2018-19 tariff war and the 2020’s Coronavirus Pandemic.

The following chart provides the latest update for how the non-inflation adjusted total value of goods traded between the U.S. and China has evolved from January 2017 through October 2023.

Through October 2023, a $14.1 billion gap has opened up with respect to the counterfactual, based upon how trade between the U.S. and China recovered following the 2008-09 economic recession. Adding up the monthly loss of trade recorded by this measure, we find a total loss of over $97 billion has been recorded since September 2022. Much of this loss is a consequence of the implementation of the Biden administration’s trade restrictions on the export of semiconductor chips on October 7, 2022.

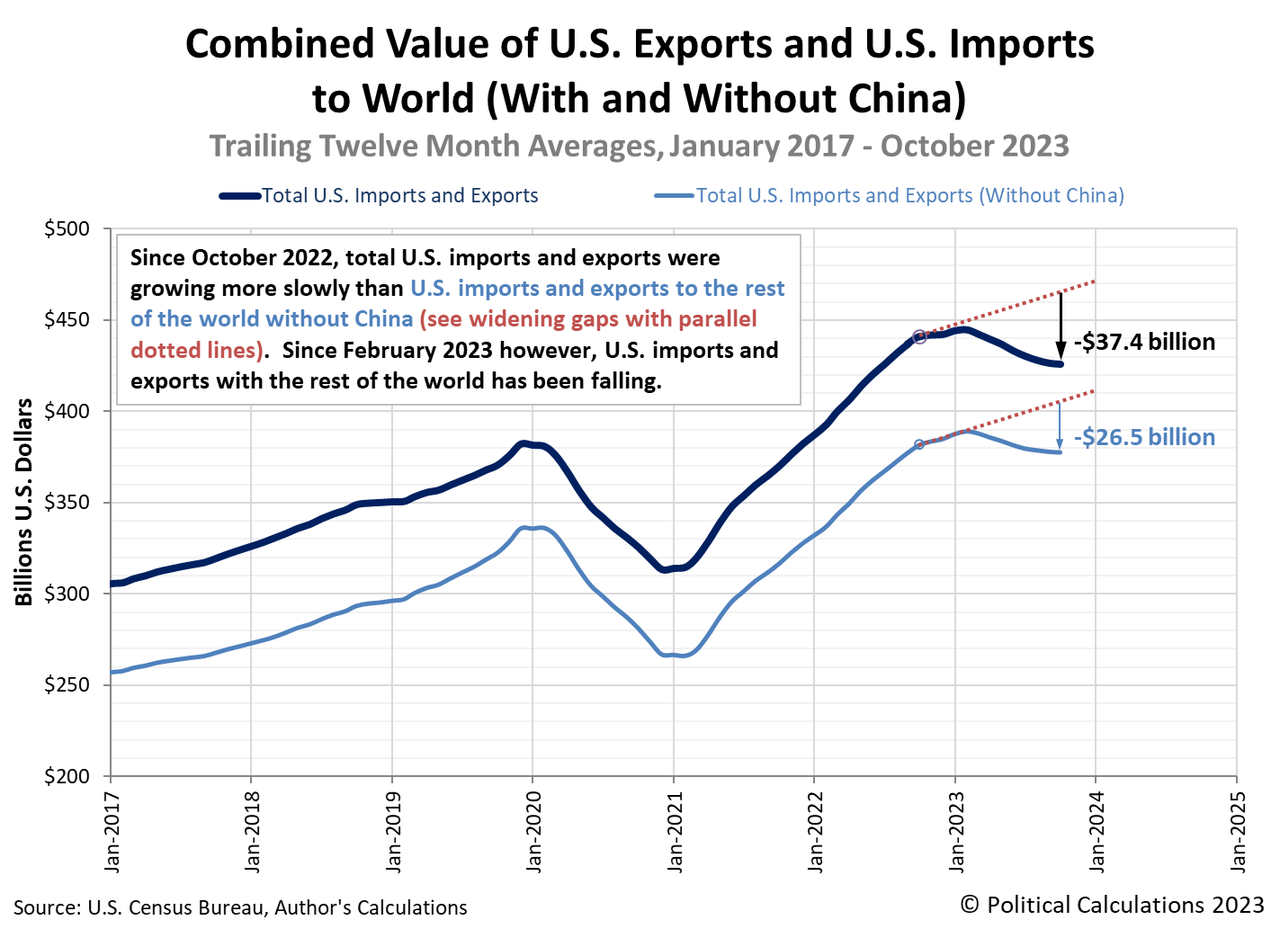

Meanwhile, trade between the U.S. and the rest of the world has been shrinking since February 2023, when President Biden announced an expansion of his administration’s “Buy American” anti-free trade policies. The data series shown in light blue on the next chart shows the contraction in trade that has taken place during the months since.

The trailing twelve-month average of the total value of goods traded between the U.S. and every other nation in the world except China is $26.5 billion less in October 2023 than would be expected had the value of that trade continued growing at the rate it had been from October 2022 through February 2023. The aggregate loss of trade between the U.S. and the rest of the world since February 2023 is over $126 billion.

U.S. Census Bureau. Trade in Goods with China. Last updated: 6 December 2023.

U.S. Census Bureau. Trade in Goods with World, Not Seasonally Adjusted. Last updated: 6 December 2023.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here