By Scott Glasser, Chief Investment Officer

Mega Cap Rally Not an All Clear Sign for Equities

Coming into the year, we anticipated the Federal Reserve’s rapid withdrawal of liquidity would keep pressure on equities and ultimately lead to a recession. While the S&P 500 Index briefly entered correction territory in late October, equity markets surged in November as a massive rally in interest rates pushed down yields amid disinflationary trends and the expectation that not only had the Fed finished its rate hikes, but rate cuts would also begin sooner than previously expected. While on the surface this sounds like an attractive backdrop for investors, and inflationary pressures are indeed abating, we are not yet ready to declare the “all clear” signal for equities. In fact, despite gains in the large cap-dominated indexes, equity performance across the average stock has been muted, and the economy is now starting to show more significant signs of slowing. The question for 2024 is whether the economy will experience a soft landing as consensus now expects, or a more material decline in corporate profits.

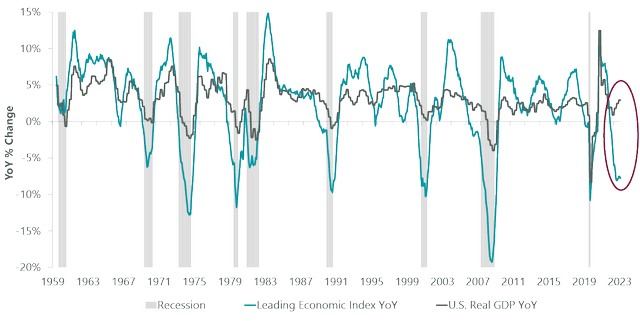

We continue to forecast at least a mild recession, as many of the key indicators we track still point in that direction. The Conference Board’s basket of leading economic indicators (LEI) has declined sharply over the last two years and remains disconnected with GDP growth. We would remind investors that the GDP impact of negative LEIs lags, which makes forecast timing difficult. In addition, the yield curve has been inverted for over a year, a duration consistent with where economic weakness should begin to become more evident. In contrast, credit spreads, another indicator that we follow that has a reliable history, are elevated but not reflective of a recession. This may be due to a significant rise in debt refinancings by corporate America during COVID, which lowered rates and pushed out maturity dates. Nevertheless, our research shows that smaller cap and private companies that did not have the same flexibility during COVID are now struggling with debt levels and higher interest rates.

Exhibit 1: Leading Economic Indicators Point to Recession

The Conference Board, BEA, FactSet.

While we believe investors remain too complacent regarding corporate profits and the economy, our prior forecasts underestimated the impact of fiscal stimulus on the U.S. financial system during the COVID years. Huge fiscal spending programs, both at the state and federal levels, materially boosted GDP this past year and their impact continues to help counteract the effects of tighter monetary conditions. In addition, structural changes in employment, again partially resulting from COVID, have made corporations reluctant to cut employees, keeping labor markets tight. As a result, consumption, which accounts for two-thirds of U.S. GDP, remains at higher levels than might be expected during more traditional tightening cycles. That said, consumer savings are now back at pre-COVID levels, the housing market is both slow and unaffordable and employment is likely to deteriorate as employers attempt to maintain margins in the face of slowing demand. Although a recession remains our base case, we believe that the odds of a significant economic downturn are lower as the lingering effects of fiscal spending are helping cushion the impact of monetary tightening.

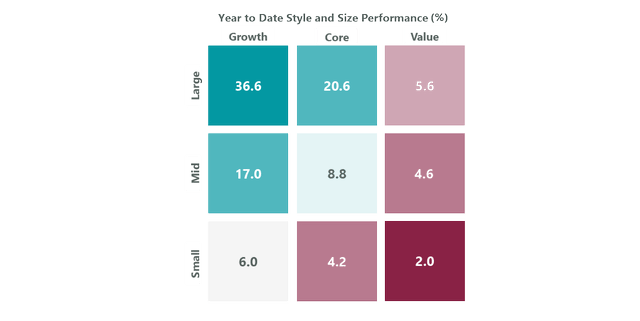

In addition to trying to read the economic tea leaves, we believe that market breadth provides valuable insights about the durability of future market performance. While this year’s market return has been better than we expected, its underlying performance is far more varied and nuanced than one might assume by just looking at the S&P 500. Year-to-date returns have been disproportionately driven by the top seven weightings of the S&P 500, which have accounted for approximately 70% of the overall index return (as of November) and earned the nickname the Magnificent Seven. As a result, large-cap growth strategies have surged this past year. In contrast, all value styles, as well as all small-cap categories, have trailed those stocks by approximately 30 percentage points (Exhibit 2).

Historically, at the start of a new bull market, small- and mid-cap stocks often lead the way in terms of performance, and participation is robust across the spectrum. In the current narrow market, small- and mid-cap stock participation has been a missing component to the rally. Furthermore, only three of 11 sectors in the S&P 500 are outperforming the overall index, a condition that has impacted the returns for most diversified strategies. We will continue to watch breadth indicators, hoping to see them expand materially as a leading indicator of a healthier outlook, but without improvement, we will continue to lean cautious.

Exhibit 2: Large Growth Has Dominated Performance

FTSE Russell, Bloomberg

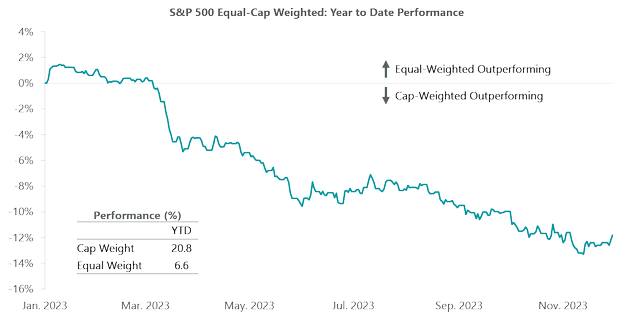

Exhibit 3: Equal Weighted Underperformance Signals Active Opportunity

FactSet

One consequence of the current narrow market is a historically wide performance differential between the market-cap weighted and equal-weighted S&P 500 (Exhibit 3). Over the course of the next year, we expect this divergence to reverse as other sectors of the market gain relative ground. While we do not expect the Magnificent Seven to decline materially, we also do not anticipate the same step function higher in earnings for those companies as we saw in 2023. Instead, we expect relative leadership to broaden and include more defensive-oriented groups that have been underperformers this past year. We believe high-quality defensive stocks, particularly in health care, will hold up better than the current mega-cap leaders in an economic downturn. Finally, we believe banks will be an important group to watch as a potential barometer of economic weakness due to their sensitivity to potential credit issues. We remain open-minded, however, that this time could be different due to the economic impact and remedies associated with COVID, but we will wait patiently for the data before reaching that conclusion.

Scott Glasser is the Chief Investment Officer and a Portfolio Manager at ClearBridge Investments.

Read the full article here