There is a lot of hype about U.S. shale oil production going into year-end, and let me tell you like it is, it’s almost all fluff.

HFIR

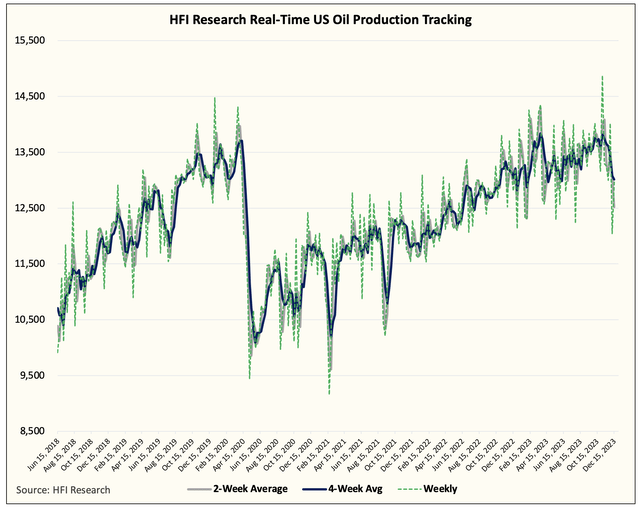

Note: Figures following November do not include “transfers to crude oil supply.” Instead, it’s a more realistic reflection of U.S. oil production.

Looking at our real-time tracker, you can see that U.S. oil production is closer to ~13 million b/d today. Over the past 4-weeks, EIA has reported an average production of 13.011 million b/d. In November, U.S. oil production showed an average of ~13.392 million b/d.

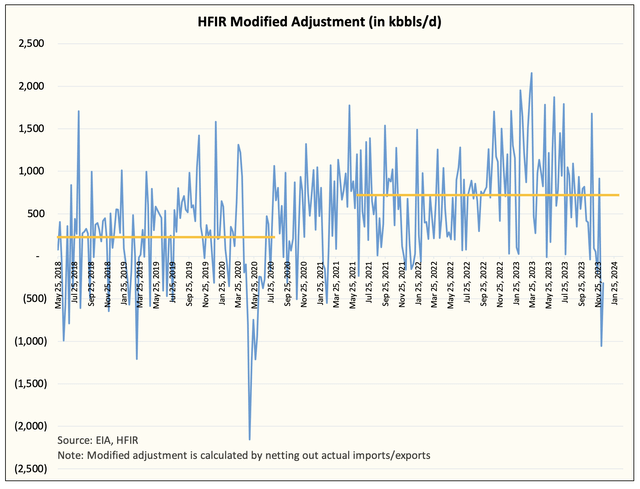

Now there are some caveats with these figures. For starters, the first week of November was when the “transfers to crude oil supply” was first introduced. At the time, our modified adjustment showed a material jump to ~1.6 million b/d. At the time, we wrote that such large jumps have always reverted. Since then, we have seen a major downward revision.

EIA, HFIR

If we had to guess, November’s U.S. oil production was likely closer to ~13.2 million b/d. Now for those of you watching U.S. oil production closely, you would note that we estimated U.S. oil production to be ~13.08 million b/d in September. Headline figures out of the EIA showed U.S. oil production hitting ~13.2 million b/d, but the adjustment figure was solidly negative. The implication of that is EIA likely overstated U.S. oil production.

One of the big fears going into year-end is that U.S. oil production would further surprise to the upside leaving those expecting U.S. shale to peak to fold their hands. Instead, we think the latest data is validation that U.S. oil production wasn’t anywhere near as strong as people suspected.

Following the November PSM release, we wrote to readers that the upside surprise of ~250k b/d was largely because of private producers looking to juice up production ahead of the M&A boom we are seeing in energy. Without a successful exit, many of these private names will have to resort back to a steady state, which should see production meaningfully fall into year-end and at the start of 2024.

Seasonally speaking, U.S. oil production is always at its lowest in Q1, so without a ramp into December, production usually falls more meaningfully. We are already starting to see that.

My guess is that U.S. oil production will finish December right around ~13.05 million b/d. This would bring the upside surprise to +100k b/d versus our original estimate of 12.95 million b/d. By Q1 2024, we expect U.S. oil production to have fallen to ~12.8 million b/d before recovering to ~13.1 million b/d by Q2 2024.

Looking at 2024 balances, we expect U.S. oil production to reach ~13.5 to ~13.6 million b/d by Q3/Q4 2024. We will be looking at an exit of +500k b/d y-o-y.

Following this growth, 2025 should see U.S. oil production remaining flat right around the ~13.5 to ~13.6 million b/d with a possibility of ~13.7 million b/d. But that’s about all the growth there is, U.S. oil production will peak following 2025.

More fluff than substance…

You can make all the technical improvements you want. You can increase drilling speed and completion turnaround, but at the end of the day, you can’t change the geology. U.S. shale growth is akin to running on a treadmill. The faster you grow, the faster you have to run just to stay in place. For most producers, staying flat is the most optimal way to go, going forward. By increasing production steadily, you run the risk of: 1) running out of inventory and 2) decreasing your rate of return.

Discipline in U.S. shale is not because shareholders are asking for it. Discipline in U.S. shale is happening because the geology, the inventory, and the execution don’t support rapid growth. At ~13.5 to ~13.6 million b/d total U.S. oil production, U.S. shale oil production would see declines of over ~3 million b/d a year. In essence, you need to produce half a Permian a year just to stay flat. That’s a tall task and something that won’t jive with the inventory that’s left out there.

How do we know we are right?

Simple. First things first, U.S. oil production will decline to ~12.8 to ~12.9 million b/d in Q1 2024. If this happens, this validates our thesis that private producers were the only reason U.S. oil production surprised to the upside.

Second, if U.S. oil production follows the roadmap we laid out, then we know growth is going to stop soon. By H2 2024, U.S. shale oil producers will signal more capital returns back to shareholders via dividends versus share buybacks (you don’t want to buy back in companies with shrinking inventories).

Third, capex growth projections for 2025 will show minimal growth. This will once again signal that we are on the right trajectory.

Once we validate that we are on the right path, then readers will know that our analysis of U.S. oil production peaking in 2025 will be correct.

Read the full article here