Introduction

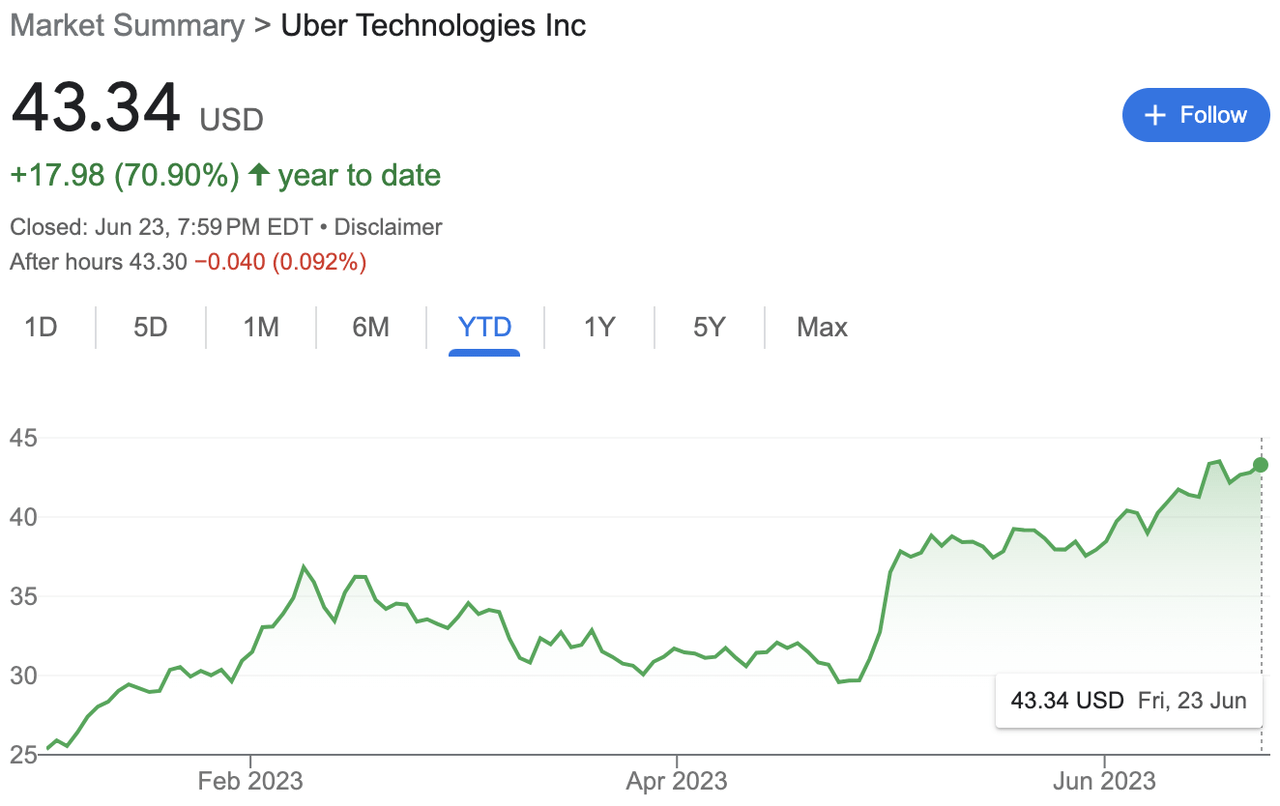

Uber Technologies, Inc. (NYSE:UBER) is a San Francisco-based American Transportation-as-a-Service (TaaS) company that primarily offers customers ride (taxi) hailing service, with additional services including food and package delivery and freight transport in approximately 70 countries and 10,500 cities around the world. Uber is currently the biggest player in the US rideshare market, with the company holding approximately 74% of the market share. Despite uneasy macroeconomic conditions and increasing competitiveness of the market, Uber stock had a great year with its share price increasing 70.9% YTD. Given its dominance in the rideshare market and high growth potential, Uber seems like a great long-term investment. It is a strong buy.

Google Finance

Company Overview

The primary source of Uber’s income is derived from its rideshare service with food delivery coming to a close second, where it generates revenue through service fees and commissions from drivers. The key to understanding Uber’s business model is acknowledging that the company is essentially a platform business. Uber does not hold any physical assets, rather it provides a platform service that connects the supply and demand side of the market. They do not simply have any real-world assets that equate to fixed costs, which gives the company the ability to leverage higher margins and operations.

Industry Overview

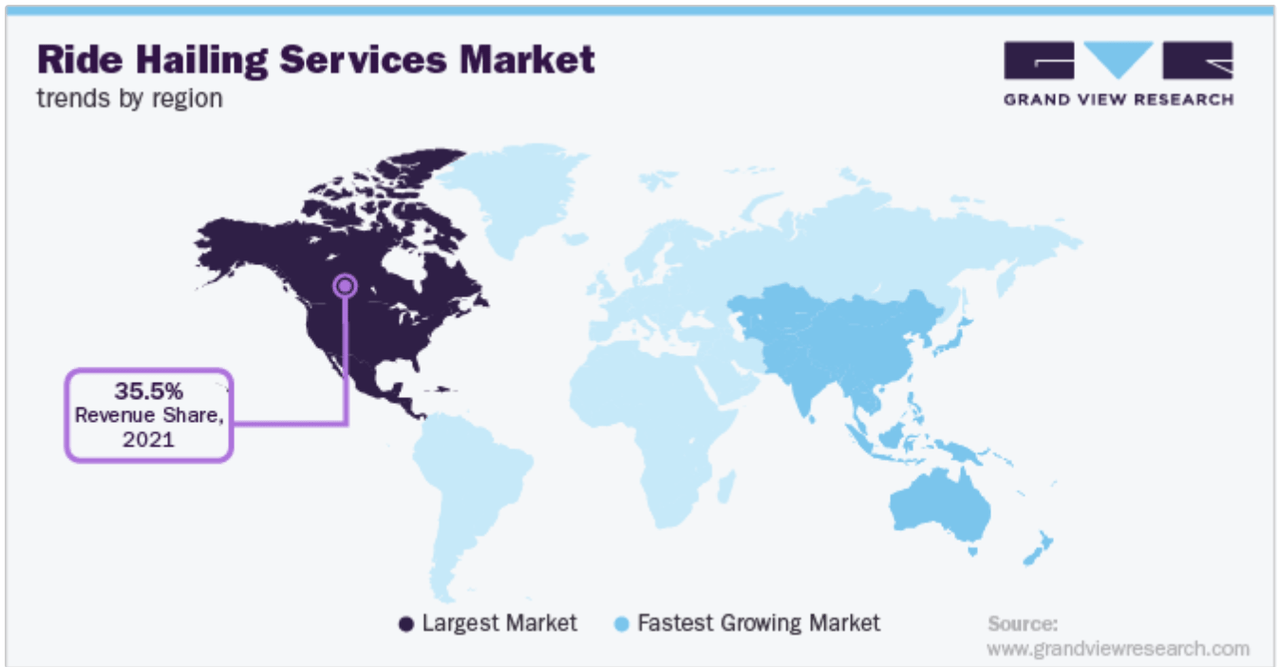

Uber is in a high growth market, as the global ride hailing service market is projected to grow at a 15.7% CAGR, with the US market expected to grow at a similar 15.1% CAGR from 2022-2030.

Grand View Research

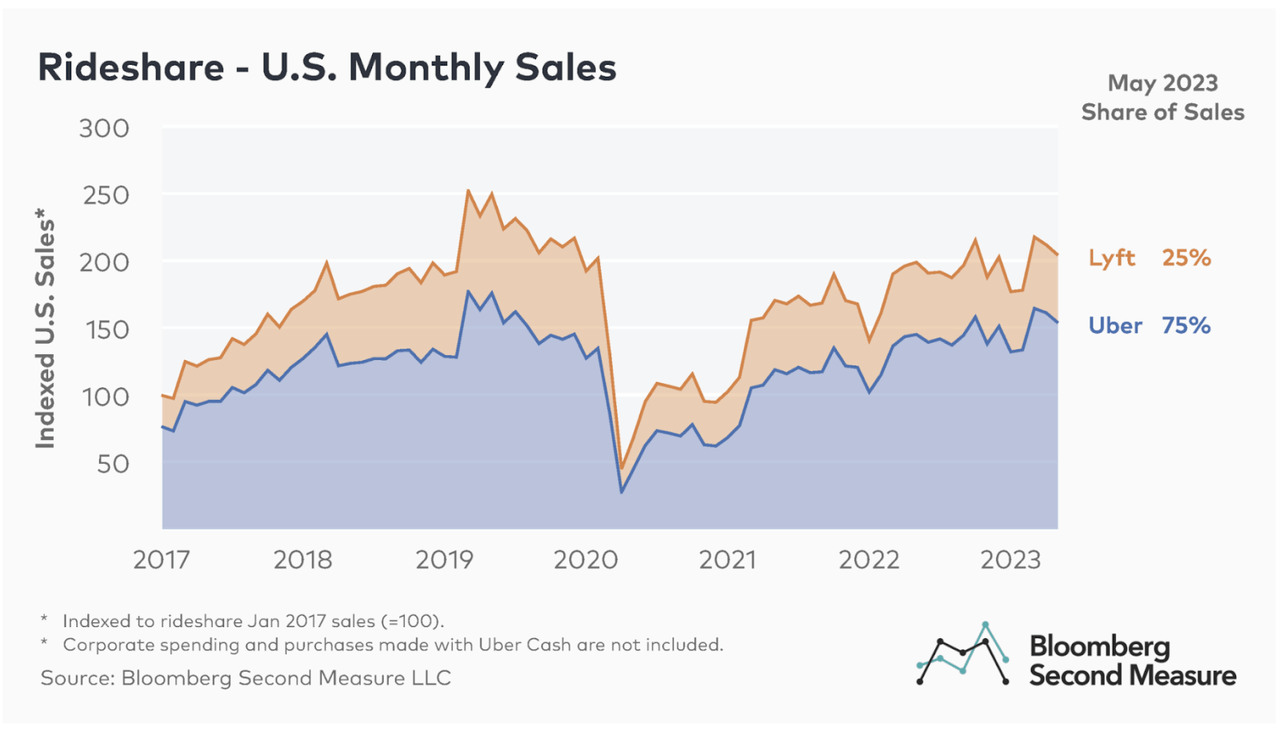

It is important to mention that the rideshare industry is an “economies of scale” market. It is the battle of the market share. For Uber, the US market accounts for about 60% of total sales. As of May 2023, Uber is clearly a dominant force in the US rideshare market, the company accounting for 75% of rideshare spending.

Bloomberg Second Measure

Competitive Analysis

Uber’s competitive edge comes from its success in its diverse range of services. In terms of rideshare, it is not trivial to talk about Uber without mentioning Lyft. During the pre-pandemic era, both companies were viewed as near substitutes in the US rideshare market–like McDonald’s and Burger King–as there was ample potential market share available in the North America region. However, during the post-pandemic era, the two companies went on a rather divergent track, with Uber taking outright dominance in the market. Currently, Lyft is by far a smaller player compared to Uber, as shown by its revenue less than a quarter of Uber’s in the mobility service. Uber is the dominant force in the US market, with the market shifting towards an unbalanced duopoly to near-monopoly.

The company’s food delivery platform, Uber Eats, is currently experiencing an incredible revenue growth. Although the company is second in the US food delivery market (25% market share) after DoorDash (65% market share), its revenue has surpassed DoorDash by far, with Uber Eats reaching nearly $11 billion in revenue in 2022 compared to DoorDash at $6.58 billion. Uber’s great performance amidst the highly competitive landscape corroborated with its unmatched global reach suggests that the company has incredible growth potential in the long term.

Financials

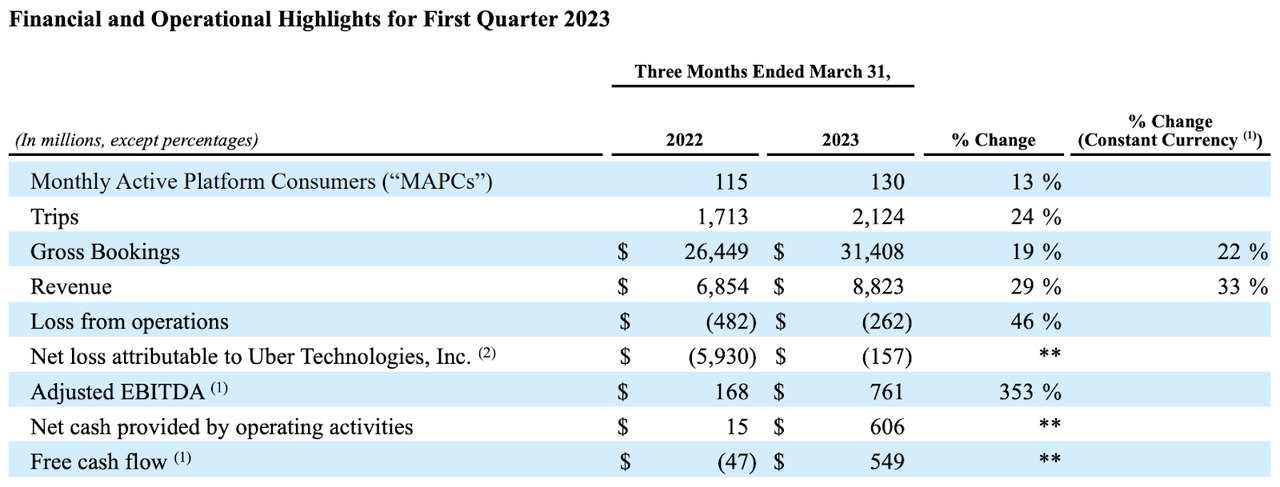

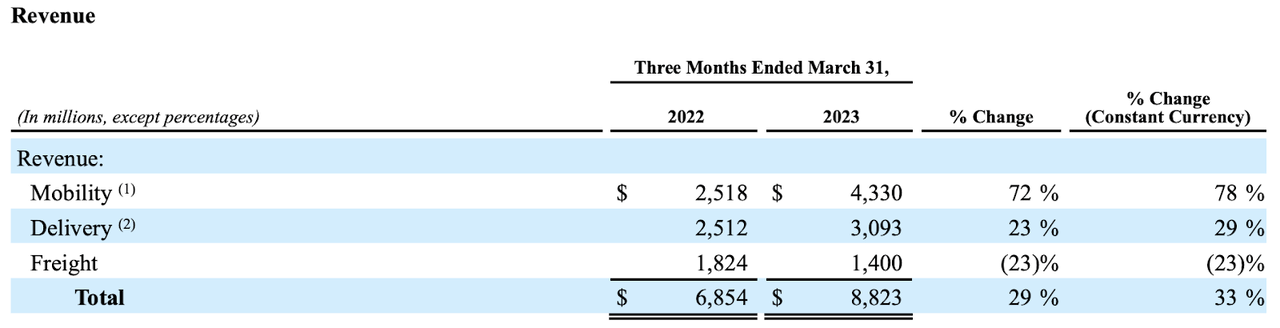

Uber had an amazing performance in terms of financials. In 1Q23, Uber reached revenue of $8.8 billion, up 29% YoY. Similar to revenue, Uber’s gross booking and trips also increased by a noticeable amount. The gross booking number reached $31.4 billion, growing 19% YoY. Total number of trips during the quarter increased 24% YoY to 2.1 billion, which is on average equivalent to approximately 24 million trips per day. Also, it is important to note that Uber is now free cash flow positive, which suggests the potential of return to shareholders.

Uber Q1 Earnings

As seen in the chart below, Uber’s primary services–rideshare (mobility) and delivery–both grew in revenue compared to last year. However, it is important to note that mobility experienced revenue growth in much higher magnitude than delivery, most possibly due to the expansion of Uber rideshare service into more diverse global markets and favorable macroeconomic conditions such as increased number of travelers due to the easing of pandemic. Although Uber’s freight service decreased in revenue, declining 23% YoY, Uber’s future seems promising with the primary sectors experiencing impressive growth.

Uber Q1 Earnings

Key Catalyst

Uber’s take on its freight transport service would be the key catalyst for its price. Uber differentiates itself from its “delivery” competitors such as DoorDash (NYSE:DASH) by providing a logistics-as-a-service through its platform. With its primary rideshare and delivery service experiencing exceptional growth, Uber’s logistics-as-a-service is expected to add on to the company’s total revenue, generating a global network of demand (shippers) and supply (carriers) like Uber rideshare and Uber Eats, which would further drive up Uber stock’s price.

Easing macroeconomic and social conditions also seem to drive up Uber’s price. In particular, with the easing of COVID, Uber’s revenue is expected to have good prospects with more airport rides and outside travels. Also, the seasonality might favor Uber’s performance in the rest of quarters in fiscal 2023. As the weather gets warmer with upcoming travel peak season until winter, the demand for rideshare is expected to increase.

Valuation

Uber stock is undervalued. According to the consensus, the stock is currently being traded at a relatively cheaper price of $49.64 with its average price being $43.34. EV/EBITDA ratio speaks the same. Uber currently has the EV/EBITDA ratio of -50.01, which is much lower than the US Software (Internet) industry’s median of 14.84. Meanwhile, the Price/Sales ratio suggests that Uber’s prospect is optimistic. The company’s PS ratio is currently at 2.55, while the Internet Software & Services industry’s number is at 3.71, which shows that Uber’s return on investment would be greater and faster than the industry average. Moreover, analysts forecast that Uber’s revenue will grow faster (17% per year) than the US rideshare market average (8.25% per year). All in all, Uber stock is undervalued, and it is promising as a long-term investment given its outstanding revenue growth, competitiveness in the market, and return on investment.

ESG

Uber has been actively incorporating ESG values into its operations. In 2023, Uber’s active number of EV increased 3.5x YoY, Uber fulfilled 11 of anti-racism commitments, and made 400+ app changes including the addition of various safety features. Also, Uber is making significant progress in incorporating the value of diversity to its governance by making the leadership and worker population more diverse in terms of race, gender, ethnicity, and background. Not only that, Uber strives to support and enhance the working condition of its gig economy contractors including drivers and couriers by providing them financial benefits, insurance, and safety measures. It is impressive that more than 80% individuals who became drivers and couriers for Uber in the initial stages of the pandemic said that the gig served as a financial safety net throughout the challenging period.

Risks

Highly competitive market is the biggest risk for Uber. Although the current rideshare market dynamics favor Uber as the dominant force in the market, Uber must continue to invest more in the food and freight delivery service to increase profitability. However, considering Uber’s recent strides in technology and operations, benefits seem to outweigh the risks. Uber is an undefeatable cash-cow in the rideshare market, a competitive second player in the food delivery market, and an unmatched, innovative participant in the expanding freight and logistics business.

Conclusion

Uber has bright prospects. Uber’s revenue has grown to $33.8 billion in the last twelve months, up $11 since IPO. Its platform business is attracting millions of people every day, generating vast networks of sellers and buyers in rideshare, delivery, and freight markets all around the world. Uber is a strong buy.

Analyst Recommendation By: Kyeongmook Lee

Read the full article here